|

Green Card Test

The Green Card Test (GCT) is a criterion used by the Internal Revenue Service (IRS) in the United States to determine whether an individual qualifies as a "resident for tax purposes". The GCT asks whether, during the calendar year, an individual spent at least one day in the US as a lawful permanent resident (i.e. possessed a green card). In particular, it is not required to possess a green card when the individual files a return. The GCT is used alongside the Substantial Presence Test; specifically, an alien is considered a "resident for tax purposes" if they pass either the GCT or the Substantial Presence Test. Residency for income tax purposes is different than immigration purposes, i.e. an individual may be considered a resident for income tax purposes, but non-resident for immigration purposes. Exceptions There exists an exception to the Green Card Test if an individual stops being a lawful permanent resident during the calendar year. Specifically, if an individual volunta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Calendar Year

Generally speaking, a calendar year begins on the New Year's Day of the given calendar system and ends on the day before the following New Year's Day, and thus consists of a whole number of days. A year can also be measured by starting on any other named day of the calendar, and ending on the day before this named day in the following year. This may be termed a "year's time", but not a "calendar year". To reconcile the calendar year with the astronomical cycle (which has a fractional number of days) certain years contain extra days ("leap days" or "intercalary days"). The Gregorian year, which is in use in most of the world, begins on January 1 and ends on December 31. It has a length of 365 days in an ordinary year, with 8760 hours, 525,600 minutes, or 31,536,000 seconds; but 366 days in a leap year, with 8784 hours, 527,040 minutes, or 31,622,400 seconds. With 97 leap years every 400 years, the year has an average length of 365.2425 days. Other formula-based calendars ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Residence (United States)

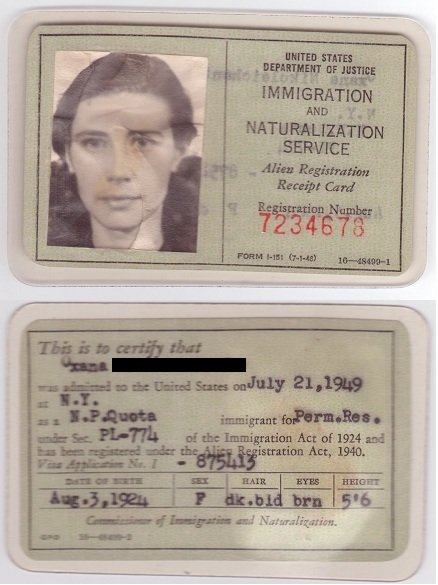

A green card, known officially as a permanent resident card, is an identity document which shows that a person has permanent residency in the United States. ("The term 'lawfully admitted for permanent residence' means the status of having been lawfully accorded the privilege of residing permanently in the United States as an immigrant in accordance with the immigration laws, such status not having changed."). Green card holders are formally known as lawful permanent residents (LPRs). , there are an estimated 13.9 million green card holders, of whom 9.1 million are eligible to become United States citizens. Approximately 65,000 of them serve in the U.S. Armed Forces. Green card holders are statutorily entitled to apply for U.S. citizenship after showing by a preponderance of the evidence that they, among other things, have continuously resided in the United States for one to five years and are persons of good moral character.''Al-Sharif v. United States Citizenship and Immigr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Substantial Presence Test

The Substantial Presence Test (SPT) is a criterion used by the Internal Revenue Service (IRS) in the United States to determine whether an individual who is ''not'' a citizen or lawful permanent resident in the recent past qualifies as a "resident for tax purposes" or a "nonresident for tax purposes"; it is a form of physical presence test. The SPT should be used in conjunction with the Green Card Test (the criterion that the individual possessed a valid Green Card at any time of the year). An individual who satisfies either one or both of these tests is treated as a resident for tax purposes. Summary of the test Formula used by the IRS The SPT features a number of exemptions. Ignoring the exemptions, the criterion is as follows. Note that the criterion is used to determine residency for tax purposes for people who are not citizens and fail the Green Card Test. * The individual must have been physically present in the United States for at least 31 days in the year for which the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Citizenship And Immigration Services

U.S. Citizenship and Immigration Services (USCIS) is an agency of the United States Department of Homeland Security (DHS) that administers the country's naturalization and immigration system. It is a successor to the Immigration and Naturalization Service (INS), which was dissolved by the Homeland Security Act of 2002 and replaced by three components within the DHS: USCIS, Immigration and Customs Enforcement (ICE), and Customs and Border Protection (CBP). USCIS performs many of the duties of the former INS, namely processing and adjudicating various immigration matters, including applications for work visas, asylum, and citizenship. Additionally, the agency is officially tasked with safeguarding national security, maintaining immigration case backlogs, and improving efficiency. Ur Jaddou has been the director of USCIS since August 3, 2021. Functions USCIS processes immigrant visa petitions, naturalization applications, asylum applications, applications for adjustment of status ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Form W-9

Form W-9 (officially, the "Request for Taxpayer Identification Number and Certification") is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service (IRS).Internal Revenue Code § 31.3406(h)-3 It requests the name, address, and taxpayer identification information of a taxpayer (in the form of a Social Security Number or Employer Identification Number). The form is never actually sent to the IRS; it is maintained by the individual who files the information return for verification purposes. The information on the Form W-9 and the payment made are reported on a Form 1099. Use cases Business–contractor arrangement Form W-9 is most commonly used in a business–contractor arrangement. Businesses can use Form W-9 to request information from contractors they hire. When a business pays a contractor in excess of $600 during a tax year, the business is required to file Form 1099-MISC, a variant of Form 1099. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Immigration And Naturalization Service

The United States Immigration and Naturalization Service (INS) was an agency of the U.S. Department of Labor from 1933 to 1940 and the U.S. Department of Justice from 1940 to 2003. Referred to by some as former INS and by others as legacy INS, the agency ceased to exist under that name on March 1, 2003, when most of its functions were transferred to three new entities – U.S. Citizenship and Immigration Services (USCIS), U.S. Immigration and Customs Enforcement (ICE), and U.S. Customs and Border Protection (CBP) – within the newly created Department of Homeland Security (DHS), as part of a major government reorganization following the September 11 attacks of 2001. Prior to 1933, there were separate offices administering immigration and naturalization matters, known as the Bureau of Immigration and the Bureau of Naturalization, respectively. The INS was established on June 10, 1933, merging these previously separate areas of administration. In 1890, the federal government, r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resident For Tax Purposes

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, Physical presence test, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test. Domicile (law), Domicile is, in common law jurisdictions, a different legal concept to residence, though the place of residence and the place of domicile would typically be the same. The criteria for residence in Tax treaty, double t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Permanent Resident Card

A green card, known officially as a permanent resident card, is an identity document which shows that a person has permanent residency in the United States. ("The term 'lawfully admitted for permanent residence' means the status of having been lawfully accorded the privilege of residing permanently in the United States as an immigrant in accordance with the immigration laws, such status not having changed."). Green card holders are formally known as lawful permanent residents (LPRs). , there are an estimated 13.9 million green card holders, of whom 9.1 million are eligible to become United States citizens. Approximately 65,000 of them serve in the U.S. Armed Forces. Green card holders are statutorily entitled to apply for U.S. citizenship after showing by a preponderance of the evidence that they, among other things, have continuously resided in the United States for one to five years and are persons of good moral character.''Al-Sharif v. United States Citizenship and Immigr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statutory Residence Test

A statute is a formal written enactment of a legislative authority that governs the legal entities of a city, state, or country by way of consent. Typically, statutes command or prohibit something, or declare policy. Statutes are rules made by legislative bodies; they are distinguished from case law or precedent, which is decided by courts, and regulations issued by government agencies. Publication and organization In virtually all countries, newly enacted statutes are published and distributed so that everyone can look up the statutory law. This can be done in the form of a government gazette which may include other kinds of legal notices released by the government, or in the form of a series of books whose content is limited to legislative acts. In either form, statutes are traditionally published in chronological order based on date of enactment. A universal problem encountered by lawmakers throughout human history is how to organize published statutes. Such publications ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between the Kingdom of England (which included Wales, annexed in 1542) and the Kingdom of Scotland in 170 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physical Presence Test

In international taxation, a physical presence test is a rule used to determine tax residence of a natural or legal person. It may rely on having a place of business in the jurisdiction (for legal persons), or remaining in or out of the jurisdiction for a certain number of days each year (for natural persons). Australia The "physical presence in Australia test" is one of the three tests under Australian law through which a charitable institution may be entitled to the income tax-exempt charity endorsement; the others are the "deductible gift recipient test" and the "prescribed by law" test. The two elements of the test are whether the institution has a physical presence in Australia (wholly or through a division, branch, or subdivision) and whether or not the expenditures of an institution are incurred principally in Australia. An institution may still qualify even if its expenditure is not incurred principally in Australia, provided that the amounts expended elsewhere are less tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |