|

List Of Singaporean Exchange-traded Funds

This is a list of notable Singaporean exchange-traded funds, or ETFs. * ABF Singapore Bond Index Fund * CIMB FTSE ASEAN40 ETF * CIMB S&P Ethical Asia Pacific Dividend ETF * db x-trackers CSI300 UCITS ETF * db x-trackers DB Commodity Booster Bloomberg UCITS ETF * db x-trackers DB Commodity Booster Light Energy Benchmark UCITS ETF * db x-trackers EURO Stoxx 50® UCITS ETFF * db x-trackers FTSE China 50 UCITS ETF * db x-trackers Markit iBoxx ABF Indonesia Government UCITS ETF * db x-trackers Markit iBoxx ABF Korea Government UCITS ETF * db x-trackers Markit iBoxx ABF Singapore Government UCITS ETF * db x-trackers Markit iBoxx ABF Korea Government UCITS ETF * db x-trackers MSCI AC Asia Ex Japan Index UCITS ETF * db x-trackers MSCI AC Asia Ex Japan High Dividend Yield Index UCITS ETF * db x-trackers MSCI Brazil Index UCITS ETF (DR) * db x-trackers MSCI EM Asia Index UCITS ETF * db x-trackers MSCI Emerging Markets Index UCITS ETF * db x-trackers MSCI Europe Index UCITS ETF (DR) * db x-tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow (), is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indexes. Many professionals consider it to be an inadequate representation of the overall U.S. stock market compared to a broader market index such as the S&P 500. The DJIA includes only 30 large companies. It is price-weighted, unlike stock indices which use market capitalization. Furthermore, the DJIA does not use a weighted arithmetic mean. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor which is currently () approximately 0.152. The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split. First calculated on May 26, 1896, the index is the second-oldest among U.S. market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CNX Nifty

The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange. It is one of the two main stock indices used in India, the other being the BSE SENSEX. Nifty 50 is owned and managed by NSE Indices (previously known as India Index Services & Products Limited), which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited. NSE Indices had a marketing and licensing agreement with Standard & Poor's for co-branding equity indices until 2013. The Nifty 50 index was launched on 22 April 1996, and is one of the many stock indices of Nifty. The NIFTY 50 index has shaped up to be the largest single financial product in India, with an ecosystem consisting of exchange-traded funds (onshore and offshore), exchange-traded options at NSE, and futures and options abroad at the SGX. NIFTY 50 is the world's most actively traded contract. WFE, IOM and FIA surveys en ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Topix

, commonly known as TOPIX, along with the Nikkei 225, is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, tracking all domestic companies of the exchange's Prime market division. It is calculated and published by the TSE. , there were 1,669 companies listed on the First Section of the TSE, and the market value for the index was ¥197.4 trillion. TOPIX facts via Wikinvest The index transitioned from a system where a company's weighting is based on the total number of shares outstanding to a weighting based on the number of shares available for trading (called the free float). This transition took place in three phases starting in October 2005 and was completed in June 2006. Although the change is a technicality, it had a significant effect on the weighting of many companies in the index, because many companies in Japan hold a significant number of shares of their business partners as a part of intricate business alliances, and such shares are no longer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MSCI World

The MSCI World is a market cap weighted stock market index of 1,546 companies throughout the world. It is maintained by MSCI, formerly Morgan Stanley Capital International, and is used as a common benchmark for 'world' or 'global' stock funds intended to represent a broad cross-section of global markets. The index includes a collection of stocks of all the developed markets in the world, as defined by MSCI. The index includes securities from 23 countries excluding stocks from emerging and frontier economies making it less worldwide than the name suggests. A related index, the MSCI All Country World Index (ACWI), incorporated both developed and emerging countries. MSCI also produces a Frontier Markets index, including another 31 markets. The MSCI World Index has been calculated since 1969, in various forms: without dividends (Price Index), with net or with gross dividends reinvested (Net and Gross Index), in US dollars, Euro and local currencies. Countries/Regions The index inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Straits Times Index

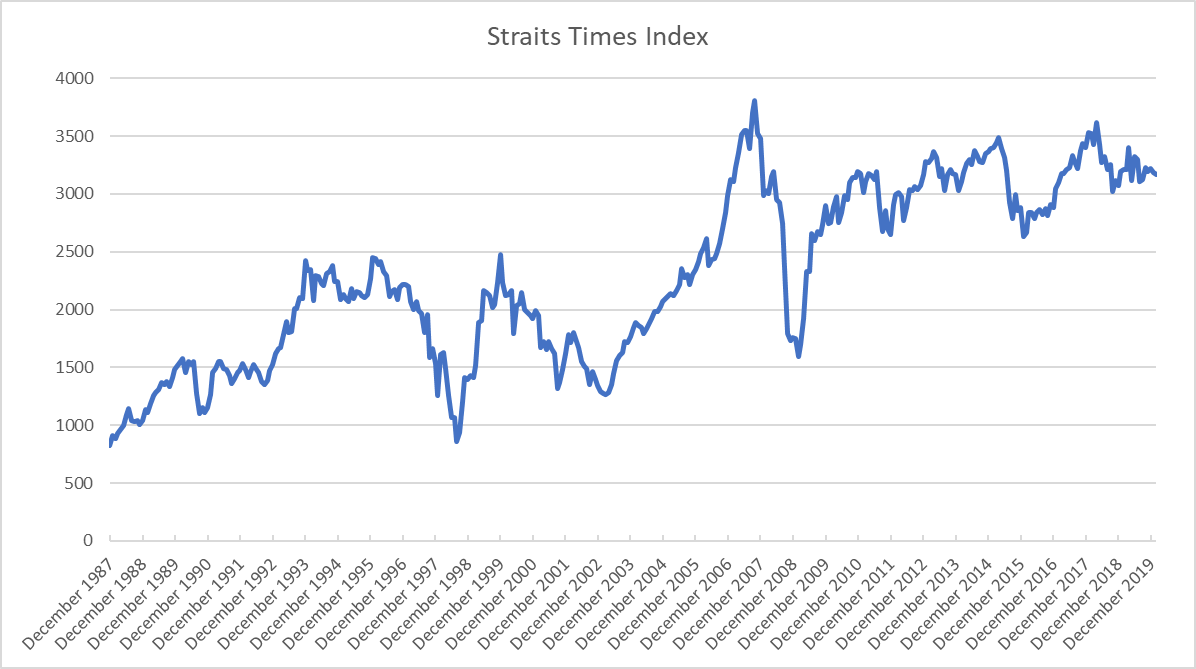

The Straits Times Index (abbreviation: STI) is a capitalisation-weighted measurement stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the Singapore Exchange (SGX). In addition to the SGX, it is also jointly calculated by the Singapore Press Holdings (SPH) and the FTSE Group (FTSE). History Early years The STI has a history dating back to its founding in 1966. Following a major sectoral re-classification of listed companies by the Singapore Exchange, which saw the removal of the "industrials" category, the STI replaced the previous Straits Times Industrials Index (abbreviation: STII) and began trading on 31 August 1998 at 885.26 points, in continuation of where the STII left off. At the time, it represented 78% of the average daily traded value over a 12-month period and 61.2% of total market capitalisation on the exchange. The STI was constructed by SPH, the Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Exchange-traded Funds

The exchange-traded funds available on exchanges vary from country to country. Many of the ETFs listed below are available exclusively on that nation's primary stock exchange and cannot be purchased on a foreign stock exchange. *List of American exchange-traded funds *List of Australian exchange-traded funds *List of Canadian exchange-traded funds *List of European exchange-traded funds *List of Hong Kong exchange-traded funds *List of Indian exchange-traded funds *List of Indonesian exchange-traded funds *List of Japanese exchange-traded funds *List of New Zealand exchange-traded funds *List of Singaporean exchange-traded funds *List of South African exchange-traded funds *List of South Korean exchange-traded funds *List of Taiwan exchange-traded funds *List of Turkish exchange-traded funds See also * Exchange-traded fund * Exchange-traded product * List of hedge funds * List of private-equity firms * List of investment banks * Boutique investment bank * Fund of funds * Boutique ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |