|

Income Trust

An income trust is an investment that may hold equities, debt instruments, royalty interests or real properties. It is especially useful for financial requirements of institutional investors such as pension funds, and for investors such as retired individuals seeking yield. The main attraction of income trusts, in addition to certain tax preferences for some investors, is their stated goal of paying out consistent cash flows for investors, which is especially attractive when cash yields on bonds are low. Many investors are attracted by the fact that income trusts are not allowed to make forays into unrelated businesses; if a trust is in the oil and gas business, it cannot buy casinos or motion picture studios. The names ''income trust'' and '' income fund'' are sometimes used interchangeably even though most trusts have a narrower scope than funds. Income trusts are most commonly seen in Canada. The closest analogue in the United States to the business and royalty trusts would be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity that pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, real estate investment trusts, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Institutional investors appear to be more sophisticated than retail investors, but it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage-backed Security

A mortgage-backed security (MBS) is a type of asset-backed security (an "Financial instrument, instrument") which is secured by a mortgage loan, mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitization, securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed Residential mortgage-backed security, residential; another class is Commercial mortgage-backed security, commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as pass-through security, "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exit Strategy

An exit strategy is a means of leaving one's current situation, either after a predetermined objective has been achieved, or as a strategy to mitigate failure. An organisation or individual without an exit strategy may be in a quagmire. At worst, an exit strategy will save face; at best, an exit strategy will deliver an objective worth more than the cost of continuing the execution of a previous plan considered "deemed to fail" by weight of the present situation. In warfare In military strategy, an exit strategy is understood to minimise losses of what military jargon called "blood and treasure" (lives and materiel). The term was used technically in internal Pentagon critiques of the Vietnam War (cf. President Richard Nixon's promise of Peace With Honor), but remained obscure to the general public until the Battle of Mogadishu, Somalia when the U.S. military involvement in that U.N. peacekeeping operation cost the lives of U.S. troops without a clear objective. Republican cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

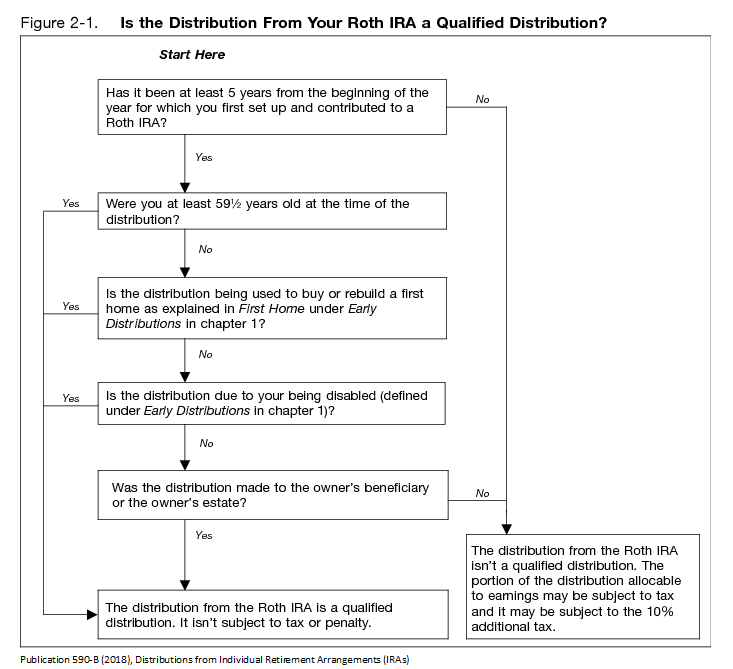

Roth IRA

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not Taxation in the United States, taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting an income tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free. The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997 and is named for Senator William Roth. Overview A Roth IRA can be an individual retirement account containing investments in securities, usually common stock, common stocks and bond (finance), bonds, often through mutual fund, mutual funds (although other investments, including derivatives, notes, Certificate of deposit, certificates of deposit, and real estate are possible). A Roth IRA can also be an individual retirement Annuity (US financial p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contribut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Partnership

A limited partnership (LP) is a type of partnership with general partners, who have a right to manage the business, and limited partners, who have no right to manage the business but have only limited liability for its debts. Limited partnerships are distinct from limited liability partnerships in which all partners have limited liability. The general partners (GPs) are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership. As in a general partnership, the GPs have actual authority, as agency law, agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership's business. As with a general partnership, "an act of a general partner which is not apparently for carrying on in the ordinary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Telecommunication

Telecommunication, often used in its plural form or abbreviated as telecom, is the transmission of information over a distance using electronic means, typically through cables, radio waves, or other communication technologies. These means of transmission may be divided into communication channels for multiplexing, allowing for a single medium to transmit several concurrent Session (computer science), communication sessions. Long-distance technologies invented during the 20th and 21st centuries generally use electric power, and include the electrical telegraph, telegraph, telephone, television, and radio. Early telecommunication networks used metal wires as the medium for transmitting signals. These networks were used for telegraphy and telephony for many decades. In the first decade of the 20th century, a revolution in wireless communication began with breakthroughs including those made in radio communications by Guglielmo Marconi, who won the 1909 Nobel Prize in Physics. Othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electricity Distribution

Electric power distribution is the final stage in the delivery of electricity. Electricity is carried from the transmission system to individual consumers. Distribution substations connect to the transmission system and lower the transmission voltage to medium voltage ranging between and with the use of transformers. ''Primary'' distribution lines carry this medium voltage power to distribution transformers located near the customer's premises. Distribution transformers again lower the voltage to the utilization voltage used by lighting, industrial equipment and household appliances. Often several customers are supplied from one transformer through ''secondary'' distribution lines. Commercial and residential customers are connected to the secondary distribution lines through service drops. Customers demanding a much larger amount of power may be connected directly to the primary distribution level or the subtransmission level. The transition from transmission to distrib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Utility

A public utility company (usually just utility) is an organization that maintains the infrastructure for a public service (often also providing a service using that infrastructure). Public utilities are subject to forms of public control and regulation ranging from local community-based groups to statewide government monopolies. Public utilities are meant to supply goods and services that are considered essential; water, gas, electricity, telephone, waste disposal, and other communication systems represent much of the public utility market. The transmission lines used in the transportation of electricity, or natural gas pipelines, have natural monopoly characteristics. A monopoly can occur when it finds the best way to minimize its costs through economies of scale to the point where other companies cannot compete with it. For example, if many companies are already offering electricity, the additional installation of a power plant will only disadvantage the consumer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Trust

An investment trust is a form of investment fund found mostly in the United Kingdom and Japan. Investment trusts are constituted as Public limited company, public limited companies and are therefore closed ended since the fund managers cannot redeem or create shares. The first investment trust was the Foreign & Colonial Investment Trust, started in 1868 "to give the investor of moderate means the same advantages as the large capitalists in diminishing the risk by spreading the investment over a number of stocks". In many respects, the investment trust was the progenitor of the investment company in the U.S. The name is somewhat misleading, given that (according to law) an investment "trust" is not in fact a "English trust law, trust" in the legal sense at all, but a separate legal person or a UK company law, company. This matters for the fiduciary duties owed by the board of directors and the equitable ownership of the fund's assets. In the United Kingdom, the term "investment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Structure

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt (borrowed funds), and preferred stock, and is detailed in the company's balance sheet. The larger the debt component is in relation to the other sources of capital, the greater financial leverage (or gearing, in the United Kingdom) the firm is said to have. Too much debt can increase the risk of the company and reduce its financial flexibility, which at some point creates concern among investors and results in a greater cost of capital. Company management is responsible for establishing a capital structure for the corporation that makes optimal use of financial leverage and holds the cost of capital as low as possible. Capital structure is an important issue in setting rates charged to customers by regulated utilities in the United States. The utility company has the right to choose any capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |