|

Hedge Fund Standards Board

The Standards Board for Alternative Investments (SBAI), formerly known as the Hedge Fund Standards Board, is an international standard-setting body for the alternative investment industry and sets the voluntary standard of best practices and practices endorsed by its members. Its primary role is to be the custodian of the Alternative Investment Standards (formerly known as "the Standards"), which are designed to create a "framework of transparency, integrity and good governance" in the way the hedge fund industry operates. History The SBAI originated in June 2007, when a group of leading alternative investment managers formed the Hedge Fund Working Group to develop industry standards in areas such as disclosure, valuation, risk management, governance, and shareholder conduct. Founding firms included Marshall Wace, Cheyne Capital Management, Man Group, and CQS. In January 2008, the working group was established as a nonprofit, called the Hedge Fund Standards Board (HFSB). Its p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

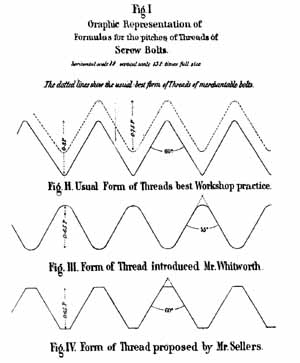

Standards Organization

A standards organization, standards body, standards developing organization (SDO), or standards setting organization (SSO) is an organization whose primary function is developing, coordinating, promulgating, revising, amending, reissuing, interpreting, or otherwise contributing to the usefulness of technical standards to those who employ them. Such an organization works to create uniformity across producers, consumers, government agencies, and other relevant parties regarding terminology, product specifications (e.g. size, including units of measure), protocols, and more. Its goals could include ensuring that Company A's external hard drive works on Company B's computer, an individual's blood pressure measures the same with Company C's sphygmomanometer as it does with Company D's, or that all shirts that should not be ironed have the same icon (a clothes iron crossed out with an X) on the label. Most standards are voluntary in the sense that they are offered for adoption by people ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Forum Of Sovereign Wealth Funds

The International Forum of Sovereign Wealth Funds (IFSWF) is a nonprofit international group of sovereign wealth funds managers which was established in 2009. It is based in London, England. History In 2009, a group of 23 leading state-owned international investors from around the world established the IFSWF's precursor, the International Working Group of Sovereign Wealth Funds, following discussions with global groups such as the G20, International Monetary Fund, IMF, and the U.S. Department of Treasury in 2007 and 2008. The Working Group created a set of Generally Accepted Principles and Practices, better known as the "Santiago Principles", for sovereign wealth funds' institutional governance and risk-management frameworks. Following the Kuwait Declaration in 2009, the International Working Group became the IFSWF with the mandate of helping members implement the Principles. Overview As of February 2018 IFSWF had 32 members, including some of the world's largest sovereign we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Organisations Based In London

International is an adjective (also used as a noun) meaning "between nations". International may also refer to: Music Albums * ''International'' (Kevin Michael album), 2011 * ''International'' (New Order album), 2002 * ''International'' (The Three Degrees album), 1975 *''International'', 2018 album by L'Algérino Songs * The Internationale, the left-wing anthem * "International" (Chase & Status song), 2014 * "International", by Adventures in Stereo from ''Monomania'', 2000 * "International", by Brass Construction from ''Renegades'', 1984 * "International", by Thomas Leer from ''The Scale of Ten'', 1985 * "International", by Kevin Michael from ''International'' (Kevin Michael album), 2011 * "International", by McGuinness Flint from ''McGuinness Flint'', 1970 * "International", by Orchestral Manoeuvres in the Dark from '' Dazzle Ships'', 1983 * "International (Serious)", by Estelle from '' All of Me'', 2012 Politics * Political international, any transnational organization of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

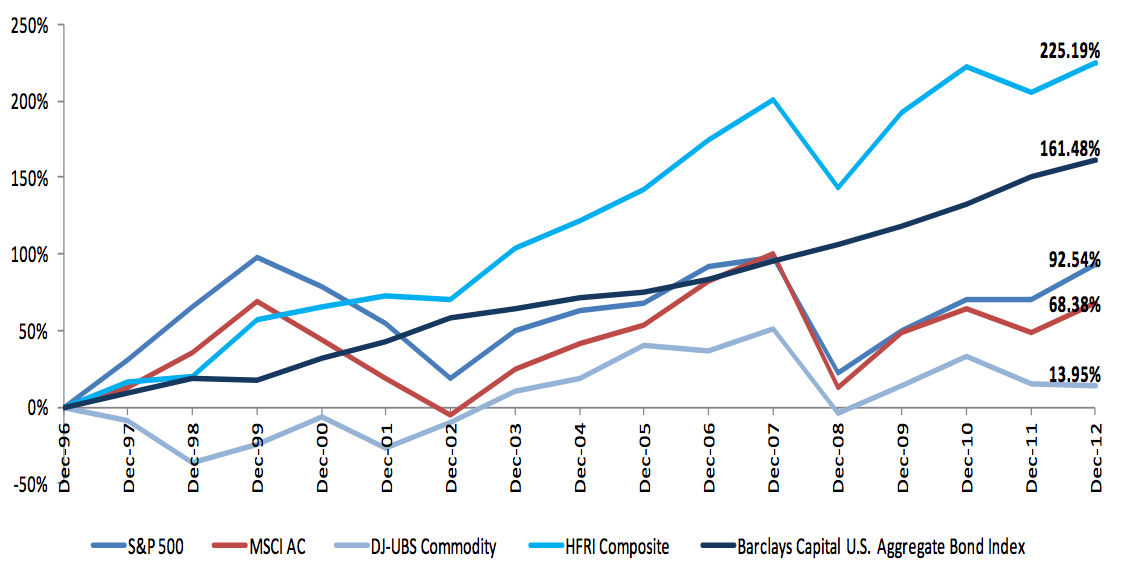

Hedge Funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whereas privat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability assessme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the stability and integrity of the financial system. This may be handled by either a government or non-government organization. Financial regulation has also influenced the structure of banking sectors by increasing the variety of financial products available. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in financial regulation. The first recorded ban (regulation) on short selling was enacted by the Dutch authorities as early as 1610. Aims of regulation The objectives of financial regulators are usually: * market confidence – to maintain confidence in the financial system * financial stability – contributing to the protection and e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Standard

international standard is a technical standard developed by one or more international standards organizations. International standards are available for consideration and use worldwide. The most prominent such organization is the International Organization for Standardization (ISO). Other prominent international standards organizations including the International Telecommunication Union (ITU) and the International Electrotechnical Commission (IEC). Together, these three organizations have formed the World Standards Cooperation alliance. Purpose International standards may be used either by direct application or by a process of modifying an international standard to suit local conditions. Adopting international standards results in creating national standards that are equivalent, or substantially the same as international standards in technical content, but may have (i) editorial differences as to appearance, use of symbols and measurement units, substitution of a point for a com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Managed Accounts

In banking, a managed account is a fee-based investment management product for high-net-worth individuals. The main appeal for wealthy individuals is the access to professional money managers, a high degree of customization and greater tax efficiencies in a fee-based product. They are not to be confused with managed bank accounts such as thinkmoney, e-money accounts and basic bank accounts, all of which are consumer banking products in the UK. Managed accounts started as separately managed accounts (SMAs) and have since evolved into multiple strategy accounts (MSAs) and the rapidly emerging unified managed accounts (UMAs). There is broad agreement that managed accounts provide the added benefits of greater transparency, liquidity and control. Managed account minimums and the cost to operate managed account programs have steadily dropped as technology helps with efficiency and scale. Increasingly, managed account products are seeing interest from the "mass affluent" as well. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity Co-investment

An equity co-investment (or co-investment) is a minority investment, made directly into an operating company, alongside a financial sponsor or other private equity investor, in a leveraged buyout, recapitalization or growth capital transaction. In certain circumstances, venture capital firms may also seek co-investors. Overview Private equity firms seek co-investors for several reasons. Most important of these is that co-investments allow a manager to make larger investments without either dedicating too much of the fund's capital to a single transaction (i.e., exposure issues) or sharing the deal with competing private equity firms. Co-investors bring a friendly source of capital. Typically, co-investors are existing limited partners in an investment fund managed by the lead financial sponsor in a transaction. Unlike the investment fund however, co-investments are made outside the existing fund and as such co-investors rarely pay management fees or carried interest on an in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquid Alternatives

A liquid is a nearly incompressible fluid that conforms to the shape of its container but retains a (nearly) constant volume independent of pressure. As such, it is one of the four fundamental states of matter (the others being solid, gas, and plasma), and is the only state with a definite volume but no fixed shape. A liquid is made up of tiny vibrating particles of matter, such as atoms, held together by intermolecular bonds. Like a gas, a liquid is able to flow and take the shape of a container. Most liquids resist compression, although others can be compressed. Unlike a gas, a liquid does not disperse to fill every space of a container, and maintains a fairly constant density. A distinctive property of the liquid state is surface tension, leading to wetting phenomena. Water is by far the most common liquid on Earth. The density of a liquid is usually close to that of a solid, and much higher than that of a gas. Therefore, liquid and solid are both termed condensed matte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Funds

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whereas privat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Organization Of Securities Commissions

The International Organization of Securities Commissions (IOSCO) is an association of organizations that regulate the world's securities and futures markets. Members are typically primary securities and/or futures regulators in a national jurisdiction or the main financial regulator from each country. Its mandate is to: * Develop, implement, and promote high standards of regulation to enhance investor protection and reduce systemic risk * Share information with exchanges and assist them with technical and operational issues * Establish standards toward monitoring global investment transactions across borders and markets IOSCO has members from over 100 countries, who regulate more than 95% of the world's securities markets. It has a permanent secretariat in Madrid, Spain. History IOSCO was born in 1983 from the transformation of its ancestor the "Inter-American Regional Association" (created in 1974) into a truly global cooperative. This decision to expand the organization beyond t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |