|

Imperial Bank Of Persia

The Imperial Bank of Persia ( fa, بانک شاهنشاهی ایران, Bank-e Šâhanšâhi-ye Irân) was a British bank that operated as the state bank and bank of issue in Iran (formerly known as Persia until 1935) between 1889 and 1929. It was established in 1885 with a concession from the Persian government to Baron Julius De Reuter (born Israel Beer Josaphat) a German–Jewish banker and businessman who later became a Christian and a British subject. The bank was the first modern bank in Iran and introduced European banking ideas to a country in which they were previously unknown. The legal centre of the bank was in London and whilst it was subject to British law, its activities were based in Tehran. It also had operations in other Middle Eastern countries. It was later named British Bank of the Middle East (BBME) and is now called HSBC Bank Middle East Limited. After the Iranian Revolution of 1979, all the Iranian activities of this bank were transferred to Bank Tejara ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Imperial Bank Of Persia

The Imperial Bank of Persia ( fa, بانک شاهنشاهی ایران, Bank-e Šâhanšâhi-ye Irân) was a British bank that operated as the state bank and bank of issue in Iran (formerly known as Persia until 1935) between 1889 and 1929. It was established in 1885 with a concession from the Persian government to Baron Julius De Reuter (born Israel Beer Josaphat) a German–Jewish banker and businessman who later became a Christian and a British subject. The bank was the first modern bank in Iran and introduced European banking ideas to a country in which they were previously unknown. The legal centre of the bank was in London and whilst it was subject to British law, its activities were based in Tehran. It also had operations in other Middle Eastern countries. It was later named British Bank of the Middle East (BBME) and is now called HSBC Bank Middle East Limited. After the Iranian Revolution of 1979, all the Iranian activities of this bank were transferred to Bank Tejara ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Persian Empire

The Achaemenid Empire or Achaemenian Empire (; peo, wikt:𐎧𐏁𐏂𐎶, 𐎧𐏁𐏂, , ), also called the First Persian Empire, was an History of Iran#Classical antiquity, ancient Iranian empire founded by Cyrus the Great in 550 BC. Based in Western Asia, it was contemporarily the List of largest empires, largest empire in history, spanning a total of from the Balkans and ancient Egypt, Egypt in the west to Central Asia and the Indus River, Indus Valley in the east. Around the 7th century BC, the region of Persis in the southwestern portion of the Iranian plateau was settled by the Persians. From Persis, Cyrus rose and defeated the Medes, Median Empire as well as Lydia and the Neo-Babylonian Empire, marking the formal establishment of a new imperial polity under the Achaemenid dynasty. In the modern era, the Achaemenid Empire has been recognized for its imposition of a successful model of centralized, bureaucratic administration; its multicultural policy; building comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking And Insurance In Iran

Following the Iranian Revolution, Iran's banking system was transformed to be run on an Islamic interest-free basis. As of 2010 there were seven large government-run commercial banks. As of March 2014, Iran's banking assets made up over a third of the estimated total of Islamic banking assets globally. They totaled 17,344 trillion rials, or US$523 billion at the free market exchange rate, using central bank data, according to Reuters. Since 2001 the Iranian Government has moved toward liberalising the banking sector, although progress has been slow. In 1994 Bank Markazi (the central bank) authorised the creation of private credit institutions, and in 1998 authorised foreign banks (many of whom had already established representative offices in Tehran) to offer full banking services in Iran's free-trade zones. The central bank sought to follow this with the recapitalisation and partial privatisation of the existing commercial banks, seeking to liberalise the sector and encour ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Friendly Takeover

In business, a takeover is the purchase of one company (the ''target'') by another (the ''acquirer'' or ''bidder''). In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company. Management of the target company may or may not agree with a proposed takeover, and this has resulted in the following takeover classifications: friendly, hostile, reverse or back-flip. Financing a takeover often involves loans or bond issues which may include junk bonds as well as a simple cash offers. It can also include shares in the new company. Types Friendly A ''friendly takeover'' is an acquisition which is approved by the management of the target company. Before a bidder makes an offer for another company, it usually first informs the company's board of directors. In an ideal world, if the board feels that accepting the offer serves the shareholders better than rejecting it, it recommend ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hongkong Bank

The Hongkong and Shanghai Banking Corporation Limited (), commonly known as HSBC (), was the parent entity of the multinational HSBC banking group until 1991, and is now its Hong Kong-based Asia-Pacific subsidiary. The largest bank in Hong Kong, HSBC operates branches and offices throughout the Indo-Pacific region and in other countries around the world. It is also one of the three commercial banks licensed by the Hong Kong Monetary Authority to issue banknotes for the Hong Kong dollar. The Hongkong and Shanghai Bank was established in British Hong Kong in 1865 and was incorporated as The Hongkong and Shanghai Banking Corporation in 1866, and has been based in Hong Kong (although now as a subsidiary) ever since. It was "The Hongkong and Shanghai Banking Corporation Limited" in 1989. It is the founding member of the HSBC group of banks and companies, and, since 1990, is the namesake and one of the leading subsidiaries of the London-based HSBC Holdings PLC. The company's busin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arab States Of The Persian Gulf

The Arab states of the Persian Gulf refers to a group of Arab states which border the Persian Gulf. There are seven member states of the Arab League in the region: Bahrain, Kuwait, Iraq, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Yemen is bound to the six countries of the Gulf Cooperation Council, based on history and culture. The term has been used in different contexts to refer to a number of Arab states in the Persian Gulf region. The prominent regional political union Gulf Cooperation Council includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Historically, various British Empire protectorates, including the Trucial States were Arab states along the Persian Gulf. Politics Some of the Arab states of the Persian Gulf are constitutional monarchies with elected parliaments. Bahrain ('' Majlis al Watani'') and Kuwait ('' Majlis al Ummah'') have legislatures with members elected by the population. The Sultanate of Oman also has an ad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Melli

Bank Melli Iran (BMI; fa, بانک ملی ایران, lit=National Bank of Iran, ''Bânk-e Melli-ye Irân'') is the first national and commercial retail bank of Iran. It is considered as the largest Iranian company in terms of annual income with a revenue of 364 657 billion Rials in 2016. It is the largest bank in the Islamic world and in the Middle East. By the end of 2016, BMI had a net asset of $76.6 billion and a vast network of 3.328 banking branches; so it is known as the largest Iranian bank based on the amount of assets. The brand of BMI was recognized as one of the 100 top Iranian brands in 10th National Iranian Heroes Championship in 2013. The National Bank has 3328 active branches inside, 14 active branches and 4 sub-stations abroad and it has 180 booths. The first managing director of BMI was from Germany. Also, the first foreign branch of BMI was opened in Hamburg, Germany in 1948. History The formation of a new bank was first proposed by Haj Mohammad Has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Albert Houtum-Schindler

General Sir Albert Houtum-Schindler (born 24 September 1846, the Netherlands or Germany; died 15 June 1916, Fenstanton, England) was a scholar of Persia and an employee of the Persian government. Career Educated in engineering at Leipzig University, Houtum-Schindler was recruited to Persia in 1868 by the Indo-European Telegraph Service.Houtum-Schindler L. in: Eight years later he became an inspector-general of the Persian telegraph service, and acquired the honorary rank of general in the Persian army. In 1882 he became the managing director of Khorasan's turquoise mines, and in 1889 became the inspector of branches for the Imperial Bank, as well as inspector-general of mines for the Persian Bank Mining Rights Corporation. However, he was dismissed in 1894 after this failed, which was deemed due to his management. By 1896 Houtum-Schindler had become Director of the Foreign Office Control Department and acted as adviser to the Persian Government on numerous topics. From 1902 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Geoffrey Jones (academic)

Geoffrey G. Jones is a British-born business historian. He became a US citizen in 2010. He is currently Isidor Straus Professor of Business History at the Harvard Business School. The previous holders of this Chair, which was the first in the world in business history being founded in 1927, included Alfred D. Chandler, Jr. and Thomas K. McCraw. Jones's works have concentrated on the historical evolution of globalization, international banking and trading, and foreign direct investment by multinationals. He has published histories of Unilever, and has more recently written on the history of sustainable business worldwide. In 2017 he published a historical study of green entrepreneurship from the nineteenth century until the present day called ''Profits and Sustainability. A History of Green Entrepreneurship'' (Oxford, 2017) Life Born in Birmingham, Jones attended Corpus Christi, Cambridge. After receiving his PhD, he worked there as a research fellow. He then became a lecturer i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

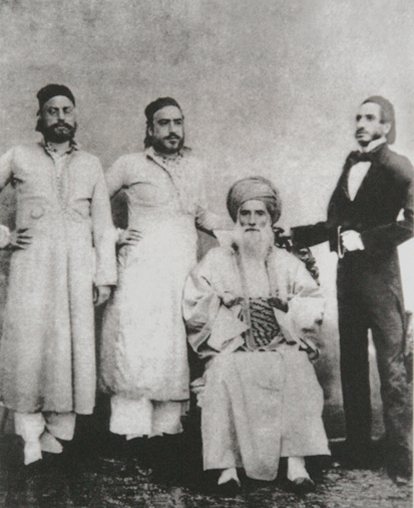

David Sassoon & Co

David Sassoon & Co., Ltd. (in the early years called ″David Sassoon & Sons″) was a trading company operating in the 19th century and early 20th century predominantly in India, China and Japan. History Established 1832 in Bombay (today Mumbai) by David Sassoon (1792–1864), a Baghdadi Jewish businessman in Bombay. The company was set up in a small counting house at 9 Tamarind Street (does not exist any longer) initially involved in banking activities and property investments. But it soon started to deal successfully in all sorts of commodities like precious metals, silks, gums, spices, wool and wheat. But by that time it specialised in trading Indian cotton yarn and opium from Bombay to China. The latter was promoted by the First Opium War and the Treaty of Nanking in 1842 between the United Kingdom and the Chinese Qing dynasty.Jonathan Goldstein (Editor): "The Jews of China", Volume One, M.E. Sharpe Publisher, Armonk/ London 1999, p.145, For the fast transport of the o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Schroders

Schroders plc is a British multinational asset management company, founded in 1804. The company employs over 5,000 people worldwide in 32 locations around Europe, America, Asia, Africa and the Middle East. Headquartered in the City of London, it is traded on the London Stock Exchange and is a constituent of the FTSE 100 Index. Schroders bears the name of the Schröder family, a prominent Hanseatic family of Hamburg with branches in other countries. The Schroder family, through trustee companies, individual ownership and charities, control 47.93 per cent of the company's ordinary shares. History Schroders' history began in 1804 when Johann Heinrich Schröder (John Henry) became a partner in J.F. Schröder & Co, the London-based firm of his brother, Johann Friedrich (John Frederick), founded in 1800. In 1818 J. Henry Schröder & Co. was established in London. During the American Civil War, Schroders "issued £3m bonds in 1863 for the Confederacy." Key events in the development ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)