|

Grand Supercycle

The Grand Supercycle is the longest period, or ''wave'', in the growth of a financial market as described by the Elliott wave principle, originally conceived and formulated by Ralph Nelson Elliott. Elliott speculated that a Grand Supercycle advance had started in the United States stock market in 1857 and ran to the year 1928, but acknowledged another interpretation that it may have been the third or even the fifth Grand Supercycle wave. However, these assignments have been reevaluated and clarified using larger historical financial data sets in the works of A. J. Frost and R.R. Prechter, and the start is now considered to be 1789, when stock market data began to be recorded.Alfred John Frost, Robert Rougelot Prechter,Chapter 5, Figure 5-4/ref> Like all Elliott waves, Grand Supercycle waves are subdivided into smaller generations of waves. The next smaller generation of waves are those of Supercycle degree. Modern applications of the Wave Principle also describe waves of larger de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Elliott Wave Principle

The Elliott Wave Principle, or Elliott wave theory, is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices. Ralph Nelson Elliott (1871–1948), an American accountant, developed a model for the underlying social principles of financial markets by studying their price movements, and developed a set of analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call ''Elliott waves'', or simply ''waves''. Elliott published his theory of market behavior in the book ''The Wave Principle'' in 1938, summarized it in a series of articles in ''Financial World'' magazine in 1939, and covered it most comprehensively in his final major work, ''Nature's Laws: The Secret of the Universe'' in 1946. Elliott stated that "because man is subject to rhythmical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oxford University Press

Oxford University Press (OUP) is the university press of the University of Oxford. It is the largest university press in the world, and its printing history dates back to the 1480s. Having been officially granted the legal right to print books by decree in 1586, it is the second oldest university press after Cambridge University Press. It is a department of the University of Oxford and is governed by a group of 15 academics known as the Delegates of the Press, who are appointed by the vice-chancellor of the University of Oxford. The Delegates of the Press are led by the Secretary to the Delegates, who serves as OUP's chief executive and as its major representative on other university bodies. Oxford University Press has had a similar governance structure since the 17th century. The press is located on Walton Street, Oxford, opposite Somerville College, in the inner suburb of Jericho. For the last 500 years, OUP has primarily focused on the publication of pedagogical texts and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andrey Korotayev

Andrey Vitalievich Korotayev (russian: link=yes, Андре́й Вита́льевич Корота́ев; born 17 February 1961) is a Russian anthropologist, economic historian, comparative political scientist, demographer and sociologist, with major contributions to world-systems theory, cross-cultural studies, Near Eastern history, Big History, and mathematical modelling of social and economic macrodynamics. He is currently the Head of the Laboratory for Monitoring of the Risks of Sociopolitical Destabilization at the HSE University in Moscow,http://www.hse.ru/org/hse/cfi/lab_mr/staff and a Senior Research Professor at the Center for Big History and System Forecasting of the Institute of Oriental Studies as well as in the Institute for African Studies of the Russian Academy of Sciences. In addition, he is a senior research professor of the International Laboratory on Political Demography and Social Macrodynamics (PDSM) of the Russian Presidential Academy of National ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Trends

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A market trend can only be determined in hindsight, since at any time prices in the future are not known. Market terminology The terms "bull market" and "bear market" describe upward and downward market trends, respectively, and can be used to describe either the market as a whole or specific sectors and securities. The terms come from London's Exchange Alley in the early 18th century, where traders who engaged in naked short selling were called "bear-skin jobbers" because they sold a bear's skin (the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Cycles

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in [Harvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics''], such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Human History

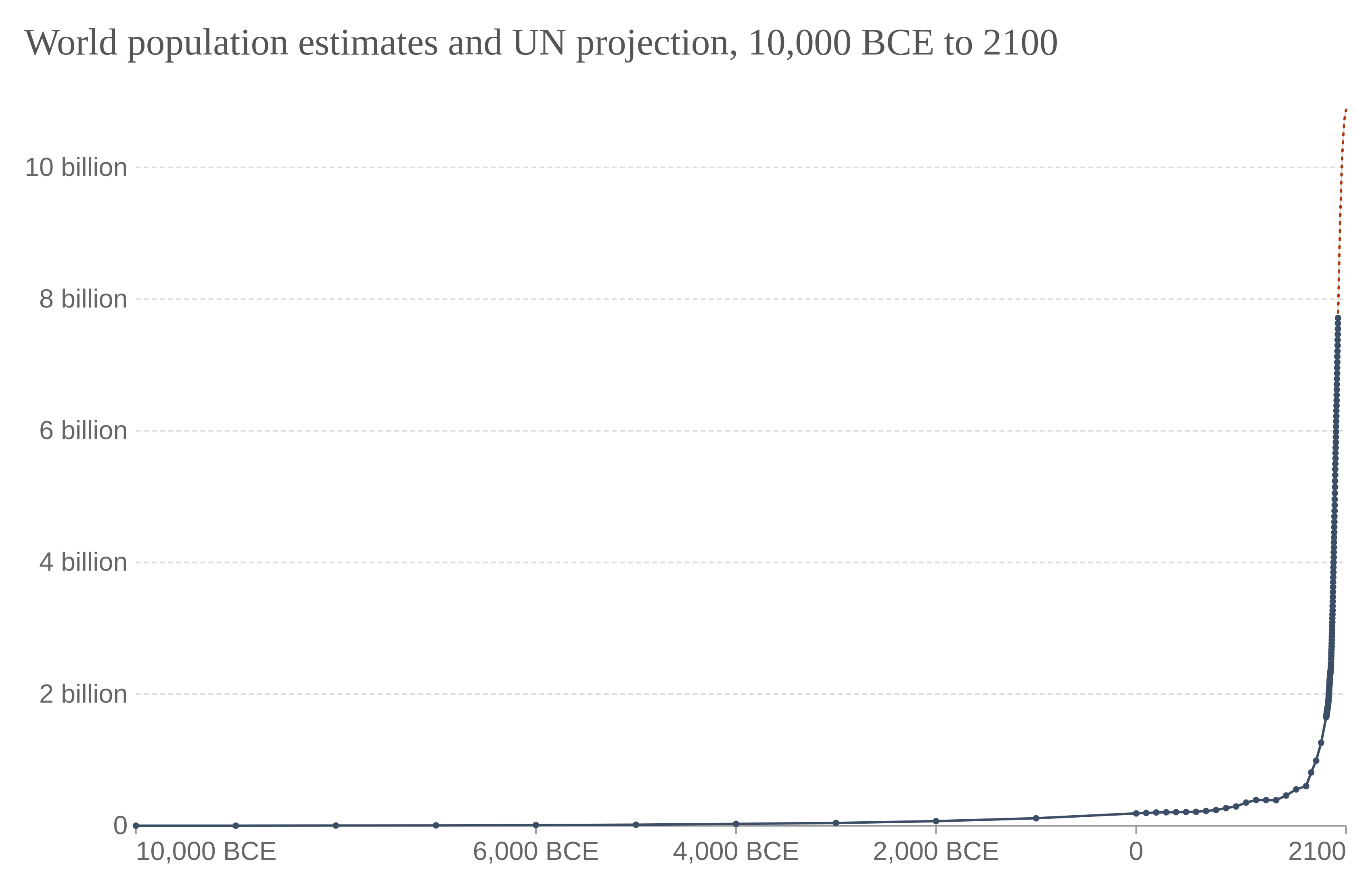

Human history, also called world history, is the narrative of humanity's past. It is understood and studied through anthropology, archaeology, genetics, and linguistics. Since the invention of writing, human history has been studied through primary and secondary source documents. Humanity's written history was preceded by its prehistory, beginning with the Paleolithic ("Old Stone Age") era. This was followed by the Neolithic ("New Stone Age") era, which saw the Agricultural Revolution begin in the Middle East around 10,000 BCE. During this period, humans began the systematic husbandry of plants and animals. As agriculture advanced, most humans transitioned from a nomadic to a settled lifestyle as farmers in permanent settlements. The relative security and increased productivity provided by farming allowed communities to expand into increasingly larger units, fostered by advances in transportation. The earliest complex societies appeared in fertile river valleys ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crises

A crisis ( : crises; : critical) is either any event or period that will (or might) lead to an unstable and dangerous situation affecting an individual, group, or all of society. Crises are negative changes in the human or environmental affairs, especially when they occur abruptly, with little or no warning. More loosely, a crisis is a testing time for an emergency. Etymology The English word ''crisis'' was borrowed from the Latin, which in turn was borrowed from the Greek ''krisis'' 'discrimination, decision, crisis'.''Oxford English Dictionary'', 1893''s.v.'' 'crisis'/ref> The noun is derived from the verb ''krinō'', which means 'distinguish, choose, decide'. In English, ''crisis'' was first used in a medical context, for the time in the development of a disease when a change indicates either recovery or death, that is, a turning-point. It was also used for a major change in the development of a disease. By the mid-seventeenth century, it took on the figurative meaning o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Hackett Fischer

David Hackett Fischer (born December 2, 1935) is University Professor of History Emeritus at Brandeis University. Fischer's major works have covered topics ranging from large macroeconomic and cultural trends (''Albion's Seed,'' ''The Great Wave (book), The Great Wave'') to narrative histories of significant events (''Paul Revere's Ride,'' ''Washington's Crossing'') to explorations of historiography (''Historians' Fallacies'', in which he coined the term "historian's fallacy"). Education Fischer grew up in Baltimore, Maryland. He received an A.B. from Princeton University in 1958 and a Ph.D. from Johns Hopkins University in 1962. Career Fischer has been on the faculty of Brandeis University for 50 years, where he is known for being interested in his students and history. He is best known for two major works: ''Albion's Seed'' (1989), and ''Washington's Crossing (book), Washington's Crossing (Pivotal Moments in American History)'' (2004). In ''Albion's Seed'', he argues that core ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)