|

Institutional Venture Partners

Institutional Venture Partners (IVP) is a US-based private equity investment firm focusing on later-stage venture capital and growth equity investments. IVP is one of the oldest venture capital firms, founded in 1980. History While Reid W. Dennis was an analyst at the Fireman's Fund Insurance Company starting in 1952, he started an informal network of screened individual investors (now called angel investors). In 1974, Dennis founded Institutional Venture Associates (IVA), funded by six institutions such as American Express. Burton J. McMurtry and David Marquardt, who had been involved with IVA, left and founded Technology Venture Investors, the first investor in Microsoft. These were some of the first venture capital firms located on Sand Hill Road near Stanford University, within Silicon Valley. With his personal wealth and that of other partners, Dennis founded Institutional Venture Partners in 1980. The first IVP fund had $22 million. In a field that was generally male-domina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microsoft

Microsoft Corporation is an American multinational technology corporation producing computer software, consumer electronics, personal computers, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washington, United States. Its best-known software products are the Windows line of operating systems, the Microsoft Office suite, and the Internet Explorer and Edge web browsers. Its flagship hardware products are the Xbox video game consoles and the Microsoft Surface lineup of touchscreen personal computers. Microsoft ranked No. 21 in the 2020 Fortune 500 rankings of the largest United States corporations by total revenue; it was the world's largest software maker by revenue as of 2019. It is one of the Big Five American information technology companies, alongside Alphabet, Amazon, Apple, and Meta. Microsoft was founded by Bill Gates and Paul Allen on April 4, 1975, to develop and sell BASIC interpreters for the Altair 8800. It rose to do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Redpoint Ventures

Redpoint Ventures is an American venture capital firm focused on investments in seed, early and growth-stage companies. History The firm was founded in 1999 and is headquartered in Menlo Park, California, with offices in San Francisco, Los Angeles, Beijing and Shanghai. The firm manages $3.8 billion of capital. The firm's partners include Allen Beasley, Jeff Brody, Jamie Davidson, Satish Dharmaraj, Tom Dyal, Tim Haley, Brad Jones, Chris Moore, Lars Pedersen, Scott Raney, Ryan Sarver, Tomasz Tunguz, John Walecka, Geoff Yang and David Yuan. The founders of Redpoint Ventures have been involved with successful investments including Foundry, Juniper Networks, Netflix and Right Media. Its partners have been involved in 136 IPOs and acquisitions. IPOs include Snowflake, Twilio, Pure Storage, 2u, Just Eat, Zendesk, HomeAway, Qihoo, Responsys, Fortinet and Calix. Acquisitions include Acompli, Caspida, Efficient Frontier, Heroku, RelateIQ, BlueKai, Posterous, Trip.com, LifeSize, Refres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brentwood Venture Capital

Brentwood Associates is a private equity firm in the US with groups focusing on leveraged buyout. The firm, which is based in Los Angeles, was founded in 1972. Their most recent fund was a $1.15bn fund raised in 2017. The venture capital group raised over $900 million across nine funds, the earliest of which was formed in 1980 and the last of which was raised in 1998, prior to the spinout of the firm's venture business. History Brentwood was founded by Frederick Warren, Timothy M. Pennington III and B. Kipling Hagopian. Leading investor in start up companies in the late 1990s. Raised a $300 million venture fund in 1998. Brentwood Venture Capital was founded in 1972 as Brentwood Associates. Over the last 26 years, Brentwood has grown to be one of the oldest and largest firms in the venture capital industry, having raised over $1 billion in capital and investing in over 300 entrepreneurial companies. In 1999, the partners from Brentwood joined with partners from Institutiona ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silicon Valley

Silicon Valley is a region in Northern California that serves as a global center for high technology and innovation. Located in the southern part of the San Francisco Bay Area, it corresponds roughly to the geographical areas San Mateo County and Santa Clara County. San Jose is Silicon Valley's largest city, the third-largest in California, and the tenth-largest in the United States; other major Silicon Valley cities include Sunnyvale, Santa Clara, Redwood City, Mountain View, Palo Alto, Menlo Park, and Cupertino. The San Jose Metropolitan Area has the third-highest GDP per capita in the world (after Zurich, Switzerland and Oslo, Norway), according to the Brookings Institution, and, as of June 2021, has the highest percentage of homes valued at $1 million or more in the United States. Silicon Valley is home to many of the world's largest high-tech corporations, including the headquarters of more than 30 businesses in the Fortune 1000, and thousands of startup companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stanford University

Stanford University, officially Leland Stanford Junior University, is a private research university in Stanford, California. The campus occupies , among the largest in the United States, and enrolls over 17,000 students. Stanford is considered among the most prestigious universities in the world. Stanford was founded in 1885 by Leland and Jane Stanford in memory of their only child, Leland Stanford Jr., who had died of typhoid fever at age 15 the previous year. Leland Stanford was a U.S. senator and former governor of California who made his fortune as a railroad tycoon. The school admitted its first students on October 1, 1891, as a coeducational and non-denominational institution. Stanford University struggled financially after the death of Leland Stanford in 1893 and again after much of the campus was damaged by the 1906 San Francisco earthquake. Following World War II, provost of Stanford Frederick Terman inspired and supported faculty and graduates' entrepreneu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sand Hill Road

Sand Hill Road, often shortened to just "Sand Hill" or "SHR", is an arterial road in western Silicon Valley, California, running through Palo Alto, Menlo Park, and Woodside, notable for its concentration of venture capital companies. The road has become a metonym for that industry; nearly every top Silicon Valley company has been the beneficiary of early funding from firms on Sand Hill Road. Its significance as a symbol of private equity and venture capitalism in the United States is compared to that of Wall Street and the stock market, K Street in Washington, D.C. and political lobbying, Madison Avenue for the advertising industry, or Harley Street in London, UK for private specialist medicine and surgery. Location Connecting El Camino Real and Interstate 280, the road provides easy access to Stanford University and the northwestern area of Silicon Valley. The road also runs southwest of Interstate 280 into a residential neighborhood of Woodside, California, but the priv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Marquardt

David F. Marquardt (born February 1, 1949) was a co-founder of venture capital firm August Capital in 1995. He has served on more than 35 boards of directors during his 40-year venture capital career including Microsoft, Sun Microsystems (acquired by Oracle), Seagate, Adaptec, and Grand Junction Networks (acquired by Cisco). Career Prior to August Capital, Marquardt was a co-founder of Technology Venture Investors (TVI) in 1980 where he was involved in four highly successful funds that invested in more than 100 start-up and emerging growth companies. Among these early investments was Microsoft, where TVI was the sole investor and where Marquardt served on the board of directors from 1981 until 2014. Marquardt has been involved in every phase of the entrepreneurial process from seed investments to classic venture financings, mergers & acquisitions, public offerings and restructuring & privatizations. Marquardt began his venture career at Institutional Venture Associates, wher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

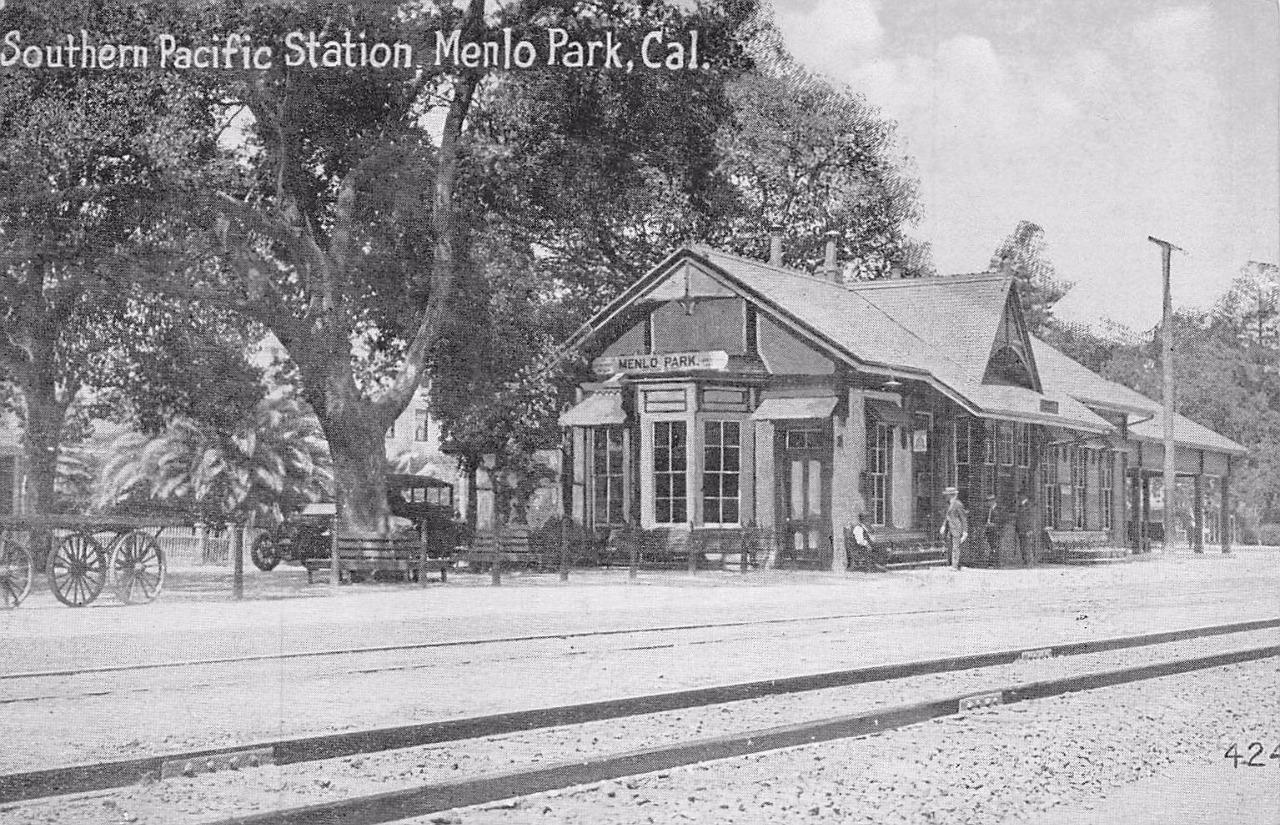

Menlo Park, California

Menlo Park is a city at the eastern edge of San Mateo County within the San Francisco Bay Area of California in the United States. It is bordered by San Francisco Bay on the north and east; East Palo Alto, Palo Alto, and Stanford to the south; and Atherton, North Fair Oaks, and Redwood City to the west. It is one of the most educated cities in California and the United States; nearly 70% of residents over 25 have earned a bachelor's degree or higher. It had 33,780 residents at the 2020 United States Census. It is home to the corporate headquarters of Meta, and is where Google, Roblox Corporation and Round Table Pizza were founded. Its train station holds the record as the oldest continually operating train station in California. Toponym "Menlo" is derived from Menlo (the anglicized spelling of Irish Gaelic 'Mionloch', meaning 'small lake') in County Galway, Ireland. The name "Menlo Park" was given to a ranch purchased by Irish settlers in honor of their home village in Ire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

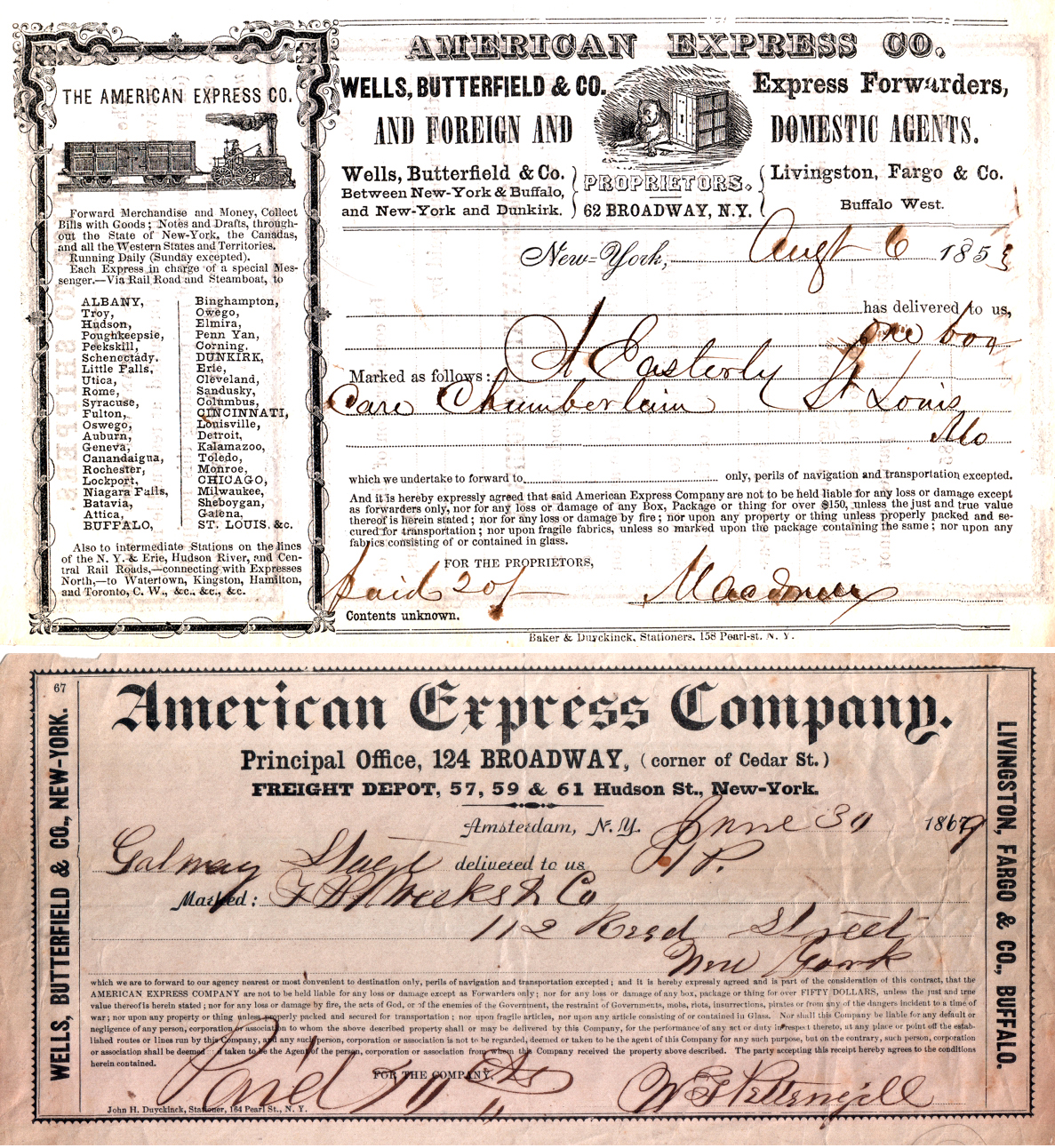

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Angel Investor

An angel investor (also known as a business angel, informal investor, angel funder, private investor, or seed investor) is an individual who provides capital for a business or businesses start-up, usually in exchange for convertible debt or ownership equity. Angel investors usually give support to start-ups at the initial moments (where risks of the start-ups failing are relatively high) and when most investors are not prepared to back them. In a survey of 150 founders conducted by Wilbur Labs, about 70% of entrepreneurs will face potential business failure, and nearly 66% will face this potential failure within 25 months of launching their company. A small but increasing number of angel investors invest online through equity crowdfunding or organize themselves into angel groups or angel networks to share investment capital, as well as to provide advice to their portfolio companies. Over the last 50 years, the number of angel investors has greatly increased. Etymology and origin T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |