|

Léon Walras

Marie-Esprit-Léon Walras (; 16 December 1834 – 5 January 1910) was a French mathematical economist and Georgist. He formulated the marginal theory of value (independently of William Stanley Jevons and Carl Menger) and pioneered the development of general equilibrium theory. Walras is best known for his book ''Éléments d'économie politique pure'', a work that has contributed greatly to the mathematization of economics through the concept of general equilibrium. The definition of the role of the entrepreneur found in it was also taken up and amplified by Joseph Schumpeter. For Walras, exchanges only take place after a Walrasian ''tâtonnement'' (French for "trial and error"), guided by the auctioneer, has made it possible to reach market equilibrium. It was the general equilibrium obtained from a single hypothesis, rarity, that led Joseph Schumpeter to consider him "the greatest of all economists". The notion of general equilibrium was very quickly adopted by major economist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Évreux

Évreux () is a commune in and the capital of the department of Eure, in the French region of Normandy. Geography The city is on the Iton river. Climate History In late Antiquity, the town, attested in the fourth century CE, was named ''Mediolanum Aulercorum'', "the central town of the Aulerci", the Gallic tribe then inhabiting the area. Mediolanum was a small regional centre of the Roman province of Gallia Lugdunensis. Julius Caesar wintered eight legions in this area after his third campaigning season in the battle for Gaul (56-55 BC): Legiones VII, VIII, IX, X, XI, XII, XIII and XIV. The present-day name of ''Évreux'' originates from the Gallic tribe of Eburovices, literally ''Those who overcome by the yew?'', from the Gaulish root '' eburos''. Counts of Évreux The first known members of the family of the counts of Évreux were descended from an illegitimate son of Richard I, duke of Normandy; these counts became extinct in the male line with the death of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kenneth Arrow

Kenneth Joseph Arrow (23 August 1921 – 21 February 2017) was an American economist, mathematician, writer, and political theorist. He was the joint winner of the Nobel Memorial Prize in Economic Sciences with John Hicks in 1972. In economics, he was a major figure in post-World War II neo-classical economic theory. Many of his former graduate students have gone on to win the Nobel Memorial Prize themselves. His most significant works are his contributions to social choice theory, notably "Arrow's impossibility theorem", and his work on general equilibrium analysis. He has also provided foundational work in many other areas of economics, including endogenous growth theory and the economics of information. Education and early career Arrow was born on 23 August 1921, in New York City. Arrow's mother, Lilian (Greenberg), was from Iași, Romania, and his father, Harry Arrow, was from nearby Podu Iloaiei. The Arrow family were Romanian Jews. His family was very supportive of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Georgist

Georgism, also called in modern times Geoism, and known historically as the single tax movement, is an economic ideology holding that, although people should own the value they produce themselves, the economic rent derived from land—including from all natural resources, the commons, and urban locations—should belong equally to all members of society. Developed from the writings of American economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems, based on principles of land rights and public finance which attempt to integrate economic efficiency with social justice. Georgism is concerned with the distribution of economic rent caused by land ownership, natural monopolies, pollution rights, and control of the commons, including title of ownership for natural resources and other contrived privileges (e.g. intellectual property). Any natural resource which is inherently limited in supply can generate economic rent, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Economics

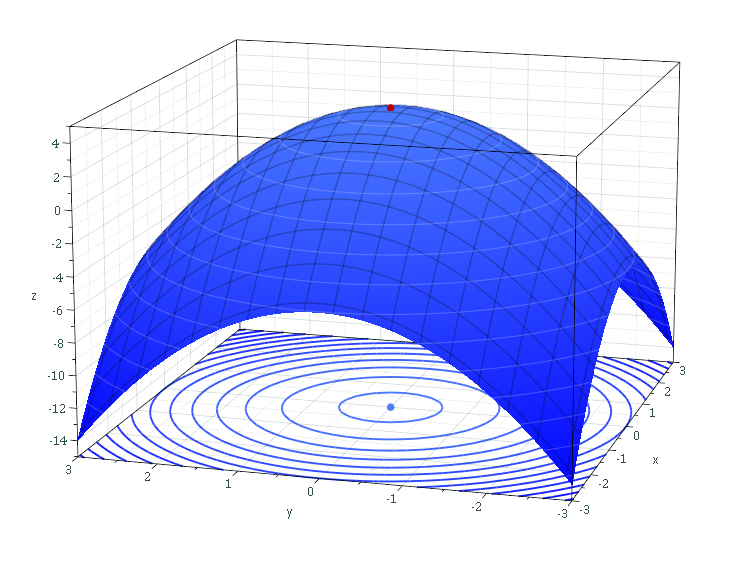

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity. Mathematics allows economists to form meaningful, testable propositions about wide-ranging and complex subjects which could less easily be expressed informally. Further, the language of mathematics allows economists to make specific, positive claims about controversial or contentious subjects that would be impossible without mathematics. Much of economic theory is currently presented in terms of mathematical economic models, a set of stylized and simplified mathematical relationships asserted to clarif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walrasian Auction

A Walrasian auction, introduced by Léon Walras, is a type of simultaneous auction where each agent calculates its demand for the good at every possible price and submits this to an auctioneer. The price is then set so that the total demand across all agents equals the total amount of the good. Thus, a Walrasian auction perfectly matches the supply and the demand. Walras suggested that equilibrium would always be achieved through a process of tâtonnement (French for "trial and error"), a form of hill climbing. More recently, however, the Sonnenschein–Mantel–Debreu theorem proved that such a process would not necessarily reach a unique and stable equilibrium, even if the market is populated with perfectly rational agents. Walrasian auctioneer The ''Walrasian auctioneer'' is the presumed auctioneer that matches supply and demand in a market of perfect competition. The auctioneer provides for the features of perfect competition: perfect information and no transaction costs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walras's Law

Walras's law is a principle in general equilibrium theory asserting that budget constraints imply that the ''values'' of excess demand (or, conversely, excess market supplies) must sum to zero regardless of whether the prices are general equilibrium prices. That is: : \sum_^p_j \cdot (D_j - S_j) = 0, where p_j is the price of good ''j'' and D_j and S_j are the demand and supply respectively of good ''j''. Walras's law is named after the economist Léon Walras of the University of Lausanne who formulated the concept in his ''Elements of Pure Economics'' of 1874. Although the concept was expressed earlier but in a less mathematically rigorous fashion by John Stuart Mill in his '' Essays on Some Unsettled Questions of Political Economy'' (1844), Walras noted the mathematically equivalent proposition that when considering any particular market, if all other markets in an economy are in equilibrium, then that specific market must also be in equilibrium. The term "Walras's law" was c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Equilibrium

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts to the theory of ''partial'' equilibrium, which analyzes a specific part of an economy while its other factors are held constant. In general equilibrium, constant influences are considered to be noneconomic, therefore, resulting beyond the natural scope of economic analysis. The noneconomic influences is possible to be non-constant when the economic variables change, and the prediction accuracy may depend on the independence of the economic factors. General equilibrium theory both studies economies using the model of equilibrium pricing and seeks to determine in which circumstances the assumptions of general equilibrium will hold. The theory dates to the 1870s, particularly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Utility

In economics, utility is the satisfaction or benefit derived by consuming a product. The marginal utility of a good or service describes how much pleasure or satisfaction is gained by consumers as a result of the increase or decrease in consumption by one unit. There are three types of marginal utility. They are positive, negative, or zero marginal utility. For instance, you like eating pizza, the second piece of pizza brings you more satisfaction than only eating one piece of pizza. It means your marginal utility from purchasing pizza is positive. However, after eating the second piece you feel full, and you would not feel any better from eating the third piece. This means your marginal utility from eating pizza is zero. Moreover, you might feel sick if you eat more than three pieces of pizza. At this time, your marginal utility is negative. In other words, a negative marginal utility indicates that every unit of goods or service consumed will do more harm than good, which will le ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Axel Leijonhufvud

Axel Leijonhufvud (6 September 1933 – 2 May 2022) of the original. was a Swedish and professor at the (UCLA), and professor at the University of Trento, |

Oskar R

Oskar may refer to: * oskar (gene), the Drosophila gene * Oskar (given name) Oscar or Oskar is a masculine given name of Irish origin. Etymology The name is derived from two elements in Irish: the first, ''os'', means "deer"; the second element, ''car'', means "loving" or "friend", thus "deer-loving one" or "friend of deer ..., masculine given name See also * Oscar (other) {{disambig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Knut Wicksell

Johan Gustaf Knut Wicksell (December 20, 1851 – May 3, 1926) was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought. He was married to the noted feminist Anna Bugge. Early life Wicksell was born in Stockholm on December 20, 1851. His father was a relatively successful businessman and real estate broker. He lost both his parents at a relatively early age. His mother died when he was only six, and his father died when he was fifteen. His father's considerable estate allowed him to enroll at the University of Uppsala in 1869 to study mathematics and physics. Education He received his first degree in two years, and he engaged in graduate studies until 1885, when he received his doctorate in mathematics. In 1887, Wicksell received a scholarship to study on the Continent, where he heard lectures by the economist Carl Menger in Vienna. In the following years, his interest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Ludwell Moore

Henry Ludwell Moore (November 21, 1869 – April 28, 1958) was an American economist known for his pioneering work in econometrics. Paul Samuelson named Moore (along with Harry Gunnison Brown, Allyn Abbott Young, Wesley Clair Mitchell, Frank Knight, Jacob Viner, and Henry Schultz) as one of the several "American saints in economics" born after 1860. Biography Moore was born in Charles County, Maryland, the first of 15 children. He received a B.A. from Randolph-Macon College in 1892 and a Ph.D. from Johns Hopkins University in 1896. His thesis was on von Thünen's theory of the natural wage. The visiting lecturers included Simon Newcomb and J. B. Clark and he may have learned some mathematical economics from them. While doing the Ph.D., he spent a year at the University of Vienna. At that time study in Europe was quite usual; Americans often went to Europe, usually to Germany, for their entire graduate education. Moore was an early U.S. Ph.D. His academic career proceeded t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |