|

List Of Bank Mergers

This is a partial list of major banking company mergers in the United States. Table Mergers chart This 2012 chart shows some of the mergers noted above. Solid arrows point from the acquiring bank to the acquired one. The lines are labeled with the year of the deal and color-coded from blue (older) to red (newer). Dotted arrows point to the final merged entity. References Citations * Stephen A. Rhoades, "Bank Mergers and Industrywide Structure, 1980–1994," Washington: Board of Governors of the Federal Reanuary 1996.Staff study 169 * Steven J. Pilloff, "Bank Merger Activity in the United States, 1994–2003," Washington: Board of Governors of the Federal Reserve System, May 2004. Staff study 176Institute of Mergers, Acquisitions and Alliances (MANDA) M&AAn academic research institute on mergers & acquisitions, including bank mergers *Mellon Merger, ''The New York Times'', April 7, 1983 {{DEFAULTSORT:Bank Mergers In The United States, List Of Corporation-related li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid digital subscribers. It also is a producer of popular podcasts such as '' The Daily''. Founded in 1851 by Henry Jarvis Raymond and George Jones, it was initially published by Raymond, Jones & Company. The ''Times'' has won 132 Pulitzer Prizes, the most of any newspaper, and has long been regarded as a national " newspaper of record". For print it is ranked 18th in the world by circulation and 3rd in the U.S. The paper is owned by the New York Times Company, which is publicly traded. It has been governed by the Sulzberger family since 1896, through a dual-class share structure after its shares became publicly traded. A. G. Sulzberger, the paper's publisher and the company's chairman, is the fifth generation of the family to head the pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Phenix National Bank

The Chatham Phenix National Bank and Trust Company was a bank in New York City connected with the Chatham Phenix Corporation. Its predecessor Chatham and Phenix National Bank was formed in 1911 when Chatham National Bank paid $1,880,000 to absorb the asset of the Phenix National Bank. The bank grew significantly as it absorbed smaller banking institutions, such as Mutual Alliance Trust Company and Century Bank in 1915, at which point Chatham and Phenix National Bank became the "first national bank to operate branches in the same city with the main bank." Chatham Phenix National Bank and Trust Company of New York was organized in 1925 with resources of around $300,000,000. At the time of its formation, it was one of the ten largest banks in the United States. In 1932, the company merged with the Manufacturers Trust. History Phenix Bank and Chatham Bank Phenix Bank was established in 1812 as the banking division of the New York Manufacturing Company, which made cotton looms and sup ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PNC Financial Services

The PNC Financial Services Group, Inc. (stylized as PNC) is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 U.S. state, states and the District of Columbia, with 2,629 branch (banking), branches and 9,523 Automated teller machine, ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs. The company also provides financial services such as asset management, wealth management, estate planning, loan servicing, and information processing. PNC is one of the largest Small Business Administration lenders and one of the largest credit card issuers. It also provides asset-based lending to private equity firms and Middle-market company, middle market companies. PNC operates one of the largest treasury management businesses and the second largest lead arranger of asset-based loan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bank Of Delaware

The National Bank of Delaware (founded as the Bank of Delaware) was the first bank chartered in the U.S. state of Delaware. Based in Wilmington, the bank operated independently from 1795 to 1929, when it was merged into the Security Trust Company, also of Wilmington. History Independent operation The bank was formally organized on June 1, 1795, and received its charter on February 9, 1796, from the Delaware General Assembly with capital stock of $100,000. With Joseph Tatnall as president and John Hayes as cashier, it opened at Fourth and Market Streets on August 17. In 1816, the bank moved to a new building on the east corner of Sixth and Market Streets. The bank was issued a new charter in 1820, and doubled its stock's par value by 1850. On July 16, 1865, it received a national charter under the National Banking Act, and was renamed the National Bank of Delaware at Wilmington, with capital of $110,000. The charter was extended in 1885. For 127 years, the bank served an account o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security Trust Company

Security is protection from, or resilience against, potential harm (or other unwanted Coercion, coercive change) caused by others, by restraining the freedom of others to act. Beneficiaries (technically referents) of security may be of persons and social groups, objects and institutions, ecosystems or any other entity or phenomenon vulnerable to unwanted change. Security mostly refers to protection from hostile forces, but it has a wide range of other senses: for example, as the absence of harm (e.g. freedom from want); as the presence of an essential good (e.g. food security); as Resilience (organizational), resilience against potential damage or harm (e.g. secure foundations); as secrecy (e.g. a Telephone tapping, secure telephone line); as containment (e.g. a secure room or Prison cell, cell); and as a state of mind (e.g. emotional security). The term is also used to refer to acts and systems whose purpose may be to provide security (security companies, security forces, secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philadelphia Trust Company

Philadelphia, often called Philly, is the largest city in the Commonwealth of Pennsylvania, the sixth-largest city in the U.S., the second-largest city in both the Northeast megalopolis and Mid-Atlantic regions after New York City. Since 1854, the city has been coextensive with Philadelphia County, the most populous county in Pennsylvania and the urban core of the Delaware Valley, the nation's seventh-largest and one of world's largest metropolitan regions, with 6.245 million residents . The city's population at the 2020 census was 1,603,797, and over 56 million people live within of Philadelphia. Philadelphia was founded in 1682 by William Penn, an English Quaker. The city served as capital of the Pennsylvania Colony during the British colonial era and went on to play a historic and vital role as the central meeting place for the nation's founding fathers whose plans and actions in Philadelphia ultimately inspired the American Revolution and the nation's independenc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

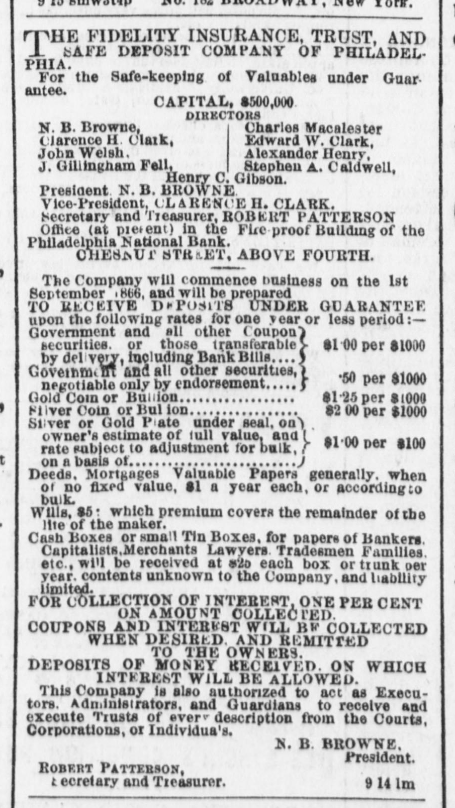

Fidelity Trust Company

Fidelity Trust Company was a bank in Philadelphia, Pennsylvania. Founded in 1866 as Fidelity Insurance, Trust, & Safe Deposit Company, the bank was later renamed Fidelity Trust Company, Fidelity-Philadelphia Trust Company, The Fidelity Bank, and Fidelity Bank, National Association. It was absorbed in 1988 in the biggest U.S. bank merger up to that point, and is today part of Wells Fargo. History It was founded in 1866 by financier Clarence H. Clark (1833–1906) and several partners as the Fidelity Insurance, Trust, & Safe Deposit Company with initial capital of $250,000. Besides selling insurance and transacting trust business, the company was the second U.S. bank to offer safe deposit services. The bank was located at Broad and Walnut Streets in Philadelphia. The Chestnut Street building was designed by G. W. & W. D. Hewitt - Architects, Frederick S. Holmes - Vault Engineer, anDamon Safe & Iron Works Co.- Vault Builder. Clark served as the bank's first president, followed by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CoreStates Financial Corporation

CoreStates Financial Corporation, previously known as Philadelphia National Bank (PNB), was an American bank holding company in the Philadelphia, Pennsylvania, metropolitan area. The bank was renamed in the mid-1980s after a series of mergers. After being acquired by First Union Corporation, which later also acquired Wachovia National Bank to become Wachovia Corporation, CoreStates Financial Corporation became a part of Wells Fargo in 2008 when Wachovia (formerly known as First Union) was acquired by that company. History Philadelphia National Bank and First Pennsylvania Bank The bank was founded in Philadelphia on September 8, 1803, as The Philadelphia Bank. George Clymer was the bank's first president. Later, the bank became known as Philadelphia National Bank, or PNB. During the early years of the United States, Philadelphia developed as the banking center of the country. The First Bank of the United States chartered in 1791, was based in the city until its charter expired i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of North America

The Bank of North America was the first chartered bank in the United States, and served as the country's first ''de facto'' central bank. Chartered by the Congress of the Confederation on May 26, 1781, and opened in Philadelphia on January 7, 1782, it was based upon a plan presented by US Superintendent of Finance Robert Morris on May 17, 1781, based on recommendations by Revolutionary era figure Alexander Hamilton. Although Hamilton later noted its "essential" contribution to the war effort, the Pennsylvania government objected to its privileges and reincorporated it under state law, making it unsuitable as a national bank under the federal Constitution. Instead Congress chartered a new bank, the First Bank of the United States, in 1791, while the Bank of North America continued as a private concern. History Congressional charter In May 1781 Alexander Hamilton revealed that he had recommended Robert Morris for the position of Superintendent of Finance of the United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Alliance Trust Company

The Mutual Alliance Trust Company was a trust company formed in New York City in 1902, with founders such as Cornelius Vanderbilt and William Rockefeller. On January 14, 1915, the company was acquired by Chatham-Phenix National and Alliance Trust in New York. History Formation At the end of April 1902, H. M. Humphreys resigned from his positions as superintendent of the Coffee Exchange to become vice president of the newly formed Mutual Alliance Trust Company. On May 1, 1902, the ''New York Times'' reported the details of the newly formed Mutual Alliance Trust Company. It was organized by Cornelius Vanderbilt, William Rockefeller, and "a dozen more well-known men" with $1,000,000 in capital. Its initial place of business was an office at Orchard and Grand Streets in New York City. Kalman Haas was founding president, and Henry M. Humphrey vice president. It opened for business on the Tuesday after June 29, 1902, as a general trust company on the east side of Manhattan. There were 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First National Bank (Wilmington)

First National Bank may refer to: Worldwide Lebanon * First National Bank (Lebanon) Japan * Dai-Ichi Kangyo Bank, formerly South Africa * First National Bank (South Africa) United States Banking institutions (existing) * First National Bank of Florida * First National Bank of Layton, Utah * First National Bank of Omaha, Nebraska * FNB Corporation of Pittsburgh, Pennsylvania Banking institutions (former) * First National Bank (Brooksville, Florida) * First National Bank (Clinton, Iowa) * First National Bank of Davenport, Iowa * First National Bank (Iowa Falls, Iowa) * First National Bank of Mason City, Mason City, Iowa * First National Bank (Mount Pleasant, Iowa) * First National Bank (Bolivar, Missouri) * First National Bank, Hoboken, New Jersey * First National Bank (Philadelphia), Philadelphia, Pennsylvania * First National Bank (New Cumberland, West Virginia) * First National Bank of Arizona, became part of First Interstate Bancorp * First National Bank of Boston, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

M&T Bank

M&T Bank Corporation (Manufacturers and Traders Trust Company) is an American bank holding company headquartered in Buffalo, New York. It operates 1680 branches in New York, New Jersey, Connecticut, Pennsylvania, Maine, Maryland, Massachusetts, New Hampshire, Delaware, Vermont, Virginia, West Virginia, and Washington, D.C. M&T is ranked 519th on the Fortune 500 list based on 2021 revenues. Until May 1998, the bank's holding company was named First Empire State Corporation. M&T Bank has been profitable in every quarter since 1976. Other than Northern Trust, M&T was the only bank in the S&P 500 Index not to lower its dividend during the financial crisis of 2007–2008. The bank owns the Buffalo Savings Bank building in downtown Buffalo, and Bridgeport Center in Bridgeport, Connecticut. M&T Bank also sponsors M&T Bank Stadium, home of the Baltimore Ravens. M&T Bank is the official bank of the Buffalo Bills in Western New York and of their home Bills Stadium in Orchard Park, New Y ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)

-Pennsylvania-6_Aug_1789.jpg)