|

June 2010 United Kingdom Budget

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010 (just 90 days after the previous budget speech).Budget key points: At-a-glance BBC News, 22 June 2010 It was the first budget of the Conservative-Liberal Democrat coalition formed after the [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of MPs Elected In The 2010 United Kingdom General Election

The 2010 general election took place on 6 May 2010 and saw each of Parliament's 650 constituencies return one Member of Parliament (MP) to the House of Commons. Parliament, which consists of the House of Lords and the elected House of Commons, was convened on 25 May at the Palace of Westminster by Queen Elizabeth II. It was dissolved at the beginning of 30 March 2015, being 25 working days ahead of the 2015 general election on 7 May 2015. The Conservative Party, led by David Cameron, became the single largest party, though without an overall majority. This resulted in a hung parliament. A coalition agreement was then formed following negotiations with the Liberal Democrats and their leader Nick Clegg. John Bercow resumed his role as Speaker of the House of Commons. In September 2010, Ed Miliband won a Labour Party leadership vote to succeed Gordon Brown as permanent Leader of the Opposition. In the House of Lords, Baroness Hayman (formerly a Labour member) resumed her ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

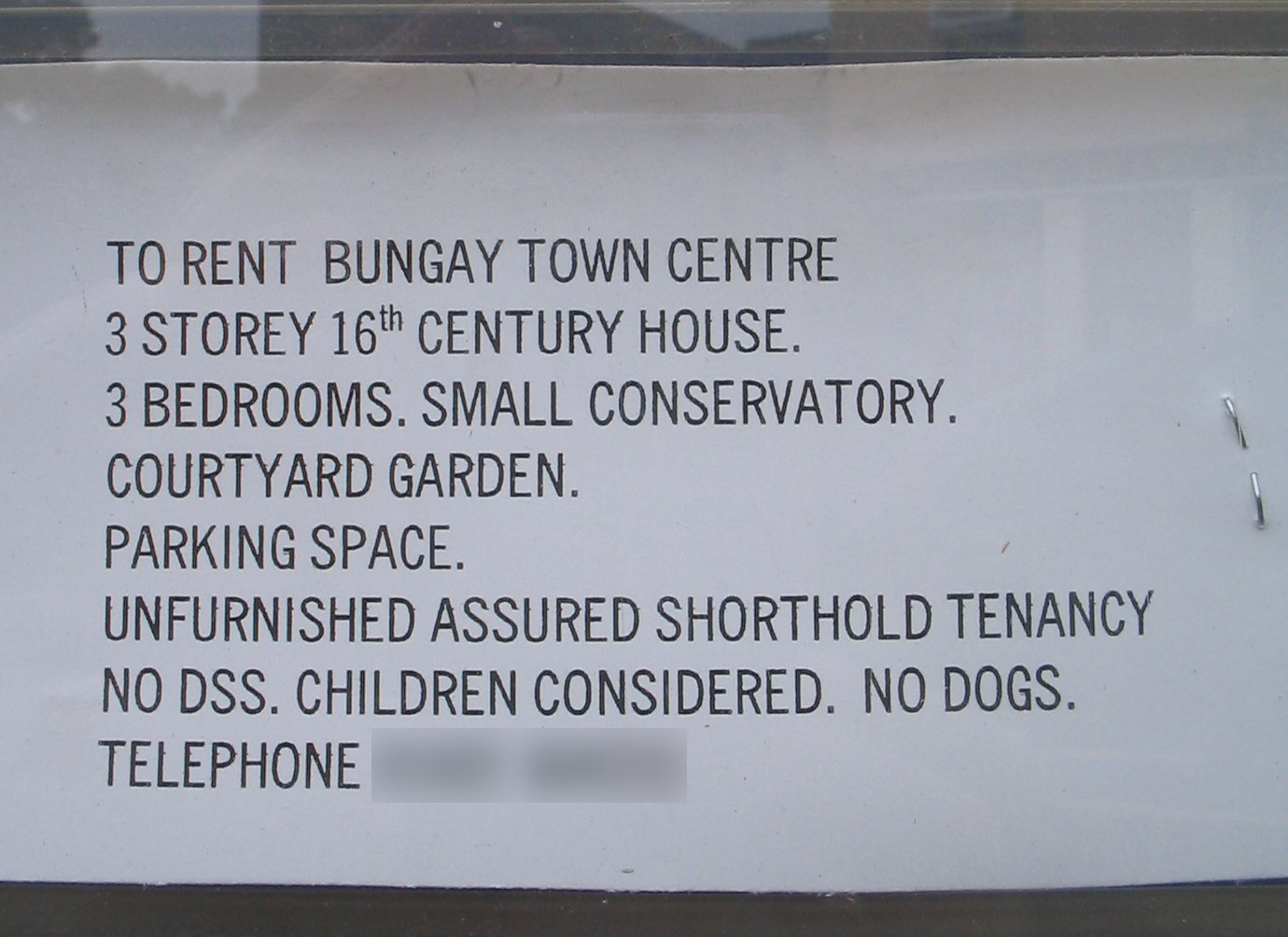

Housing Benefit

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state pension, totalling £23.8 billion in 2013–14. The primary legislation governing Housing Benefit is the Social Security Contributions and Benefits Act 1992. Operationally, the governing regulations are statutory instruments arising from that Act. It is governed by one of two sets of regulations. For working age claimants it is governed by the "Housing Benefit Regulations 2006", but for those who have reached the qualifying age for Pension Credit (regardless of whether it has been claimed) it is governed by the "Housing Benefit (Persons who have attained the qualifying age for state pension credit) Regulations 2006". It is normally administered by the local authority in whose area the property being rented lies. In some circumstances, n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

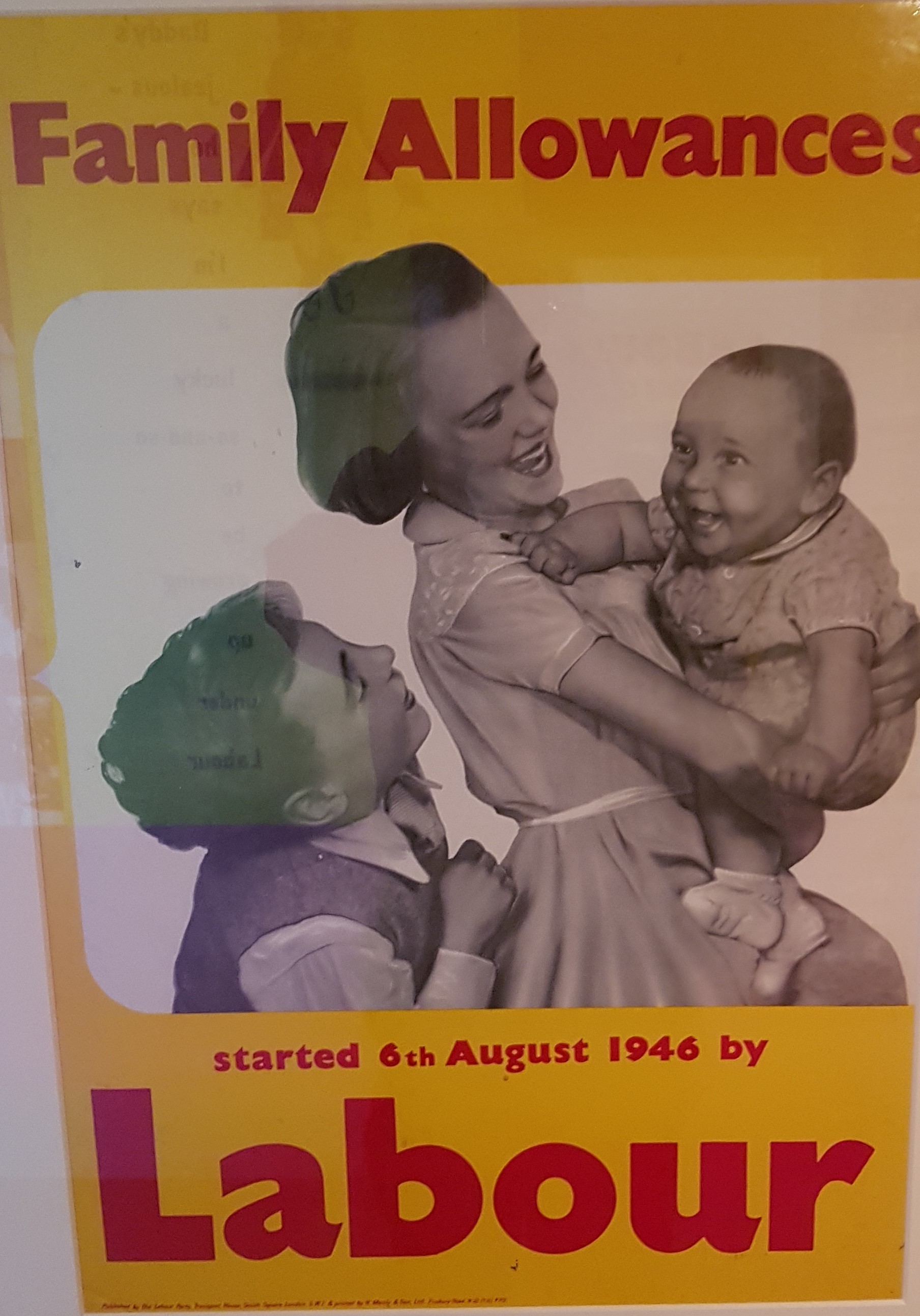

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-testing, means-tested and the amount of child benefit paid is usually dependent on the number of children one has. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, Child benefit payments are currently called Social Security (Australia)#Family Tax benefit, Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Income tax in Australia#Family Tax Benefit, Australian Income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Prices Index

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail final good, goods and Service (economics), services. As the RPI was held not to meet international statistical standards, since 2013 the Office for National Statistics no longer classifies it as a "national statistic", emphasising the Consumer Price Index (United Kingdom), Consumer Price Index instead. However, as of 2018 the HM Treasury, UK Treasury still uses the RPI measure of inflation for various index-linked tax rises. History RPI was first introduced in 1956, replacing the previous Interim Index of Retail Prices that had been in use since June 1947. It was once the principal official measure of inflation. It has been superseded in that regard by the Consumer Price Index (United Kingdom), Consumer Price Index (CPI). The RPI is still used by the go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. Overview A CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically. Sub-indices and sub-sub-indices can be computed for different categories and sub-categories of goods and services, being combined to produce the overall index with weights reflecting their shares in the total of the consumer expenditures covered by the index. It is one of several price indices calculated by most national statistical agencies. The annual percentage change in a CPI is used as a measure of inflation. A CPI can be used to index (i.e. adjust for the effect of inflation) the real value of wages, salaries, and pensions; to regulate prices; and to deflate monetary magnitudes to show changes in real values. In most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

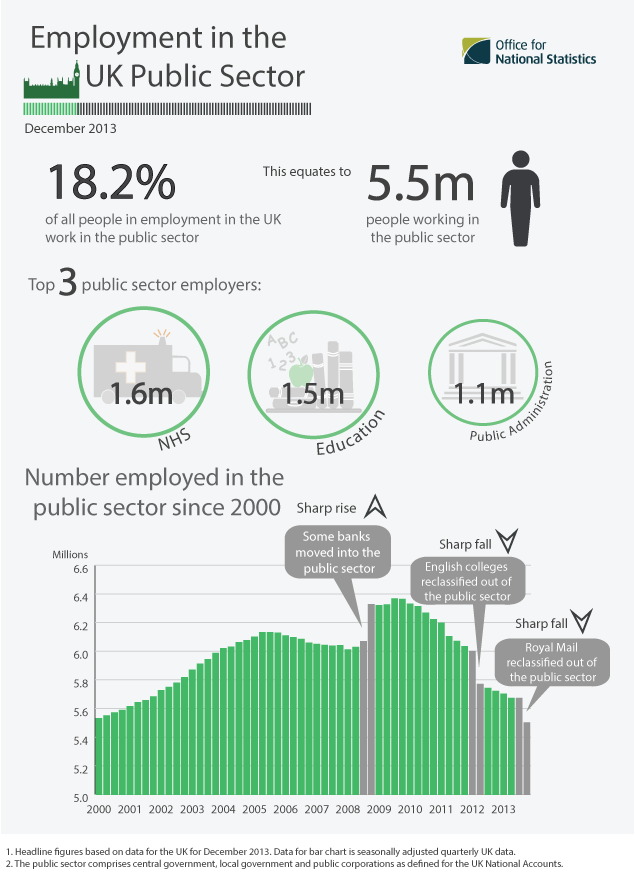

Public Sector

The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, infrastructure, public transit, public education, along with health care and those working for the government itself, such as elected officials. The public sector might provide services that a non-payer cannot be excluded from (such as street lighting), services which benefit all of society rather than just the individual who uses the service. Public enterprises, or state-owned enterprises, are self-financing commercial enterprises that are under public ownership which provide various private goods and services for sale and usually operate on a commercial basis. Organizations that are not part of the public sector are either part of the private sector or voluntary sector. The private sector is composed of the economic sectors that are int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spending Review

A spending review, or occasionally a comprehensive spending review, is a governmental process in the United Kingdom carried out by HM Treasury to set firm expenditure limits and, through public service agreements, define the key improvements that the public can expect from these resources. Spending reviews typically focus upon one or several aspects of public spending while comprehensive spending reviews focus upon each government department's spending requirements from a zero base (i.e. without reference to past plans or, initially, current expenditure). The latter are named after the year in which they are announced – thus ''CSR07'' (completed in October 2007) applies to financial years 2008–2011. Other developed countries have similar review processes, e.g. Canada, New Zealand, The Netherlands, Italy, Ireland, and France. France conducted its first comprehensive spending review (called in French "''la Révision Générale des Politiques Publiques''") in 2008. The Netherland ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Expenditure

Capital expenditure or capital expense (capex or CAPEX) is the money an organization or corporate entity spends to buy, maintain, or improve its fixed assets, such as buildings, vehicles, equipment, or land. It is considered a capital expenditure when the asset is newly purchased or when money is used towards extending the useful life of an existing asset, such as repairing the roof. Capital expenditures contrast with operating expenses (opex), which are ongoing expenses that are inherent to the operation of the asset. Opex includes items like electricity or cleaning. The difference between opex and capex may not be immediately obvious for some expenses; for instance, repaving the parking lot may be thought of inherent to the operation of a shopping mall. The dividing line for items like these is that the expense is considered capex if the financial benefit of the expenditure extends beyond the current fiscal year. Usage Capital expenditures are the funds used to acquire or upgra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diesel Fuel

Diesel fuel , also called diesel oil, is any liquid fuel specifically designed for use in a diesel engine, a type of internal combustion engine in which fuel ignition takes place without a spark as a result of compression of the inlet air and then injection of fuel. Therefore, diesel fuel needs good compression ignition characteristics. The most common type of diesel fuel is a specific fractional distillate of petroleum fuel oil, but alternatives that are not derived from petroleum, such as biodiesel, biomass to liquid (BTL) or gas to liquid (GTL) diesel are increasingly being developed and adopted. To distinguish these types, petroleum-derived diesel is sometimes called petrodiesel in some academic circles. In many countries, diesel fuel is standardised. For example, in the European Union, the standard for diesel fuel is EN 590. Diesel fuel has many colloquial names; most commonly, it is simply referred to as ''diesel''. In the United Kingdom, diesel fuel for on-road use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |