|

List Of Countries By Sovereign Wealth Funds

A sovereign wealth fund (SWF) is a fund owned (or a political subdivision of a federal state) composed of financial assets such as stocks, bonds, property or other financial instruments. Sovereign wealth funds are entities that manage the national savings for the purposes of investment. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Monetary Fund (IMF) reserve position held by central banks and monetary authorities, along with other national assets such as pension investments, oil funds, or other industrial and financial holdings. These are assets of the sovereign nations which are typically held in domestic and different reserve currencies such as the dollar, euro and yen. The names attributed to the management entities may include central banks, official investment companies, sovereign oil funds, among others. Some countries may have more than one SWF. Also, while the United St ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Wealth Fund

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for the purposes of investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 U.S. state, states, a Washington, D.C., federal district, five major unincorporated territories, nine United States Minor Outlying Islands, Minor Outlying Islands, and 326 Indian reservations. The United States is also in Compact of Free Association, free association with three Oceania, Pacific Island Sovereign state, sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Palau, Republic of Palau. It is the world's List of countries and dependencies by area, third-largest country by both land and total area. It shares land borders Canada–United States border, with Canada to its north and Mexico–United States border, with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the List of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emirates Investment Authority

The Emirates Investment Authority (EIA) is the only sovereign wealth fund A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as ... of the federal government of the United Arab Emirates. It was established in 2007, the EIA has actively sought unique investment opportunities locally, regionally and internationally, focussing on investing in asset classes considered to help strengthen and diversify the UAE economy. Investments The EIA made two investments when it acquired major holdings in two Middle Eastern and North African telecommunications companies, Etisalat and du. Further investments are known to have been made in Gulf International Bank in Bahrain, the United Arab Shipping Company, and the Gulf Investment Corporation. In total, the EIA has acquired over 30 stakes in corporation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abu Dhabi Investment Authority

The Abu Dhabi Investment Authority ( ar, جهاز أبوظبي للاستثمار, ADIA) is a sovereign wealth fund owned by the Emirate of Abu Dhabi (in the United Arab Emirates) founded for the purpose of investing funds on behalf of the Government of the Emirate of Abu Dhabi. It manages the Emirate's excess oil reserves and is estimated to manage $790 billion. ADIA's operations have been characterized as secretive and opaque. History In 1967, Abu Dhabi emirate created the Financial Investments Board which operated within its Department of Finance and was responsible for managing the Emirate's excess oil revenues. However, in 1976, Sheikh Zayed bin Sultan Al Nahyan, the founding president of the United Arab Emirates, converted it into the Abu Dhabi Investment Authority. The goal was to invest the Abu Dhabi government's surpluses across various asset classes, with low risk. At the time it was novel for a government to invest its reserves in anything other than gold or short-ter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Government Pension Fund Of Norway

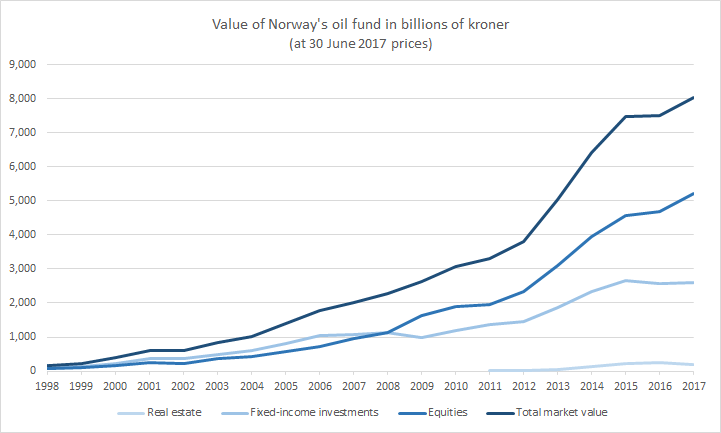

The Government Pension Fund of Norway ( no, Statens pensjonsfond) comprises two entirely separate sovereign wealth funds owned by the government of Norway. The Government Pension Fund Global, also known as the Oil Fund, was established in 1990 to invest the surplus revenues of the Norwegian petroleum sector. It has over US$1.19 trillion in assets, and holds 1.4% of all of the world’s listed companies, making it among the world’s largest sovereign wealth funds. In December 2021, it was worth about $250,000 per Norwegian citizen. It also holds portfolios of real estate and fixed-income investments. Many companies are excluded by the fund on ethical grounds. The Government Pension Fund Norway is smaller and was established in 1967 as a type of national insurance fund. It is managed separately from the Oil Fund and is limited to domestic and Scandinavian investments and is therefore a key stock holder in many large Norwegian companies, predominantly via the Oslo Stock Exchange. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Provident Fund (Singapore)

The Central Provident Fund Board (CPFB), commonly known as the CPF Board or simply the Central Provident Fund (CPF), is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement, healthcare, education and housing needs in Singapore. The CPF is an employment-based savings scheme with the help of employers and employees contributing a mandated amount to the fund for their benefits. It is administered by the Central Provident Fund Board, a statutory board operating under the Ministry of Manpower which is responsible for investing contributions. The Global Pension Index, an index that assesses retirement income systems, placed Singapore as the best within in Asia and 7th worldwide in 2020. CPF monies are used by the CPF Board to invest in the exclusive purchase of Government-issued Special Singapore Government Securities (SSGS), with the proceeds from these transactions going into the past reserves. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Temasek Holdings

Temasek Holdings (Private) Limited, or simply Temasek, is a Singaporean state holding company owned by the Government of Singapore. Incorporated on 25 June 1974, Temasek owns and manages a total of US$496.59 billion (S$671 billion) in assets under management (AUM) as of December 2022. Its net portfolio is US$287 billion (S$403 billion) as of 2022, with S$37 billion divested and S$61 billion invested during the year. Its one-year total shareholder return (TSR) was 5.8%, with longer term 10 and 20-year TSRs at 7% and 8% respectively, compounded annually. Its TSR since inception was 14%, compounded over 48 years. Headquartered in Singapore, it has 12 offices in 8 countries around the world, including in Beijing, Hanoi, Mumbai, Shanghai, Shenzhen; and London, Brussels, New York, San Francisco, Washington, D.C. and Mexico City outside Asia. It is an active shareholder and investor, with four key structural trends guiding its long term portfolio construction – Digitisation, Sus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

GIC Private Limited

GIC Private Limited is a sovereign wealth fund in Singapore that manages its foreign reserves. Established by the Government of Singapore in 1981 as the Government of Singapore Investment Corporation, its mission is to preserve and enhance the international purchasing power of the reserves with the aim of achieving good long-term returns above global inflation over the investment time horizon. With a network of 10 offices in key financial capitals worldwide, GIC invests internationally in developed market equities, emerging market equities, nominal bonds and cash, inflation-linked bonds, private equity and real estate. The Sovereign Wealth Fund Institute (SWFI) had estimated the fund's assets at US$690 billion as of June 2022 while Forbes estimated the fund's assets at US$744 billion after legislation were passed to transfer about USD137b from the central bank. Besides GIC, Singapore also owns another sovereign wealth fund Temasek Holdings with managed assets at abo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Caisse Des Dépôts Et Consignations

The Caisse des dépôts et consignations (CDC; ) is a French public sector financial institution created in 1816, and part of the government institutions under the control of the Parliament. Often described as the "investment arm" of the French State, it is defined in the French Monetary and Financial Code as a "public group serving the public interest" and a "long-term investor". Since 2017, Éric Lombard has served as its CEO. Areas of intervention As set out within the French Monetary and Financial Code, the Caisse des dépôts et consignations carries out missions of public interest in support of the public policies implemented by the State and local government bodies. It contributes to the development of enterprises in line with its own proprietorial interests, and may also exercise competitive activities. It ensures, on behalf of the State and local authorities, missions of general interest: *Management of the regulated savings funds (Livret A, LDD, etc.) and financing o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bpifrance

''Banque publique d'investissement'' (literally '' renchPublic Investment Bank'', also known as Bpifrance, BPI Groupe S.A.) is a French public investment bank. It is a joint venture of two public entities: the Caisse des dépôts et consignations and EPIC BPI-Groupe, formerly EPIC OSEO. The former subsidiary of EPIC OSEO, OSEO S.A., became a subsidiary of Bpifrance known as Bpifrance Financement. The bank was directly supervised by the European Central Bank due to its size. Subsidiaries and minority interests * Bpifrance Financement S.A. (90%) (ex- OSEO S.A.) ** Bpifrance Régions (99%) *Bpifrance Participations (100%) (ex-Fonds stratégique d'investissement) ** Bpifrance Investissement (100%) (ex-CDC Entreprises) ** Orange S.A. (shared with APE as the largest shareholders (23.04%); the rest publicly floats) **FT1CI (79.2%, the rest owned by another French agency CEA) ***STMicroelectronics Holding (50%; joint venture with Italian government) ****STMicroelectronics (27.6% ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Council For Social Security Fund

The National Social Security Fund is a supplementary fund of the People's Republic of China which is used for social security Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specificall .... The fund was managed by National Council for Social Security Fund. History On 1 August 2000, the Central Committee of CPC and the State Council decided to establish National Social Security Fund (NSSF), and set up the National Council for Social Security Fund (SSF) for managing and operating the NSSF's assets. NSSF aims to be a solution to the problem of aging and serves as a strategic reserve fund accumulated by the central government to support future social security expenditures and other social security needs. Investment policy and scope Under relevant provisions of the Interim Management Measures on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

China Investment Corporation

China Investment Corporation (CIC) ( Chinese: 中国投资有限责任公司; pinyin: ''zhōngguó tóuzī yǒuxiàn zérèn gōngsī'') is a sovereign wealth fund that manages part of the People's Republic of China's foreign exchange reserves. China's largest sovereign wealth fund, CIC was established in 2007 with about US$200 billion of assets under management, a number that grew to US$941 billion in 2017 and US$1.2 trillion in 2021. History As of 2007, the People's Republic of China has US$1.4 trillion in currency reserves. (By 2013, US$3.44 trillion.China Investment Corporation Profile Sovereign Wealth Fund Institute. July 2, 2008. Retrieved August 27, 2013.) The China Investment Corporation was established with the intent of using these reserves for the benefit of the state, modeled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |