|

IBEX 35

The IBEX 35 (IBerian IndEX) is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. Initiated in 1992, the index is administered and calculated by Sociedad de Bolsas, a subsidiary of Bolsas y Mercados Españoles (BME), the company which runs Spain's securities markets (including the Bolsa de Madrid). It is a market capitalization weighted index comprising the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index and is reviewed twice annually. Trading on options and futures contracts on the IBEX 35 is provided by MEFF (Mercado Español de Futuros Financieros), another subsidiary of BME. History The IBEX 35 was inaugurated on January 14, 1992, although there are calculated values for the index back to December 29, 1989, where the base value of 3,000 points lies. Between 2000 and 2007, the index outperformed many of its Western peers, driven by relatively strong domestic economic growth which particularly helped co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bolsas Y Mercados Españoles

Bolsas y Mercados Españoles (; BME) is the Spanish company that deals with the organizational aspects of the Spanish stock exchanges and financial markets, which includes the stock exchanges in Madrid, Barcelona, Bilbao and Valencia. In addition to the trading of shares and bonds, BME offers access to a number of other products ( warrants, trackers) and the clearing and settlement of operations. BME is also developing a technological consultancy, operating in 23 countries and mainly providing trading systems. BME owns the stocks exchanges of Madrid, Barcelona, Valencia and Bilbao as well as Latibex, the only international market for Latin American securities, and the company Openfinance, a provider of technology in the wealth management industry. BME also holds a participation in the Cámara de Riesgo Central de Contraparte of Colombia and the Mexican Stock Exchange. BME has been a listed company since 14 July 2006 and an IBEX 35 constituent since July 2007 until December 2015. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AEX Index

The AEX index, derived from Amsterdam Exchange index, is a stock market index composed of Dutch companies that trade on Euronext Amsterdam, formerly known as the ''Amsterdam Stock Exchange''. Started in 1983, the index is composed of a maximum of 25 of the most frequently traded securities on the exchange. It is one of the main national indices of the stock exchange group Euronext alongside Euronext Brussels' BEL20, Euronext Dublin's ISEQ 20, Euronext Lisbon's PSI-20, the Oslo Bors OBX Index, and Euronext Paris's CAC 40. History The AEX started from a base level of 100 index points on 3 January 1983 (a corresponding value of 45.378 is used for historic comparisons due to the adoption of the Euro). The index's peak to date was set on 26th October 2021 816.91 After the dot-com bubble in 1999, the index value more than halved over the following three years before recovering in line with most global financial markets. The AEX index dealt with its second largest one-day loss on March ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalization-weighted Index

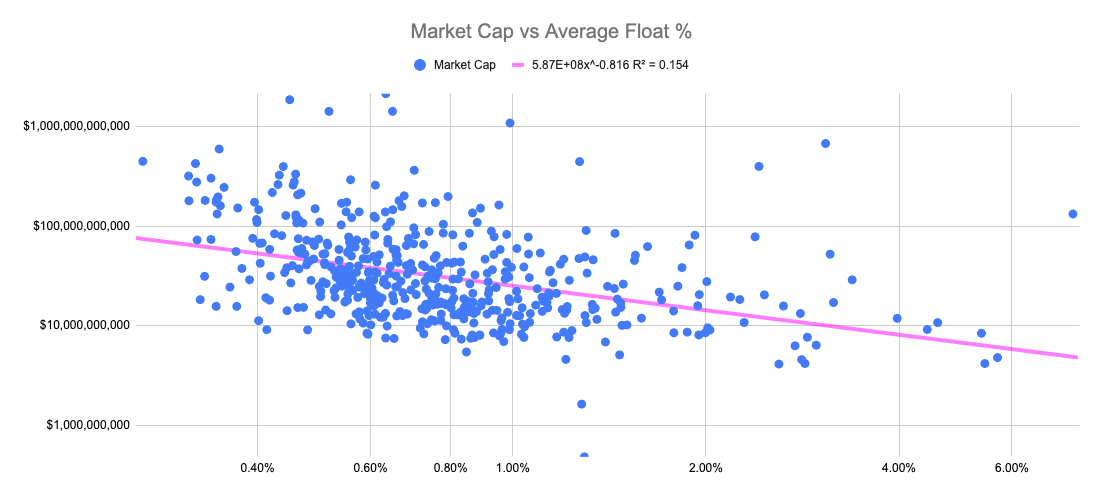

A capitalization-weighted (or cap-weighted) index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value (the share price multiplied by the number of outstanding shares), in a capitalization-weighted index. In other types of indices, different ratios are used. For example, the AMEX Composite Index (XAX) had more than 800 component stocks. The weighting of each stock constantly shifted with changes in the stock's price and the number of shares outstanding. The index fluctuates in line with the price move of the stocks. Stock market indices are a type of economic index. Free-float weighting A common version of capitalization weighting is the ''free-float'' weighting. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interior Del Palacio De La Bolsa, Madrid, España, 2017 29

Interior may refer to: Arts and media * ''Interior'' (Degas) (also known as ''The Rape''), painting by Edgar Degas * ''Interior'' (play), 1895 play by Belgian playwright Maurice Maeterlinck * ''The Interior'' (novel), by Lisa See * Interior design, the trade of designing an architectural interior Places * Interior, South Dakota * Interior, Washington * Interior Township, Michigan * British Columbia Interior, commonly known as "The Interior" Government agencies * Interior ministry, sometimes called the ministry of home affairs * United States Department of the Interior Other uses * Interior (topology), mathematical concept that includes, for example, the inside of a shape * Interior FC, a football team in Gambia See also * * * List of geographic interiors * Interiors (other) * Inter (other) * Inside (other) Inside may refer to: * Insider, a member of any group of people of limited number and generally restricted access Film * ''Inside'' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders. Market capitalization is equal to the market price per common share multiplied by the number of common shares outstanding. Since outstanding stock is bought and sold in public markets, capitalization could be used as an indicator of public opinion of a company's net worth and is a determining factor in some forms of stock valuation. Description Market capitalization is sometimes used to rank the size of companies. It measures only the equity component of a company's capital structure, and does not reflect management's decision as to how much debt (or leverage) is used to finance the firm. A more comprehensive measure of a firm's size is enterprise value (EV), which gives effect to outstanding debt, preferred stock, and other factors. For insurance firms, a value called the embedded value (EV) has been used. It is also ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Float (finance)

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . The euro is divided into 100 cents. The currency is also used officially by the institutions of the European Union, by four European microstates that are not EU members, the British Overseas Territory of Akrotiri and Dhekelia, as well as unilaterally by Montenegro and Kosovo. Outside Europe, a number of special territories of EU members also use the euro as their currency. Additionally, over 200 million people worldwide use currencies pegged to the euro. As of 2013, the euro is the second-largest reserve currency as well as the second-most traded currency in the world after the United States dollar. , with more than €1.3 trillion in circulation, the euro has one of the highest combined values of banknotes and coins in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Academia

An academy (Attic Greek: Ἀκαδήμεια; Koine Greek Ἀκαδημία) is an institution of secondary education, secondary or tertiary education, tertiary higher education, higher learning (and generally also research or honorary membership). The name traces back to Plato's school of philosophy, founded approximately 385 BC at Akademia, a sanctuary of Athena, the goddess of wisdom and Skills, skill, north of Ancient Athens, Athens, Greece. Etymology The word comes from the ''Academy'' in ancient Greece, which derives from the Athenian hero, ''Akademos''. Outside the city walls of Athens, the Gymnasium (ancient Greece), gymnasium was made famous by Plato as a center of learning. The sacred space, dedicated to the goddess of wisdom, Athena, had formerly been an olive Grove (nature), grove, hence the expression "the groves of Academe". In these gardens, the philosopher Plato conversed with followers. Plato developed his sessions into a method of teaching philosophy and in 3 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements ( hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets. Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (off-exchange) or on an exchange such as the Chicago Mercantile Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financial crisis of 2007–2009, there has been increased pressure to move derivatives to trade on exchanges. Derivatives are one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

El País

''El País'' (; ) is a Spanish-language daily newspaper in Spain. ''El País'' is based in the capital city of Madrid and it is owned by the Spanish media conglomerate PRISA. It is the second most circulated daily newspaper in Spain . ''El País'' is the most read newspaper in Spanish online and one of the Madrid dailies considered to be a national newspaper of record for Spain (along with '' El Mundo'' and ''ABC)''. In 2018, its number of daily sales were 138,000. Its headquarters and central editorial staff are located in Madrid, although there are regional offices in the principal Spanish cities (Barcelona, Seville, Valencia, Bilbao, and Santiago de Compostela) where regional editions were produced until 2015. ''El País'' also produces a world edition in Madrid that is available online in English and in Spanish (Latin America). History ''El País'' was founded in May 1976 by a team at PRISA which included Jesus de Polanco, José Ortega Spottorno and Carlos Mendo. The p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |