|

Government-Household Analogy

The Government-Household analogy refers to rhetoric in political economic discourse that compares the finances of a federal government to those of a household. The analogy has frequently been made in debates about government debt, with critics of government debt arguing that greater government debt is equivalent to a household taking on more debt. The analogy has been characterized by economists as misleading and false, as the functions and constraints of governments and households are vastly dissimilar. Differences include that governments can print money, interest rates on government borrowing may be cheaper than individual borrowing, governments can increase their budgets through taxation, governments have indefinite planning horizons, national debt may be held primarily domestically (the equivalent of household members owing each other), governments typically have greater collateral for borrowing, and contractions in government spending can cause or prolong economic crises and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on: # The efficient allocation of available resources; # The distribution of income among citizens; and # The stability of the economy. Economist Jonathan Gruber has put forth a framework to assess the broad field of public finance. Gruber suggests public finance should be thought of in terms of four central questions: # When should the government intervene in the economy? To which there are two central motivations for government intervention, Market failure and redistribution of income and wealth. # How might the government intervene? Once the decision is made to intervene the government must ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

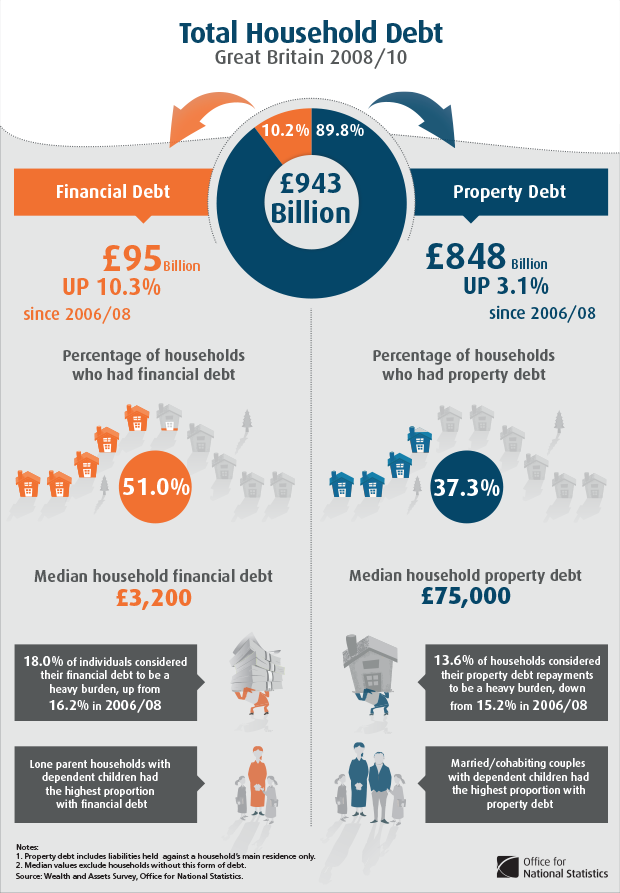

Household Debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries. Overview Household debt can be defined in several ways, based on what types of debt are included. Common debt types include home mortgages, home equity loans, auto loans, student loans, and credit cards. Household debt can also be measured across an economy, to measure how indebted households are relative to various measures of income (e.g., pre-tax and disposable income) or relative to the size of the economy (GDP). The burden of debt can also be measured in terms of the amount of interest it generates relative to the income of the borrower. For example, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Hawk

Deficit hawk is a political slang term in the English speaking world for people who place great emphasis on keeping government budgets under control. 'Hawk' can be used to describe someone calling for harsh or pain-inducing measures (alluding to the predatory nature of hawks in the natural world) in many political contexts; in the specific context of deficit reduction, the term is more commonly applied to those advocating for cuts in government spending than to those supporting increases in taxes. Economist and opinion writer Paul Krugman has popularized the use of "deficit scold" in place of deficit hawk. According to Krugman, a columnist of ''The New York Times'', " the Peter G. Peterson Foundation is deficit-scold central; Peterson funding lies behind much of the movement." Deficit hawks often warn that unsustainable fiscal policies could lead to investors losing confidence in U.S. government bonds, which would in turn force an increase in interest rates. Krugman has dismisse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are many sub-fields, ranging from the broad philosophy, philosophical theory, theories to the focused study of minutiae within specific Market (economics), markets, macroeconomics, macroeconomic analysis, microeconomics, microeconomic analysis or financial statement analysis, involving analytical methods and tools such as econometrics, statistics, Computational economics, economics computational models, financial economics, mathematical finance and mathematical economics. Professions Economists work in many fields including academia, government and in the private sector, where they may also "study data and statistics in order to spot trends in economic activity, economic confidence levels, and consumer attitudes. They assess ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Times

''The Times'' is a British daily national newspaper based in London. It began in 1785 under the title ''The Daily Universal Register'', adopting its current name on 1 January 1788. ''The Times'' and its sister paper ''The Sunday Times'' (founded in 1821) are published by Times Newspapers, since 1981 a subsidiary of News UK, in turn wholly owned by News Corp. ''The Times'' and ''The Sunday Times'', which do not share editorial staff, were founded independently and have only had common ownership since 1966. In general, the political position of ''The Times'' is considered to be centre-right. ''The Times'' is the first newspaper to have borne that name, lending it to numerous other papers around the world, such as ''The Times of India'', ''The New York Times'', and more recently, digital-first publications such as TheTimesBlog.com (Since 2017). In countries where these other titles are popular, the newspaper is often referred to as , or as , although the newspaper is of nationa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank. Central banks monitor the amount of money in the economy by measuring monetary aggregates (termed broad money), consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.For example, in the United States, money supply measured as M2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Vickrey

William Spencer Vickrey (21 June 1914 – 11 October 1996) was a Canadian-American professor of economics and Nobel Laureate. Vickrey was awarded the 1996 Nobel Memorial Prize in Economic Sciences with James Mirrlees for their research into the economic theory of incentives under asymmetric information, becoming the only Nobel laureate born in British Columbia. The announcement of his Nobel Prize was made just three days prior to his death. Vickrey died while traveling to a conference of Georgist academics that he helped found and never missed once in 20 years. His Columbia University economics department colleague C. Lowell Harriss accepted the posthumous prize on his behalf. There are only three other cases where a Nobel Prize has been presented posthumously. Early years Vickrey was born in Victoria, British Columbia and attended high school at Phillips Academy in Andover, Massachusetts. After obtaining his B.S. in Mathematics at Yale University in 1935, he went on to comp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

False Analogy

Argument from analogy or false analogy is a special type of inductive argument, whereby perceived similarities are used as a basis to infer some further similarity that has yet to be observed. Analogical reasoning is one of the most common methods by which human beings attempt to understand the world and make decisions. When a person has a bad experience with a product and decides not to buy anything further from the producer, this is often a case of analogical reasoning. It is also implicit in much of science; for instance, experiments on laboratory rats typically proceed on the basis that some physiological similarities between rats and humans entails some further similarity (e.g. possible reactions to a drug). Structure The process of analogical inference involves noting the shared properties of two or more things, and from this basis inferring that they also share some further property. The structure or form may be generalized like so: : P and Q are similar in respect t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |