|

Isoelastic Function

In mathematical economics, an isoelastic function, sometimes constant elasticity function, is a function that exhibits a constant elasticity, i.e. has a constant elasticity coefficient. The elasticity is the ratio of the percentage change in the dependent variable to the percentage causative change in the independent variable, in the limit as the changes approach zero in magnitude. For an elasticity coefficient r (which can take on any real value), the function's general form is given by : f(x) = , where k and r are constants. The elasticity is by definition :\text = \frac \frac = \frac , which for this function simply equals ''r''. Derivation Elasticity of demand is indicated by = \frac \frac , where r is the elasticity, Q is quantity, and P is price. Rearranging gets us: \frac = \frac Then integrating \int\frac =\int \frac r \ln(P) + C = \ln(Q) Simplify e^ = e^ (e^)^re^C = Q CP^r = Q Q(p) = kP^r Examples Demand functions An example in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Economics

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Often, these applied methods are beyond simple geometry, and may include differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, or other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity. Mathematics allows economists to form meaningful, testable propositions about wide-ranging and complex subjects which could less easily be expressed informally. Further, the language of mathematics allows economists to make specific, positive claims about controversial or contentious subjects that would be impossible without mathematics. Much of economic theory is currently presented in terms of mathematical economic models, a set of stylized and simplified mathematical relationships asserted to clarify ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elasticity (economics)

In economics, elasticity measures the percentage change of one economic variable in response to a percentage change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the demand quantity to fall by 20%. Introduction Elasticity is an important concept in neoclassical economic theory, and enables in the understanding of various economic concepts, such as the incidence of indirect taxation, marginal concepts relating to the theory of the firm, distribution of wealth, and different types of goods relating to the theory of consumer choice. An understanding of elasticity is also important when discussing welfare distribution, in particular consumer surplus, producer surplus, or government surplus. Elasticity is present throughout many economic theories, with the concept of elasticity appearing in several main indicators. These include price elasticity of demand, price elasticity of supply, income elasticity of demand, elastici ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elasticity Coefficient

The rate of a chemical reaction is influenced by many different factors, such as temperature, pH, reactant, and product concentrations and other effectors. The degree to which these factors change the reaction rate is described by the elasticity coefficient. This coefficient is defined as follows: : \varepsilon_^v=\left(\frac \frac\right)_=\frac \approx \frac where v denotes the reaction rate and s denotes the substrate concentration. Be aware that the notation will use lowercase roman letters, such as s, to indicate concentrations. The partial derivative in the definition indicates that the elasticity is measured with respect to changes in a factor S while keeping all other factors constant. The most common factors include substrates, products, and effectors. The scaling of the coefficient ensures that it is dimensionless and independent of the units used to measure the reaction rate and magnitude of the factor. The elasticity coefficient is an integral part of metabolic con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dependent Variable

Dependent and independent variables are variables in mathematical modeling, statistical modeling and experimental sciences. Dependent variables receive this name because, in an experiment, their values are studied under the supposition or demand that they depend, by some law or rule (e.g., by a mathematical function), on the values of other variables. Independent variables, in turn, are not seen as depending on any other variable in the scope of the experiment in question. In this sense, some common independent variables are time, space, density, mass, fluid flow rate, and previous values of some observed value of interest (e.g. human population size) to predict future values (the dependent variable). Of the two, it is always the dependent variable whose variation is being studied, by altering inputs, also known as regressors in a statistical context. In an experiment, any variable that can be attributed a value without attributing a value to any other variable is called an in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Independent Variable

Dependent and independent variables are variables in mathematical modeling, statistical modeling and experimental sciences. Dependent variables receive this name because, in an experiment, their values are studied under the supposition or demand that they depend, by some law or rule (e.g., by a mathematical function), on the values of other variables. Independent variables, in turn, are not seen as depending on any other variable in the scope of the experiment in question. In this sense, some common independent variables are time, space, density, mass, fluid flow rate, and previous values of some observed value of interest (e.g. human population size) to predict future values (the dependent variable). Of the two, it is always the dependent variable whose variation is being studied, by altering inputs, also known as regressors in a statistical context. In an experiment, any variable that can be attributed a value without attributing a value to any other variable is called an ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microeconomics

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics. One goal of microeconomics is to analyze the market mechanisms that establish relative prices among goods and services and allocate limited resources among alternative uses. Microeconomics shows conditions under which free markets lead to desirable allocations. It also analyzes market failure, where markets fail to produce efficient results. While microeconomics focuses on firms and individuals, macroeconomics focuses on the sum total of economic activity, dealing with the issues of growth, inflation, and unemployment and with national policies relating to these issues. Microeconomics also deal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Curve

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for the price-quantity relationship for an individual consumer (an individual demand curve), or for all consumers in a particular market (a market demand curve). It is generally assumed that demand curves slope down, as shown in the adjacent image. This is because of the law of demand: for most goods, the quantity demanded falls if the price rises. Certain unusual situations do not follow this law. These include Veblen goods, Giffen goods, and speculative bubbles where buyers are attracted to a commodity if its price rises. Demand curves are used to estimate behaviour in competitive markets and are often combined with supply curves to find the equilibrium price (the price at which sellers together are willing to sell the same amount as bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply Curve

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention. The supply curve can be either for an individual seller or for the market as a whole, adding up the quantity supplied by all sellers. The quantity supplied is for a particular time period (e.g., the tons of steel a firm would supply in a year), but the units and time are often omitted in theoretical presentations. In the goods market, supply is the amount of a product per un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

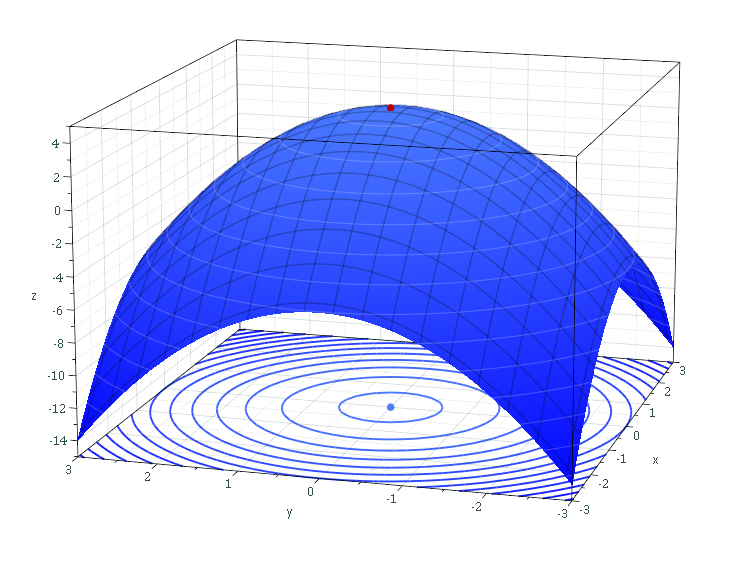

Concave Function

In mathematics, a concave function is the negative of a convex function. A concave function is also synonymously called concave downwards, concave down, convex upwards, convex cap, or upper convex. Definition A real-valued function f on an interval (or, more generally, a convex set in vector space) is said to be ''concave'' if, for any x and y in the interval and for any \alpha \in ,1/math>, :f((1-\alpha )x+\alpha y)\geq (1-\alpha ) f(x)+\alpha f(y) A function is called ''strictly concave'' if :f((1-\alpha )x + \alpha y) > (1-\alpha) f(x) + \alpha f(y)\, for any \alpha \in (0,1) and x \neq y. For a function f: \mathbb \to \mathbb, this second definition merely states that for every z strictly between x and y, the point (z, f(z)) on the graph of f is above the straight line joining the points (x, f(x)) and (y, f(y)). A function f is quasiconcave if the upper contour sets of the function S(a)=\ are convex sets. Properties Functions of a single variable # A differentiab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Von Neumann-Morgenstern Utility Function

The expected utility hypothesis is a popular concept in economics that serves as a reference guide for decisions when the payoff is uncertain. The theory recommends which option rational individuals should choose in a complex situation, based on their risk appetite and preferences. The expected utility hypothesis states an agent chooses between risky prospects by comparing expected utility values (i.e. the weighted sum of adding the respective utility values of payoffs multiplied by their probabilities). The summarised formula for expected utility is U(p)=\sum u(x_k)p_k where p_k is the probability that outcome indexed by k with payoff x_k is realized, and function ''u'' expresses the utility of each respective payoff. On a graph, the curvature of u will explain the agent's risk attitude. For example, if an agent derives 0 utils from 0 apples, 2 utils from one apple, and 3 utils from two apples, their expected utility for a 50–50 gamble between zero apples and two is 0.5''u''(0 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Isoelastic Utility

In economics, the isoelastic function for utility, also known as the isoelastic utility function, or power utility function, is used to express utility in terms of consumption or some other economic variable that a decision-maker is concerned with. The isoelastic utility function is a special case of hyperbolic absolute risk aversion and at the same time is the only class of utility functions with constant relative risk aversion, which is why it is also called the CRRA utility function. It is : u(c) = \begin \frac & \eta \ge 0, \eta \neq 1 \\ \ln(c) & \eta = 1 \end where c is consumption, u(c) the associated utility, and \eta is a constant that is positive for risk averse agents. Since additive constant terms in objective functions do not affect optimal decisions, the term –1 in the numerator can be, and usually is, omitted (except when establishing the limiting case of \ln(c) as below). When the context involves risk, the utility function is viewed as a von Neumann–Morgen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |