|

Market For Corporate Control

__NOTOC__ The market for corporate control is the role of equity markets in facilitating corporate takeovers. This was first described in an article by HG Manne, "Mergers and the Market for Corporate Control". According to Manne: In this way the market for corporate control could magnify the efficacy of corporate governance rules, and facilitate greater accountability of directors to their investors. See also *Associate company *Business valuation *Consolidation (business) *Corporate governance *Drag-along right *Minority discount *Minority interest *Pre-emption right *Tag-along right *Voting interest Voting interest (or voting power) in business and accounting means the total number, or percent, of votes entitled to be cast on the issue at the time the determination of voting power is made, excluding a vote which is contingent upon the happeni ... Notes References * Manne, Henry G. (1965). "Mergers and the Market for Corporate Control". 73 ''Journal of Political Economy'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minority Interest

In accounting, minority interest (or non-controlling interest) is the portion of a subsidiary corporation's stock that is not owned by the parent corporation. The magnitude of the minority interest in the subsidiary company is generally less than 50% of outstanding shares, or the corporation would generally cease to be a subsidiary of the parent. It is, however, possible (such as through special voting rights) for a controlling interest requiring consolidation to be achieved without exceeding 50% ownership, depending on the accounting standards being employed. Minority interest belongs to other investors and is reported on the consolidated balance sheet of the owning company to reflect the claim on assets belonging to other, non-controlling shareholders. Also, minority interest is reported on the consolidated income statement as a share of profit belonging to minority shareholders. The reporting of 'minority interest' is a consequence of the requirement by accounting standards to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Library Of Economics And Liberty

Liberty Fund, Inc. is an American private educational foundation headquartered in Carmel, founded by Pierre F. Goodrich. Through publishing, conferences, and educational resources, the operating mandate of the Liberty Fund was set forth in an unpublished memo written by Goodrich "to encourage the study of the ideal of a society of free and responsible individuals".Morgan N. KnullGoodrich, Pierre, ''First Principles'', 09/23/11Robert T. Grimm (ed.), ''Notable American Philanthropists: Biographies of Giving and Volunteering'', Greenwood Publishing Group, 2002, pp. 125–128 History Liberty Fund was founded by Pierre F. Goodrich in 1960. In 1997 it received an $80 million donation from Goodrich's wife, Enid, increasing its assets to over $300 million. In November 2015, it was announced that the Liberty Fund was building a $22 million headquarters in Carmel, Indiana. Liberty Fund has been cited by historian Donald T. Critchlow as one of the endowed conservative foundations which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concise Encyclopedia Of Economics

Liberty Fund, Inc. is an American private educational foundation headquartered in Carmel, founded by Pierre F. Goodrich. Through publishing, conferences, and educational resources, the operating mandate of the Liberty Fund was set forth in an unpublished memo written by Goodrich "to encourage the study of the ideal of a society of free and responsible individuals".Morgan N. KnullGoodrich, Pierre, ''First Principles'', 09/23/11Robert T. Grimm (ed.), ''Notable American Philanthropists: Biographies of Giving and Volunteering'', Greenwood Publishing Group, 2002, pp. 125–128 History Liberty Fund was founded by Pierre F. Goodrich in 1960. In 1997 it received an $80 million donation from Goodrich's wife, Enid, increasing its assets to over $300 million. In November 2015, it was announced that the Liberty Fund was building a $22 million headquarters in Carmel, Indiana. Liberty Fund has been cited by historian Donald T. Critchlow as one of the endowed conservative foundations which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David R

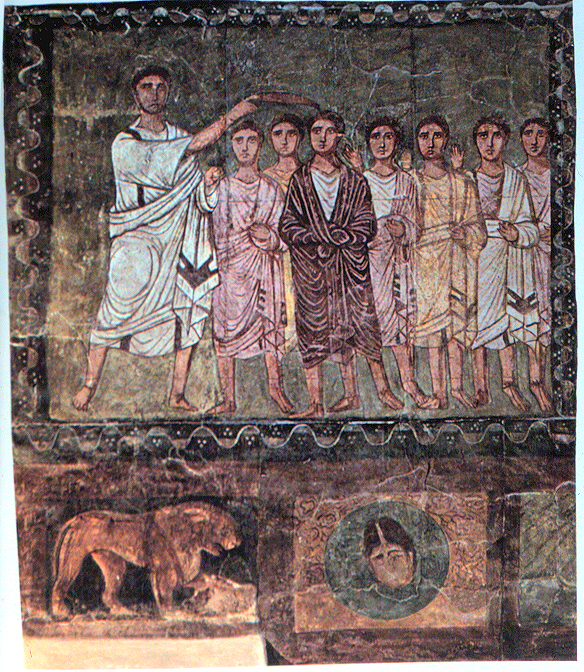

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, David ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voting Interest

Voting interest (or voting power) in business and accounting means the total number, or percent, of votes entitled to be cast on the issue at the time the determination of voting power is made, excluding a vote which is contingent upon the happening of a condition or event which has not occurred at the time. Voting interest is one form of economic interest. Economic interests comprise all types and forms of investment vehicles that an investee could issue or be a party to, including equity securities; financial instruments with characteristics of equity, liabilities, or both; long-term debt and other debt-financing arrangements; leases; and contractual arrangements such as management contracts, service contracts, or intellectual property licenses. Non-voting interest Ownership of more than 50% of voting shares generally gives the right of control and consolidation. In special cases, control is possible without having to own more than 50% of voting stock. For example, if agreed, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tag-along Right

Tag along rights (TARs) comprise a group of clauses in a contract which together have the effect of allowing the minority shareholder(s) in a corporation to also take part in a sale of shares by the majority shareholder to a third party under the same terms and conditions. Consider an example: A and B are both shareholders in a company, with A being the majority shareholder and B the minority shareholder. C, a third party, offers to buy A's shares at an attractive price, and A accepts. In this situation, tag-along rights would allow B to also participate in the sale under the same terms and conditions as A. As with other contractual provisions, tag-along rights originated from the doctrine of freedom of contract and is governed by contract law (in common law countries) or the law of obligations (in civil law countries). As tag-along rights are contractual terms between private parties, they are often found in venture capital and private equity firms but not public companies. Stru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pre-emption Right

A pre-emption right, right of pre-emption, or first option to buy is a contractual right to acquire certain property newly coming into existence before it can be offered to any other person or entity. It comes from the Latin verb ''emo, emere, emi, emptum'', to buy or purchase, plus the inseparable preposition ''pre'', before. A right to acquire existing property in preference to any other person is usually referred to as a ''right of first refusal''. Company shares In practice, the most common form of pre-emption right is the right of existing shareholders to acquire new shares issued by a company in a rights issue, usually a public offering. In this context, the pre-emptive right is also called subscription right or subscription privilege. It is the right but not the obligation of existing shareholders to buy the new shares before they are offered to the public. In that way, existing shareholders can maintain their proportional ownership of the company and thus prevent stock dilut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minority Discount

Minority discount is an economic concept reflecting the notion that a partial ownership interest may be worth less than its proportional share of the total business. The concept applies to equities with voting power because the size of voting position provides additional benefits or drawbacks. For example, ownership of a 51% share in the business is usually worth more than 51% of its equity value—this phenomenon is called the premium for control. Conversely, ownership of a 30% share in the business may be worth less than 30% of its equity value. This is so because this minority ownership limits the scope of control over critical aspects of the business. Share prices of public companies usually reflect the minority discount. This is why take-private transactions involve a substantial premium over recently quoted prices. Properties of minority interest On a per-share basis, buyers will pay less for minority interest versus a controlling or majority interest because a minority positi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Takeover

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Management of the target company may or may not agree with a proposed takeover, and this has resulted in the following takeover classifications: friendly, hostile, reverse or back-flip. Financing a takeover often involves loans or bond issues which may include junk bonds as well as a simple cash offers. It can also include shares in the new company. Types Friendly A ''friendly takeover'' is an acquisition which is approved by the management of the target company. Before a bidder makes an offer for another company, it usually first informs the company's board of directors. In an ideal world, if the board feels that accepting the offer serves the shareholders better than rejecting it, it recommend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Drag-along Right

Drag-along right (DAR) is a legal concept in corporate law. Under the concept, if the majority shareholder(s) of an entity sells their stake, the prospective owner(s) have the right to force the remaining minority shareholders to join the deal. However, the owner must usually offer the same terms and conditions to the minority shareholders as to the majority shareholder(s). Drag-along rights are fairly standard terms in a stock purchase agreement. This right protects majority shareholders (allowing them to sell to an owner desiring total control of the entity, without being encumbered by holdout investors) but also protects minority shareholders (who can sell their investment on the same terms and conditions as the majority shareholder). This differs from a tag-along right, which also allows minority shareholders to sell on the same terms and conditions (and requires the new owner to offer them), but does not require them to sell. In most jurisdictions drag-along and tag-along r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Governance

Corporate governance is defined, described or delineated in diverse ways, depending on the writer's purpose. Writers focused on a disciplinary interest or context (such as accounting, finance, law, or management) often adopt narrow definitions that appear purpose-specific. Writers concerned with regulatory policy in relation to corporate governance practices often use broader structural descriptions. A broad (meta) definition that encompasses many adopted definitions is "Corporate governance” describes the processes, structures, and mechanisms that influence the control and direction of corporations." This meta definition accommodates both the narrow definitions used in specific contexts and the broader descriptions that are often presented as authoritative. The latter include: the structural definition from the Cadbury Report, which identifies corporate governance as "the system by which companies are directed and controlled" (Cadbury 1992, p. 15); and the relational-structura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |