|

Haig–Simons Income

Haig–Simons income or Schanz–Haig–Simons income is an income measure used by public finance economists to analyze economic well-being which defines income as consumption plus change in net worth. It is represented by the mathematical formula: :I = ''C'' + Δ''NW'' where ''C'' = consumption and Δ''NW'' = change in net worth. Consumption refers to the money spent on goods and services of any kind. From a perfect theory view, consumption does not include capital expenditures, and the full spending would be amortized. History The measure of the income tax base equal to the sum of consumption and change in net worth was first advocated by German legal scholar Georg von Schanz. His concept was further developed by the American economists Robert M. Haig and Henry C. Simons in the 1920s and 1930s. Haig defined personal income as "the money value of the net accretion to one's economic power between two points of time," a formulation that was intended to include the taxpayer' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. Economist Jonathan Gruber has put forth a framework to assess the broad field of public finance. Gruber suggests public finance should be thought of in terms of four central questions: # When should the government intervene in the economy? To which there are two central motivations for government intervention, Market failure and redistribution of income and wealth. # How might the government intervene? Once the decision is made to intervene the government must ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Donation

A donation is a gift for charity, humanitarian aid, or to benefit a cause. A donation may take various forms, including money, alms, services, or goods such as clothing, toys, food, or vehicles. A donation may satisfy medical needs such as blood or organs for transplant. Charitable donations of goods or services are also called ''gifts in kind''. Donating statistics In the United States, in 2007, the Bureau of Labor Statistics found that American households in the lowest fifth in terms of wealth, gave on average a higher percentage of their incomes to charitable organizations than those households in the highest fifth. Charity Navigator writes that, according to Giving USA, Americans gave $298 billion in 2011 (about 2% of GDP). The majority of donations were from individuals (73%), then from bequests (about 12%), foundations (2%) and less than 1% from corporations. The largest sector to receive donations was religious organizations (32%), then education (13%). Giving has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumption tax can also be structured as a form of direct, personal taxation, such as the Hall–Rabushka flat tax. Types Value-added tax A value-added tax applies to the market value added to a product or material at each stage of its manufacture or distribution. For example, if a retailer buys a shirt for twenty dollars and sells it for thirty dollars, this tax would apply to the ten dollar difference between the two amounts. A simple value-added tax is proportional tax, proportional to consumption but is regressive tax, regressive on income at higher income levels, as consumption tends to fall as a percentage of income as income rises. Savings and investment are tax-deferred until they become consumption. A value-added t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tautology (logic)

In mathematical logic, a tautology (from el, ταυτολογία) is a formula or assertion that is true in every possible interpretation. An example is "x=y or x≠y". Similarly, "either the ball is green, or the ball is not green" is always true, regardless of the colour of the ball. The philosopher Ludwig Wittgenstein first applied the term to redundancies of propositional logic in 1921, borrowing from rhetoric, where a tautology is a repetitive statement. In logic, a formula is satisfiable if it is true under at least one interpretation, and thus a tautology is a formula whose negation is unsatisfiable. In other words, it cannot be false. It cannot be untrue. Unsatisfiable statements, both through negation and affirmation, are known formally as contradictions. A formula that is neither a tautology nor a contradiction is said to be Contingency (philosophy), logically contingent. Such a formula can be made either true or false based on the values assigned to its propositi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

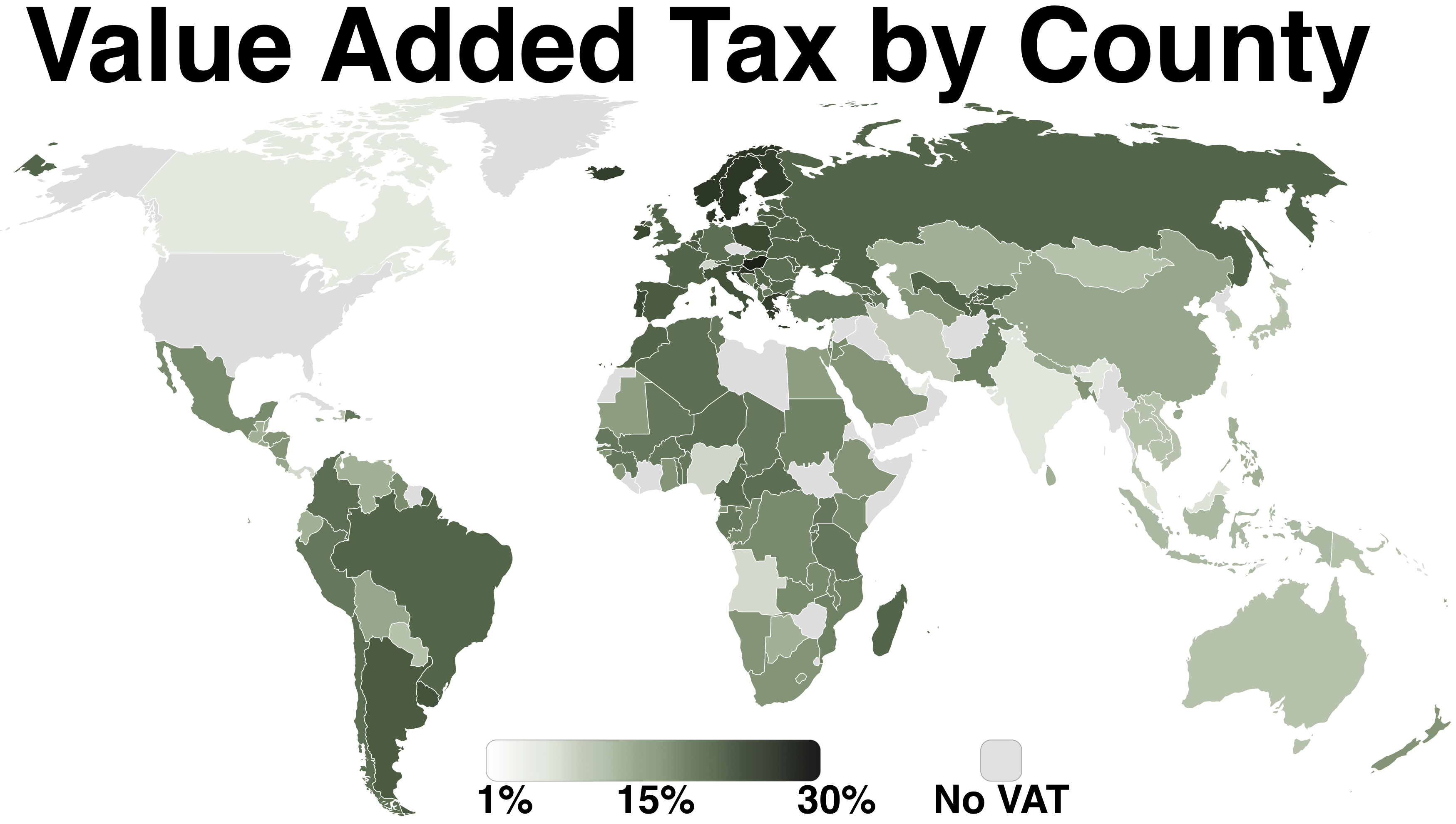

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumption tax can also be structured as a form of direct, personal taxation, such as the Hall–Rabushka flat tax. Types Value-added tax A value-added tax applies to the market value added to a product or material at each stage of its manufacture or distribution. For example, if a retailer buys a shirt for twenty dollars and sells it for thirty dollars, this tax would apply to the ten dollar difference between the two amounts. A simple value-added tax is proportional tax, proportional to consumption but is regressive tax, regressive on income at higher income levels, as consumption tends to fall as a percentage of income as income rises. Savings and investment are tax-deferred until they become consumption. A value-added t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been described as a '' sui generis'' political entity (without precedent or comparison) combining the characteristics of both a federation and a confederation. Containing 5.8per cent of the world population in 2020, the EU generated a nominal gross domestic product (GDP) of around trillion in 2021, constituting approximately 18per cent of global nominal GDP. Additionally, all EU states but Bulgaria have a very high Human Development Index according to the United Nations Development Programme. Its cornerstone, the Customs Union, paved the way to establishing an internal single market based on standardised legal framework and legislation that applies in all member states in those matters, and only those matters, where the states have agreed to act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash-flow Consumption Tax

A cash flow is a real or virtual movement of money: *a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows; *a cash flow is determined by its time ''t'', nominal amount ''N'', currency ''CCY'' and account ''A''; symbolically ''CF'' = ''CF''(''t,N,CCY,A''). * it is however popular to use ''cash flow'' in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product. Cash flows are narrowly interconnected with the concepts of value, ''interest rate'' and liquidity. A cash flow that shall happen on a future day ''t''N can be transformed into a cash flow of the same value in ''t''0. Cash flow analysis Cash flows are often transformed into measures that give information e.g. on a company's value and situat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Windfall Gain

A windfall gain is an unusually high or abundant income, that is sudden and/or unexpected. Types Examples of windfall gains include, but are not limited to: *Gains from demutualization - this example can lead to especially large windfall gains. A study in 1999 into the potential demutualization of the John Lewis Partnership predicted that partners would receive upwards of £100,000 in windfall gains if the company were to be floated on the stock market. *Unexpected inheritance or other large gift from another *Sweepstakes winnings *Winning a lottery or success in another form of gambling *Returns on investments *Proceeds or profit from a large sale *Game show, or other contest winnings *Employment payroll bonus *Natural resources * Foreign aid *Proceeds from an insurance claim *Settlement from a lawsuit *Discoveries from treasure hunting Uses What people do with windfall gains is subject to much debate. While they differ from one account to the next, most economists hypothesize ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard Law Review

The ''Harvard Law Review'' is a law review published by an independent student group at Harvard Law School. According to the ''Journal Citation Reports'', the ''Harvard Law Review''s 2015 impact factor of 4.979 placed the journal first out of 143 journals in the category "Law". It is published monthly from November through June, with the November issue dedicated to covering the previous year's term of the Supreme Court of the United States. The journal also publishes the online-only ''Harvard Law Review Forum'', a rolling journal of scholarly responses to the main journal's content. The law review is one of three honors societies at the law school, along with the Harvard Legal Aid Bureau and the Board of Student Advisors. Students who are selected for more than one of these three organizations may only join one. The Harvard Law Review Association, in conjunction with the ''Columbia Law Review'', the ''University of Pennsylvania Law Review'', and the '' Yale Law Journal'', publi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economists, only the final purchase of newly produced goods and services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g. the selection, adoption, use, disposal and recycling of goods and services). Economists are particularly interested in the relationship betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |