|

LendingPoint

LendingPoint is a financial technology platform. The company looks at a person's complete financial picture, taking into consideration credit history, employment history, earning potential and other data to determine creditworthiness. LendingPoint gives access to more affordable loans for consumers with credit scores between 500–850 and discounts traditional creditworthiness factors, such as FICO scores, Debt-to-income ratio, debt-to-income (DTI) ratios, and payment-to-income (PTI) ratios. It was founded in 2014 by Tom Burnside, Franck Fatras, Victor J. Pacheco, and Juan E. Tavares. History LendingPoint launched its first consumer loan product in January 2015. In October 2015, LendingPoint announced a $100 million credit facility with funds managed by the Tradable Credit and Direct Lending groups of Ares Management. Two months later, LendingPoint signed an additional credit facility for $5 million of incremental financing with Aeterna Capital Partners. In August 2016, form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FICO

FICO (legal name: Fair Isaac Corporation), originally Fair, Isaac and Company, is a data analytics company based in Bozeman, Montana, focused on credit scoring services. It was founded by Bill Fair and Earl Isaac in 1956. Its FICO score, a measure of consumer credit risk, has become a fixture of consumer lending in the United States. In 2013, lenders purchased more than 10 billion FICO scores and about 30 million American consumers accessed their scores themselves. The company reported a revenue of $1.29 billion dollars for the fiscal year of 2020. History FICO was founded in 1956 as Fair, Isaac and Company by engineer William R. "Bill" Fair and mathematician Earl Judson Isaac. The two met while working at the Stanford Research Institute in Menlo Park, California. Selling its first credit scoring system two years after the company's creation, [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-to-income Ratio

In the consumer mortgage industry, debt-to-income ratio (often abbreviated DTI) is the percentage of a consumer's monthly gross income that goes toward paying debts. (Speaking precisely, DTIs often cover more than just debts; they can include principal, taxes, fees, and insurance premiums as well. Nevertheless, the term is a set phrase that serves as a convenient, well-understood shorthand.) There are two main kinds of DTI, as discussed below. Two main kinds of DTI The two main kinds of DTI are expressed as a pair using the notation x/y (for example, 28/36). # The first DTI, known as the ''front-end ratio'', indicates the percentage of income that goes toward housing costs, which for renters is the rent amount and for homeowners is PITI (mortgage principal and interest, mortgage insurance premium hen applicable hazard insurance premium, property taxes, and homeowners' association dues hen applicable. # The second DTI, known as the ''back-end ratio'', indicates the percentage ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ares Management

Ares Management Corporation is an American global alternative investment manager operating in the credit, private equity and real estate markets. The company was founded in 1997 and is headquartered in Los Angeles, California, with additional offices across North America, Europe, and Asia. As of September 2021, Ares Management Corporation's global platform had approximately $295 billion of assets under management and 1,500 employees operating across North America, Europe, Asia Pacific and the Middle East. History The firm was established in 1997. The co-founders included Antony Ressler, Michael Arougheti, David Kaplan, John H. Kissick, and Bennett Rosenthal. It has several subsidiaries: *Ares Capital Corporation established in 2004: provides financing for middle market acquisitions, recapitalizations, and leveraged buyouts, mainly in the United States. It is a publicly traded closed-end, non-diversified specialty finance company that is regulated as a business development co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

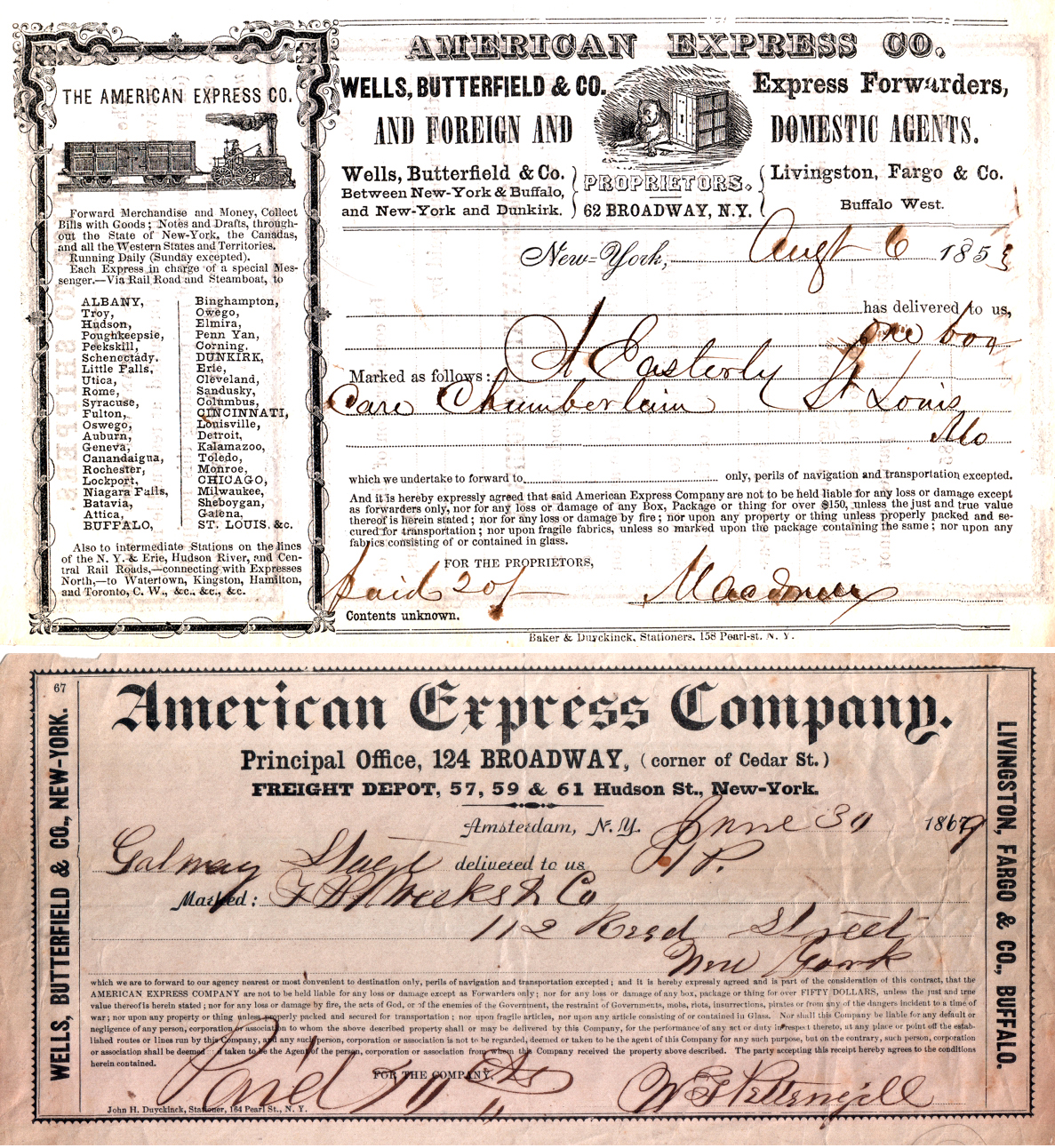

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chief Revenue Officer

A chief revenue officer (CRO) is a corporate officer (executive) responsible for all revenue generation processes in an organization. In this role, a CRO is accountable for driving better integration and alignment between all revenue-related functions, including marketing, sales, customer support, pricing, and revenue management.Cross, R. (1997) Revenue Management: Hard-Core Tactics for Market Domination. New York, NY: Broadway Books. Roles and functions In short, a CRO is responsible for all activities that generate revenue. In most companies, the CRO is tasked with primary or shared responsibility for operations, sales, corporate development, marketing, pricing, and revenue management. Since these functions extend across multiple teams in most companies, a good CRO must maintain an excellent communication framework across the various organizational functions and share best practices among the revenue stream managers in order to maximize revenue production. Like with any corpor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Guggenheim Partners

Guggenheim Partners is a global investment and advisory financial services firm that engages in investment banking, asset management, capital markets services, and insurance services. Organization The firm is headquartered in New York City and Chicago. It has more than $325 billion of assets under management. The firm's CEO is Mark Walter. Guggenheim Partners provides services across asset management, investment banking, and broker dealer services including capital markets. Guggenheim Investment Advisors oversees about $50 billion in assets. In October 2009, Guggenheim hired former J.P. Morgan head of Media Investment Banking Mark Van Lith as Senior Managing Director and Head of Investment Banking and former Apollo Global Management director and vice chairman Henry Silverman as vice chairman of asset management. In January 2013, Guggenheim named former Yahoo! interim CEO Ross Levinsohn as CEO of private equity unit Guggenheim Digital Media. In May & June 2013, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mezzanine Capital

In finance, mezzanine capital is any subordinated debt or preferred equity instrument that represents a claim on a company's assets which is senior only to that of the common shares. Mezzanine financings can be structured either as debt (typically an unsecured and subordinated note) or preferred stock. Mezzanine capital is often a more expensive financing source for a company than secured debt or senior debt. The higher cost of capital associated with mezzanine financings is the result of it being an unsecured, subordinated (or junior) obligation in a company's capital structure (i.e., in the event of default, the mezzanine financing is only repaid after all senior obligations have been satisfied). Additionally, mezzanine financings, which are usually private placements, are often used by smaller companies and may involve greater overall levels of leverage than issues in the high-yield market; they thus involve additional risk. In compensation for the increased risk, mezzanine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EBay

eBay Inc. ( ) is an American multinational e-commerce company based in San Jose, California, that facilitates consumer-to-consumer and business-to-consumer sales through its website. eBay was founded by Pierre Omidyar in 1995 and became a notable success story of the dot-com bubble. eBay is a multibillion-dollar business with operations in about 32 countries, as of 2019. The company manages the eBay website, an online auction and shopping website in which people and businesses buy and sell a wide variety of goods and services worldwide. The website is free to use for buyers, but sellers are charged fees for listing items after a limited number of free listings, and an additional or separate fee when those items are sold. In addition to eBay's original auction-style sales, the website has evolved and expanded to include: instant "Buy It Now" shopping; shopping by Universal Product Code, ISBN, or other kind of SKU number (via Half.com, which was shut down in 2017); and othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset-backed Security

An asset-backed security (ABS) is a security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues. Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Warburg Pincus

Warburg Pincus LLC is a global private equity firm, headquartered in New York, with offices in the United States, Europe, Brazil, China, Southeast Asia and India. Warburg has been a private equity investor since 1966. The firm currently has over $80 billion in assets under management and invests in a range of sectors including retail, industrial manufacturing, energy, financial services, health care, technology, media, and real estate. Warburg Pincus is a growth investor. Warburg Pincus has raised 21 private equity funds which have invested over $100 billion in over 1,000 companies in 40 countries. Warburg Pincus invested in the information and communication technology sectors, including investments in Avaya, Bharti Tele-Ventures, Harbour Networks, NeuStar, PayScale, and Telcordia. History Founding and early history In 1939, Eric Warburg of the Warburg banking family founded a company under the name E.M. Warburg & Co. Its first address was 52 William Street, New York ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 2014

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Companies Established In 2014

American(s) may refer to: * American, something of, from, or related to the United States of America, commonly known as the "United States" or "America" ** Americans, citizens and nationals of the United States of America ** American ancestry, people who self-identify their ancestry as "American" ** American English, the set of varieties of the English language native to the United States ** Native Americans in the United States, indigenous peoples of the United States * American, something of, from, or related to the Americas, also known as "America" ** Indigenous peoples of the Americas * American (word), for analysis and history of the meanings in various contexts Organizations * American Airlines, U.S.-based airline headquartered in Fort Worth, Texas * American Athletic Conference, an American college athletic conference * American Recordings (record label), a record label previously known as Def American * American University, in Washington, D.C. Sports teams Soccer * B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |