|

Institute On Taxation And Economic Policy

The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan think tank that works on state and federal tax policy issues. ITEP was founded in 1980, and is a 501(c)(3) tax-exempt organization. ITEP describes its mission as striving to "keep policymakers and the public informed of the effects of current and proposed tax policies on tax fairness, government budgets and sound economic policy." Publications ITEP's flagship publication is its "Who Pays?" report. The report was originally released in 1996, and has since been updated in 2003, 2009, 2013, 2015 and 2018. The 2018 report includes tax changes enacted through September 10, 2018, at 2015 income levels. "Who Pays?" analyzes the distribution, by income level, of state and local taxes in all 50 states, as well as in the District of Columbia. Its main finding is that: "the vast majority of state and local tax systems are fundamentally unfair. An overreliance on consumption taxes and the absence of a progres ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Think Tank

A think tank, or policy institute, is a research institute that performs research and advocacy concerning topics such as social policy, political strategy, economics, military, technology, and culture. Most think tanks are non-governmental organizations, but some are semi-autonomous agencies within government or are associated with particular political parties, businesses or the military. Think-tank funding often includes a combination of donations from very wealthy people and those not so wealthy, with many also accepting government grants. Think tanks publish articles and studies, and even draft legislation on particular matters of policy or society. This information is then used by governments, businesses, media organizations, social movements or other interest groups. Think tanks range from those associated with highly academic or scholarly activities to those that are overtly ideological and pushing for particular policies, with a wide range among them in terms of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

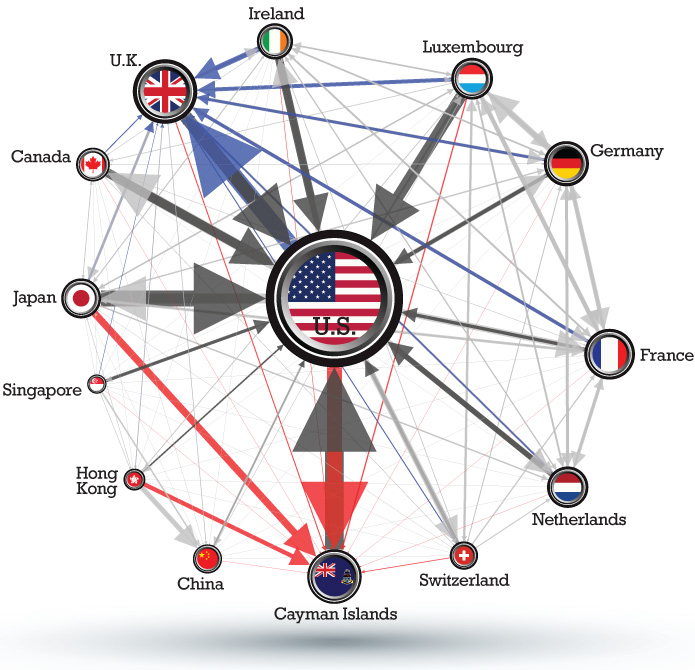

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Center On Budget And Policy Priorities

The Center on Budget and Policy Priorities (CBPP) is a progressive American think tank that analyzes the impact of federal and state government budget policies. A 501(c)(3) nonprofit organization, the Center's stated mission is to "conduct research and analysis to help shape public debates over proposed budget and tax policies and to help ensure that policymakers consider the needs of low-income families and individuals in these debates." CBPP was founded in 1981 by Robert Greenstein, a former political appointee in the Jimmy Carter administration. Greenstein founded the organization, which is based in Washington, D.C., to provide an alternative perspective on the social policy initiatives of the Ronald Reagan administration. Activities Based in Washington, D.C., the Center was founded in 1981 by Robert Greenstein. In 2013, the Center reported revenue of $37.5 million, expenses of $27.3 million, and total year-end assets of $67.7 million. In 1993, the Center was involved in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

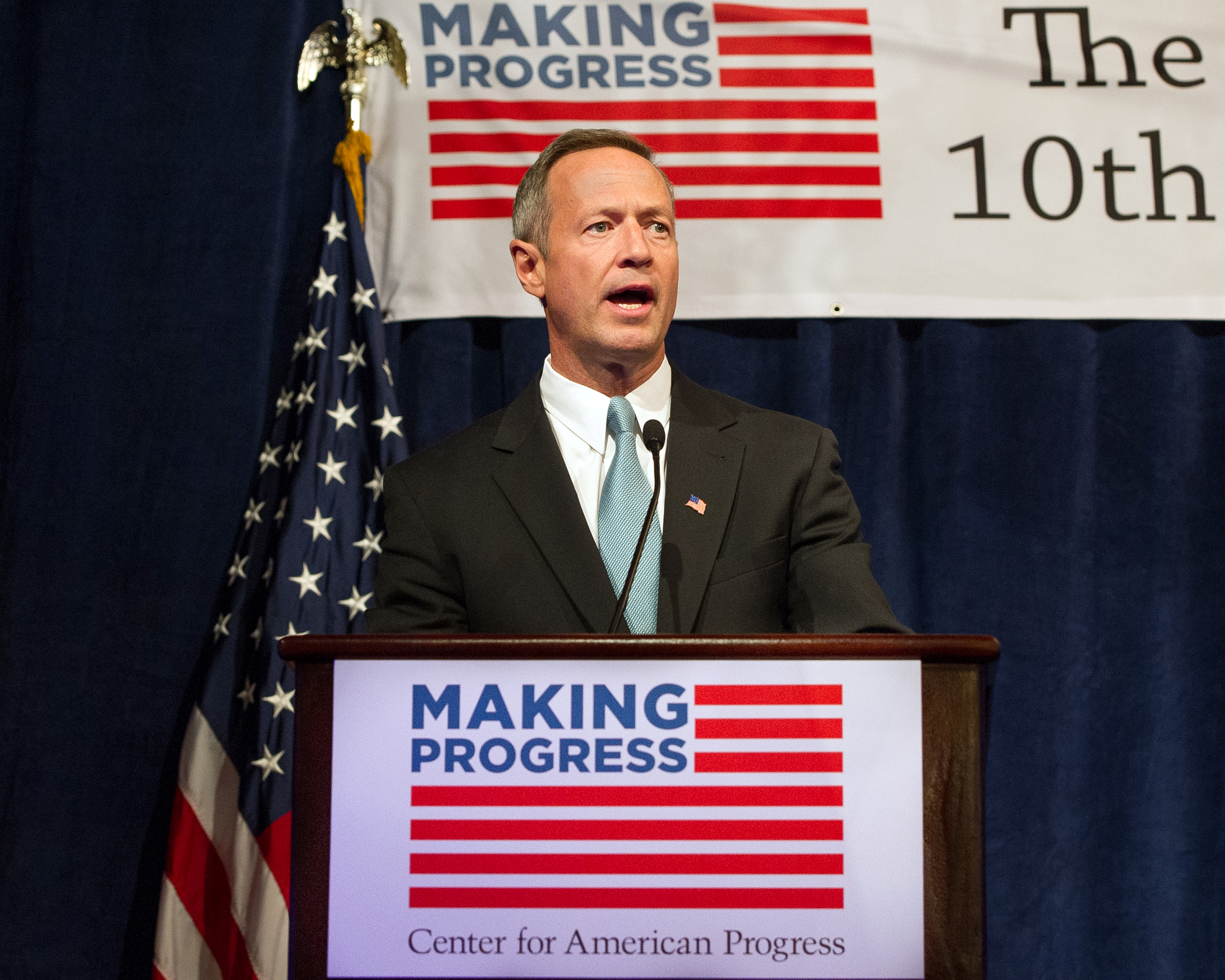

Center For American Progress

The Center for American Progress (CAP) is a public policy research and advocacy organization which presents a liberal viewpoint on economic and social issues. It has its headquarters in Washington, D.C. The president and chief executive officer of CAP is Patrick Gaspard, a former diplomat and labor leader, who served most recently as the president of the Open Society Foundations. Gaspard succeeded Neera Tanden, who was appointed special advisor to President Joe Biden in May 2021. Tanden previously worked for the Obama and Clinton administrations and for Hillary Clinton's campaigns. The first president and CEO was John Podesta, who has served as White House Chief of Staff to U.S. President Bill Clinton and as the chairman of the 2016 presidential campaign of Hillary Clinton. Podesta remained with the organization as chairman of the board until he joined the Obama White House staff in December 2013. Tom Daschle is the current chairman. The Center for American Progress has a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Havens

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Chicago

The University of Chicago (UChicago, Chicago, U of C, or UChi) is a private research university in Chicago, Illinois. Its main campus is located in Chicago's Hyde Park neighborhood. The University of Chicago is consistently ranked among the best universities in the world and it is among the most selective in the United States. The university is composed of an undergraduate college and five graduate research divisions, which contain all of the university's graduate programs and interdisciplinary committees. Chicago has eight professional schools: the Law School, the Booth School of Business, the Pritzker School of Medicine, the Crown Family School of Social Work, Policy, and Practice, the Harris School of Public Policy, the Divinity School, the Graham School of Continuing Liberal and Professional Studies, and the Pritzker School of Molecular Engineering. The university has additional campuses and centers in London, Paris, Beijing, Delhi, and Hong Kong, as well as in downtown ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Bureau Of Economic Research

The National Bureau of Economic Research (NBER) is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community". The NBER is well known for providing start and end dates for recessions in the United States. Many chairpersons of the Council of Economic Advisers were previously NBER Research Associates, including the former NBER president and Harvard Professor, Martin Feldstein. The NBER's president and CEO is James M. Poterba of MIT. History The NBER was founded in 1920. Its first staff economist, director of research, and one of its founders was American economist Wesley Clair Mitchell. He was succeeded by Malcolm C. Rorty in 1922. The Russian American economist Simon Kuznets, a student of Mitchell, was working at the NBER when the U.S. government recruited him to oversee the production of the first official estimates of national in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BEPS

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is detained. The Organization for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Corporate tax havens offer BEPS tools to "shift" pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gabriel Zucman

Gabriel Zucman (born 30 October 1986) is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy. The author of '' The Hidden Wealth of Nations: The Scourge of Tax Havens'' (2015), Zucman is known for his research on tax havens and corporate tax havens. Zucman's research has found that the leading corporate tax havens are all OECD–compliant, and that tax disputes between high–tax locations and havens are very rare. His papers are some of the most cited papers on research into tax havens. Zucman is also known for his work on the quantification of the financial scale of base erosion and profit shifting (BEPS) tax avoidance techniques employed by multinationals in corporate tax havens, through which he identified Ireland as the world's largest corporate tax haven in 2018. In 2018, Zucman was the recipient of the Prize for the Best Young Economist in France, awarded ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |