|

International Securities Exchange

International Securities Exchange Holdings, Inc. (ISE) is a wholly owned subsidiary of American multinational financial services corporation Nasdaq, Inc. It is a member of the Options Clearing Corporation (OCC) and the Options Industry Council (OIC). Founded in 2000, the ISE was conceived in 1997 when then-chairman of E-Trade, William A. Porter and his colleague, Marty Averbuch approached David Krell and Gary Katz about their concept and the four founded what is today the International Securities Exchange, a leading U.S. equity options exchange. Launched as the first fully electronic US options exchange, ISE developed a unique market structure for advanced screen-based trading. ISE offers equity and index options, including proprietary index products, as well as FX options based on foreign currency pairs. ISE also offers market data tools designed for sophisticated investors seeking information on investor sentiment, volatility, and other options data. In 2013, ISE strengthe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Direct Edge

Direct Edge was a Jersey City, New Jersey-based stock exchange operating two separate platforms, EDGA Exchange and EDGX Exchange. Beginning in March 2009, Direct Edge's market share ranged from 9% to 12% of U.S. equities trading volume, and regularly traded one to two billion shares per day. Before their merger, Direct Edge jockeyed with BATS Trading to be the third largest stock market in the United States, behind the New York Stock Exchange and NASDAQ. History The firm began in 1998 as an electronic communication network (ECN) under the name Attain. In 2005, the assets of Attain were purchased by Knight Capital Group and subsequently spun off two years later as the re-branded Direct Edge ECN. The spin-off brought in new management as well as new ownership— Citadel Derivatives Group and Goldman Sachs were brought in as partners alongside Knight. The partnership was further diluted when in 2008 the International Securities Exchange relinquished operational control of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Organizations Established In 2000

An organization or organisation (English in the Commonwealth of Nations, Commonwealth English; American and British English spelling differences#-ise, -ize (-isation, -ization), see spelling differences), is an legal entity, entity—such as a company, an institution, or an Voluntary association, association—comprising one or more person, people and having a particular purpose. The word is derived from the Greek word ''organon'', which means tool or instrument, musical instrument, and Organ (anatomy), organ. Types There are a variety of legal types of organizations, including corporations, governments, non-governmental organizations, political organizations, international organizations, armed forces, charitable organization, charities, not-for-profit corporations, partnerships, cooperatives, and Types of educational institutions, educational institutions, etc. A hybrid organization is a body that operates in both the public sector and the private sector simultaneously, fu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 2000

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

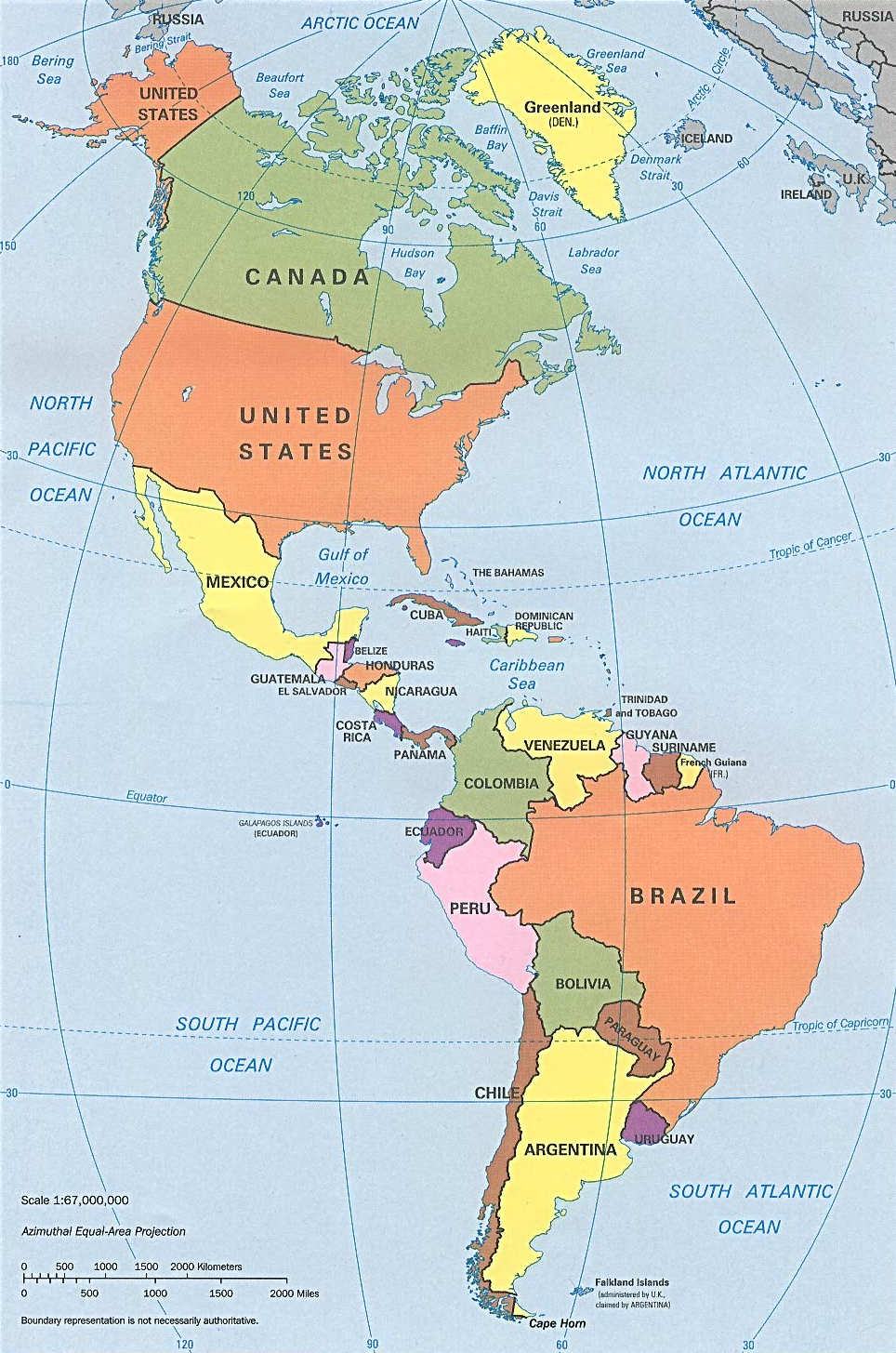

List Of Stock Exchanges In The Americas

This is a list of active stock exchanges in the Americas. Stock exchanges in Latin America (where Spanish and Portuguese prevail) use the term ''Bolsa de Valores'', meaning "bag" or "purse" of "values". (compare Börse in German or bourse in French). The Caribbean has one major regional stock exchange: the Eastern Caribbean Securities Exchange (ECSE), which serves Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines. The service area of the ECSE corresponds to the service area of the Eastern Caribbean Central Bank, with which it is associated. Stock exchanges in the Americas Former exchanges Major exchange mergers See also * List of futures exchanges * List of stock exchanges External linksWorld-Stock-Exchange.net list of Stock Markets in South America References {{DEFAULTSORT:Stock Exchanges In The Americas, List Of * * * * Americas-related lists Americas The Americas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Stock Exchanges

This is a list of major stock exchanges. Those futures exchanges that also offer trading in securities besides trading in futures contracts are listed both here and in the list of futures exchanges. There are sixteen stock exchanges in the world that have a market capitalization of over US$1 trillion each. They are sometimes referred to as the "$1 Trillion Club". These exchanges accounted for 87% of global market capitalization in 2016. Some exchanges do include companies from outside the country where the exchange is located. Major stock exchanges Major stock exchange groups (the current top 21 by market capitalization) of issued shares of listed companies ("MIC" = market identifier code). * Note: "Δ" to UTC, as well as "Open (UTC)" and "Close (UTC)" columns contain valid data only for standard time in a given time zone. During daylight saving time period, the UTC times will be one hour less and Δs one hour more. **Applicable for non-closing auction session shares only. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$30.1 trillion as of February 2018. The average daily trading value was approximately 169 billion in 2013. The NYSE trading floor is at the New York Stock Exchange Building on 11 Wall Street and 18 Broad Street and is a National Historic Landmark. An additional trading room, at 30 Broad Street, was closed in February 2007. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. History The earliest recorded organization of securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, securiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Börse

Deutsche Börse AG () or the Deutsche Börse Group, is a German company offering marketplace organizing for the trading of shares and other securities. It is also a transaction services provider. It gives companies and investors access to global capital markets. It is a joint stock company and was founded in 1992. The headquarters are in Frankfurt. As of December 2010, the over 765 companies listed had a combined market capitalization of . On 1 October 2014, Deutsche Börse AG became the 14th announced member of the United Nations Sustainable Stock Exchanges initiative. Company More than 3,200 employees service customers in Europe, the United States, and Asia. Deutsche Börse has locations in Germany, Luxembourg, Switzerland, Czech Republic, and Spain, as well as representative offices in Beijing, London, Paris, Chicago, New York, Hong Kong, and Dubai. FWB Frankfurter Wertpapierbörse (Frankfurt Stock Exchange), is one of the world's largest trading centers for securities ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Communication Network

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee (often a fraction of a cent per share). The first ECN, Instinet, was created in 1969. ECNs increase competition among trading firms by lowering transaction costs, giving clients full access to their order books, and offering order matching outside traditional exchange hours. ECNs are sometimes also referred to as alternative trading systems or alternative trading networks. History The term ECN was used by the SEC to define, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange (organized Market)

An exchange, bourse (), trading exchange or trading venue is an organized market where (especially) tradable securities, commodities, foreign exchange, futures, and options contracts are bought and sold. History 12th century: Brokers on the Grand Bridge, France In the twelfth century, foreign exchange dealers in France were responsible for controlling and regulating the debts of agricultural communities on behalf of banks. These were actually the first brokers. They met on the Grand Bridge in Paris, the current Pont au Change. It takes its name from the forex brokers. 13th century: ''Huis ter Beurze'', Belgium The term ''bourse'') which was later used as bursa in Medieval Latin to refer to the "purse". is related to the 13th-century inn named "''Huis ter Beurze''" owned by family in Bruges, Belgium, where traders and foreign merchants from across Europe, especially the Italian Republics of Genoa, Florence and Venice, conducted business in the late medieval period. The build ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |