|

Investment Company Act Of 1940

The Investment Company Act of 1940 (commonly referred to as the '40 Act) is an act of Congress which regulates investment funds. It was passed as a United States Public Law () on August 22, 1940, and is codified at . Along with the Securities Exchange Act of 1934, the Investment Advisers Act of 1940, and extensive rules issued by the U.S. Securities and Exchange Commission; it is central to financial regulation in the United States. It has been updated by the Dodd-Frank Act of 2010. It is the primary source of regulation for mutual funds and closed-end funds, now a multi-trillion dollar investment industry. The 1940 Act also impacts the operations of hedge funds, private equity funds and even holding companies. History Following the founding of the mutual fund in 1924, investors invested in this new investment vehicle heavily. Five and a half years later, the Wall Street Crash of 1929 occurred in the stock market, followed shortly thereafter by the United States entry into t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

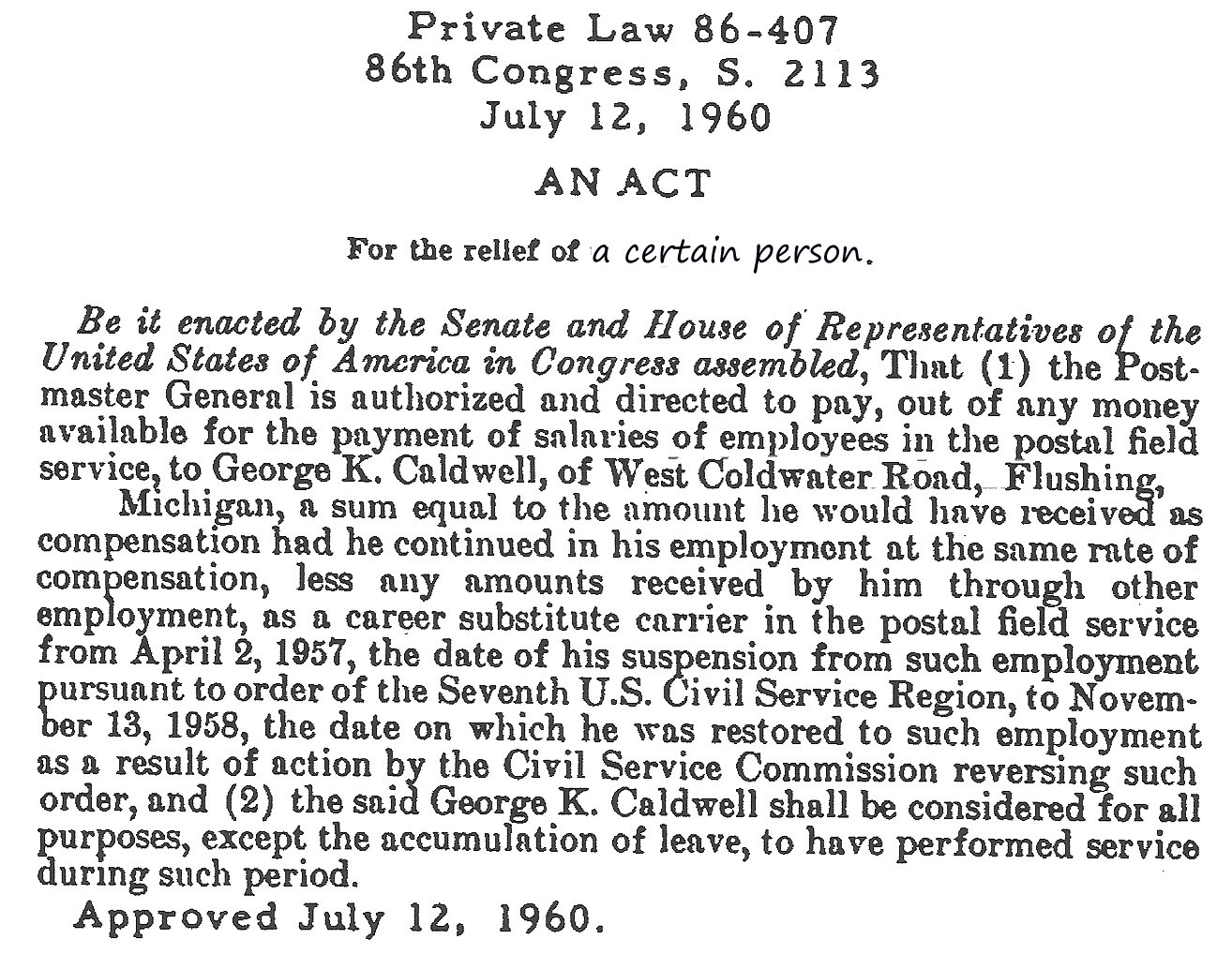

Act Of Congress

An Act of Congress is a statute enacted by the United States Congress. Acts may apply only to individual entities (called private laws), or to the general public ( public laws). For a bill to become an act, the text must pass through both houses with a majority, then be either signed into law by the president of the United States, be left unsigned for ten days (excluding Sundays) while Congress remains in session, or, if vetoed by the president, receive a congressional override from of both houses. Public law, private law, designation In the United States, Acts of Congress are designated as either public laws, relating to the general public, or private laws, relating to specific institutions or individuals. Since 1957, all Acts of Congress have been designated as "Public Law X–Y" or "Private Law X–Y", where X is the number of the Congress and Y refers to the sequential order of the bill (when it was enacted). For example, P. L. 111–5 (American Recovery and Reinvest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

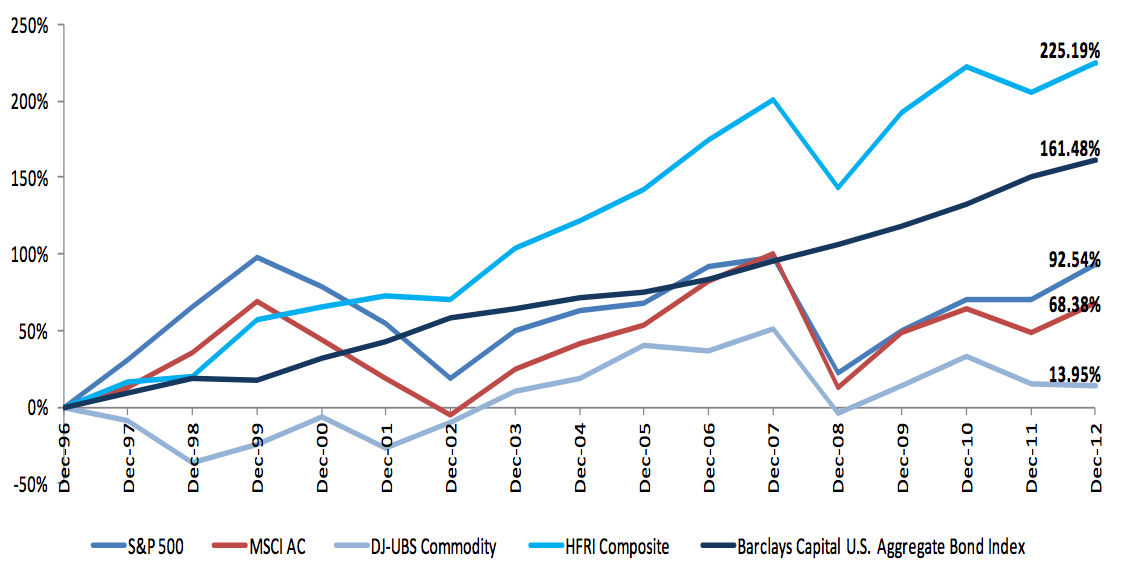

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividends

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually a deposit into a bank account) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by a shareholder is income of the shareholder and may be subject to income tax (see dividend tax). The tax treatment of this income varies considerably between jurisdictions. The corporation does not receive a tax de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than Stock, equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., Warrant (finance), equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic (Dematerialization (securities), dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they enti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trust (property)

A trust is a legal relationship in which the holder of a right gives it to another person or entity who must keep and use it solely for another's benefit. In the Anglo-American common law, the party who entrusts the right is known as the " settlor", the party to whom the right is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the "beneficiary", and the entrusted property itself is known as the "corpus" or "trust property". A ''testamentary trust'' is created by a will and arises after the death of the settlor. An ''inter vivos trust'' is created during the settlor's lifetime by a trust instrument. A trust may be revocable or irrevocable; an irrevocable trust can be "broken" (revoked) only by a judicial proceeding. The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unit Investment Trust

In U.S. financial law, a unit investment trust (UIT) is an investment product offering a fixed (unmanaged) portfolio of securities having a definite life. Unlike open-end and closed-end investment companies, a UIT has no board of directors. A UIT is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 and is classified as an investment company. UITs are assembled by a sponsor and sold through brokerage firms to investors. Types A UIT portfolio may contain one of several different types of securities. The two main types are stock (equity) trusts and bond (fixed-income) trusts. Unlike a mutual fund, a UIT is created for a specific length of time and is a fixed portfolio: its securities will not be sold or new ones bought except in certain limited situations (for instance, when a company is filing for bankruptcy or the sale is required because of a merger). Stock trusts Stock trusts are generally designed to provide capital appreciation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Face-amount Certificate Company

A face-amount certificate company is an investment company which offers an investment certificate as defined by the United States Investment Company Act of 1940. In general, these companies issue fixed income debt securities that obligate the issuer to pay a fixed sum at a future date. They are generally sold on an installment basis.Lemke, Lins and Smith, ''Regulation of Investment Companies,'' §4.02 (Matthew Bender, 2014 ed.). A face-amount certificate (FAC) is a contract between an investor and an issuer in which the issuer guarantees payment of a stated (face amount) sum to the investor at some set date in the future. In return for this future payment, the investor agrees to pay the issuer a set amount of money either as a lump sum or in periodic installments. If the investor pays for the certificate in a lump sum, the investment is known as a fully paid face amount certificate. Issuers of these investments are face-amount certificate companies. Very few face-amount certifi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Law

{{SIA ...

State law refers to the law of a federated state, as distinguished from the law of the federation of which it is a part. It is used when the constituent components of a federation are themselves called states. Federations made up of provinces, cantons, or other units use analogous terms like provincial law or cantonal law. State law may refer to: * State law (Australia) * State law (Brazil) * State law (Germany) * State law (India) * State law (Mexico) * State law (Nigeria) *State law (United States) *State law (Venezuela) State law refers to the law of a federated state, as distinguished from the law of the federation of which it is a part. It is used when the constituent components of a federation are themselves called states. Federations made up of provinces, cant ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interstate Commerce

The Commerce Clause describes an enumerated power listed in the United States Constitution ( Article I, Section 8, Clause 3). The clause states that the United States Congress shall have power "to regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes". Courts and commentators have tended to discuss each of these three areas of commerce as a separate power granted to Congress. It is common to see the individual components of the Commerce Clause referred to under specific terms: the Foreign Commerce Clause, the Interstate Commerce Clause, and the Indian Commerce Clause. Dispute exists within the courts as to the range of powers granted to Congress by the Commerce Clause. As noted below, it is often paired with the Necessary and Proper Clause, and the combination used to take a more broad, expansive perspective of these powers. During the Marshall Court era (1801–1835), interpretation of the Commerce Clause gave Congress jurisdiction o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Law

Federal law is the body of law created by the federal government of a country. A federal government is formed when a group of political units, such as states or provinces join in a federation, delegating their individual sovereignty and many powers to the central government while retaining or reserving other limited powers. As a result, two or more levels of government exist within an established geographic territory. The body of law of the common central government is the federal law. Examples of federal governments include those of Australia, Brazil, Canada, Germany, Malaysia, Pakistan, Republic of India, Russia, the former Soviet Union and the United States. Australia Brazil Canada Germany India Malaysia Pakistan Russia United States The United States Constitution established through the supremacy clause that the United States Constitution and federal law takes precedent over state law. These powers include the authority to govern international af ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)