|

Glass–Steagall Legislation

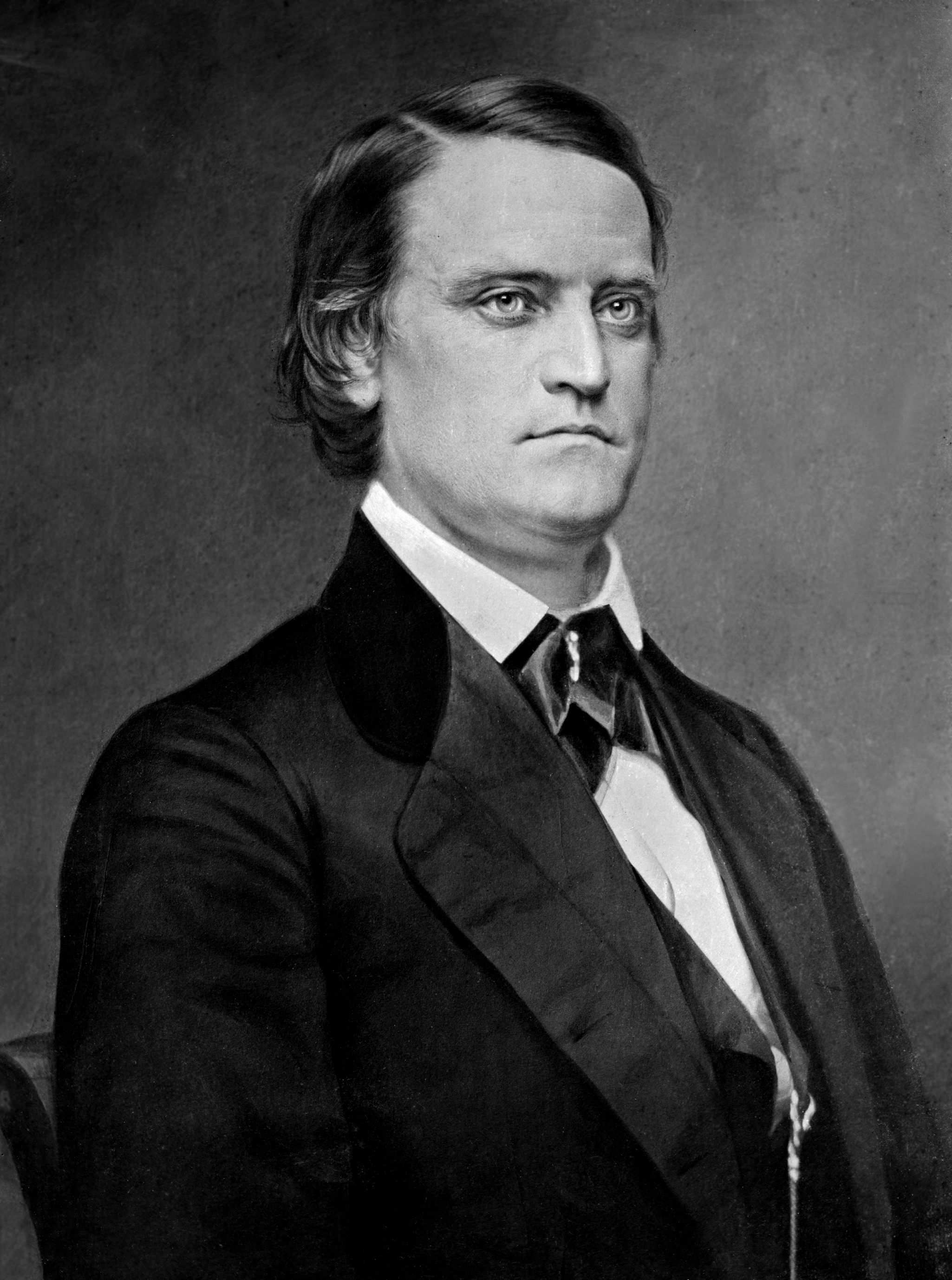

The Glass–Steagall legislation describes four provisions of the United States Banking Act of 1933 separating commercial and investment banking.. Wilmarth 1990, p. 1161. The article 1933 Banking Act describes the entire law, including the legislative history of the provisions covered herein. As with the Glass–Steagall Act of 1932, the common name comes from the names of the Congressional sponsors, Senator Carter Glass and Representative Henry B. Steagall. The separation of commercial and investment banking prevented securities firms and investment banks from taking deposits, and commercial Federal Reserve member banks from: * dealing in non-governmental securities for customers, * investing in non-investment grade securities for themselves, * underwriting or distributing non-governmental securities, * affiliating (or sharing employees) with companies involved in such activities. Starting in the early 1960s, federal banking regulators' interpretations of the Act permitted ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking Act Of 1933

The Banking Act of 1933 () was a statute enacted by the United States Congress that established the Federal Deposit Insurance Corporation (FDIC) and imposed various other banking reforms. The entire law is often referred to as the Glass–Steagall Act, after its Congressional sponsors, Senator Carter Glass ( D) of Virginia, and Representative Henry B. Steagall (D) of Alabama. The term "Glass–Steagall Act," however, is most often used to refer to four provisions of the Banking Act of 1933 that limited commercial bank securities activities and affiliations between commercial banks and securities firms. That limited meaning of the term is described in the article on Glass–Steagall Legislation. The Banking Act of 1933 (the 1933 Banking Act) joined together two long-standing Congressional projects: #A federal system of bank deposit insurance championed by Representative Steagall #The regulation (or prohibition) of the combination of commercial and investment banking and other ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vanity Fair (magazine)

''Vanity Fair'' is a monthly magazine of popular culture, fashion, and current affairs published by Condé Nast in the United States. The first version of ''Vanity Fair'' was published from 1913 to 1936. The imprint was revived in 1983 and currently includes five international editions of the magazine. As of 2018, the Editor-in-Chief is Radhika Jones. Vanity Fair is most recognized for its celebrity pictures and the occasional controversy that surrounds its more risqué images. Furthermore, the publication is known for its energetic writing, in-depth reporting, and social commentary. History ''Dress and Vanity Fair'' Condé Montrose Nast began his empire by purchasing the men's fashion magazine ''Dress'' in 1913. He renamed the magazine ''Dress and Vanity Fair'' and published four issues in 1913. It continued to thrive into the 1920s. However, it became a casualty of the Great Depression and declining advertising revenues, although its circulation, at 90,000 copies, was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

James Kwak

James Kwak (born 1969) is a Professor of Law at the University of Connecticut School of Law, best known as co-founder, with Simon Johnson, in September 2008, of the economics blog "The Baseline Scenario", a commentary on developments in the global economy, law, and public policy, mostly focused on the situation in the USA. Kwak received his A.B. ''magna cum laude'' in 1990 from Harvard University and his Ph.D. on French intellectual history in 1997 from the University of California, Berkeley (1997). While he frequently writes about the subject, Kwak holds no degrees in economics. He justifies this by stating that economics education below the PhD level is misleading. Kwak has worked as a consultant for McKinsey & Company and later was Director of Product Marketing at Ariba, where he led product strategy and marketing for the Platform Solutions division and the Ariba Network. He was a co-founder of Guidewire Software, an independent software vendor for the property and casualty in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simon Johnson (economist)

Simon H. Johnson (born January 16, 1963) is a British American economist. He is the Ronald A. Kurtz Professor of Entrepreneurship at the MIT Sloan School of Management and a senior fellow at the Peterson Institute for International Economics. He has held a wide variety of academic and policy-related positions, including professor of economics at Duke University's Fuqua School of Business. From March 2007 through the end of August 2008, he was Chief Economist of the International Monetary Fund. Education Johnson's first degree was a BA from the University of Oxford, which was followed by an MA from the University of Manchester, and finally in 1989 he earned a Ph.D. in economics from MIT, with a dissertation entitled ''Inflation, intermediation, and economic activity''. Career In November 2020, Johnson was named a volunteer member of the Joe Biden presidential transition Agency Review Team to support transition efforts related to the United States Department of Treasury and the F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of The Comptroller Of The Currency

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and thrift institutions and the federally licensed branches and agencies of foreign banks in the United States. The acting Comptroller of the Currency is Michael J. Hsu, who took office on May 10, 2021. Duties and functions Headquartered in Washington, D.C., it has four district offices located in New York City, Chicago, Dallas and Denver. It has an additional 92 operating locations throughout the United States. It is an independent bureau of the United States Department of the Treasury and is headed by the Comptroller of the Currency, appointed to a five-year term by the President with the consent of the Senate. The OCC pursues a number of main objectives: * to ensure the safety and soundness of the national banking system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking giant #Citicorp, Citicorp and financial conglomerate Travelers Group in 1998; Travelers was subsequently spun off from the company in 2002. Citigroup owns Citicorp, the holding company for Citibank, as well as several international subsidiaries. Citigroup is Delaware General Corporation Law, incorporated in Delaware. Citigroup is the List of largest banks in the United States, third largest banking institution in the United States; alongside JPMorgan Chase, Bank of America, and Wells Fargo, it is one of the Big Four (banking)#United States, Big Four banking institutions of the United States. It is considered a Systemically important financial institution, systemically important bank by the Financial Stability Board and is commonly cited as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings And Loan Association

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held (often called mutual savings banks), meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20percent of their len ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking Act Of 1935

The ''Banking Act of 1935'' passed on August 19, 1935 and was signed into law by the president, Franklin D. Roosevelt, on August 23. The Act changed the structure and power distribution in the Federal Reserve System that began with the ''Banking Act of 1933''. The Act contained three titles. Title I Title I amended section 12B of the 1933 Act with regards to the creation of the Federal Deposit Insurance Corporation (FDIC) and its duties. The board of directors of the FDIC would include the Comptroller of Currency and two members selected by the President and confirmed by the Senate. They shall hold a term of 6 years and receive an annual salary of $10,000. Title I also established the maximum insured deposit to be $5,000. FDIC The Act of 1935 made the FDIC permanent, and included the following provisions: * All accounts would be insured up to $5,000. At this time 98.5% of all deposits were under the $5,000 limit. This was a dramatic change from the initial guidelines under ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pecora Commission

The Pecora Investigation was an inquiry begun on March 4, 1932, by the United States Senate Committee on Banking and Currency to investigate the causes of the Wall Street Crash of 1929. The name refers to the fourth and final chief counsel for the investigation, Ferdinand Pecora. His exposure of abusive practices in the financial industry galvanized broad public support for stricter regulations. As a result, the U.S. Congress passed the Glass–Steagall Banking Act of 1933, the Securities Act of 1933, and the Securities Exchange Act of 1934. History Following the 1929 Wall Street Crash, the U.S. economy had gone into a depression, and a large number of banks failed. The Pecora Investigation sought to uncover the causes of the financial collapse. As chief counsel, Ferdinand Pecora personally examined many high-profile witnesses, who included some of the nation's most influential bankers and stockbrokers. Among these witnesses were Richard Whitney, president of the New York Stoc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin Delano Roosevelt

Franklin Delano Roosevelt (; ; January 30, 1882April 12, 1945), often referred to by his initials FDR, was an American politician and attorney who served as the 32nd president of the United States from 1933 until his death in 1945. As the leader of the Democratic Party, he won a record four presidential elections and became a central figure in world events during the first half of the 20th century. Roosevelt directed the federal government during most of the Great Depression, implementing his New Deal domestic agenda in response to the worst economic crisis in U.S. history. He built the New Deal Coalition, which defined modern liberalism in the United States throughout the middle third of the 20th century. His third and fourth terms were dominated by World War II, which ended in victory shortly after he died in office. Born into the prominent Roosevelt family in Hyde Park, New York, he graduated from both Groton School and Harvard College, and attended Columbia Law S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Southern Democrats

Southern Democrats, historically sometimes known colloquially as Dixiecrats, are members of the U.S. Democratic Party who reside in the Southern United States. Southern Democrats were generally much more conservative than Northern Democrats with most of them voting against the Civil Rights Act of 1964 by holding the longest filibuster in the American Senate history while Democrats in non-Southern states supported the Civil Rights Act of 1964. After 1994 the Republicans typically won most elections in the South. In the 19th century, Southern Democrats were people in the South who believed in Jacksonian democracy. In the 19th century, they defended slavery in the United States, and promoted its expansion into the West against northern Free Soil opposition. The United States presidential election of 1860 formalized the split in the Democratic Party and brought about the American Civil War. Stephen Douglas was the candidate for the Northern Democratic Party, and John C. Breckinrid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |