|

Income And Corporation Taxes Act 1988

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (e.g., mandatory pension contributions), and is widely used as a basis to com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economists, only the final purchase of newly produced goods and services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g. the selection, adoption, use, disposal and recycling of goods and services). Economists are particularly interested in the relationship betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Income

In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period. It is computed as the residual of all revenues and gains less all expenses and losses for the period,Stickney, et al. (2009) Financial Accounting: An Introduction to Concepts, Methods, and Uses. Cengage Learning and has also been defined as the net increase in shareholders' equity that results from a company's operations.Needles, et al. (2010) Financial Accounting. Cengage Learning. It is different from gross income, which only deducts the cost of goods sold from revenue. For households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension contributions). Definition Net income can be distributed among holders of common stock as a dividend or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Hicks

Sir John Richards Hicks (8 April 1904 – 20 May 1989) was a British economist. He is considered one of the most important and influential economists of the twentieth century. The most familiar of his many contributions in the field of economics were his statement of consumer demand theory in microeconomics, and the IS–LM model (1937), which summarised a Keynesian view of macroeconomics. His book ''Value and Capital'' (1939) significantly extended general-equilibrium and value theory. The compensated demand function is named the Hicksian demand function in memory of him. In 1972 he received the Nobel Memorial Prize in Economic Sciences (jointly) for his pioneering contributions to general equilibrium theory and welfare theory. Early life Hicks was born in 1904 in Warwick, England, and was the son of Dorothy Catherine (Stephens) and Edward Hicks, a journalist at a local newspaper. He was educated at Clifton College (1917–1922) and at Balliol College, Oxford (1922– ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Accounting Standards Board

The International Accounting Standards Board (IASB) is the independent accounting standard-setting body of the IFRS Foundation. The IASB was founded on April 1, 2001, as the successor to the International Accounting Standards Committee (IASC). It is responsible for developing International Financial Reporting Standards (IFRS) and for promoting their use and application."About the IASB" IFRS Foundation, 2018. Background and semantics The (IASC) had been established in 1973 and had issued a number of standards known as International Accounting Standards (IAS). As t ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social Security Amendments of 1972 and is incorporated in Title 16 of the Social Security Act. The program is administered by the Social Security Administration (SSA) and began operations in 1974. Individuals or their helpers may start the application for SSI benefits by completing a short form on SSA's website. SSA staff will schedule an appointment for the individual or helper within 1–2 weeks and complete the process. SSI was created to replace federal-state adult assistance programs that served the same purpose, but were administered by the state agencies and received criticism for lacking consistent eligibility criteria. The restructuring of these programs was intended to standardize the eligibility requirements and level of benefits. Alth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Workman's Compensation

Workers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her employer for the tort of negligence. The trade-off between assured, limited coverage and lack of recourse outside the worker compensation system is known as "the compensation bargain.” One of the problems that the compensation bargain solved is the problem of employers becoming insolvent as a result of high damage awards. The system of collective liability was created to prevent that and thus to ensure security of compensation to the workers. While plans differ among jurisdictions, provision can be made for weekly payments in place of wages (functioning in this case as a form of disability insurance), compensation for economic loss (past and future), reimbursement or payment of medical and like expenses (functioning in this case as a form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Income Hypothesis

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his ''A Theory of Consumption Function'', published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption. The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Keynesian orthodoxy. Friedman's predictions of consumption smoothing, where people spread out transitory changes in income over time, departe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth (economics)

Wealth is the abundance of Value (economics), valuable financial assets or property, physical possessions which can be converted into a form that can be used for financial transaction, transactions. This includes the core meaning as held in the originating Old English word , which is from an Indo-European languages, Indo-European word stem. The modern concept of wealth is of significance in all areas of economics, and clearly so for economic growth, growth economics and development economics, yet the meaning of wealth is context-dependent. An individual possessing a substantial net worth is known as ''wealthy''. Net worth is defined as the current value of one's assets less liabilities (excluding the principal in trust accounts). At the most general level, economists may define wealth as "the total of anything of value" that captures both the subjective nature of the idea and the idea that it is not a fixed or static concept. Various definitions and concepts of wealth have been a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of Demand

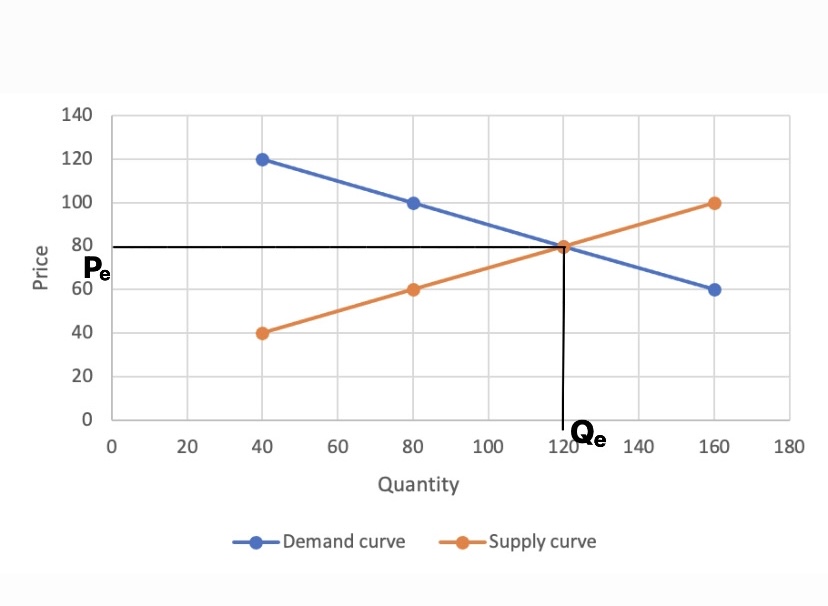

In microeconomics, the law of demand is a fundamental principle which states that there is an inverse relationship between price and quantity demanded. In other words, "conditional on all else being equal, as the price of a good increases (↑), quantity demanded will decrease (↓); conversely, as the price of a good decreases (↓), quantity demanded will increase (↑)". Alfred Marshall worded this as: "When we say that a person's demand for anything increases, we mean that he will buy more of it than he would before at the same price, and that he will buy as much of it as before at a higher price". The law of demand, however, only makes a qualitative statement in the sense that it describes the direction of change in the amount of quantity demanded but not the magnitude of change. The law of demand is represented by a graph called the demand curve, with quantity demanded on the x-axis and price on the y-axis. Demand curves are downward sloping by definition of the law of dema ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Theory

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their preferences subject to limitations on their expenditures, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods: income level, cultural factors, product information and physio-psychological factors. Consumption is separated from production, logically, because two different economic agents are involved. In the first case consumption is by the primary individual, individual tastes or preferences determine the amount of pleasure people derive from the goods and services they consume.; in the second case, a producer might make something that he would not consume himself. Therefore, different motivations and abilities are involved. The models that make up consumer theory ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Factor Income

Factor Income is the flow of income that is derived from the factors of production, i.e., the general inputs required to produce goods and services. Factor Income on the use of land is called rent, income generated from labor is called wages, and income generated from capital is called profit. The factor income of all normal residents of a country is referred to as the national income, while factor income and current transfers together are referred to as private income. Factor income is used to analyze macroeconomic situations and to find out the difference between Gross Domestic Product and Gross Domestic Income which is also the difference between the total value of the goods and services produced in a country and the net income of the citizens of the country. This helps the government understand the magnitude of income of the country's citizens and the citizens living abroad. The applicability of the concept of Factor Income can be seen in developing countries A develo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Welfare Function

In welfare economics, a social welfare function is a function that ranks social states (alternative complete descriptions of the society) as less desirable, more desirable, or indifferent for every possible pair of social states. Inputs of the function include any variables considered to affect the economic welfare of a society. In using welfare measures of persons in the society as inputs, the social welfare function is individualistic in form. One use of a social welfare function is to represent prospective patterns of collective choice as to alternative social states. The social welfare function provides the government with a simple guideline for achieving the optimal distribution of income. The social welfare function is analogous to the consumer theory of indifference-curve– budget constraint tangency for an individual, except that the social welfare function is a mapping of individual preferences or judgments of everyone in the society as to collective choices, which ap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |