|

Longevity Insurance

Longevity insurance, describes the process of mitigating against Longevity risk. Such risk mitigation is often achieved using a longevity annuity or Tontine, qualifying longevity annuity contract (QLAC), deferred income annuity, is an annuity contract designed to provide to the policyholder payments for life starting at a pre-established future age, e.g., 85, and purchased many years before reaching that age. General description Longevity annuities are like "reverse life insurance", meaning premium dollars are collected by the life insurance company by its policy holders to pay income when a policy holder lives a long life, instead of collecting premium dollars and paying a death claim on a policy holder's short life in ordinary life insurance Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Longevity Risk

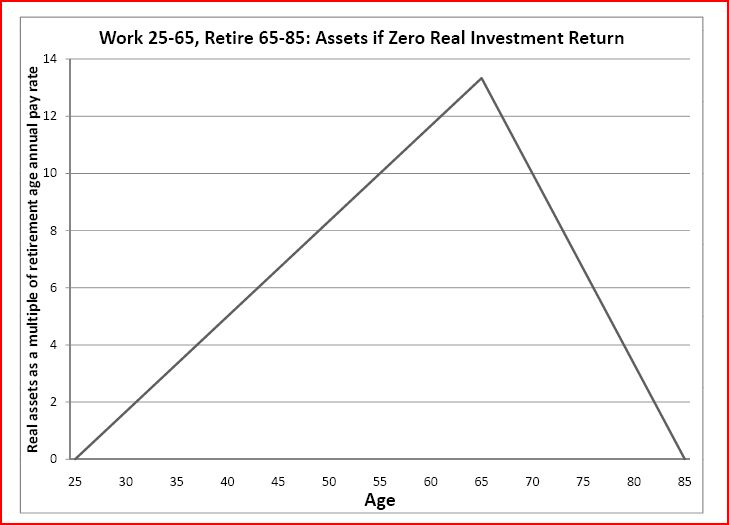

A longevity risk is any potential risk attached to the increasing life expectancy of pensioners and policy holders, which can eventually result in higher pay-out ratios than expected for many pension funds and insurance companies. One important risk to individuals who are spending down savings is that they will live longer than expected, and thus exhaust their savings, dying in poverty or burdening relatives. This is also referred to as "outliving one's savings" or "outliving one's assets". Individuals Individuals often underestimate longevity risk. In the United States, most retirees do not expect to live past 85, but this is in fact the median conditional life expectancy for men at 65 (half of 65-year-old men will live to 85 or older, and more women will). Low interest rates and declining returns exacerbating longevity risk The collapse in returns on government bonds is taking place against the backdrop of a protracted fall in returns for other core assets such as blue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tontine

A tontine () is an investment linked to a living person which provides an income for as long as that person is alive. Such schemes originated as plans for governments to raise capital in the 17th century and became relatively widespread in the 18th and 19th centuries. Tontines enable subscribers to share the risk of living a long life by combining features of a group annuity with a kind of mortality lottery. Each subscriber pays a sum into a trust and thereafter receives a periodical payout. As members die, their payout entitlements devolve to the other participants, and so the value of each continuing payout increases. On the death of the final member, the trust scheme is usually wound up. Tontines are still common in France. They can be issued by European insurers under the Directive 2002/83/EC of the European Parliament. The Pan-European Pension Regulation passed by the European Commission in 2019 also contains provisions that specifically permit next-generation pension produc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annuity (US Financial Products)

In the United States, an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life. Typically these are offered as structured (insurance) products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurer. There are many different varieties of annuities sold by carriers. In a typical scenario, an investor (usually the annuitant) will make a single cash premium to own an annuity. After the policy is issued the owner may elect to annuitize the contract (start receiving payments) for a chosen period of time (e.g., 5, 10, 20 years, a lifetime). This process is called annuitization and can also provide a predictable, guaranteed stream of future income during retirement until the death of the annuitant (or joint annuitants). Alternatively, an investor can defer annuitizing their contract to get larger payments later, hedge long-term care cost ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Types Of Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |