|

Keynes Effect

The Keynes effect is the effect that changes in the price level have upon goods market spending via changes in interest rates. As prices fall, a given nominal money supply will be associated with a larger real money supply, causing interest rates to fall and in turn causing investment spending on physical capital to increase. This implies that insufficient demand in the product market cannot exist forever, because insufficient demand will cause a lower price level, resulting in increased demand. There are two cases in which the Keynes effect does not occur: in the liquidity trap (when the LM curve is horizontal and thus changes in the real money supply do not affect interest rates), and when expenditure is inelastic with respect to (unresponsive to) interest rates (when the IS curve is vertical). The Patinkin-Pigou real balance effect suggests that due to wealth effects of changes in the price level upon spending itself, insufficient demand cannot persist even in the two cases ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Level

The general price level is a hypothetical measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set. Typically, the general price level is approximated with a daily price ''index'', normally the Daily CPI. The general price level can change more than once per day during hyperinflation. Theoretical foundation The classical dichotomy is the assumption that there is a relatively clean distinction between overall increases or decreases in prices and underlying, “nominal” economic variables. Thus, if prices ''overall'' increase or decrease, it is assumed that this change can be decomposed as follows: Given a set C of goods and services, the total value of transactions in C at time t is :\sum_ (p_\cdot q_)=\sum_ P_t\cdot p'_)\cdot q_P_t\cdot \sum_ (p'_\cdot q_) where :q_\, represents the quantity of c at time t :p_\, represents the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Vs

Real may refer to: Currencies * Brazilian real (R$) * Central American Republic real * Mexican real * Portuguese real * Spanish real * Spanish colonial real Music Albums * ''Real'' (L'Arc-en-Ciel album) (2000) * ''Real'' (Bright album) (2010) * ''Real'' (Belinda Carlisle album) (1993) * ''Real'' (Gorgon City EP) (2013) * ''Real'' (IU EP) (2010) * ''Real'' (Ivy Queen album) (2004) * ''Real'' (Mika Nakashima album) (2013) * ''Real'' (Ednita Nazario album) (2007) * ''Real'' (Jodie Resther album), a 2000 album by Jodie Resther * ''Real'' (Michael Sweet album) (1995) * ''Real'' (The Word Alive album) (2014) * ''Real'', a 2002 album by Israel Houghton recording as Israel & New Breed Songs * "Real" (Goo Goo Dolls song) (2008) * "Real" (Gorgon City song) (2013) * "Real" (Plumb song) (2004) * "Real" (Vivid song) (2012) * "Real" (James Wesley song) (2010) * "Real", a song by Kendrick Lamar from ''Good Kid, M.A.A.D City'' * "Real", a song by NF from ''Therapy Session'' * "Re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (currency), currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). The central bank of a country may use a definition of what constitutes legal tender for its purposes. Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public sector, Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of Security (finance), securities, inflation, the exchange rates, and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physical Capital

Physical capital represents in economics one of the three primary factors of production. Physical capital is the apparatus used to produce a good and services. Physical capital represents the tangible man-made goods that help and support the production. Inventory, cash, equipment or real estate are all examples of physical capital. Definition N.G. Mankiw definition from the book Economics: '' Capital is the equipment and structures used to produce goods and services. Physical capital consists of man-made goods (or input into the process of production) that assist in the production process. Cash, real estate, equipment, and inventory are examples of physical capital.'' Capital goods represents one of the key factors of corporation function. Generally, capital allows a company to preserve liquidity while growing operations, it refers to physical assets in business and the way a company have reached their physical capital. While referring how companies have obtained their capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt ( financial instrument) which yields so low a rate of interest." Keynes, John Maynard (1936) ''The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity Origin and definition of the term John Maynard Keynes, in his 1936 ''Gener ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elasticity (economics)

In economics, elasticity measures the percentage change of one economic variable in response to a percentage change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the demand quantity to fall by 20%. Introduction Elasticity is an important concept in neoclassical economic theory, and enables in the understanding of various economic concepts, such as the incidence of indirect taxation, marginal concepts relating to the theory of the firm, distribution of wealth, and different types of goods relating to the theory of consumer choice. An understanding of elasticity is also important when discussing welfare distribution, in particular consumer surplus, producer surplus, or government surplus. Elasticity is present throughout many economic theories, with the concept of elasticity appearing in several main indicators. These include price elasticity of demand, price elasticity of supply, income elasticity of demand, elastici ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IS Curve

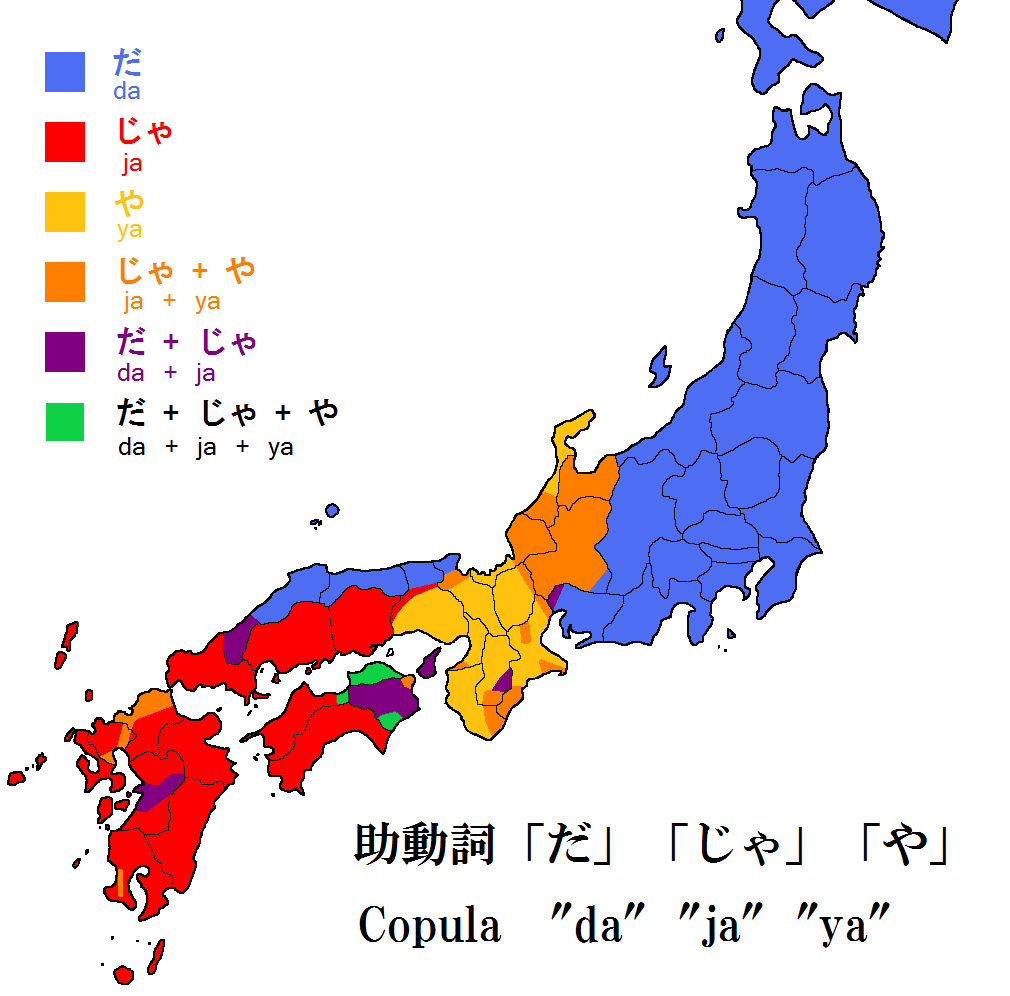

In linguistics, a copula (plural: copulas or copulae; abbreviated ) is a word or phrase that links the subject of a sentence to a subject complement, such as the word ''is'' in the sentence "The sky is blue" or the phrase ''was not being'' in the sentence "It was not being co-operative." The word ''copula'' derives from the Latin noun for a "link" or "tie" that connects two different things. A copula is often a verb or a verb-like word, though this is not universally the case. A verb that is a copula is sometimes called a copulative or copular verb. In English primary education grammar courses, a copula is often called a linking verb. In other languages, copulas show more resemblances to pronouns, as in Classical Chinese and Guarani, or may take the form of suffixes attached to a noun, as in Korean, Beja, and Inuit languages. Most languages have one main copula, although some (like Spanish, Portuguese and Thai) have more than one, while others have none. In the case of Eng ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pigou Effect

In economics, the Pigou effect is the stimulation of output and employment caused by increasing consumption due to a rise in real balances of wealth, particularly during deflation. The term was named after Arthur Cecil Pigou by Don Patinkin in 1948. Real wealth was defined by Arthur Cecil Pigou as the summation of the money supply and government bonds divided by the price level. He argued that Keynes' '' General Theory'' was deficient in not specifying a link from "real balances" to current consumption and that the inclusion of such a "wealth effect" would make the economy more "self correcting" to drops in aggregate demand than Keynes predicted. Because the effect derives from changes to the "Real Balance", this critique of Keynesianism is also called the Real Balance effect. History The Pigou effect was first popularised by Arthur Cecil Pigou in 1943, in ''The Classical Stationary State'' an article in the ''Economic Journal''. He had proposed the link from balances to consu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |