|

Mutual Savings Bank

A mutual savings bank is a financial institution chartered by a central or regional government, without capital stock, owned by its members who subscribe to a common fund. From this fund, claims, loans, etc., are paid. Profits after deductions are shared among the members. The institution is intended to provide a safe place for individual members to save and to invest those savings in mortgages, loans, stocks, bonds and other securities and to share in any profits or losses that result. History The institution most frequently identified as the first modern savings bank was the " Savings and Friendly Society" organized in 1810 by Rev. Henry Duncan of the Ruthwell Presbyterian Church in Dumfriesshire, Scotland. Duncan established a friendly society to create a cooperative depository institution in order to enable his poorest parishioners to hold savings accounts accruing interest for sickness and old-age. Another precursor of modern savings banks were the ideas of Fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial institutions: # Depository institutions – deposit-taking institutions that accept and manage deposits and make loans, including banks, building societies, credit unions, trust companies, and mortgage loan companies; # Contractual institutions – insurance companies and pension funds # Investment institutions – investment banks, underwriters, and other different types of financial entities managing investments. Financial institutions can be distinguished broadly into two categories according to ownership structure: * Commercial banks * Cooperative banks Some experts see a trend toward homogenisation of financial institutions, meaning a tendency to invest in similar areas and have similar business strategies. A consequence of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depository Institution

Colloquially, a depository institution is a financial institution in the United States (such as a savings bank, commercial bank, savings and loan associations, or credit unions) that is legally allowed to accept monetary deposits from consumers. Under federal law, however, a "depository institution" is limited to banks and savings associations - credit unions are not included. An example of a non-depository institution might be a mortgage bank. While licensed to lend, they cannot accept deposits. See also *Authorised deposit-taking institution Financial institutions in Australia are only permitted to accept deposits from the public if they are authorised deposit-taking institutions (ADIs). The ADI’s authority is granted by the Australian Prudential Regulation Authority (APRA) under th ... References * Ruben D Cohen (2004) �The Optimal Capital Structure of Depository Institutions��, ''Wilmott Magazine'', March issue. Financial services in the United States {{Bus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dollar Bank

Dollar Bank is a full-service regional savings bank serving both individuals and business customers, operating more than 70 offices throughout Pennsylvania, Ohio, and Virginia. The bank's Pennsylvania headquarters is located in downtown Pittsburgh, Ohio headquarters is located in downtown Cleveland, and Virginia headquarters is located in Hampton Roads. History Founding Charles A. Colton (1807-1881), a Hartford, Connecticut native, moved to Pittsburgh with his family in 1850 to sell insurance. Mills, factories, coal mines and other industries in the fast-growing Pittsburgh region were drawing thousands of people annually, Americans and immigrants alike, in search of work. Colton recognized the need for a mutual bank to serve the interests of the working class. On July 19, 1855, Dollar Bank opened for business as "The Pittsburgh Dollar Savings Institution".dollar.bank: About Historical Timeline/ref> For $1, anyone could open a savings account. The first day's deposit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demutualization

Demutualization is the process by which a customer-owned mutual organization (''mutual'') or co-operative changes legal form to a joint stock company. It is sometimes called stocking or privatization. As part of the demutualization process, members of a mutual usually receive a "windfall" payout, in the form of shares in the successor company, a cash payment, or a mixture of both. Mutualization or mutualisation is the opposite process, wherein a shareholder-owned company is converted into a mutual organization, typically through takeover by an existing mutual organization. Furthermore, re-mutualization depicts the process of aligning or refreshing the interest and objectives of the members of the mutual society. The mutual traditionally raises capital from its customer members in order to provide services to them (for example building societies, where members' savings enable the provision of mortgages to members). It redistributes some profits to its members. By contrast, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately 169 billion in 2013. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. History The earliest recorded organization of securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eastern Bank

Eastern Bank is a bank based in Boston, Massachusetts. Before de-mutualizing in 2020, it was the oldest and largest mutual bank in the United States and the largest community bank in Massachusetts. With 95 branches, Eastern had a 3.2% market share in Massachusetts in 2016. It was founded in 1818 in Salem, and then moved to Lynn, Massachusetts. The company began an aggressive expansion campaign near the end of the 1990s and moved its headquarters to Boston's Financial District. In 2020, Eastern Bank announced plans to de-mutualize and become a publicly traded corporation. History Eastern Bank was established on April 15, 1818, as Salem Savings Bank and became insured by the Federal Deposit Insurance Corporation on October 1, 1983. On October 19, 1989, Eastern Savings Bank's parent company Lynn, Massachusetts-based Eastern Bank Corporation, renamed it Eastern Bank, and reorganized it into a mutual holding company, making it the first of its kind in Massachusetts. In the years fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Provident Institution For Savings In The Town Of Boston

The Provident Institution for Savings (est.1816) in Boston, Massachusetts, was the first chartered savings bank in the United States. James Savage and others founded the bank on the belief that "savings banks would enable the less fortunate classes of society to better themselves in a manner which would avoid the dangers of moral corruption traditionally associated with outright charitable institutions." History 19th century "The leading citizens of Boston ... felt that participation in the administration of the savings banks in their itywas an integral part of their civic duties." Led by Savage, founders of the bank included William Ellery Channing, William Cochran, Thomas Dawes, Samuel Eliot, Jonathan Hunnewell, John Phillips, William Phillips, Jesse Putnam, Josiah Quincy, Richard Sullivan, Elisha Ticknor, Redford Webster. Boston's Catholic bishop, John Cheverus, provided significant start-up energy, since a savings bank would encourage virtuous thrifty behavior amongst ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Friendly Society

A friendly society (sometimes called a benefit society, mutual aid society, benevolent society, fraternal organization or ROSCA) is a mutual association for the purposes of insurance, pensions, savings or cooperative banking. It is a mutual organization or benefit society composed of a body of people who join together for a common financial or social purpose. Before modern insurance and the welfare state, friendly societies provided financial and social services to individuals, often according to their religious, political, or trade affiliations. These societies are still widespread in many parts of the developing world, where they are referred to as ROSCAs (rotating savings and credit associations), ASCAs (accumulating savings and credit associations), burial societies, chit funds, etc. Character Before the development of large-scale government and employer health insurance and other financial services, friendly societies played an important part in many people's lives. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cooperative Bank

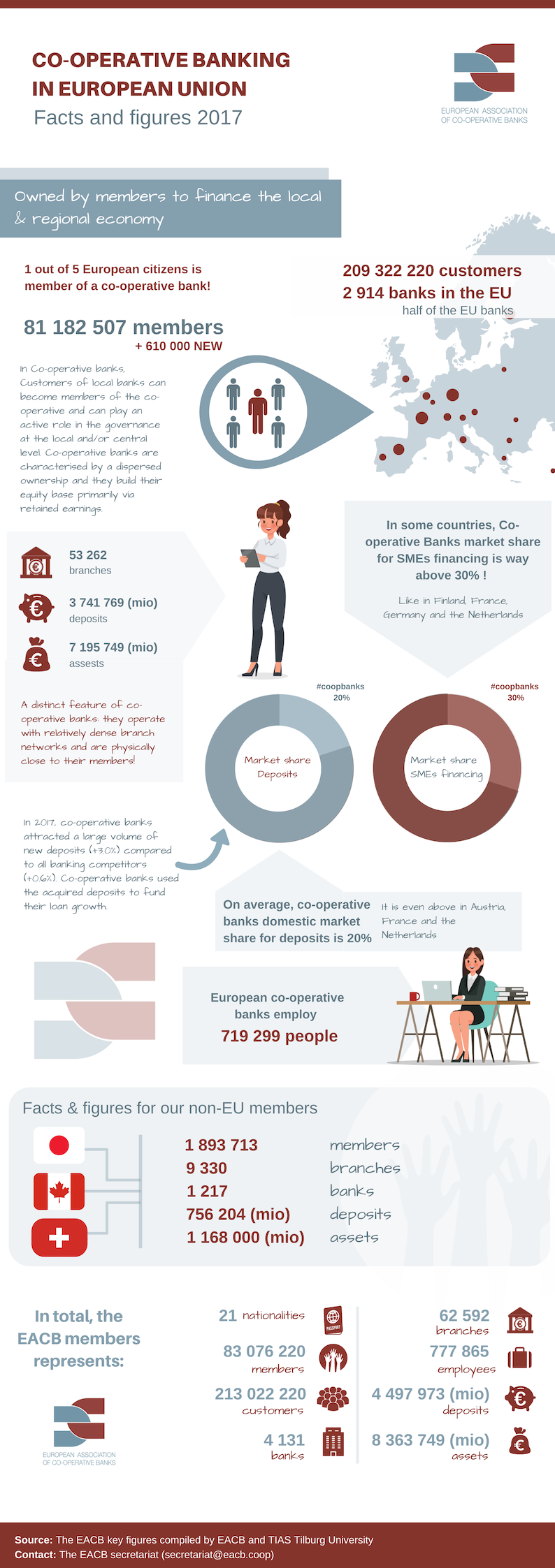

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times low ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Unions

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative to credit unions and were two and a half t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Friedrich Wilhelm Raiffeisen

Friedrich Wilhelm Raiffeisen (30 March 1818 – 11 March 1888) was a German mayor and cooperative pioneer. Several credit union systems and cooperative banks have been named after Raiffeisen, who pioneered rural credit unions. Life Friedrich Wilhelm Raiffeisen was born March 30, 1818 at Hamm/Sieg (Westerwald). He was the seventh of nine children. His father Gottfried Friedrich Raiffeisen was a farmer and also served as the mayor of Hamm. His family’s origins trace back to the 16th century in the Swabian-Franconian region. The family of his mother, Amalie Christiane Susanna Maria, born Lantzendörffer, came from the “ Siegerland”."Internationale Raiffeisen-Union" .Accessed: 18-04-2011. Leaving school at the age of 14 he received three years of education from a local |