|

In Re Wragg Ltd

''In re Wragg Ltd'' 8971 Ch 796 is a UK company law case, also relevant for English contract law, concerning shares, and the rule that shares should be exchanged for consideration that is in some sense at least sufficient, not necessarily adequate. Facts Mr Wragg and Mr Martin sold their omnibus and livery stable business to a newly incorporated company for £46,300. The company paid by issuing debentures and fully paid shares to Mr Wragg and Mr Martin. The liquidator of Wragg Ltd claimed that the company was (in return for the share issue) worth £18,000 less than the board had decided to pay. Judgment Lindley LJ held that the transaction was wholly legitimate. He noted that '' Ooregum Gold Mining Co of India v Roper''892AC 125 decided shares cannot be issued at a discount, or below their nominal value, and continued. Smith LJ concurred, saying if the consideration is ‘not clearly colourable nor illusory, then, in my judgment, the adequacy of the consideration cannot be im ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Court Of Appeal Of England And Wales

The Court of Appeal (formally "His Majesty's Court of Appeal in England", commonly cited as "CA", "EWCA" or "CoA") is the highest court within the Courts of England and Wales#Senior Courts of England and Wales, Senior Courts of England and Wales, and second in the legal system of England and Wales only to the Supreme Court of the United Kingdom. The Court of Appeal was created in 1875, and today comprises 39 Lord Justices of Appeal and Lady Justices of Appeal. The court has two divisions, Criminal and Civil, led by the Lord Chief Justice of England and Wales, Lord Chief Justice and the Master of the Rolls, Master of the Rolls and Records of the Chancery of England respectively. Criminal appeals are heard in the Criminal Division, and civil appeals in the Civil Division. The Criminal Division hears appeals from the Crown Court, while the Civil Division hears appeals from the County Court (England and Wales), County Court, High Court of Justice and Family Court (England and Wales ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nathaniel Lindley, Baron Lindley

Nathaniel Lindley, Baron Lindley, (29 November 1828 – 9 December 1921) was an English judge. Early life He was the second son of the botanist Dr. John Lindley, born at Acton Green, London. From his mother's side, he was descended from Sir Edward Coke. He was educated at University College School, and studied for a time at University College London, and the University of Edinburgh and University of Cambridge in 1898 and achieved Doctor of Civil Law in University of Oxford in 1903. Legal career He was called to the bar at the Middle Temple in 1850, and began practice in the Court of Chancery. In 1855 he published ''An Introduction to the Study of Jurisprudence'', consisting of a translation of the general part of Thibaut's ''System des Pandekten Rechts'', with copious notes. In 1860 he published in two volumes his ''Treatise on the Law of Partnership, including its Application to Joint Stock and other Companies'', and in 1862 a supplement including the Companies Act 1862. This w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Rigby (politician)

Sir John Rigby, PC (8 January 1834 – 26 July 1903), was a British judge and Liberal politician who sat in the House of Commons between 1885 and 1894. Background and education Rigby was born in Runcorn, Cheshire, the son of Thomas Rigby of Halton, Cheshire, and his wife Elizabeth Kendal. He attended Liverpool College before going to Trinity College, Cambridge in 1853. He graduated as Second Wrangler in 1856, also being placed second for the Smith's Prize. He became a fellow of Trinity in 1856 and was called to the Bar at Lincoln's Inn in 1860. Legal career The story of how Rigby came to the Bar may be found on pg. 120 of the 1958 memoir “B-berry and I Look Back”, by Dornford Yates. In 1875 Rigby was appointed junior counsel to the Treasury. In 1881 he "took silk", becoming a Queen's Counsel. He distinguished himself as an advocate, and was frequently involved in bringing appeals to the judicial committee of the House of Lords. Rigby was twice briefly a Liberal Party Membe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consideration In English Law

Consideration is an English common law concept within the law of contract, and is a necessity for simple contracts (but not for special contracts by deed). The concept of consideration has been adopted by other common law jurisdictions, including the US. Consideration can be anything of value (such as any goods, money, services, or promises of any of these), which each party gives as a quid pro quo to support their side of the bargain. Mutual promises constitute consideration for each other. If only one party offers consideration, the agreement is a "bare promise" and is unenforceable. Value According to ''Currie v Misa'', consideration for a particular promise exists where some ''right'', ''interest'', ''profit'' or ''benefit'' accrues (''or will accrue'') to the promisor as a direct result of some ''forbearance'', ''detriment'', ''loss'' or ''responsibility'' that has been given, suffered or undertaken by the promisee. Forbearance to act amounts to consideration only if one is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Company Law

The United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandato ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

English Contract Law

English contract law is the body of law that regulates legally binding agreements in England and Wales. With its roots in the lex mercatoria and the activism of the judiciary during the industrial revolution, it shares a heritage with countries across the Commonwealth of Nations, Commonwealth (such as Australian contract law, Australia, Canadian contract law, Canada, Indian contract law, India), from membership in the European Union, continuing membership in Unidroit, and to a lesser extent the United States. Any agreement that is enforceable in court is a contract. A contract is a Voluntariness, voluntary Law of obligations, obligation, contrasting to the duty to not violate others rights in English tort law, tort or English unjust enrichment law, unjust enrichment. English law places a high value on ensuring people have truly consented to the deals that bind them in court, so long as they comply with statutory and UK human rights law, human rights. Generally a contract forms w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In finance, financial markets, a share is a unit of Equity (finance), equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share is an indivisible unit of capital, expressing the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Valuation Shares are valued according to the various principle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oxford University Press

Oxford University Press (OUP) is the university press of the University of Oxford. It is the largest university press in the world, and its printing history dates back to the 1480s. Having been officially granted the legal right to print books by decree in 1586, it is the second oldest university press after Cambridge University Press. It is a department of the University of Oxford and is governed by a group of 15 academics known as the Delegates of the Press, who are appointed by the vice-chancellor of the University of Oxford. The Delegates of the Press are led by the Secretary to the Delegates, who serves as OUP's chief executive and as its major representative on other university bodies. Oxford University Press has had a similar governance structure since the 17th century. The press is located on Walton Street, Oxford, opposite Somerville College, in the inner suburb of Jericho. For the last 500 years, OUP has primarily focused on the publication of pedagogical texts and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidator (law)

In law, a liquidator is the officer appointed when a company goes into winding-up or liquidation who has responsibility for collecting in all of the assets under such circumstances of the company and settling all claims against the company before putting the company into dissolution. Liquidator is a person officially appointed to 'liquidate' a company or firm. Their duty is to ascertain and settle the liabilities of a company or a firm. If there are any surplus, then those are distributed to the contributories. Origins In English law, the term "liquidator" was first used in the Joint Stock Companies Act 1856. Prior to that time, the equivalent role was fulfilled by "official managers" pursuant to the amendments to the Joint Stock Companies Winding-Up Act 1844 passed in 1848 - 1849. Powers In most jurisdictions, a liquidator's powers are defined by statute. Certain powers are generally exercisable without the requirement of any approvals; others may require sanction, either by t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ooregum Gold Mining Co Of India V Roper

''Ooregum Gold Mining Co of India v Roper'' 892AC 125 is an old and controversial English company law case concerning shares. It concerns the rule that shares should not be issued "at a discount" on the price at which they were issued. Under United Kingdom company law the rule is now codified in Companies Act 2006, sections 552 and 580. Facts The Ooregum Gold Mining Co of India issued 120,000 shares at £1 each. Shareholders said they wanted to sell on the shares for 5 shillings, (i.e. 25 new pence) one quarter of the value the shares were issued at, but that the buyers would be credited with a full £1 in the company. This would mean that shareholders would get a 15 shilling (75 new pence) discount. At the time of the litigation, the share price stood at £2 14s. The shareholders at the time of the purchase (who now wanted money to pay off a debenture) even though they had voted for the issue, then turned around to the buyers and argued that shares were prohibited from being is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value (economics)

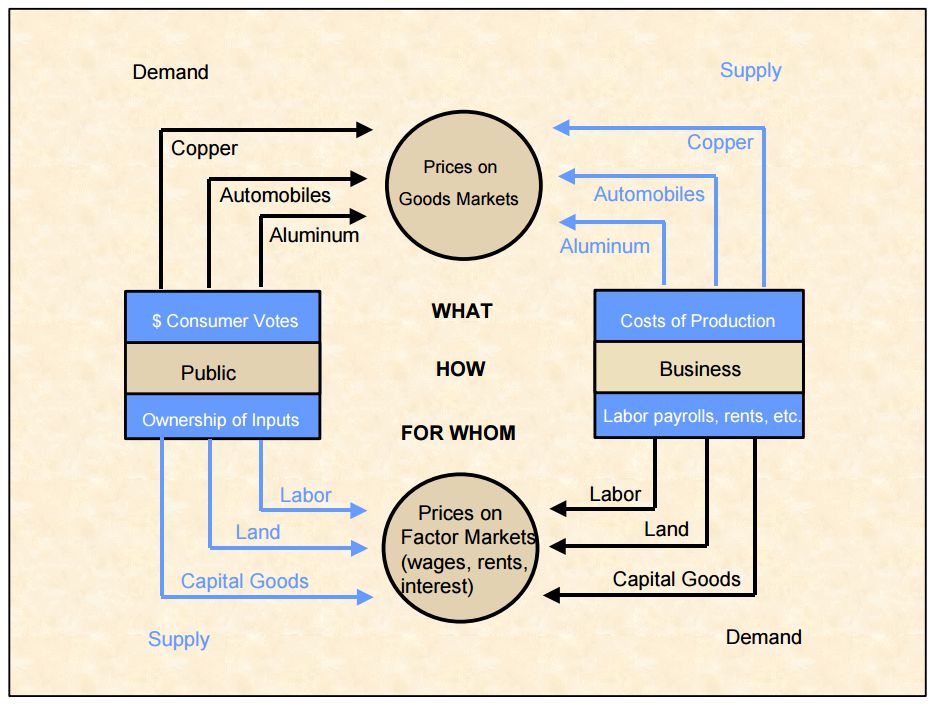

In economics, economic value is a measure of the benefit provided by a goods, good or service (economics), service to an Agent (economics), economic agent. It is generally measured through units of currency, and the interpretation is therefore "what is the maximum amount of money a specific actor is Willingness to pay, willing and able to pay for the good or service"? Among the competing schools of economic theory there are differing Theory of value (economics), theories of value. Economic value is ''not'' the same as Price, market price, nor is economic value the same thing as market value. If a consumer is willing to buy a good, it implies that the customer places a higher value on the good than the market price. The difference between the value to the consumer and the market price is called "Economic surplus, consumer surplus". It is easy to see situations where the actual value is considerably larger than the market price: purchase of drinking water is one example. Overvi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted to currency, quantities of goods or vouchers. * In modern economies, prices are generally expressed in units of some form of currency. (More specifically, for raw materials they are expressed as currency per unit weight, e.g. euros per kilogram or Rands per KG.) * Although prices ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)