|

Hypothecated Tax

The hypothecation of a tax (also known as the ring-fencing or earmarking of a tax) is the dedication of the revenue from a specific tax for a particular expenditure purpose. This approach differs from the classical method according to which all government spending is done from a consolidated fund. History Hypothecated taxes have a long history. One of the first examples of earmarking was ship money, the tax paid by English seaports used to finance the Royal Navy. Later, in the 20th century, the hypothecated tax began to be discussed by politicians in the United Kingdom. For example, the Vehicle Excise Duty from 1920 when earned revenues were used for the construction and maintenance of the roads, assigning 1p on the income tax directly to education in 1992, or giving £300 million per year from the revenues from taxes on the tobacco industry to help the fight against smoking-related diseases since 1999. Nowadays, earmarking of taxes is mainly connected to the health care system, e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

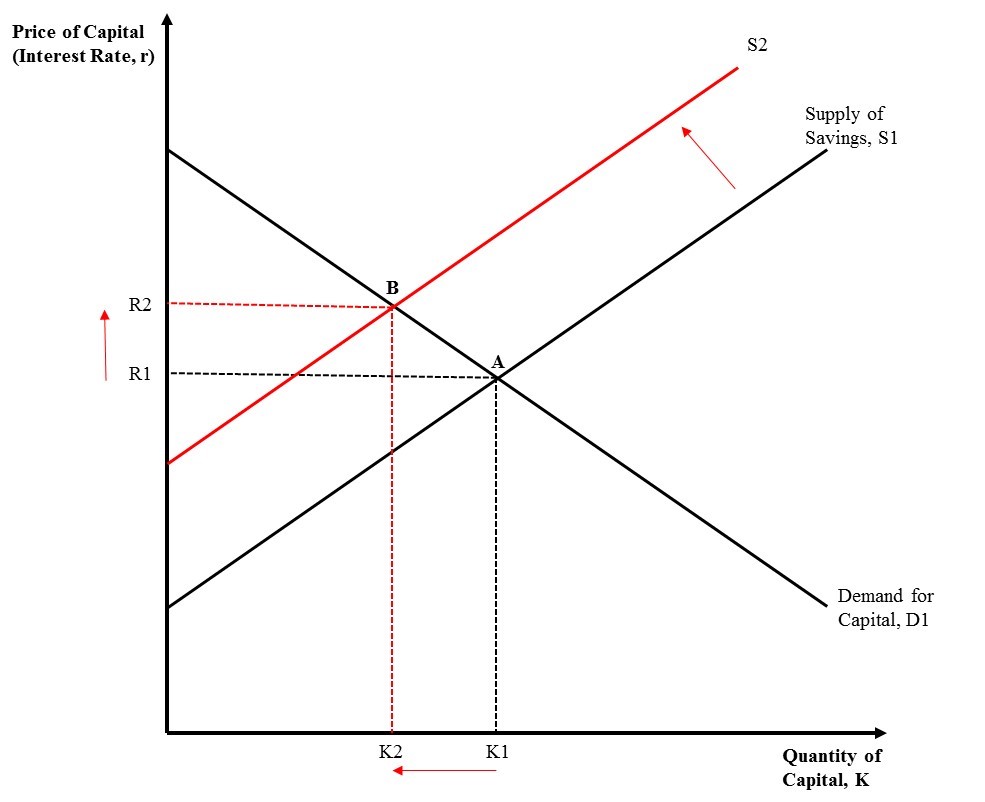

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between the Kingdom of England (which included Wales, annexed in 1542) and the Kingdom of Scotland in 170 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

User Charge

{{Taxation A user charge is a charge for the use of a product or service. A user charge may apply per use of the good or service or for the use of the good or service. The first is a charge for each time while the second is a charge for bulk or time-limited use. Government user charges United States government user charges The federal government Office of Management and Budget has set forth policies for setting user charges by the United States Government in "Circular No. A-25 Revised". Among the policies established, the government may: * Apply user charges against identifiable recipients who enjoy special benefits derived from federal activities beyond those received by the general public; * Set user charges sufficient to recover the full cost to the federal government of providing the service, resource or good provided by the government; and, * Whenever possible set the charges at rates rather than fixed dollar amounts in order to adjust for changes in costs to the government ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Other Invisible Hand

''The Other Invisible Hand'' is a non-fiction book written by the economist Julian Le Grand. The primary focus of his book is increasing taxpayer sovereignty by developing a market in the public sector. The title of the book refers to Adam Smith's invisible hand. The invisible hand is the idea that individual choice benefits society more than does a government which assumes that it "can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess-board." Overview Le Grand begins his book by suggesting that there are four models concerning the provision of public goods: trusting professionals, command and control, voice mechanisms and choice. Out of the four, "choice" is the best way to ensure the optimal provision of quality public services. This is because choice, in theory, "creates incentives for providers to deliver what users want". The key focus is on how to make choice work better. This includes "ensurin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Choice

In public choice theory, tax choice (sometimes called taxpayer sovereignty, earmarking, or fiscal subsidiarity) is the belief that individual taxpayers should have direct control over how their taxes are spent. Its proponents apply the theory of consumer choice to public finance. They claim taxpayers react positively when they are allowed to allocate portions of their taxes to specific spending. Tax relationship between the state and taxpayers The term tax sovereignty emphasizes the perceived equal status of state and taxpayer, instead of the traditional view of the dominant position of the state in taxation. Tracing back to the legitimacy of the state, Viktoria Raritska points out that “the legitimacy of the state as a formal institution is substantiated by the people’s refusal of their freedoms and an agreement to submit to government in exchange for the protection of their guaranteed rights”. Proponents of tax sovereignty believe that in a traditional system of taxatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hypothec

Hypothec (; german: Hypothek, french: hypothèque, pl, hipoteka, from Lat. ''hypotheca'', from Gk. : hypothēkē), sometimes tacit hypothec, is a term used in civil law systems (e.g. law of entire Continental Europe except Gibraltar) or mixed legal systems (e.g. Scots law, South African law) to refer to a registered non-possessory real security over real estate, but under some jurisdictions it may sometimes also denote security on other collaterals such as securities, intellectual property rights or corporeal movable property, either ships only ( ship hypothec) as opposed to other movables covered by a different type of right (pledge) in the legal systems of some countries, or any movables in legal systems of other countries. The common law has two equivalents to the term, namely mortgage and non-possessory lien. Originating in Roman law, a ''hypotheca'' was essentially a non-possessory pledge over a person's entire estate, but during the Renaissance the device was revived by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Sovereignty

Consumer sovereignty is the economic concept that the consumer has some controlling power over goods that are produced, and the idea that the consumer is the best judge of their own welfare. ''Consumer sovereignty in production'' is the controlling power of consumers, versus the holders of scarce resources, in what final products should be produced from these resources. It is sometimes used as a hypothesis that the production of goods and services is determined by the consumers' demand (rather than, say, by capital owners or producers). ''Consumer sovereignty in welfare'' is the idea that the consumer is the best judge of their own welfare (rather than, say, politicians). It is used to claim that, for example, the government should help the poor by giving them monetary transfers, rather than by giving them products that are deemed "essential" by the politicians. Consumer sovereignty in production Consumer sovereignty was first defined by William Harold Hutt as follows:The consu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bundling (public Choice)

Bundling is a concept used for studying the selection of candidates for public office. A voter typically chooses a candidate (or party) for the legislature, rather than directly voting for specific policies. When doing so, the voter is essentially selecting among bundles of policies that a candidate or a party will enact if in power. Overview Occurring principally in republics, the electorate, rather than directly voting on each individual piece of proposed legislation, must choose a number of candidates (or parties) for the legislature. In so doing, they accept or reject each individual candidate or party and their "bundle" of positions on various issues. As there may be no candidate who perfectly reflects the views of an individual voter on all the issues of importance to him/her, each voter must prioritize what issues are most important and choose a candidate accordingly. Another form of bundling occurs in races where the candidate has a running mate who is elected on the same t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benefit Principle

The benefit principle is a concept in the theory of taxation from public finance. It bases taxes to pay for public-goods expenditures on a politically-revealed willingness to pay for benefits received. The principle is sometimes likened to the function of prices in allocating private goods. In its use for assessing the efficiency of taxes and appraising fiscal policy, the benefit approach was initially developed by Knut Wicksell (1896) and Erik Lindahl (1919), two economists of the Stockholm School. Wicksell's near-unanimity formulation of the principle was premised on a just income distribution. The approach was extended in the work of Paul Samuelson, Richard Musgrave,Bernd Hansjürgens, 2000. "The Influence of Knut Wicksell on Richard Musgrave and James Buchanan", ''Public Choice'', 103(1/2), pp95116. and others. It has also been applied to such subjects as tax progressivity, corporation taxes, and taxes on property or wealth. The unanimity-rule aspect of Wicksell's appro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Motivation, Agency, And Public Policy

''Motivation, Agency, and Public Policy'' is a non-fiction book written by the economist Julian Le Grand. The book, which argues in favor of increasing tax choice, was described by ''The Economist'' as "accessible – and profound" and by ''The Times'' as "one of the most stimulating books on public policy in recent years". Overview In his book, Le Grand explores ways of increasing the amount of choice and competition in the public sector. This quasi-market would transform citizens from pawns to queens and "improve quality and value for money". Specific policy recommendations include "demogrants" and hypothecation (earmarking). Criticism One criticism is that Le Grand's argument only has limited appeal. "Le Grand’s argument does not speak to libertarians; rejecting the welfare state, they part from him long before he calls on them to cheer for transforming service users into queens. Nor does his argument entice liberal egalitarians." See also * '' Scroogenomics'' * ''The Othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earmark (politics)

An earmark is a provision inserted into a discretionary spending appropriations bill that directs funds to a specific recipient while circumventing the merit-based or competitive funds allocation process. Earmarks feature in United States Congress spending policy, and they are present in public finance of many other countries as a form of political particularism. Etymology "Earmark" comes from the livestock term, where the ears of domestic animals were cut in specific ways so that farmers could distinguish their stock from others grazing on public land. In particular, the term comes from earmarked hogs where, by analogy, pork-barreled legislation would be doled out among members of the local political machine. Definitions In 2006 the Congressional Research Service (CRS) compiled a report on the use of earmarks in thirteen Appropriation Acts from 1994 through 2005 in which they noted that there was "not a single definition of the term earmark accepted by all practitioners and obser ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Television Set

A television set or television receiver, more commonly called the television, TV, TV set, telly, tele, or tube, is a device that combines a tuner, display, and loudspeakers, for the purpose of viewing and hearing television broadcasts, or using it as a computer monitor. Introduced in the late 1920s in Mechanical television, mechanical form, television sets became a popular consumer product after World War II in electronic form, using cathode ray tube (CRT) technology. The addition of color to broadcast television after 1953 further increased the popularity of television sets in the 1960s, and an outdoor antenna became a common feature of suburban homes. The ubiquitous television set became the display device for the first recorded media in the 1970s, such as , VHS and later DVD. It has been used as a display device since the first generation of (e.g. Timex Sinclair 1000) and dedicated video game consoles (e.g. Atari) in the 1980s. By the early 2010s, flat-panel television incorp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |