|

Maples And Calder

Maples Group (previously Maples and Calder) is a multi-jurisdictional firm providing legal and financial services, headquartered in the Cayman Islands. It has offices in many financial centres around the world, including several tax neutral jurisdictions. Its law firm is a member of the offshore magic circle, and specialises in advising on the laws of the Cayman Islands, Ireland, Luxembourg, Jersey and the British Virgin Islands, across a range of legal services including commercial litigation, intellectual property, sport, and finance, in which the firm has a focus on the structuring of tax efficient legal structures (or vehicles). History MacDonald and Maples was founded by Jim MacDonald and John Maples. MacDonald later retired and Douglas Calder joined as a partner, resulting in the name of the firm being changed to Maples and Calder. Today it is referred to simply as Maples and is headquartered in Ugland House in the Cayman Islands. The Cayman Islands office was opened in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ugland House

Ugland House is a building located in George Town, Cayman Islands. Located at 121 South Church Street, the building is occupied by the law firm Maples and Calder and is the registered office address for 40,000 entities, including many major investment funds, international joint ventures and capital market issuers. Investigation by the U.S. government During his first presidential campaign, U.S. President Barack Obama referred to Ugland House as "the biggest tax scam in the world", raising questions over the number of companies with a registered office in the building. President Obama subsequently nominated Jack Lew to Treasury Secretary in 2013, despite objections that Mr. Lew had invested heavily in funds in Ugland House while he worked as an investment banker at Citigroup during the 2008 financial meltdown, with President Obama stating that he was not concerned about Mr. Lew's past financial transactions. In 2008, the United States Government Accountability Office (GAO), an in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Law Firms With Offices In Hong Kong

Foreign may refer to: Government * Foreign policy, how a country interacts with other countries * Ministry of Foreign Affairs, in many countries ** Foreign Office, a department of the UK government ** Foreign office and foreign minister * United States state law, a legal matter in another state Science and technology * Foreign accent syndrome, a side effect of severe brain injury * Foreign key, a constraint in a relational database Arts and entertainment * Foreign film or world cinema, films and film industries of non-English-speaking countries * Foreign music or world music * Foreign literature or world literature * ''Foreign Policy'', a magazine Music * "Foreign", a song by Jessica Mauboy from her 2010 album ''Get 'Em Girls'' * "Foreign" (Trey Songz song), 2014 * "Foreign", a song by Lil Pump from the album ''Lil Pump'' Other uses * Foreign corporation, a corporation that can do business outside its jurisdiction * Foreign language, a language not spoken by the people of a ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1962 Establishments In The Cayman Islands

Year 196 ( CXCVI) was a leap year starting on Thursday (link will display the full calendar) of the Julian calendar. At the time, it was known as the Year of the Consulship of Dexter and Messalla (or, less frequently, year 949 ''Ab urbe condita''). The denomination 196 for this year has been used since the early medieval period, when the Anno Domini calendar era became the prevalent method in Europe for naming years. Events By place Roman Empire * Emperor Septimius Severus attempts to assassinate Clodius Albinus but fails, causing Albinus to retaliate militarily. * Emperor Septimius Severus captures and sacks Byzantium; the city is rebuilt and regains its previous prosperity. * In order to assure the support of the Roman legion in Germany on his march to Rome, Clodius Albinus is declared Augustus by his army while crossing Gaul. * Hadrian's wall in Britain is partially destroyed. China * First year of the '' Jian'an era of the Chinese Han Dynasty. * Emperor Xian of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Matheson (law Firm)

Matheson (previously Matheson Ormsby Prentice), is an Irish law firm partnership based in the IFSC in Dublin, which specialises in multinational tax schemes (e.g. for clients in Ireland such as Microsoft, Google and Abbot), and tax structuring of special purpose vehicles (e.g. Section 110 securitisation SPVs). Matheson is estimated to be Ireland's largest corporate law firm. Matheson state in the International Tax Review that their tax department is: "significantly the largest tax practice group amongst Irish law firms". Development While Matheson's website traces their history back to 1825 and notes that their offices were burnt in the Irish Easter Rising of 1916, it wasn't until after the creation and initial development of Dublin's International Financial Services Centre (or IFSC) that Matheson emerged as a small but standalone law firm with 14 partners and over 50 solicitors (or lawyers) in 1991. It moved to its current IFSC offices, 70 Sir John Rogerson's Quay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Haven

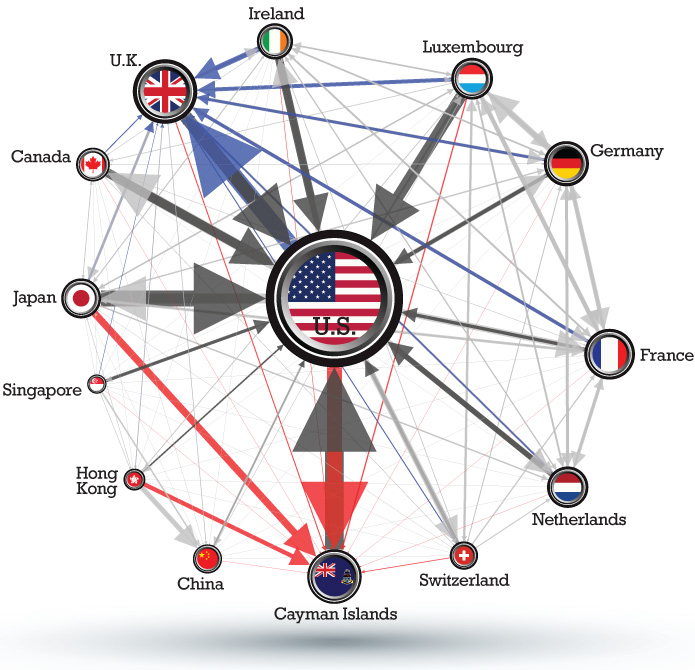

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Singapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, bordering the Strait of Malacca to the west, the Singapore Strait to the south, the South China Sea to the east, and the Straits of Johor to the north. The country's territory is composed of one main island, 63 satellite islands and islets, and one outlying islet; the combined area of these has increased by 25% since the country's independence as a result of extensive land reclamation projects. It has the third highest population density in the world. With a multicultural population and recognising the need to respect cultural identities of the major ethnic groups within the nation, Singapore has four official languages: English, Malay, Mandarin, and Tamil. English is the lingua franca and numerous public services are available only in Eng ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dublin

Dublin (; , or ) is the capital and largest city of Republic of Ireland, Ireland. On a bay at the mouth of the River Liffey, it is in the Provinces of Ireland, province of Leinster, bordered on the south by the Dublin Mountains, a part of the Wicklow Mountains range. At the 2016 census of Ireland, 2016 census it had a population of 1,173,179, while the preliminary results of the 2022 census of Ireland, 2022 census recorded that County Dublin as a whole had a population of 1,450,701, and that the population of the Greater Dublin Area was over 2 million, or roughly 40% of the Republic of Ireland's total population. A settlement was established in the area by the Gaels during or before the 7th century, followed by the Vikings. As the Kings of Dublin, Kingdom of Dublin grew, it became Ireland's principal settlement by the 12th century Anglo-Norman invasion of Ireland. The city expanded rapidly from the 17th century and was briefly the second largest in the British Empire and sixt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)