|

Keytrade Bank

Keytrade Bank is a financial services company based in Belgium with a subsidiary in Luxembourg. History VMS-Keytrade, Belgium's first online investment site, was founded in 1998. In 2002, VMS-Keytrade became Keytrade Bank and acquired its banking status by taking over RealBank. Between 2005 and 2016, Keytrade Bank was part of the Crelan Group, which until 2015 was 50% owned by the Crédit Agricole Group, one of Europe's largest groups (own funds of €64.8 billion and net profit of €6 billion). Since June 2016, Keytrade Bank has been part of the Crédit Mutuel Arkéa banking group. Products Keytrade Bank offers all banking and trading services online. Bank Keytrade Bank offers all the usual services of a large bank with a current account, a savings account and a term account for free, but also debit and credit cards. * Current account: available 24 hours a day, yielding 5 cents for each operation executed; Bancontact / Mister Cash / Maestro cards for free and VIS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Turbo

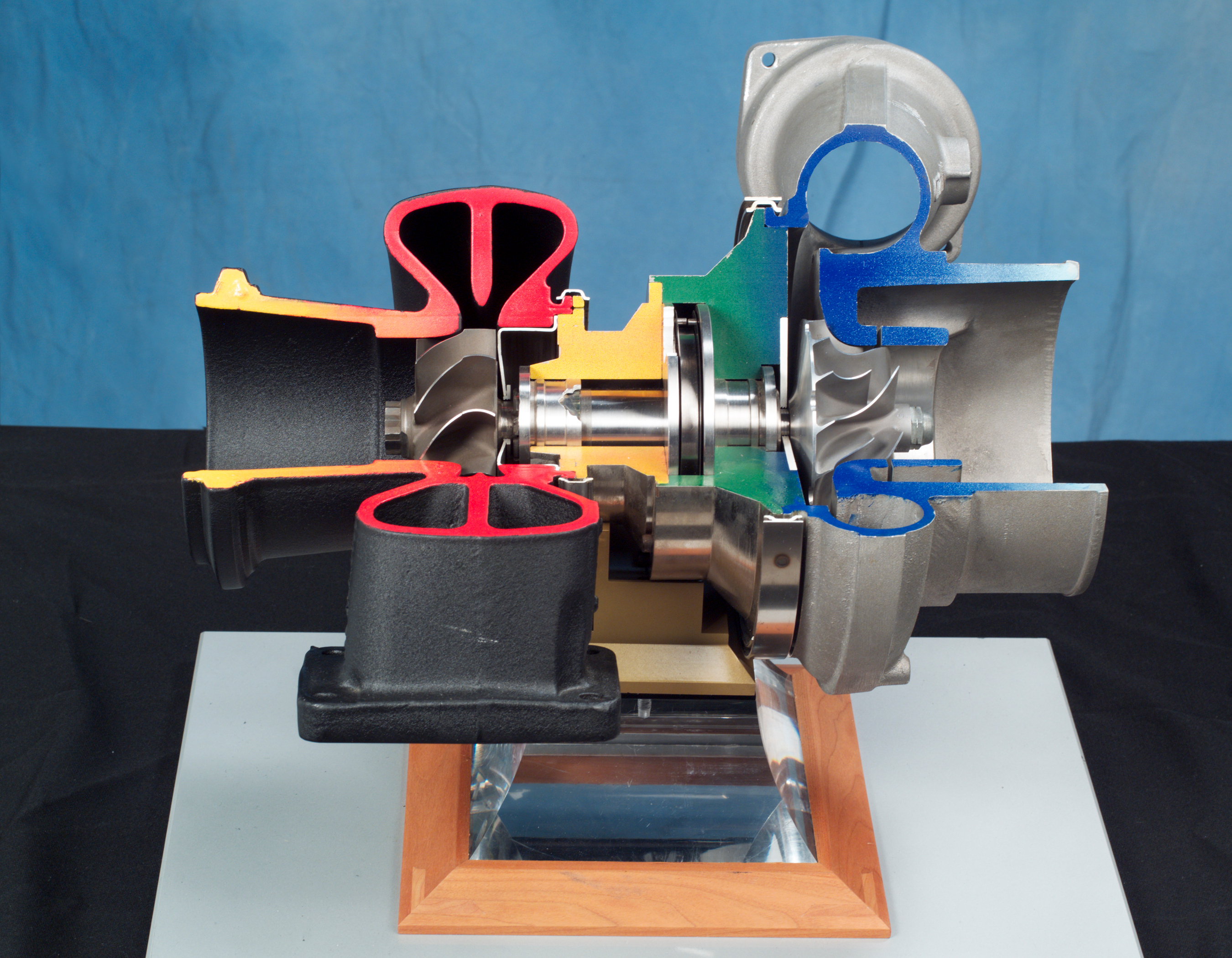

In an internal combustion engine, a turbocharger (often called a turbo) is a forced induction device that is powered by the flow of exhaust gases. It uses this energy to compress the intake gas, forcing more air into the engine in order to produce more power for a given displacement. The current categorisation is that a turbocharger is powered by the kinetic energy of the exhaust gasses, whereas a is mechanically powered (usually by a belt from the engine's crankshaft). However, up until the mid-20th century, a turbocharger was called a "turbosupercharger" and was considered a type of supercharger. History Prior to the invention of the turbocharger, |

Financial Services Companies Of Belgium

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of Production (economics), production, Distribution (economics), distribution, and Consumption (economics), consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in Financial system, financial systems at various scopes, thus the field can be roughly divided into Personal finance, personal, Corporate finance, corporate, and public finance. In a financial system, assets are bought, sold, or traded as Financial instrument, financial instruments, such as Currency, currencies, Loan, loans, Bond (finance), bonds, Share (finance), shares, Stock, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be Bank, banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are alway ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Belgium

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the anc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1998

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RTBF

The ''Radio-télévision belge de la Communauté française'' (RTBF, ''Belgian Radio-television of the French Community'', branded as rtbf.be) is a public service broadcaster delivering radio and television services to the French-speaking Community of Belgium, in Wallonia and Brussels. Its counterpart in the Flemish Community is the Dutch-language VRT (''Vlaamse Radio- en Televisieomroeporganisatie''), and in the German-speaking Community it is BRF (''Belgischer Rundfunk''). RTBF operates five television channels – ', ', ', ' and ' together with a number of radio channels, ', ', ', ', ', and '. The organisation's headquarters in Brussels, which is shared with VRT, is sometimes referred to colloquially as ''Reyers''. This comes from the name of the avenue where RTBF/VRT's main building is located, the . History Originally named the Belgian National Broadcasting Institute (french: INR, Institut national belge de radiodiffusion; nl, NIR, Belgisch Nationaal Instituut voo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forex

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trend Following

Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal, including the current market price calculation, moving averages and channel breakouts. Traders who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Due to the different techniques and time frames employed by trend followers to identify trends, trend followers as a group are not always strongly correlated to one another. Trend following is used by commodity trading advisors (CTAs) as the predominant strategy of technical traders. Research done by Galen Burghardt has shown that between 2000-2009 there was a very high correlation (.97) between tren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Day-trading

Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day, so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Traders who trade in this capacity are generally classified as speculators. Day trading contrasts with the long-term trades underlying buy-and-hold and value investing strategies. Day trading may require fast trade execution, sometimes as fast as milli-seconds in scalping, therefore a direct-access day trading software is often needed. Day traders generally use leverage such as margin loans; in the United States, Regulation T permits an initial maximum leverage of 2:1, but many brokers will permit 4:1 intraday leverage as long as the leverage is reduced to 2:1 or less by the end of the trading day. In the United States, based on rules by the Financial In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Products

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized "structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor's investment return and the issuer's payment obligations are contingent on, or highly sensitive to, changes in the value of underly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |