|

Inverse Floating Rate Note

An inverse floating rate note, or simply an inverse floater, is a type of Bond (finance), bond or other type of debt instrument used in finance whose Coupon (bond), coupon rate has an inverse relationship to short-term interest rates (or its reference rate). With an inverse floater, as interest rates rise the coupon rate falls. The basic structure is the same as an ordinary floating rate note except for the direction in which the coupon rate is adjusted. These two structures are often used in concert. As short-term interest rates fall, both the market price and the Yield (finance), yield of the inverse floater increase. This link often magnifies the fluctuation in the bond's price. However, in the opposite situation, when short-term interest rates rise, the value of the bond can drop significantly, and holders of this type of instrument may end up with a security that pays little interest and for which the market will pay very little. Thus, interest rate risk is magnified and contai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateralized Mortgage Obligation

A collateralized mortgage obligation (CMO) is a type of complex debt security that repackages and directs the payments of principal and interest from a collateral pool to different types and maturities of securities, thereby meeting investor needs. CMOs were first created in 1983 by the investment banks Salomon Brothers and First Boston for the U.S. mortgage liquidity provider Freddie Mac. The Salomon Brothers team was led by Lewis Ranieri and the First Boston team by Laurence D. Fink, although Dexter Senft also later received an industry award for his contribution). Legally, a CMO is a debt security issued by an abstraction—a special purpose entity—and is not a debt owed by the institution creating and operating the entity. The entity is the legal owner of a set of mortgages, called a ''pool''. Investors in a CMO buy bonds issued by the entity, and they receive payments from the income generated by the mortgages according to a defined set of rules. With regard to terminol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Float (finance)

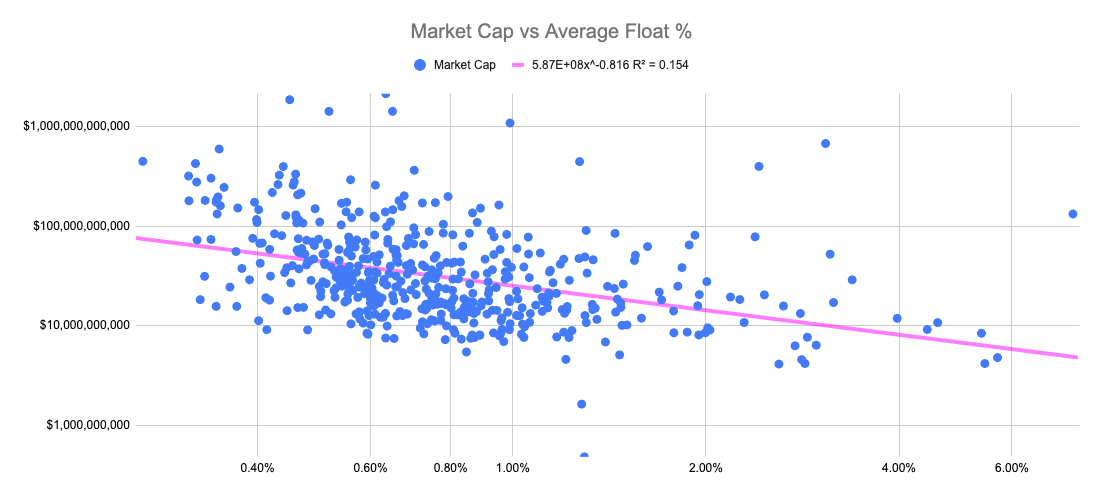

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateralized Debt Obligation

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing mortgage-backed securities (MBS).Lepke, Lins and Pi card, ''Mortgage-Backed Securities'', §5:15 (Thomson West, 2014). Like other private label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the CDO collects from the pool of bonds or other assets it owns. Distinctively, CDO credit risk is typically assessed based on a probability of default (PD) derived from ratings on those bonds or assets. The CDO is "sliced" into sections known as "tranches", which "catch" the cash flow of interest and principal payments in sequence based on seniority. If some loans default and the cash collected by the CDO is insufficient to pay all of its investors, those in the lowest, most "junior" tranches suffer loss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auction Rate Security

An auction rate security (ARS) typically refers to a debt instrument (corporate or municipal bonds) with a long-term nominal maturity for which the interest rate is regularly reset through a Dutch auction. Since February 2008, most such auctions have failed, and the auction market has been largely frozen. In late 2008, investment banks that had marketed and distributed auction rate securities agreed to repurchase most of them at par. Background The first auction rate security for the tax-exempt market was introduced by Goldman Sachs in 1988, a $121.4 million financing for Tucson Electric Company by the Industrial Development Authority of Pima County, Arizona. However, the security was invented by Ronald Gallatin at Lehman Brothers in 1984. Auctions are typically held every 7, 28, or 35 days; interest on these securities is paid at the end of each auction period. Certain types of daily auctioned ARSs have coupons paid on the first of every month. There are also other, more unus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield Curve

In finance, the yield curve is a graph which depicts how the yields on debt instruments - such as bonds - vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity. Those who issue and trade in forms of debt, such as loans and bonds, use yield curves to determine their value. Shifts in the shape and slope of the yield curve are thought to be related to investor expectations for the economy and interest rates. Ronald Melicher and Merle Welshans have identified several characteristics of a properly constructed yield curve. It should be based on a set of securities which have differing lengths of time to maturity, and all yields should be calculated as of the same point in time. All securities measured in the yield curve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage (finance)

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the comparatively small amount of money needed for borrowing into large amounts of profit. However, the technique also involves the high risk of not being able to pay back a large loan. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Leveraging enables gains to be multiplied.Brigham, Eugene F., ''Fundamentals of Financial Management'' (1995). On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coupon Leverage

Coupon leverage, or leverage factor, is the amount by which a reference rate is multiplied to determine the floating interest rate payable by an inverse floater. Some debt instruments leverage the particular effects of interest rate changes, most commonly in inverse floaters. As an example, an inverse floater with a multiple may pay interest at the rate, or coupon, of 22 percent minus the product of 2 times the 1-month London Interbank Offered Rate The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is u ... (LIBOR). The coupon leverage is 2, in this example, and the reference rate is the 1-month LIBOR. References Interest rates {{finance stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single Security (finance), security, a basket of securities, Option (finance), options, Index (economics), indices, commodities, debt issuance or foreign Currency, currencies, and to a lesser extent, Derivative (finance), derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a trading desk, desk will employ a specialized "structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have Embedded option, embedded forwards or options or securities where an investor's investment return ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Auction

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory. The open ascending price auction is arguably the most common form of auction and has been used throughout history. Participants bid openly against one another, with each subsequent bid being higher than the previous bid. An auctioneer may announce prices, while bidders submit bids vocally or electronically. Auctions are applied for trade in diverse contexts. These contexts include antiques, paintings, rare collectibles, expensive wines, commodities, livestock, radio spectrum, used cars, real estate, online advertising, vacation packages, emission trading, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tranche

In structured finance, a tranche is one of a number of related securities offered as part of the same transaction. In the financial sense of the word, each bond is a different slice of the deal's risk. Transaction documentation (see indenture) usually defines the tranches as different "classes" of notes, each identified by letter (e.g., the Class A, Class B, Class C securities) with different bond credit ratings. The term ''tranche'' is used in fields of finance other than structured finance (such as in straight lending, where ''multi-tranche loans'' are commonplace), but the term's use in structured finance may be singled out as particularly important. Use of "tranche" as a verb is limited almost exclusively to this field. The word ''tranche'' means ''a division or portion of a pool or whole'' and is derived from the French for 'slice', 'section', 'series', or 'portion', and is also a cognate of the English 'trench' ('ditch'). How tranching works All the tranches together ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment. The word hedge is from Old English ''hecg'', originally any fence, living or artificial. The first known use of the word ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)