|

Making Work Pay Tax Credit

The Making Work Pay tax credit was a personal credit provided in tax years 2009 and 2010 to U.S. federal income taxpayers. Blake Ellis, CNN, 2010-07-27 It was authorized in the . The credit was given at a rate of 6.2 percent of earned income up to a maximum of $400 for individuals or $800 for married taxpayers. Making Work Pay could be claimed by single filers making between $8,100 per year and $95,000 per year. Joint filers in the range of $8,100 and $190,000 could claim it annually. Withholding formulas directed employers to in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Recovery And Reinvestment Act Of 2009

The American Recovery and Reinvestment Act of 2009 (ARRA) (), nicknamed the Recovery Act, was a stimulus package enacted by the 111th U.S. Congress and signed into law by President Barack Obama in February 2009. Developed in response to the Great Recession, the primary objective of this federal statute was to save existing jobs and create new ones as soon as possible. Other objectives were to provide temporary relief programs for those most affected by the recession and invest in infrastructure, education, health, and renewable energy. The approximate cost of the economic stimulus package was estimated to be $787 billion at the time of passage, later revised to $831 billion between 2009 and 2019. The ARRA's rationale was based on the Keynesian economic theory that, during recessions, the government should offset the decrease in private spending with an increase in public spending in order to save jobs and stop further economic deterioration. The politics around the stimulus w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

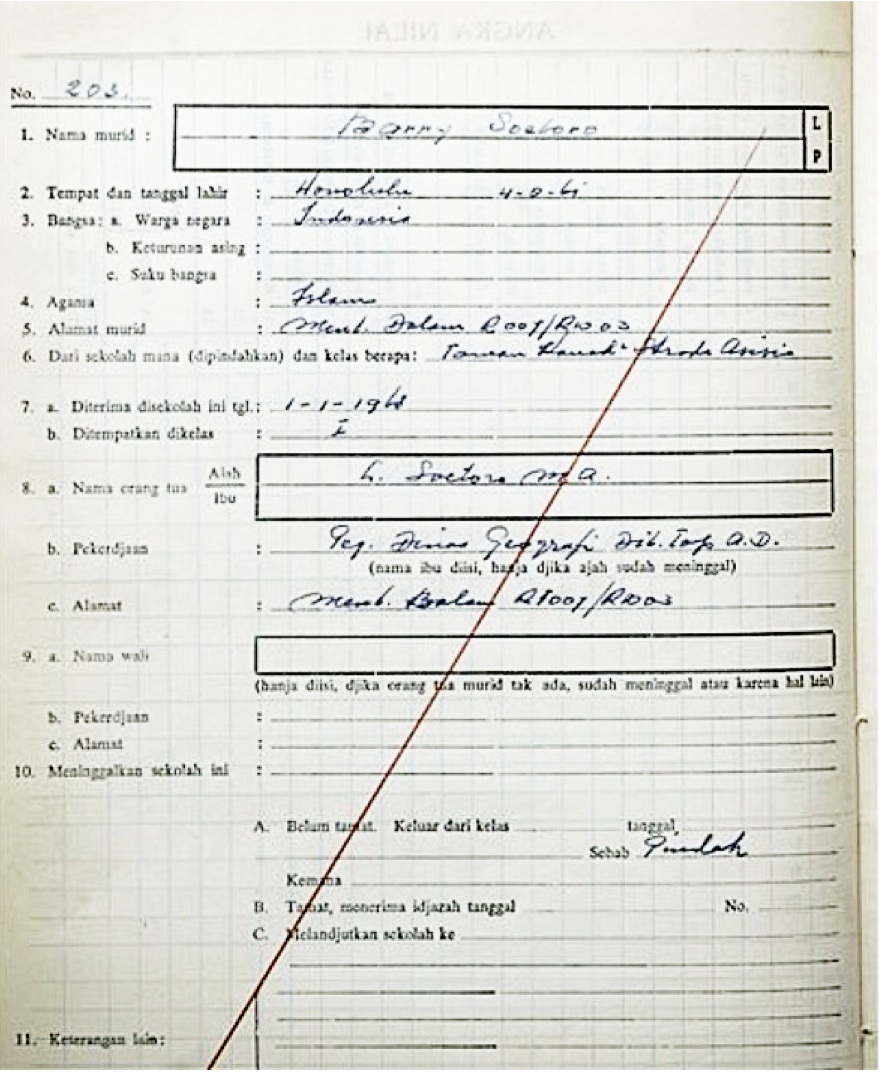

Barack Obama

Barack Hussein Obama II ( ; born August 4, 1961) is an American politician who served as the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, Obama was the first African-American president of the United States. He previously served as a U.S. senator from Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004, and previously worked as a civil rights lawyer before entering politics. Obama was born in Honolulu, Hawaii. After graduating from Columbia University in 1983, he worked as a community organizer in Chicago. In 1988, he enrolled in Harvard Law School, where he was the first black president of the '' Harvard Law Review''. After graduating, he became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. Turning to elective politics, he represented the 13th district in the Illinois Senate from 1997 until 2004, when he ran for the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. Low income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3 Rules for EIC begin on page 40 for 2020 Tax Year. EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Taxes In The United States

Personal may refer to: Aspects of persons' respective individualities * Privacy * Personality * Personal, personal advertisement, variety of classified advertisement used to find romance or friendship Companies * Personal, Inc., a Washington, D.C.-based tech startup * The Personal, a Canadian-based group car insurance and home insurance company * Telecom Personal, a mobile phone company in Argentina and Paraguay Music * ''Personal'' (album), the debut album by R&B group Men of Vizion * ''Personal'', the first album from singer-songwriter Quique González, and the title song * "Personal" (Aya Ueto song), a 2003 song by Aya Ueto from ''Message'' * "Personal" (Hrvy song), a song from ''Talk to Ya'' * "Personal" (The Vamps song), a song from ''Night & Day'' *"Personal", a song by Kehlani from ''SweetSexySavage'' Books * ''Personal'' (novel), a 2014 novel by Lee Child See also * The Personals (other) * Person * Personality psychology * Personalization * Human scal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)