|

Journal Of Fixed Income

''The Journal of Fixed Income'' is a quarterly academic journal that covers quantitative research on fixed income instruments: mortgage-backed security, mortgage-backed securities, high-yield debt, municipal bonds, corporate bonds, asset-backed security, asset-backed securities, and global bonds. Its editor-in-chief is Stanley J. Kon (Smith Breeden Associates) and its founding editor was Douglas Breeden, Douglas T. Breeden (Fuqua School of Business at Duke University). It is published by Euromoney Institutional Investor. External links * {{DEFAULTSORT:Journal Of Fixed Income,The Finance journals Publications established in 1991 Quarterly journals English-language journals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euromoney Institutional Investor

Euromoney Institutional Investor PLC is one of Europe's largest business and financial information companies which has interests in business and financial publishing and event organization. It was listed on the London Stock Exchange and was a constituent of the FTSE 250 Index until it was acquired by private equity groups, Astorg and Epiris, in November 2022. History Euromoney magazine was founded by Sir Patrick Sergeant in 1969 as an international business-to-business media group focused primarily on the international finance sector. The costs to launch the magazine were covered with £6,000 from Associated Newspapers and £200 from Sergeant himself and a number of other Mail employees, with Hambros Bank putting up stand-by credit. Padraic Fallon joined the magazine as editor. He would takeover as chairman and executive after Sergeant, overseeing the company until his death in 2012. Patrick Sergeant continued to manage the business until 1985 when he became chairman. The com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Academic Journal

An academic journal or scholarly journal is a periodical publication in which scholarship relating to a particular academic discipline is published. Academic journals serve as permanent and transparent forums for the presentation, scrutiny, and discussion of research. They nearly-universally require peer-review or other scrutiny from contemporaries competent and established in their respective fields. Content typically takes the form of articles presenting original research, review articles, or book reviews. The purpose of an academic journal, according to Henry Oldenburg (the first editor of ''Philosophical Transactions of the Royal Society''), is to give researchers a venue to "impart their knowledge to one another, and contribute what they can to the Grand design of improving natural knowledge, and perfecting all Philosophical Arts, and Sciences." The term ''academic journal'' applies to scholarly publications in all fields; this article discusses the aspects common to all ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing. For a company to grow its business, it often must raise money – for example, to finance an acquisition; buy equipment or land, or invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage-backed Security

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collatera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High-yield Debt

In finance, a high-yield bond (non-investment-grade bond, speculative-grade bond, or junk bond) is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit events, but offer higher yields than investment-grade bonds in order to compensate for the increased risk. Default risk As indicated by their lower credit ratings, high-yield debt entails more risk to the investor compared to investment grade bonds. Investors require a greater yield to compensate them for investing in the riskier securities. In the case of high-yield bonds, the risk is largely that of default: the possibility that the issuer will be unable to make scheduled interest and principal payments in a timely manner. The default rate in the high-yield sector of the U.S. bond market has averaged about 5% over the long term. During the liquidity crisis of 1989-90, the default rate was in the 5.6% to 7% range. During the pandemic of 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Municipal Bond

A municipal bond, commonly known as a muni, is a Bond (finance), bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories. The U.S. municipal debt market is relatively small compared to the corporate market. Total municipal debt outstanding was $4 trillion as of the first quarter of 2021, compared to nearly $15 trillion in the corporate and foreign markets. Local authorities in many #In other countries, other countries in the world issue similar bonds, sometimes called local authority bonds or other names. History Municipal debt predates corporate debt b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Bond

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of at least one year. Corporate debt instruments with maturity shorter than one year are referred to as commercial paper. Definition The term "corporate bond" is not strictly defined. Sometimes, the term is used to include all bonds except those issued by governments in their own currencies. In this case governments issuing in other currencies (such as the country of Mexico issuing in US dollars) will be included. The term sometimes also encompasses bonds issued by supranational organizations (such as European Bank for Reconstruction and Development). Strictly speaking, however, it only applies to those issued by corporations. The bonds of local authorities ( municipal bonds) are not included. Trading Corporate bonds trade in decentrali ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset-backed Security

An asset-backed security (ABS) is a security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues. Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Editor-in-chief

An editor-in-chief (EIC), also known as lead editor or chief editor, is a publication's editorial leader who has final responsibility for its operations and policies. The highest-ranking editor of a publication may also be titled editor, managing editor, or executive editor, but where these titles are held while someone else is editor-in-chief, the editor-in-chief outranks the others. Description The editor-in-chief heads all departments of the organization and is held accountable for delegating tasks to staff members and managing them. The term is often used at newspapers, magazines, yearbooks, and television news programs. The editor-in-chief is commonly the link between the publisher or proprietor and the editorial staff. The term is also applied to academic journals, where the editor-in-chief gives the ultimate decision whether a submitted manuscript will be published. This decision is made by the editor-in-chief after seeking input from reviewers selected on the basis of re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Douglas Breeden

Douglas T. Breeden is the William W. Priest Professor of Finance and former Dean of the Fuqua School of Business, Duke University. He is best known for establishing the use of state prices in financial economics, and for his work on the Consumption-based capital asset pricing model, Consumption CAPM. He was the International Association for Quantitative Finance “Financial Engineer of the Year 2013”, and was Founding Editor of the ''Journal of Fixed Income''. He holds a Ph.D. in Finance from Stanford and an S.B. in management science, Management Science from M.I.T. References {{DEFAULTSORT:Breeden, Douglas Duke_University_faculty Massachusetts Institute of Technology alumni Stanford University alumni Financial economists Year of birth missing (living people) Living people ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fuqua School Of Business

The Fuqua School of Business (pronounced ) is the business school of Duke University in Durham, North Carolina. It enrolls more than 1,300 students in degree-seeking programs. Duke Executive Education also offers non-degree business education and professional development programs. Its MBA program was ranked the 9th best business school in the US by ''The Economist'' in 2019, and 13th in the US by ''The Financial Times'' in 2022. Fuqua is also currently ranked 6th for having the lowest acceptance rate and 10th for having the highest application yield (percentage that matriculated after being accepted) across the top 50 MBA programs in the US. History Formed in 1969, the Graduate School of Business Administration enrolled its first class of 20 students in 1970. In 1974, Thomas F. Keller, a 1953 Duke graduate, became the graduate school's new dean. In three years, Keller's capital campaign raised $24 million, $10 million of which came from businessman and philanthropist J. B. Fuqua. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

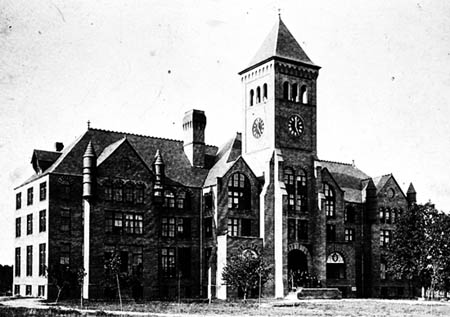

Duke University

Duke University is a private research university in Durham, North Carolina. Founded by Methodists and Quakers in the present-day city of Trinity in 1838, the school moved to Durham in 1892. In 1924, tobacco and electric power industrialist James Buchanan Duke established The Duke Endowment and the institution changed its name to honor his deceased father, Washington Duke. The campus spans over on three contiguous sub-campuses in Durham, and a marine lab in Beaufort. The West Campus—designed largely by architect Julian Abele, an African American architect who graduated first in his class at the University of Pennsylvania School of Design—incorporates Gothic architecture with the Duke Chapel at the campus' center and highest point of elevation, is adjacent to the Medical Center. East Campus, away, home to all first-years, contains Georgian-style architecture. The university administers two concurrent schools in Asia, Duke-NUS Medical School in Singapore (established in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |