|

Itô's Lemma

In mathematics Mathematics is a field of study that discovers and organizes methods, Mathematical theory, theories and theorems that are developed and Mathematical proof, proved for the needs of empirical sciences and mathematics itself. There are many ar ..., Itô's lemma or Itô's formula (also called the Itô–Döblin formula) is an identity used in Itô calculus to find the differential of a time-dependent function of a stochastic process. It serves as the stochastic calculus counterpart of the chain rule. It can be heuristically derived by forming the Taylor series expansion of the function up to its second derivatives and retaining terms up to first order in the time increment and second order in the Wiener process increment. The Lemma (mathematics), lemma is widely employed in mathematical finance, and its best known application is in the derivation of the Black–Scholes equation for option values. This result was discovered by Japanese mathematician Kiyoshi It ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Group Theory

In abstract algebra, group theory studies the algebraic structures known as group (mathematics), groups. The concept of a group is central to abstract algebra: other well-known algebraic structures, such as ring (mathematics), rings, field (mathematics), fields, and vector spaces, can all be seen as groups endowed with additional operation (mathematics), operations and axioms. Groups recur throughout mathematics, and the methods of group theory have influenced many parts of algebra. Linear algebraic groups and Lie groups are two branches of group theory that have experienced advances and have become subject areas in their own right. Various physical systems, such as crystals and the hydrogen atom, and Standard Model, three of the four known fundamental forces in the universe, may be modelled by symmetry groups. Thus group theory and the closely related representation theory have many important applications in physics, chemistry, and materials science. Group theory is also cen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quadratic Variation

In mathematics, quadratic variation is used in the analysis of stochastic processes such as Brownian motion and other martingales. Quadratic variation is just one kind of variation of a process. Definition Suppose that X_t is a real-valued stochastic process defined on a probability space (\Omega,\mathcal,\mathbb) and with time index t ranging over the non-negative real numbers. Its quadratic variation is the process, written as t, defined as : t=\lim_\sum_^n(X_-X_)^2 where P ranges over partitions of the interval ,t/math> and the norm of the partition P is the mesh. This limit, if it exists, is defined using convergence in probability. Note that a process may be of finite quadratic variation in the sense of the definition given here and its paths be nonetheless almost surely of infinite 1-variation for every t>0 in the classical sense of taking the supremum of the sum over all partitions; this is in particular the case for Brownian motion. More generally, the covariation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Càdlàg

In mathematics, a càdlàg (), RCLL ("right continuous with left limits"), or corlol ("continuous on (the) right, limit on (the) left") function is a function defined on the real numbers (or a subset of them) that is everywhere right-continuous and has left limits everywhere. Càdlàg functions are important in the study of stochastic processes that admit (or even require) jumps, unlike Brownian motion, which has continuous sample paths. The collection of càdlàg functions on a given domain is known as Skorokhod space. Two related terms are càglàd, standing for "", the left-right reversal of càdlàg, and càllàl for "" (continuous on one side, limit on the other side), for a function which at each point of the domain is either càdlàg or càglàd. Definition Let (M, d) be a metric space, and let E \subseteq \mathbb. A function f:E \to M is called a càdlàg function if, for every t \in E, * the left limit f(t-) := \lim_f(s) exists; and * the right limit f(t+) := \lim_ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Semimartingale

In probability theory, a real-valued stochastic process ''X'' is called a semimartingale if it can be decomposed as the sum of a local martingale and a càdlàg adapted finite-variation process. Semimartingales are "good integrators", forming the largest class of processes with respect to which the Itô integral and the Stratonovich integral can be defined. The class of semimartingales is quite large (including, for example, all continuously differentiable processes, Brownian motion and Poisson processes). Submartingales and supermartingales together represent a subset of the semimartingales. Definition A real-valued process ''X'' defined on the filtered probability space (Ω,''F'',(''F''''t'')''t'' ≥ 0,P) is called a semimartingale if it can be decomposed as :X_t = M_t + A_t where ''M'' is a local martingale and ''A'' is a càdlàg adapted process of locally bounded variation. This means that for almost all \omega \in \Omega and all compact intervals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Martingale (probability Theory)

In probability theory, a martingale is a stochastic process in which the expected value of the next observation, given all prior observations, is equal to the most recent value. In other words, the conditional expectation of the next value, given the past, is equal to the present value. Martingales are used to model fair games, where future expected winnings are equal to the current amount regardless of past outcomes. History Originally, ''martingale (betting system), martingale'' referred to a class of betting strategy, betting strategies that was popular in 18th-century France. The simplest of these strategies was designed for a game in which the gambler wins their stake if a coin comes up heads and loses it if the coin comes up tails. The strategy had the gambler double their bet after every loss so that the first win would recover all previous losses plus win a profit equal to the original stake. As the gambler's wealth and available time jointly approach infinity, their pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

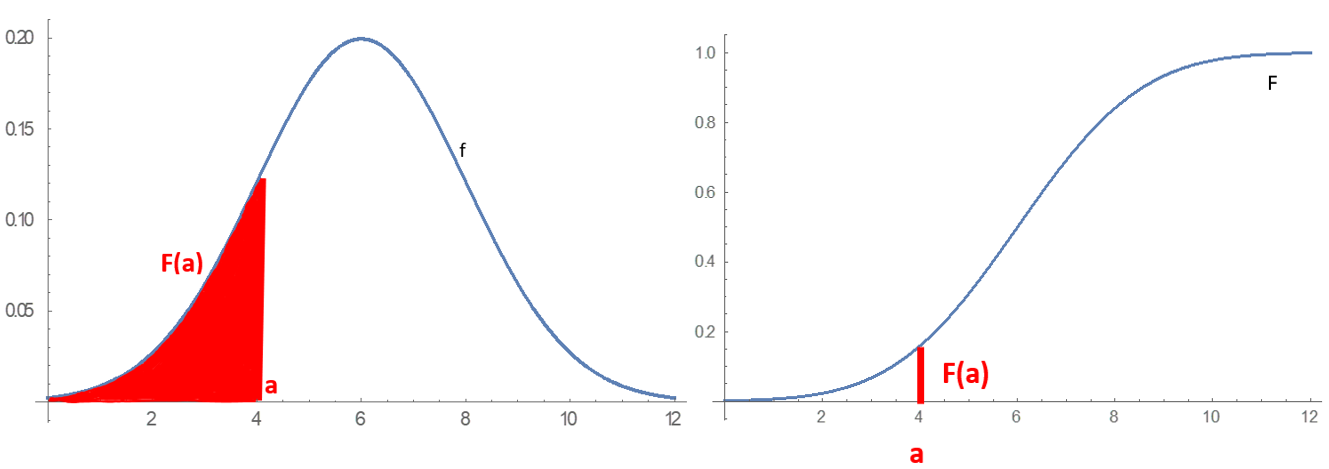

Probability Distribution

In probability theory and statistics, a probability distribution is a Function (mathematics), function that gives the probabilities of occurrence of possible events for an Experiment (probability theory), experiment. It is a mathematical description of a Randomness, random phenomenon in terms of its sample space and the Probability, probabilities of Event (probability theory), events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that fair coin, the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A prob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poisson Process

In probability theory, statistics and related fields, a Poisson point process (also known as: Poisson random measure, Poisson random point field and Poisson point field) is a type of mathematical object that consists of Point (geometry), points randomly located on a Space (mathematics), mathematical space with the essential feature that the points occur independently of one another. The process's name derives from the fact that the number of points in any given finite region follows a Poisson distribution. The process and the distribution are named after French mathematician Siméon Denis Poisson. The process itself was discovered independently and repeatedly in several settings, including experiments on radioactive decay, telephone call arrivals and actuarial science. This point process is used as a mathematical model for seemingly random processes in numerous disciplines including astronomy,G. J. Babu and E. D. Feigelson. Spatial point processes in astronomy. ''Journal of st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trace (linear Algebra)

In linear algebra, the trace of a square matrix , denoted , is the sum of the elements on its main diagonal, a_ + a_ + \dots + a_. It is only defined for a square matrix (). The trace of a matrix is the sum of its eigenvalues (counted with multiplicities). Also, for any matrices and of the same size. Thus, similar matrices have the same trace. As a consequence, one can define the trace of a linear operator mapping a finite-dimensional vector space into itself, since all matrices describing such an operator with respect to a basis are similar. The trace is related to the derivative of the determinant (see Jacobi's formula). Definition The trace of an square matrix is defined as \operatorname(\mathbf) = \sum_^n a_ = a_ + a_ + \dots + a_ where denotes the entry on the row and column of . The entries of can be real numbers, complex numbers, or more generally elements of a field . The trace is not defined for non-square matrices. Example Let be a matrix, with \m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hessian Matrix

In mathematics, the Hessian matrix, Hessian or (less commonly) Hesse matrix is a square matrix of second-order partial derivatives of a scalar-valued Function (mathematics), function, or scalar field. It describes the local curvature of a function of many variables. The Hessian matrix was developed in the 19th century by the German mathematician Otto Hesse, Ludwig Otto Hesse and later named after him. Hesse originally used the term "functional determinants". The Hessian is sometimes denoted by H or \nabla\nabla or \nabla^2 or \nabla\otimes\nabla or D^2. Definitions and properties Suppose f : \R^n \to \R is a function taking as input a vector \mathbf \in \R^n and outputting a scalar f(\mathbf) \in \R. If all second-order partial derivatives of f exist, then the Hessian matrix \mathbf of f is a square n \times n matrix, usually defined and arranged as \mathbf H_f= \begin \dfrac & \dfrac & \cdots & \dfrac \\[2.2ex] \dfrac & \dfrac & \cdots & \dfrac \\[2.2ex] \vdots & \vdot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gradient

In vector calculus, the gradient of a scalar-valued differentiable function f of several variables is the vector field (or vector-valued function) \nabla f whose value at a point p gives the direction and the rate of fastest increase. The gradient transforms like a vector under change of basis of the space of variables of f. If the gradient of a function is non-zero at a point p, the direction of the gradient is the direction in which the function increases most quickly from p, and the magnitude of the gradient is the rate of increase in that direction, the greatest absolute directional derivative. Further, a point where the gradient is the zero vector is known as a stationary point. The gradient thus plays a fundamental role in optimization theory, where it is used to minimize a function by gradient descent. In coordinate-free terms, the gradient of a function f(\mathbf) may be defined by: df=\nabla f \cdot d\mathbf where df is the total infinitesimal change in f for a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Differentiable Function

In mathematics, a differentiable function of one real variable is a function whose derivative exists at each point in its domain. In other words, the graph of a differentiable function has a non- vertical tangent line at each interior point in its domain. A differentiable function is smooth (the function is locally well approximated as a linear function at each interior point) and does not contain any break, angle, or cusp. If is an interior point in the domain of a function , then is said to be ''differentiable at'' if the derivative f'(x_0) exists. In other words, the graph of has a non-vertical tangent line at the point . is said to be differentiable on if it is differentiable at every point of . is said to be ''continuously differentiable'' if its derivative is also a continuous function over the domain of the function f. Generally speaking, is said to be of class if its first k derivatives f^(x), f^(x), \ldots, f^(x) exist and are continuous over the domain of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |