|

Hourly Worker

An hourly worker or hourly employee is an employee paid an hourly wage for their services, as opposed to a fixed salary. Hourly workers may often be found in service and manufacturing occupations, but are common across a variety of fields. Hourly employment is often associated but not synonymous with at-will employment. As of September 2017, the minimum wage in the United States In the United States, the minimum wage is set by U.S. labor law and a range of state and local laws. The first federal minimum wage was instituted in the National Industrial Recovery Act of 1933, signed into law by President Franklin D. Ro ... for hourly workers is $7.25 per hour, or $2.13 per hour for a tipped employee. As a tipped employee, wages plus tips must equal the standard minimum wage or the employer is required to provide the difference. References Employment classifications {{job-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wages In The United States

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remunerative payments such as ''prizes'' and ''tip payouts.'' Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company. Payment by wage contrasts with salaried work, in which the employer pays an arranged amount at steady intervals (such as a week or month) regardless of hours worked, with commission which conditions pay on individual performance, and with compensation based on the performance of the company as a whole. Waged employees may also receive tips or gratuity paid directly by clients and employee benefits which are non-monetary forms of compensation. Since wage labour is the predominant form of work, the term "wage" sometimes refers to al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wage

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remunerative payments such as ''prizes'' and ''tip payouts.'' Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company. Payment by wage contrasts with salaried work, in which the employer pays an arranged amount at steady intervals (such as a week or month) regardless of hours worked, with commission which conditions pay on individual performance, and with compensation based on the performance of the company as a whole. Waged employees may also receive tips or gratuity paid directly by clients and employee benefits which are non-monetary forms of compensation. Since wage labour is the predominant form of work, the term "wage" sometimes refers to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Salary

A salary is a form of periodic payment from an employer to an employee, which may be specified in an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid separately, rather than on a periodic basis. From the point of view of running a business, salary can also be viewed as the cost of acquiring and retaining human resources for running operations, and is then termed personnel expense or salary expense. In accounting, salaries are recorded in payroll accounts. Salary is a fixed amount of money or compensation paid to an employee by an employer in return for work performed. Salary is commonly paid in fixed intervals, for example, monthly payments of one-twelfth of the annual salary. Salary is typically determined by comparing market pay rates for people performing similar work in similar industries in the same region. Salary is also determined by leveling the pay rates and salary ranges established by an individual employer. Salary is a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

At-will Employment

In United States labor law, at-will employment is an employer's ability to dismiss an employee for any reason (that is, without having to establish " just cause" for termination), and without warning, as long as the reason is not illegal (e.g. firing because of the employee's gender, orientation, pregnancy, race, religion, or sexuality). When an employee is acknowledged as being hired "at will", courts deny the employee any claim for loss resulting from the dismissal. The rule is justified by its proponents on the basis that an employee may be similarly entitled to leave their job without reason or warning. The practice is seen as unjust by those who view the employment relationship as characterized by inequality of bargaining power. At-will employment gradually became the default rule under the common law of the employment contract in most U.S. states during the late 19th century, and was endorsed by the U.S. Supreme Court during the ''Lochner'' era, when members of the U.S. ju ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

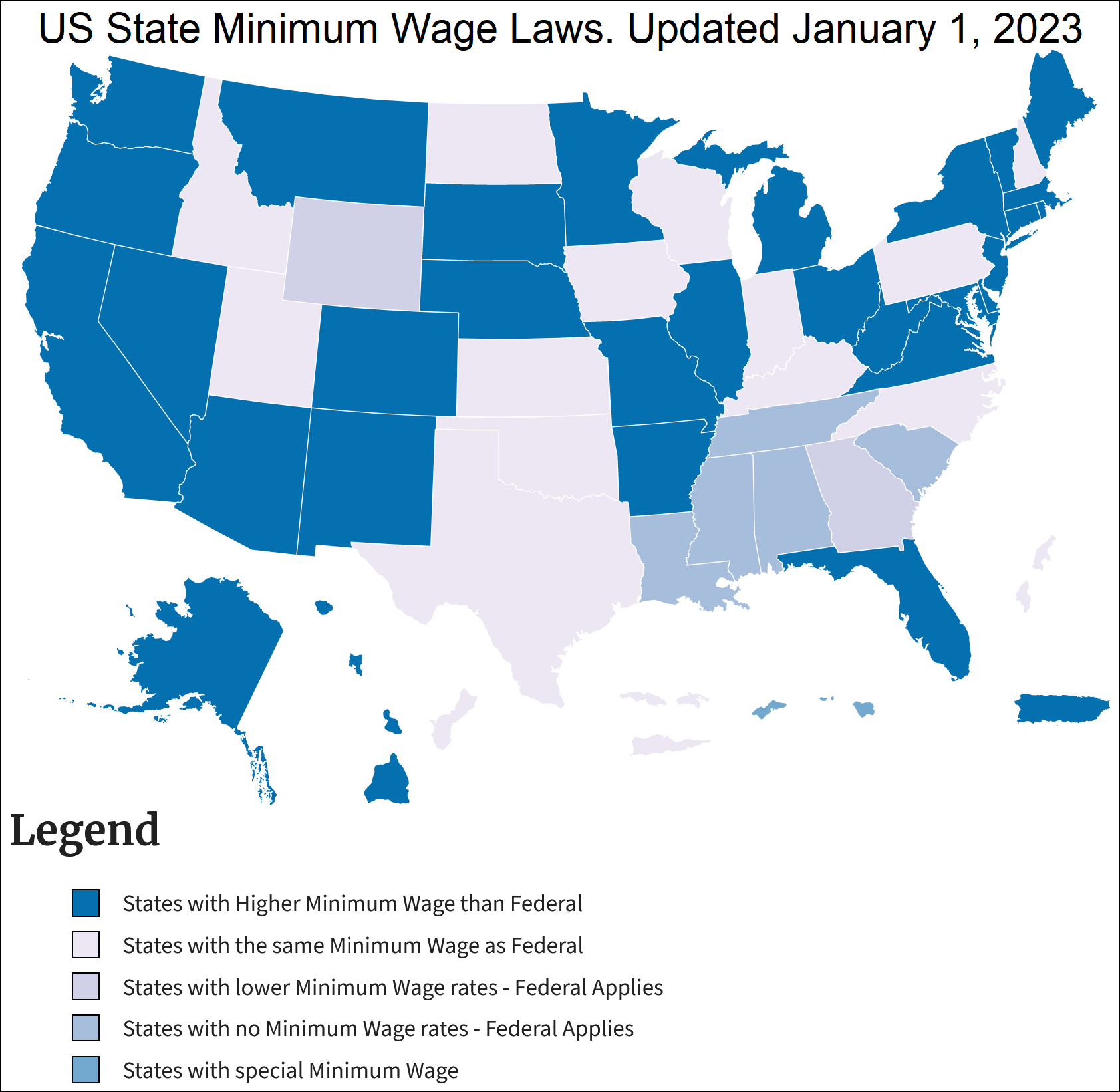

Minimum Wage In The United States

In the United States, the minimum wage is set by U.S. labor law and a range of state and local laws. The first federal minimum wage was instituted in the National Industrial Recovery Act of 1933, signed into law by President Franklin D. Roosevelt, but later found to be unconstitutional. In 1938 the Fair Labor Standards Act established it at $0.25 an hour ($ in dollars). Its purchasing power peaked in 1968, at $1.60 ($ in dollars). Since 2009, it has been $7.25 per hour. Employers have to pay workers the highest minimum wage of those prescribed by federal, state, and local laws. In January 2020, 29 states and the District of Columbia had minimum wages higher than the federal minimum, so that almost 90% of Americans earning just minimum wage got more than $7.25 an hour. The effective nationwide minimum wage (the wage that the average minimum-wage worker earns) was $11.80 in May 2019; this was the highest it had been since at least 1994, the earliest year for which effecti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |