|

Hall V Woolston Hall Leisure Ltd

''Hall v Woolston Hall Leisure Ltd'' 000EWCA Civ 170is a UK labour law case, concerning the illegality in the contract of employment. Facts Mrs Hall was dismissed from being head chef at the Epping Forest Golf Club because she became pregnant. She claimed unfair dismissal based on the Equal Treatment Directive 76/207/EC and the Sex Discrimination Act 1975 (now the Equality Act 2010). However, in September 1994, she had received a raise to £250 and her payslip still showed £250 gross and £186.65 net, which apparently demonstrated tax avoidance. She asked and was told “It’s the way we do business.” For five months she continued to work. The employer argued that because Mrs Hall was party to an illegal contract, she was not entitled to bring a claim for unfair dismissal. The Tribunal held that Mrs Hall could not bring a discrimination claim, because she turned a blind eye to the Inland Revenue being defrauded. It held it could make a limited award of compensation, but no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employee

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts. Employees and employers An employee contributes labour and expertise to an endeavor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Labour Law

United Kingdom labour law regulates the relations between workers, employers and trade unions. People at work in the UK can rely upon a minimum charter of employment rights, which are found in Acts of Parliament, Regulations, common law and equity (legal concept), equity. This includes the right to a minimum wage of £9.50 for over-23-year-olds from April 2022 under the National Minimum Wage Act 1998. The Working Time Regulations 1998 give the right to 28 days paid holidays, breaks from work, and attempt to limit long working hours. The Employment Rights Act 1996 gives the right to leave for child care, and the right to request flexible working patterns. The Pensions Act 2008 gives the right to be automatically enrolled in a basic occupational pension, whose funds must be protected according to the Pensions Act 1995. Workers must be able to vote for trustees of their occupational pensions under the Pensions Act 2004. In some enterprises, such as universities, staff can Codetermina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

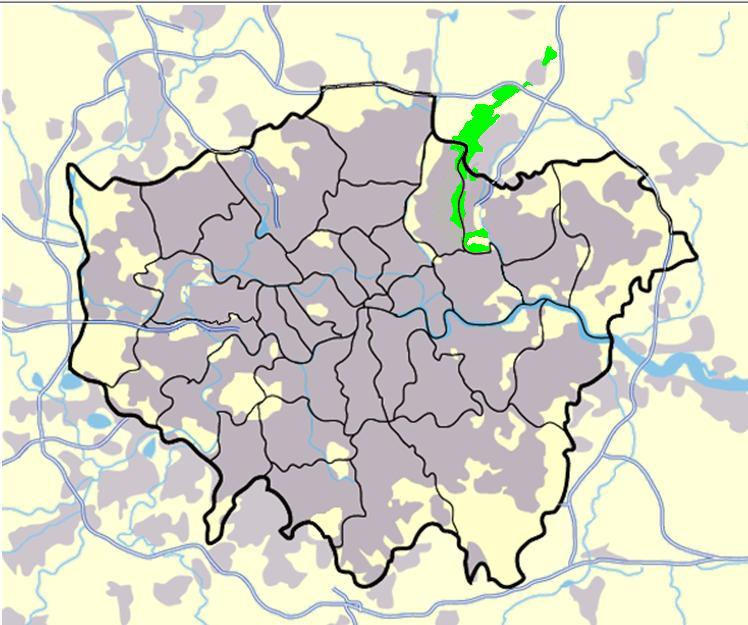

Epping Forest

Epping Forest is a area of ancient woodland, and other established habitats, which straddles the border between Greater London and Essex. The main body of the forest stretches from Epping in the north, to Chingford on the edge of the London built-up area. South of Chingford the forest narrows, and forms a green corridor that extends deep into East London, as far as Forest Gate; the Forest's position gives rise to its nickname, the ''Cockney Paradise''. It is the largest forest in London. It lies on a ridge between the valleys of the rivers Lea and Roding. It contains areas of woodland, grassland, heath, streams, bogs and ponds, and its elevation and thin gravelly soil (the result of glaciation) historically made it less suitable for agriculture. The Forest was historically managed as a common; the land was held by a number of local landowners who exercised economic rights over aspects such as timber, while local commoners had grazing and other rights. It was designated a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equal Treatment Directive

Equal Treatment Directive 20062006/54/EC is a legal act of European Union law, which implements the principle of equal treatment between men and women in EU labour law. Background Since the Treaty of Amsterdam came into force in 1999, new EU laws, or Directives, have been enacted in the area of anti-discrimination. The Equal Treatment Directive 2006/54/EC is a consolidation of previous Directives in this area, notably, the Directive 76/207/EEC, which was amended by Directive 2002/73/EC. See also *Anti-discrimination law Anti-discrimination law or non-discrimination law refers to legislation designed to prevent discrimination against particular groups of people; these groups are often referred to as protected groups or protected classes. Anti-discrimination laws ... * Directive 76/207/EEC * EU labour law * List of European Union directives * UK labour law Notes References * External linksText of the Directive [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sex Discrimination Act 1975

The Sex Discrimination Act 1975 (c. 65) was an Act of the Parliament of the United Kingdom which protected men and women from discrimination on the grounds of sex or marital status. The Act concerned employment, training, education, harassment, the provision of goods and services, and the disposal of premises. The Sex Discrimination (Gender Reassignment) Regulations 1999, The Gender Recognition Act 2004 and The Sex Discrimination Act 1975 (Amendment) Regulations 2008 amended parts of this Act to apply to those who "intend to undergo, are undergoing or have undergone gender reassignment". Other amendments were introduced by the Sex Discrimination Act 1986, the Employment Act 1989, the Equality Act 2006, and other legislation such as rulings by the European Court of Justice. The Act did not apply in Northern Ireland, however The Sex Discrimination Gender Reassignment Regulations (Northern Ireland) 1999 does. The Act was repealed in full by the Equality Act 2010.https://www.legis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equality Act 2010

The Equality Act 2010 is an Act of Parliament of the United Kingdom passed during the Brown ministry with the primary purpose of consolidating, updating and supplementing the numerous prior Acts and Regulations, that formed the basis of anti-discrimination law in mostly England, Scotland and Wales; some sections also apply to Northern Ireland. These consisted, primarily, of the Equal Pay Act 1970, the Sex Discrimination Act 1975, the Race Relations Act 1976, the Disability Discrimination Act 1995 and three major statutory instruments protecting discrimination in employment on grounds of religion or belief, sexual orientation and age. The Act has broadly the same goals as the four major EU Equal Treatment Directives, whose provisions it mirrors and implements. However, the Act also offers protection beyond the EU directives, protecting against discrimination based on a person's nationality and citizenship and also extending individuals' rights in areas of life beyond the work ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inland Revenue

The Inland Revenue was, until April 2005, a department of the British Government responsible for the collection of direct taxation, including income tax, national insurance contributions, capital gains tax, inheritance tax, corporation tax, petroleum revenue tax and stamp duty. More recently, the Inland Revenue also administered the Tax Credits schemes, whereby monies, such as Working Tax Credit (WTC) and Child Tax Credit (CTC), are paid by the Government into a recipient's bank account or as part of their wages. The Inland Revenue was also responsible for the payment of child benefit. The Inland Revenue was merged with HM Customs and Excise to form HM Revenue and Customs which came into existence on 18 April 2005. The former Inland Revenue thus became part of HM Revenue and Customs. The current name was promoted by the use of the expression "from Revenue and Customs" in a series of annual radio, and to a lesser extent, television public information broadcasts in the 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basil Markesinis

Sir Basil Markesinis KC, LLD, DCL, FBA (born July 10, 1944) is a Greek-British barrister and legal scholar currently holding the position of Jamail Regents Professor at the University of Texas, Austin. He was previously Professor of Common and Civil Law at University College London.Missing honours , '''', 21 January 2005. Retrieved 28 July 2011. Early life and education Sir Basil was born in , . He is the son of Greek po ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simon Deakin

Simon Deakin (born 26 March 1961) is Professor of Law at the Faculty of Law, Cambridge, and a Fellow of Peterhouse, Cambridge. He is regarded as the leading expert in the field of employment law and labour law and is the programme director in the Cambridge Centre for Business Research (CBR), as well as an associate Faculty member of the Judge Business School. Education Deakin holds a BA and a PhD in law from the University of Cambridge. His doctoral dissertation was awarded the Yorke Prize for legal writing. He took up his first lecturing post at Queen Mary and Westfield College, London, in 1987, after a year as a Bigelow Fellow at the University of Chicago. He joined the Cambridge Law Faculty in 1990 (first as a lecturer, then as a reader). He was appointed Professor of Law in 2005. Career Deakin was a visiting fellow at the Maison des Sciences de l’Homme Ange Guépin, Nantes, in 1993 and 1995, and the Centre for Employment and Labour Relations Law, University of M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mance LJ

Jonathan Hugh Mance, Baron Mance, (born 6 June 1943) is a retired British judge who was formerly Deputy President of the Supreme Court of the United Kingdom. Early life Mance was born on 6 June 1943, (subscription required) one of four children of Sir Henry Stenhouse Mance, one-time chairman of Lloyd's of London, by his wife Joan Erica Robertson Baker. His grandfather, Sir Henry Osborne Mance, was a distinguished soldier and President of the Institute of Transport; his great-grandfather, Sir Henry Christopher Mance, invented the heliograph. Like his father, he attended Charterhouse School, a boarding school in Godalming, Surrey. He then studied law at University College, Oxford and graduated with a first class degree. He was called to the Bar by the Middle Temple in 1965, becoming a QC in 1982 and a Bencher in 1989. Judicial career In 1990, he became a recorder, and on 25 October 1993 was appointed a High Court judge, serving in the Queen's Bench Division, and received th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |