|

Guardian's Allowance

Guardian's allowance is a payment under the United Kingdom system of Social Security. History Guardian's Allowance was introduced in 1946 in order to replace the orphan's pension payable under the Widow's Orphans and Old Age Contributory Pensions Act 1925. Entitlement It is paid to people looking after children who are effectively orphans, either because both their parents are dead or because one is dead and the other at the time of the death was lost, confined to a hospital by court order or sentenced to more than two years imprisonment. The claimant need not be the child's legal guardian to claim. Those who don't qualify but are looking after someone else's child may be able to get a fostering allowance from the local Social Services department. Amount: £15.90 per week for each child. Not taxable. It continues while the child qualifies for Child Benefit. Excluded groups: Step-parents do not count as parents so they can claim, but adoptive parents do, so they can't. Resid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

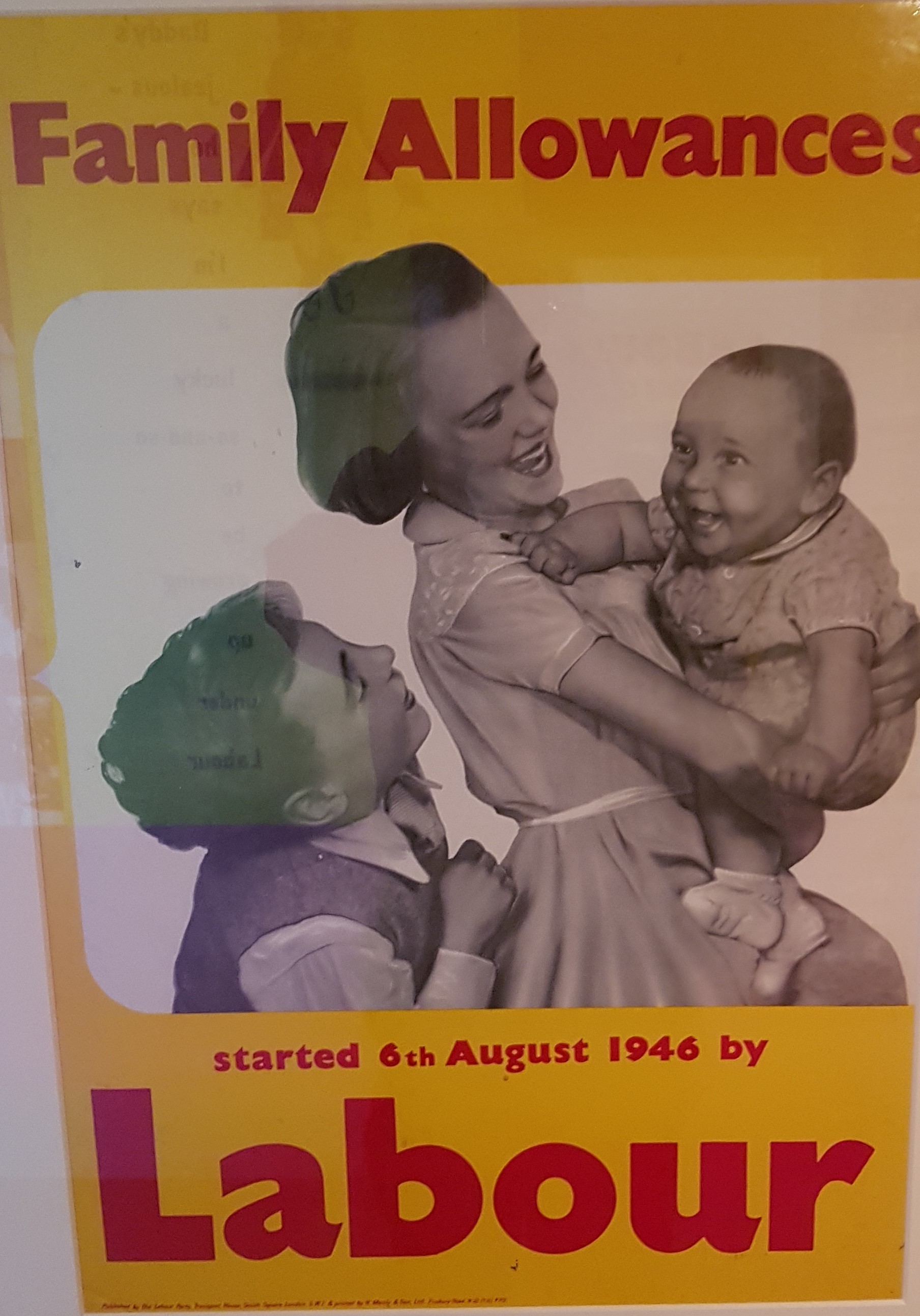

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, Child benefit payments are currently called Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Australian Income tax system. It can be claimed as fortnightly payments or as an annual lump sum. It may be payable for dependant children from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Means-tested Benefit

A means test is a determination of whether an individual or family is eligible for government assistance or welfare, based upon whether the individual or family possesses the means to do without that help. Canada In Canada, means tests are used for student finance (for post-secondary education), legal aid, and "welfare" (direct transfer payments to individuals to combat poverty). They are not generally used for primary and secondary education which are tax-funded. Means tests for public health insurance were once common but are now illegal, as the Canada Health Act of 1984 requires that all the provinces provide universal healthcare coverage to be eligible for subsidies from the federal government. Means tests are also not used for pensions and seniors' benefits, but there is a clawback of Old Age Security payments for people making over $69,562 (in 2012). The Last Post Fund uses a means test on a deceased veteran's estate and surviving widow to determine whether they are eligi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |