|

Maslowian Portfolio Theory

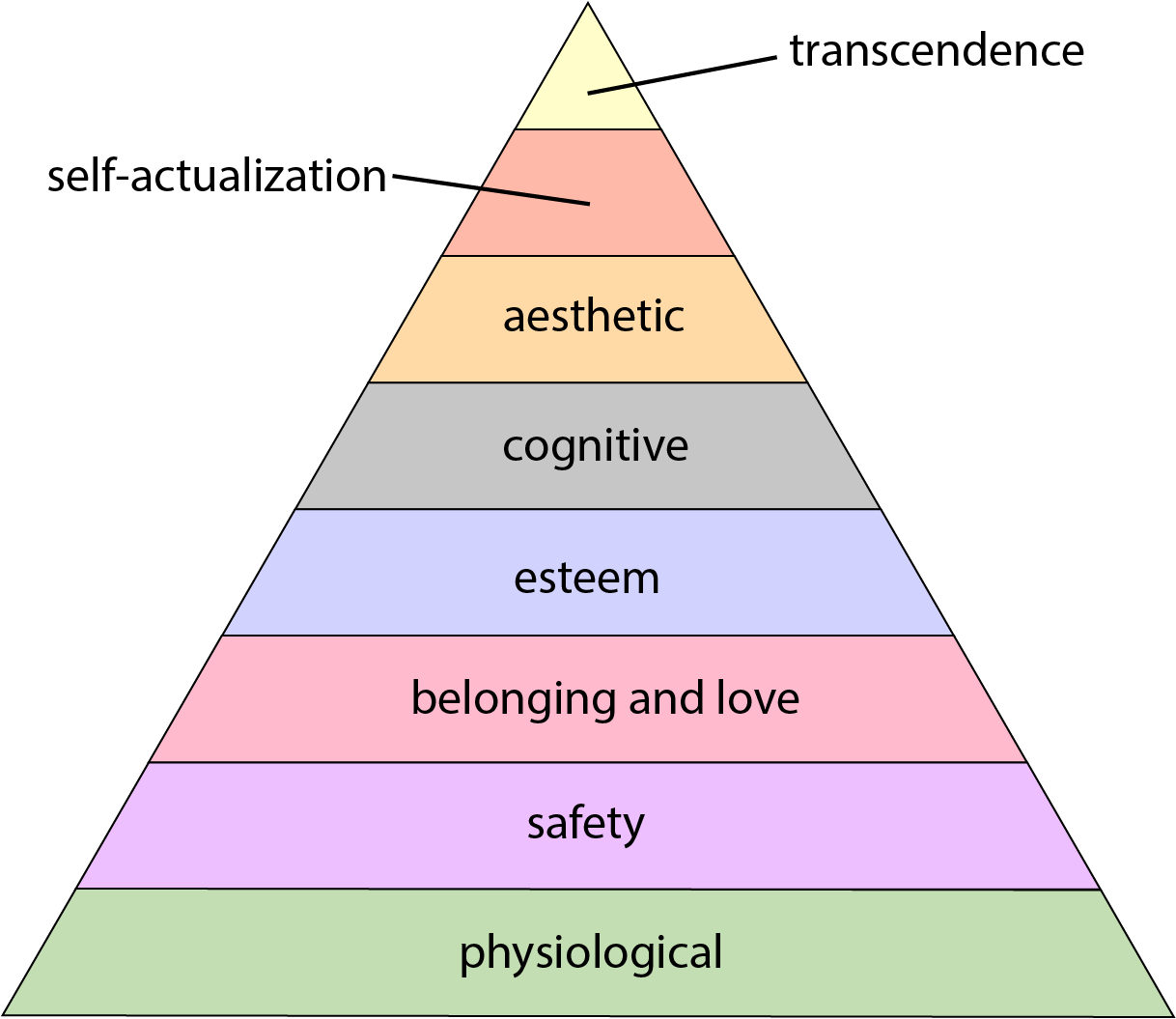

Maslowian portfolio theory (MaPT) creates a normative portfolio theory based on human needs as described by Abraham Maslow. It is in general agreement with behavioral portfolio theory, and is explained in ''Maslowian Portfolio Theory: An alternative formulation of the Behavioural Portfolio Theory'', and was first observed in ''Behavioural Finance and Decision Making in Financial Markets''. Maslowian portfolio theory is quite simple in its approach. It states that financial investments should follow human needs in the first place. All the rest is logic deduction. For each need level in Maslow's hierarchy of needs, some investment goals can be identified, and those are the constituents of the overall portfolio. Comparison with behavioral portfolio theory Behavioral portfolio theory (BPT) as introduced by Statman and Sheffrin in 2001, is characterized by a portfolio that is fragmented. Unlike the rational theories, such as modern portfolio theory (Markowitz), where investors put all th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compensat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abraham Maslow

Abraham Harold Maslow (; April 1, 1908 – June 8, 1970) was an American psychologist who was best known for creating Maslow's hierarchy of needs, a theory of psychological health predicated on fulfilling innate human needs in priority, culminating in self-actualization. Maslow was a psychology professor at Brandeis University, Brooklyn College, New School for Social Research, and Columbia University. He stressed the importance of focusing on the positive qualities in people, as opposed to treating them as a "bag of symptoms". Hoffmann (1988), p. 109. A ''Review of General Psychology'' survey, published in 2002, ranked Maslow as the tenth most cited psychologist of the 20th century. Biography Youth Born in 1908 and raised in Brooklyn, New York, Maslow was the oldest of seven children. His parents were first-generation Jewish immigrants from Kiev, then part of the Russian Empire (now Kyiv, Ukraine), who fled from Czarist persecution in the early 20th century. They had deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Behavioral Portfolio Theory

Behavioral portfolio theory (BPT), put forth in 2000 by Shefrin and Statman,SHEFRIN, H., AND M. STATMAN (2000): "Behavioral Portfolio Theory," ''Journal of Financial and Quantitative Analysis'', 35(2), 127–151. provides an alternative to the assumption that the ultimate motivation for investors is the maximization of the value of their portfolios. It suggests that investors have varied aims and create an investment portfolio that meets a broad range of goals.{{cite web, last=Bank, first=Eric, title=Behavioral Portfolio Theory 1 – Safety First, date= 18 February 2011, url=http://www.hedgefundwriter.com/2011/02/18/behavioral-portfolio-theory-1-%E2%80%93-safety/, accessdate=7 September 2011 It does not follow the same principles as the capital asset pricing model, modern portfolio theory and the arbitrage pricing theory. A behavioral portfolio bears a strong resemblance to a pyramid with distinct layers. Each layer has well defined goals. The base layer is devised in a way tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maslow's Hierarchy Of Needs

Maslow's hierarchy of needs is an idea in psychology proposed by American psychologist Abraham Maslow in his 1943 paper "A Theory of Human Motivation" in the journal ''Psychological Review''. Maslow subsequently extended the idea to include his observations of humans' innate curiosity. His theories parallel many other theories of human developmental psychology, some of which focus on describing the stages of growth in humans. The theory is a classification system intended to reflect the universal needs of society as its base, then proceeding to more acquired emotions. The hierarchy of needs is split between deficiency needs and growth needs, with two key themes involved within the theory being individualism and the prioritization of needs. While the theory is usually shown as a pyramid in illustrations, Maslow himself never created a pyramid to represent the hierarchy of needs. The hierarchy of needs is a psychological idea and also an assessment tool, particularly in education ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compensat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roy's Safety-first Criterion

Roy's safety-first criterion is a risk management technique, devised by A. D. Roy, that allows an investor to select one portfolio rather than another based on the criterion that the probability of the portfolio's return falling below a minimum desired threshold is minimized. For example, suppose there are two available investment strategies—portfolio A and portfolio B, and suppose the investor's threshold return level (the minimum return that the investor is willing to tolerate) is −1%. Then, the investor would choose the portfolio that would provide the maximum probability of the portfolio return being at least as high as −1%. Thus, the problem of an investor using Roy's safety criterion can be summarized symbolically as: \underset\Pr(R_<\underline) where is the probability of (the actual return of asset i) being less than (the minimum acceptable return). Normally distributed return and SFRatio If the portfolios under consideratio ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value At Risk

Value at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For a given portfolio, time horizon, and probability ''p'', the ''p'' VaR can be defined informally as the maximum possible loss during that time after excluding all worse outcomes whose combined probability is at most ''p''. This assumes mark-to-market pricing, and no trading in the portfolio. For example, if a portfolio of stocks has a one-day 95% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% proba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elliptical Distribution

In probability and statistics, an elliptical distribution is any member of a broad family of probability distributions that generalize the multivariate normal distribution. Intuitively, in the simplified two and three dimensional case, the joint distribution forms an ellipse and an ellipsoid, respectively, in iso-density plots. In statistics, the normal distribution is used in ''classical'' multivariate analysis, while elliptical distributions are used in ''generalized'' multivariate analysis, for the study of symmetric distributions with tails that are heavy, like the multivariate t-distribution, or light (in comparison with the normal distribution). Some statistical methods that were originally motivated by the study of the normal distribution have good performance for general elliptical distributions (with finite variance), particularly for spherical distributions (which are defined below). Elliptical distributions are also used in robust statistics to evaluate proposed multivari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Shortfall

Expected shortfall (ES) is a risk measure—a concept used in the field of financial risk measurement to evaluate the market risk or credit risk of a portfolio. The "expected shortfall at q% level" is the expected return on the portfolio in the worst q\% of cases. ES is an alternative to value at risk that is more sensitive to the shape of the tail of the loss distribution. Expected shortfall is also called conditional value at risk (CVaR), average value at risk (AVaR), expected tail loss (ETL), and superquantile. ES estimates the risk of an investment in a conservative way, focusing on the less profitable outcomes. For high values of q it ignores the most profitable but unlikely possibilities, while for small values of q it focuses on the worst losses. On the other hand, unlike the discounted maximum loss, even for lower values of q the expected shortfall does not consider only the single most catastrophic outcome. A value of q often used in practice is 5%. Expected shortfall is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Framing Effect

In the social sciences, framing comprises a set of concepts and theoretical perspectives on how individuals, groups, and societies organize, perceive, and communicate about reality. Framing can manifest in thought or interpersonal communication. ''Frames in thought'' consist of the mental representations, interpretations, and simplifications of reality. ''Frames in communication'' consist of the communication of frames between different actors. Framing is a key component of sociology, the study of social interaction among humans. Framing is an integral part of conveying and processing data on a daily basis. Successful framing techniques can be used to reduce the ambiguity of intangible topics by contextualizing the information in such a way that recipients can connect to what they already know. In social theory, framing is a schema of interpretation, a collection of anecdotes and stereotypes, that individuals rely on to understand and respond to events. Goffman, E. (1974). F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mental Accounting

Mental accounting (or psychological accounting) attempts to describe the process whereby people code, categorize and evaluate economic outcomes. The concept was first named by Richard Thaler. Mental accounting deals with the budgeting and categorization of expenditures. People budget money into mental accounts for expenses (e.g., saving for a home) or expense categories (e.g., gas money, clothing, utilities). Mental accounts are believed to act as a self-control strategy. People are presumed to make mental accounts as a way to manage and keep track of their spending and resources. People also are assumed to make mental accounts to facilitate savings for larger purposes (e.g., a home or college tuition). Like many other cognitive processes, it can prompt biases and systematic departures from rational, value-maximizing behavior, and its implications are quite robust. Understanding the flaws and inefficiencies of mental accounting is essential to making good decisions and reducing hum ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Meir Statman

Meir ( he, מֵאִיר) is a Jewish male given name and an occasional surname. It means "one who shines". It is often Germanized as Maier, Mayer, Mayr, Meier, Meyer, Meijer, Italianized as Miagro, or Anglicized as Mayer, Meyer, or Myer.Alfred J. Kolatch, ''These Are The Names'' (New York: Jonathan David Co., 1948), pp. 157, 160. Notable people with the name include: Given name: *Rabbi Meir, Jewish sage who lived in the time of the Talmud *Meir Amit (1921–2009), Israeli general and politician *Meir Ariel, Israeli singer/songwriter *Meir Bar-Ilan (1880–1949), rabbi and Religious Zionism leader *Meir Ben Baruch (1215–1293) aka Meir of Rothenburg, a German rabbi, poet, and author *Meir Daloya (born 1956), Olympic weightlifter *Meir Dizengoff (1861–1936), Israeli politician *Meir Har-Zion, Israeli commando fighter *Meir Dagan, Mossad chief *Meir Kahane (1932–1990), rabbi and political activist *Meir Lublin (1558–1616), Polish rabbi, Talmudist and Posek *Meir Nitzan, the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_(cropped).jpg)

.jpg)