|

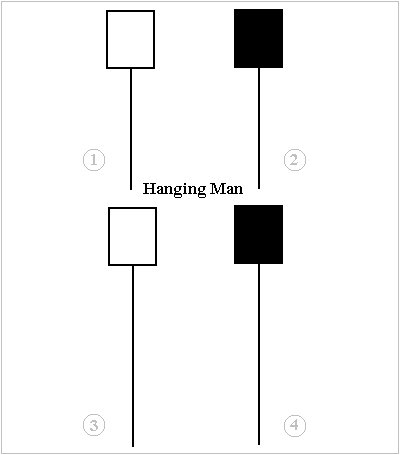

Hanging Man (candlestick Pattern)

A hanging man is a type of candlestick pattern in financial technical analysis. It is a bearish reversal pattern made up of just one candle. It has a long lower wick and a short body at the top of the candlestick with little or no upper wick. In order for a candle to be a valid hanging man most traders say the lower wick must be two times greater than the size of the body portion of the candle, and the body of the candle must be at the upper end of the trading range. See also * Hammer A hammer is a tool, most often a hand tool, consisting of a weighted "head" fixed to a long handle that is swung to deliver an impact to a small area of an object. This can be, for example, to drive nails into wood, to shape metal (as w ... — Hanging man pattern found in a downtrend External linksVideo and chart examples of hanging man patternat onlinetradingconcepts.com Hanging man definitionat investopedia.com Hanging Man Informationat candlecharts.com Candlestick patterns ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hanging Man 03

Hanging is the suspension of a person by a noose or ligature strangulation, ligature around the neck.Oxford English Dictionary, 2nd ed. Hanging as method of execution is unknown, as method of suicide from 1325. The ''Oxford English Dictionary'' states that hanging in this sense is "specifically to put to death by suspension by the neck", though it formerly also referred to crucifixion and death by impalement in which the body would remain "hanging". Hanging has been a common method of capital punishment since Middle Ages, medieval times, and is the primary execution method in numerous countries and regions. The first known account of execution by hanging was in Homer's ''Odyssey'' (Book XXII). In this specialised meaning of the common word ''hang'', the past and past participle is ''hanged'' instead of ''hung''. Hanging is a common method of suicide in which a person applies a ligature to the neck and brings about unconsciousness and then death by suspension or partial suspensi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Candlestick Pattern

In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognized patterns that can be split into simple and complex patterns. History Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. Much of the credit for candlestick charting goes to Munehisa Homma (1724–1803), a rice merchant from Sakata, Japan who traded in the Ojima Rice market in Osaka during the Tokugawa Shogunate The Tokugawa shogunate (, Japanese 徳川幕府 ''Tokugawa bakufu''), also known as the , was the military government of Japan during the Edo period from 1603 to 1868. Nussbaum, Louis-Frédéric. (2005)"''Tokugawa-jidai''"in ''Japan Encyclopedia .... According to Steve Nison, how ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hammer (candlestick Pattern)

A hammer is a type of ''bullish reversal'' candlestick pattern, made up of just one candle, found in price charts of financial assets. The candle looks like a hammer, as it has a long lower wick Wick most often refers to: * Capillary action ("wicking") ** Candle wick, the cord used in a candle or oil lamp ** Solder wick, a copper-braided wire used to desolder electronic contacts Wick or WICK may also refer to: Places and placenames ... and a short body at the top of the candlestick with little or no upper wick. In order for a candle to be a valid hammer, most traders say the lower wick must be two times greater than the size of the body portion of the candle, and the body of the candle must be at the upper end of the trading range. When you see the hammer form in a ''downtrend'' this is a sign of a potential reversal in the market as the long lower wick represents a period of trading where the sellers were initially in control but the buyers were able to reverse that cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |