|

List Of Banking Crises

This is a list of banking crises. A banking crisis is a financial crisis that affects banking activity. Banking crises include bank runs, which affect single banks; banking panics, which affect many banks; and systemic banking crises, in which a country experiences many defaults and financial institutions and corporations face great difficulties repaying contracts. A banking crisis is marked by bank runs that lead to the demise of financial institutions, or by the demise of a financial institution that starts a string of similar demises. Bank runs A bank run occurs when many bank customers withdraw their deposits because they believe the bank might fail. There have been many runs on individual banks throughout history; for example, some of the 2008–2009 bank failures in the United States were associated with bank runs. Banking panics and systemic banking crises 18th century * Crisis of 1763, started in Amsterdam, begun by the collapse of Johann Ernst Gotzkowsky and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

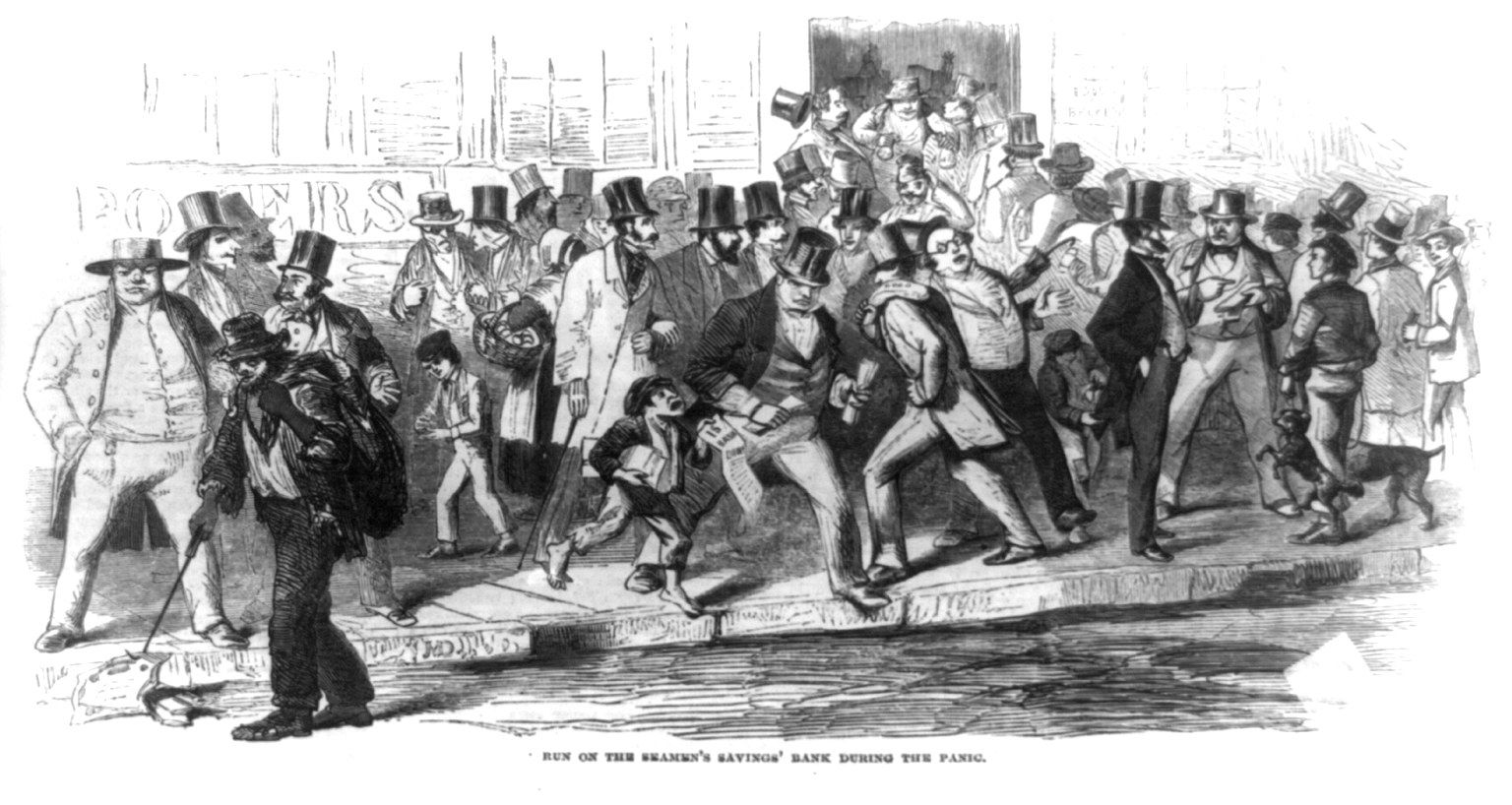

Panic Of 1857

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States. The world economy was also more interconnected by the 1850s, which also made the Panic of 1857 the first worldwide economic crisis. In Britain, the Palmerston government circumvented the requirements of the Bank Charter Act 1844, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain. Beginning in September 1857, the financial downturn did not last long, but a proper recovery was not seen until the onset of the American Civil War in 1861. The sinking of contributed to the panic of 1857, as New York banks were awaiting a much-needed shipment of gold. American banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Empire Of Japan

The also known as the Japanese Empire or Imperial Japan, was a historical nation-state and great power that existed from the Meiji Restoration in 1868 until the enactment of the post-World War II 1947 constitution and subsequent formation of modern Japan. It encompassed the Japanese archipelago and several colonies, protectorates, mandates, and other territories. Under the slogans of and following the Boshin War and restoration of power to the Emperor from the Shogun, Japan underwent a period of industrialization and militarization, the Meiji Restoration, which is often regarded as the fastest modernisation of any country to date. All of these aspects contributed to Japan's emergence as a great power and the establishment of a colonial empire following the First Sino-Japanese War, the Boxer Rebellion, the Russo-Japanese War, and World War I. Economic and political turmoil in the 1920s, including the Great Depression, led to the rise of militarism, nationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Panic

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shōwa Financial Crisis

The was a financial panic in 1927, during the first year of the reign of Emperor Hirohito of Japan, and was a foretaste of the Great Depression. It brought down the government of Prime Minister Wakatsuki Reijirō and led to the domination of the ''zaibatsu'' over the Japanese banking industry. The Shōwa Financial Crisis occurred after the post–World War I business boom in Japan. Many companies invested heavily in increased production capacity in what proved to be an economic bubble. The post-1920 economic slowdown and the Great Kantō earthquake of 1923 caused an economic depression, which led to the failures of many businesses. The government intervened through the Bank of Japan by issuing discounted "earthquake bonds" to overextended banks. In January 1927, when the government proposed to redeem the bonds, rumor spread that the banks holding these bonds would go bankrupt. In the ensuing bank run, 37 banks throughout Japan (including the Bank of Taiwan), and the second-ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

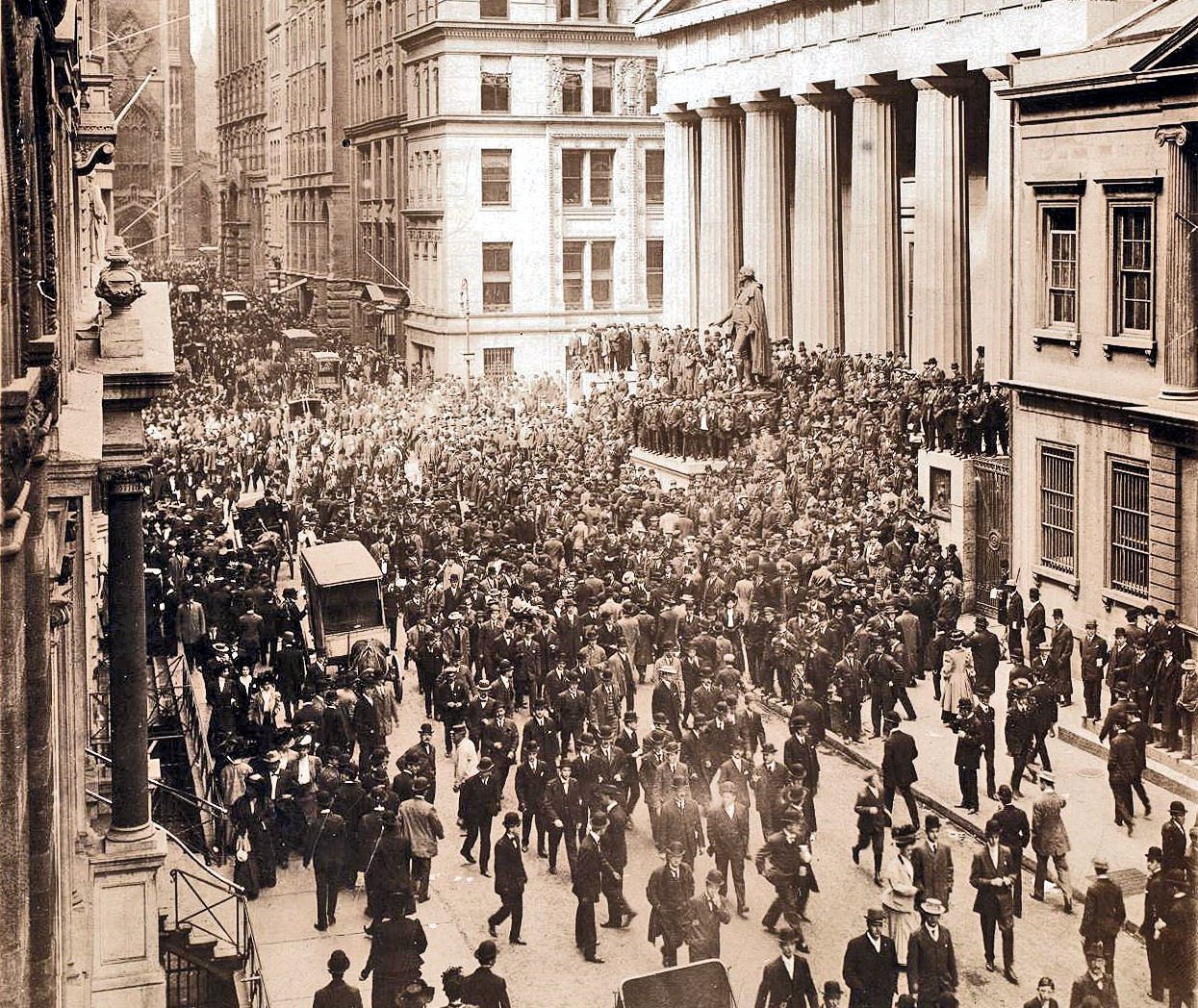

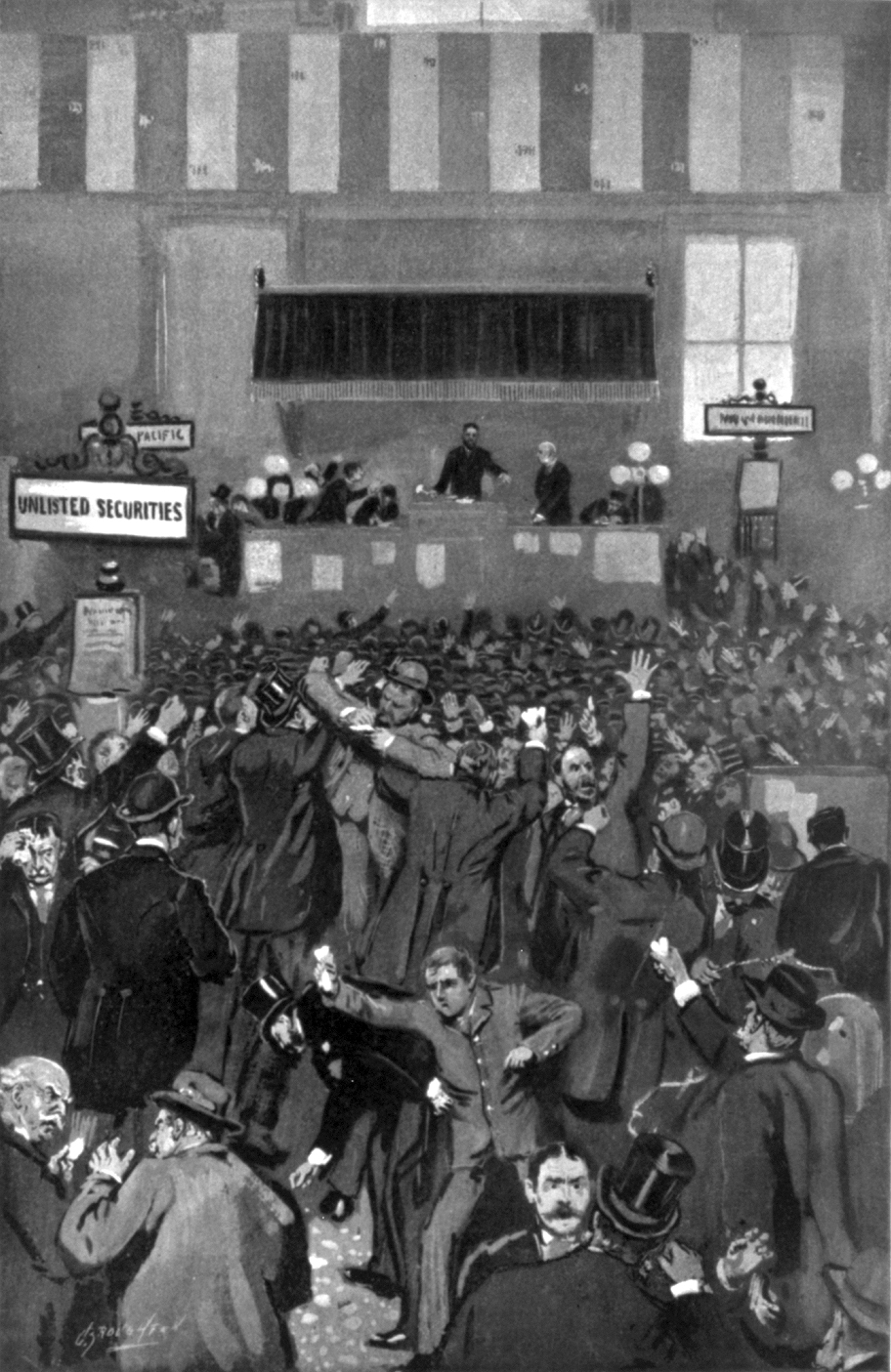

Panic Of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs on banks and on trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When that bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a week ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1901

The Panic of 1901 was the first stock market crash on the New York Stock Exchange, caused in part by struggles between E. H. Harriman, Jacob Schiff, and J. P. Morgan/ James J. Hill for the financial control of the Northern Pacific Railway. The stock cornering was orchestrated by James Stillman and William Rockefeller's First National City Bank financed with Standard Oil money. After reaching a compromise, the moguls formed the Northern Securities Company. As a result of the panic, thousands of small investors were ruined. Key players One of the key players in this was Harriman, who "by 1898…was chairman of the executive committee of the Union Pacific and he ruled without dissent. But he speculated heavily with Union Pacific holdings, and his attempt to monopolize the Chicago rail market led to the Panic of 1901." Causes One of the causes of this stock market crash was Harriman's effort to gain control of Northern Pacific by buying up its stock. The panic began when the market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1896

The Panic of 1896 was an acute economic depression in the United States that was less serious than other panics of the era, precipitated by a drop in silver reserves, and market concerns on the effects it would have on the gold standard. Deflation of commodities' prices drove the stock market to new lows in a trend that began to reverse only after the 1896 Klondike Gold Rush. During the panic, call money would reach 125 percent, the highest level since the Civil War. Causes The Panic of 1896 had roots in the Panic of 1893, and is seen as a continuation of that economic depression. The drop in American gold reserves worsened the effects of the Panic of 1893, and the Panic of 1896 was given its own distinction. The Coinage Act of 1873 demonetized the use of silver in America, and the Resumption Act of 1875 further established the gold standard. This period of deflation was met with some resistance, as the agrarian Populist Party formed to protest the adoption of the gold stan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Banking Crisis Of 1893

The 1893 banking crisis in the Australian colonies involved the collapse of a considerable number of commercial banks and building societies, and a general economic depression. It occurred at the same time as the US Panic of 1893 (1893–1897). Foundations During the 1880s, there had been a speculative boom in the Australian property market. The optimistic climate was fostered by the commercial banks, and also led to the proliferation of non-bank institutions such as building societies; as they were operating in a free banking system, there were few legal restrictions on their operations, and there was no central bank or government-provided deposit guarantees. Consequently, these banks and related bodies lent extravagantly, for property development in particular, but following the collapse of the land boom after 1888, a large number of enterprises that had borrowed money found themselves unable to repay these debts, and many began to declare bankruptcy. Crisis Banks and non-b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1893

The Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy, and produced political upheaval that led to the political realignment of 1896 and the presidency of William McKinley. Causes The Panic of 1893 has been traced to many causes, one of those points to Argentina; investment was encouraged by the Argentine agent bank, Baring Brothers. However, the 1890 wheat crop failure and a failed coup in Buenos Aires ended further investments. In addition, speculations in South African and Australian properties also collapsed. Because European investors were concerned that these problems might spread, they started a run on gold in the U.S. Treasury. Specie was considered more valuable than paper money; when people were uncertain about the future, they hoarded specie and rejected paper notes.Nelson, Scott Reynolds. 2012. A Nation of Deadbeats. New York: Alfred Knopf, p. 189. During the Gi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1890

Panic is a sudden sensation of fear, which is so strong as to dominate or prevent reason and logical thinking, replacing it with overwhelming feelings of anxiety and frantic agitation consistent with an animalistic fight-or-flight reaction. Panic may occur singularly in individuals or manifest suddenly in large groups as mass panic (closely related to herd behavior). Etymology The word "panic" derives from antiquity and is a tribute to the ancient god Pan. One of the many gods in the mythology of ancient Greece, Pan was the god of shepherds and of woods and pastures. The Greeks believed that he often wandered peacefully through the woods, playing a pipe, but when accidentally awakened from his noontime nap he could give a great shout that would cause flocks to stampede. From this aspect of Pan's nature Greek authors derived the word ''panikos'', “sudden fear,” the ultimate source of the English word: "panic". The Greek term indicates the feeling of total fear that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_(14785143685).jpg)