|

Income Fund

An income fund is a fund whose goal is to provide an income from investments. It is usually organized through a trust or partnership, rather than a corporation, to obtain more efficient flow through tax consequences in relation to the income it earns and distributes. An income fund is a type of asset allocation fund. Income funds are often assumed to be bond funds, but they may be stock funds instead, more accurately called ''equity income funds''. Typically these hold stocks with a good history of paying dividends. In fact, a typical income fund holds both stocks and bonds, to gain some of the strengths of both. The point in any case is that the investor is more interested in income than capital gains, perhaps with the intention the fund will never be sold. Income funds are often used as the endpoint for target-date funds. As each target-date fund approaches and passes its target date, it becomes more similar to the fund provider's income fund. At some point past the target da ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group such as reducing the risks of the investment by a significant percentage. These advantages include an ability to: * hire professional investment managers, who may offer better returns and more adequate risk management; * benefit from economies of scale, i.e., lower transaction costs; * increase the asset diversification to reduce some unsystematic risk. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. The regulatory term is undertaking for collective investment in transferable securities, or short collective invest ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

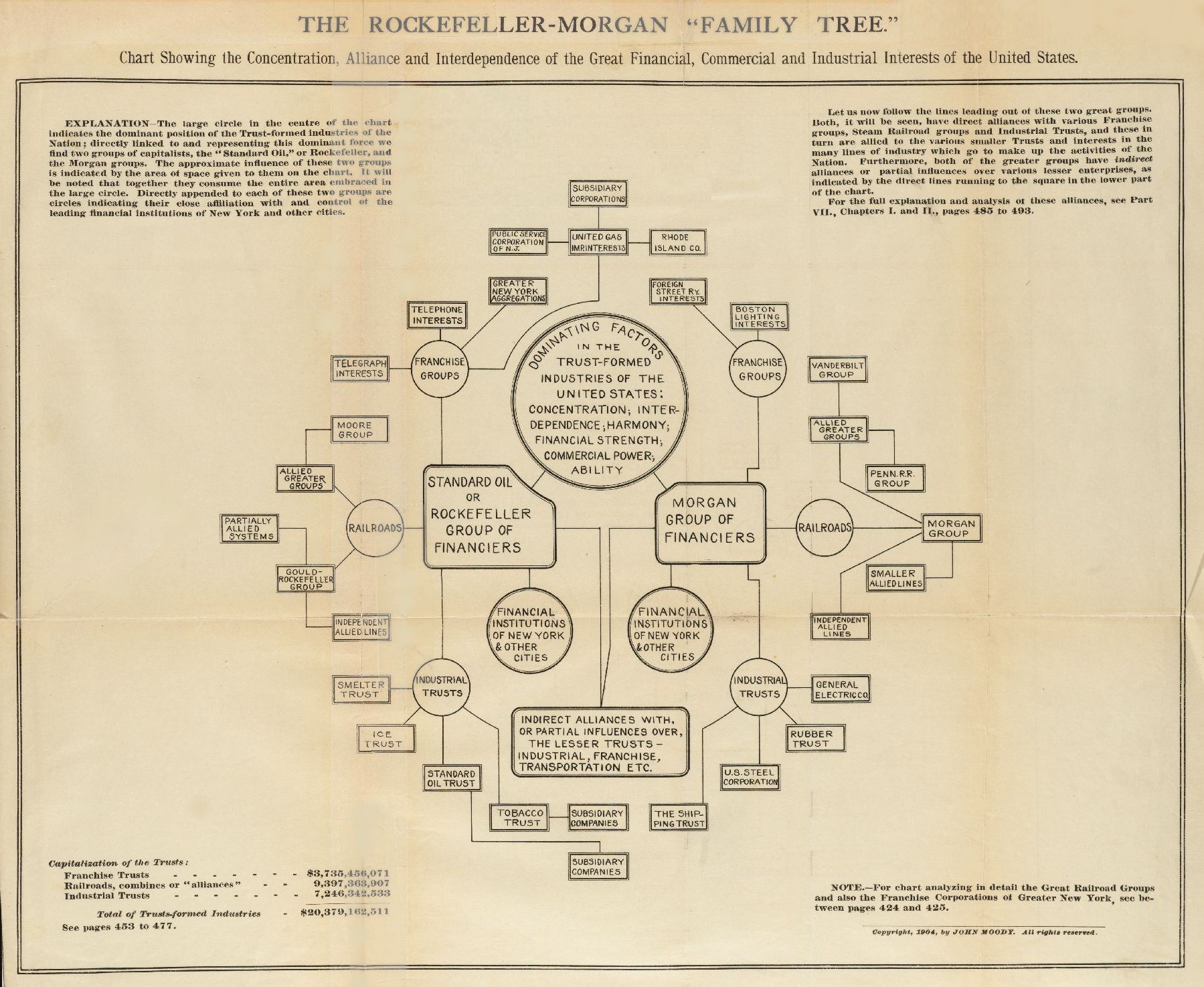

Trust (business)

A trust or corporate trust is a large grouping of business interests with significant market power, which may be embodied as a corporation or as a group of corporations that cooperate with one another in various ways. These ways can include constituting a trade association, owning stock in one another, constituting a corporate group (sometimes specifically a conglomerate), or combinations thereof. The term ''trust'' is often used in a historical sense to refer to monopolies or near-monopolies in the United States during the Second Industrial Revolution in the 19th century and early 20th century. The use of corporate trusts during this period is the historical reason for the name "antitrust law". In the broader sense of the term, relating to trust law, a trust is a centuries-old legal arrangement whereby one party conveys legal possession and title of certain property to a second party, called a trustee. While that trustee has ownership, they cannot use the property for herself, b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond Fund

A bond fund or debt fund is a fund that invests in bonds, or other debt securities. Bond funds can be contrasted with stock funds and money funds. Bond funds typically pay periodic dividends that include interest payments on the fund's underlying securities plus periodic realized capital appreciation. Bond funds typically pay higher dividends than CDs and money market accounts. Most bond funds pay out dividends more frequently than individual bonds.CNN Money 101 - Types of Bonds Types Bond Funds can be classified by their primary underlying assets: *Government: Government bonds are considered safest, since a government can always "print more money" to pay its debt. In the United States, these are |

Stock Fund

A stock fund, or equity fund, is a fund that invests in stocks, also called equity securities. Stock funds can be contrasted with bond funds and money funds. Fund assets are typically mainly in stock, with some amount of cash, which is generally quite small, as opposed to bonds, notes, or other securities. This may be a mutual fund or exchange-traded fund. The objective of an equity fund is long-term growth through capital gains, although historically dividends have also been an important source of total return. Specific equity funds may focus on a certain sector of the market or may be geared toward a certain level of risk. Stock funds can be distinguished by several properties. Funds may have a specific style, for example, value or growth. Funds may invest in solely the securities from one country, or from many countries. Funds may focus on some size of company, that is, small-cap, large-cap, ''et cetera''. Funds which involve some component of stock picking are said to be ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually a deposit into a bank account) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by a shareholder is income of the shareholder and may be subject to income tax (see dividend tax). The tax treatment of this income varies considerably between jurisdictions. The corporation does not receive a tax deduct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Fund

A stock fund, or equity fund, is a fund that invests in stocks, also called equity securities. Stock funds can be contrasted with bond funds and money funds. Fund assets are typically mainly in stock, with some amount of cash, which is generally quite small, as opposed to bonds, notes, or other securities. This may be a mutual fund or exchange-traded fund. The objective of an equity fund is long-term growth through capital gains, although historically dividends have also been an important source of total return. Specific equity funds may focus on a certain sector of the market or may be geared toward a certain level of risk. Stock funds can be distinguished by several properties. Funds may have a specific style, for example, value or growth. Funds may invest in solely the securities from one country, or from many countries. Funds may focus on some size of company, that is, small-cap, large-cap, ''et cetera''. Funds which involve some component of stock picking are said to be ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond Fund

A bond fund or debt fund is a fund that invests in bonds, or other debt securities. Bond funds can be contrasted with stock funds and money funds. Bond funds typically pay periodic dividends that include interest payments on the fund's underlying securities plus periodic realized capital appreciation. Bond funds typically pay higher dividends than CDs and money market accounts. Most bond funds pay out dividends more frequently than individual bonds.CNN Money 101 - Types of Bonds Types Bond Funds can be classified by their primary underlying assets: *Government: Government bonds are considered safest, since a government can always "print more money" to pay its debt. In the United States, these are |

Money Market Fund

A money market fund (also called a money market mutual fund) is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are managed with the goal of maintaining a highly stable asset value through liquid investments, while paying income to investors in the form of dividends. Although they are not insured against loss, actual losses have been quite rare in practice. Regulated in the United States under the Investment Company Act of 1940, and in Europe under Regulation 2017/1131, money market funds are important providers of liquidity to financial intermediaries. Explanation Money market funds seek to limit exposure to losses due to credit, market, and liquidity risks. Money market funds in the United States are regulated by the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940. Rule 2a-7 of the act restricts the quality, maturity and diversity of investments by money ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Target Date Fund

A target date fund (TDF), also known as a lifecycle fund, dynamic-risk fund, or age-based fund, is a collective investment scheme, often a mutual fund or a collective trust fund, designed to provide a simple investment solution through a portfolio whose asset allocation mix becomes more conservative as the target date (usually retirement) approaches. History Target-date funds were invented by Donald Luskin and Larry Tint of Wells Fargo Investment Advisors (later Barclays Global Investors), and first introduced in the early 1990s by BGI. Their popularity in the US increased significantly in recent years due in part to the auto-enrollment legislation Pension Protection Act of 2006 that created the need for safe-harbor type Qualifying Default Investment Alternatives, such as target-date funds, for 401(k) savings plans. With the UK enacting auto-enrollment legislation in 2012, target-date funds are used by the National Employment Savings Trust (NEST), and are expected to become in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Trust

An income trust is an investment that may hold equities, debt instruments, royalty interests or real properties. They are especially useful for financial requirements of institutional investors such as pension funds, and for investors such as retired individuals seeking yield. The main attraction of income trusts (in addition to certain tax preferences for some investors) is their stated goal of paying out consistent cash flows for investors, which is especially attractive when cash yields on bonds are low. Many investors are attracted by the fact that income trusts are not allowed to make forays into unrelated businesses: if a trust is in the oil and gas business it cannot buy casinos or motion picture studios. The names ''income trust'' and ''income fund'' are sometimes used interchangeably, even though most trusts have a narrower scope than funds. Income trusts are most commonly seen in Canada. The closest analogue in the United States to the business and royalty trusts would be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)