|

Greater Fool Theory

In finance, the greater fool theory suggests that one can sometimes make money through the purchase of overvalued items with a purchase price drastically exceeding the intrinsic valueif those assets can later be resold at an even higher price. In this context, one "fool" might pay for an overpriced asset, hoping that he can sell it to an even "greater fool" and make a profit. This only works as long as there are enough new "greater fools" willing to pay higher and higher prices for the asset. Eventually, investors can no longer deny that the price is out of touch with reality, at which point a sell-off can cause the price to drop significantly until it is closer to its fair value, which in some cases could be zero. Crowd psychology Due to cognitive bias in human behavior, some people are drawn to assets whose price they see increasing, however irrational it might be. This effect is often further exacerbated by herd mentality, whereby people hear stories of others who bought in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cognitive Bias

A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the objective input, may dictate their behavior in the world. Thus, cognitive biases may sometimes lead to perceptual distortion, inaccurate judgment, illogical interpretation, or what is broadly called irrationality. Although it may seem like such misperceptions would be aberrations, biases can help humans find commonalities and shortcuts to assist in the navigation of common situations in life. Some cognitive biases are presumably adaptive. Cognitive biases may lead to more effective actions in a given context. Furthermore, allowing cognitive biases enables faster decisions which can be desirable when timeliness is more valuable than accuracy, as illustrated in heuristics. Other cognitive biases are a "by-product" of human processing limitations, resulting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid digital subscribers. It also is a producer of popular podcasts such as '' The Daily''. Founded in 1851 by Henry Jarvis Raymond and George Jones, it was initially published by Raymond, Jones & Company. The ''Times'' has won 132 Pulitzer Prizes, the most of any newspaper, and has long been regarded as a national " newspaper of record". For print it is ranked 18th in the world by circulation and 3rd in the U.S. The paper is owned by the New York Times Company, which is publicly traded. It has been governed by the Sulzberger family since 1896, through a dual-class share structure after its shares became publicly traded. A. G. Sulzberger, the paper's publisher and the company's chairman, is the fifth generation of the family to head the pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subjective Theory Of Value

The subjective theory of value is an economic theory which proposes the idea that the value of any good is not determined by the utility value of the object, nor by the cumulative value of components or labour needed to produce or manufacture it, but instead is determined by the individuals or entities who are buying or selling the object in question. This trend is often seen in collectable items such as cars, vinyl records, and comic books. The value of an object may have increased substantially since its creation or original purchase due to age, a personal affinity, or scarcity. The modern version of this theory was created independently and nearly simultaneously by William Stanley Jevons, Léon Walras, and Carl Menger in the late 19th century.Stigler, George (1950) "The Development of Utility Theory. I" ''The Journal of Political Economy'' Overview According to the subjective theory of value, by assuming that all trades between individuals are voluntary, it can be concluded tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculation

In finance, speculation is the purchase of an asset (a commodity, good (economics), goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.) Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bond (finance), bonds, commodity futures, currency, currencies, fine art, collectibles, real estate, and derivative (finance), derivatives. Speculators play one of four primary roles in financial markets, along with hedge (finance), hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageus who seek to profit from situations where Fungibility, fungible instruments trade at different prices in different market segments, and investors who s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ponzi Scheme

A Ponzi scheme (, ) is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are coming from legitimate business activity (e.g., product sales or successful investments), and they remain unaware that other investors are the source of funds. A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own. Some of the first recorded incidents to meet the modern definition of the Ponzi scheme were carried out from 1869 to 1872 by Adele Spitzeder in Germany and by Sarah Howe in the United States in the 1880s through the "Ladies' Deposit". Howe offered a solely female clientele an 8% monthly interest rate and then stole the money that the women ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

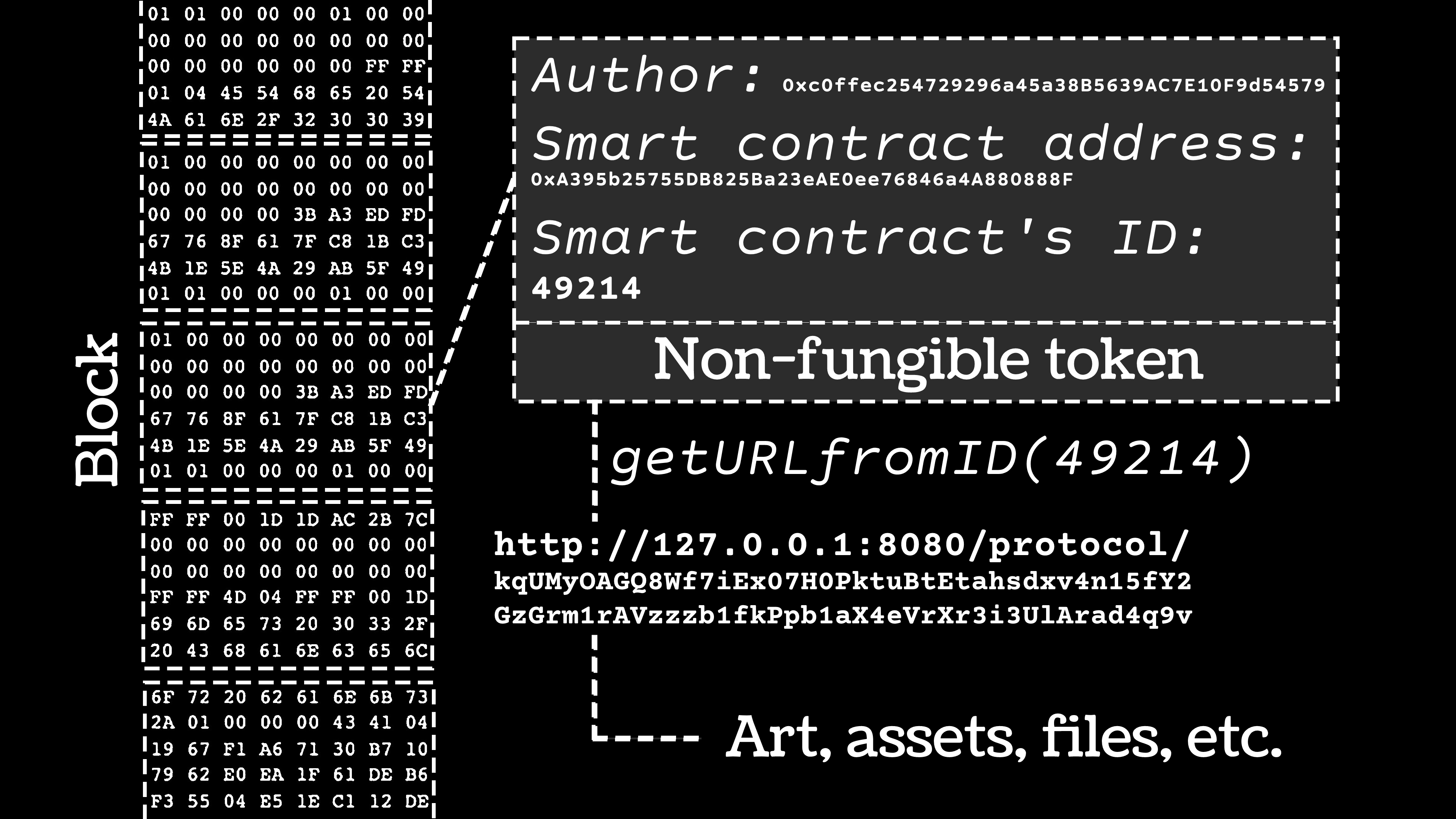

Non-fungible Token

A non-fungible token (NFT) is a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity and ownership. The ownership of an NFT is recorded in the blockchain and can be transferred by the owner, allowing NFTs to be sold and traded. NFTs can be created by anybody, and require few or no coding skills to create. NFTs typically contain references to digital files such as photos, videos, and audio. Because NFTs are uniquely identifiable assets, they differ from cryptocurrencies, which are Fungibility, fungible. Proponents of NFTs claim that NFTs provide a public certificate of authenticity or Title (property), proof of ownership, but the legal rights conveyed by an NFT can be uncertain. The ownership of an NFT as defined by the blockchain has no inherent legal meaning and does not necessarily grant copyright, intellectual property rights, or other legal rights over its associated digital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beanie Babies

Beanie Babies are a line of stuffed toys created by American businessman H. Ty Warner, who founded Ty Inc. in 1986. The toys are stuffed with plastic pellets ("beans") rather than conventional soft stuffing. They come in many different forms, mostly animals. Created in 1993, Beanie Babies emerged as a major fad and collectible during the second half of the 1990s. They have been cited as being the world's first Internet sensation in 1995. They were collected not only as toys, but also as a financial investment, due to the high resale value of particular ones. History Beanie Babies were first introduced in 1993 by Ty Warner at the World Toy Fair in New York City, New York. It was not until 1994 that the toys were put into factory production, first being sold in local stores located in Chicago, Illinois, for around $5 U.S. Dollars. There were nine original Beanie Babies, which includes: Legs the Frog, Squealer the Pig, Spot the Dog, Flash the Dolphin, Splash the Whale, Chocolate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bagholder

In financial slang, a bagholder is a shareholder left holding shares of worthless stocks. The bagholder typically bought in near the peak, when people were hyping the asset and the price was high, and held it all the way through steep declines, losing a lot of money in the process. It can also refer to the holder of other assets and financial instruments that become worthless, such as the junior bonds of a defaulted company or the coins of a failed cryptocurrency. The word is derived by combining shareholder with the expression "left holding the bag." Examples The shareholders could be caught up in a corporate bankruptcy and accounting scandal, as was the case with Enron and Worldcom, or the victims of a pump and dump scheme, in which investors fall victim to e-mail spam, rigged stock tip forums, or other tricks used by stock touts to drive up the shares of worthless penny stocks. If a worthless property is bought with the idea to sell it for a higher price, the gullible person ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

In economics and finance, arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalise on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practice, there are always risks in arbitrage, some minor (such as fluctuation of prices decreasing profit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nobel Laureates

The Nobel Prizes ( sv, Nobelpriset, no, Nobelprisen) are awarded annually by the Royal Swedish Academy of Sciences, the Swedish Academy, the Karolinska Institutet, and the Norwegian Nobel Committee to individuals and organizations who make outstanding contributions in the fields of chemistry, physics, literature, peace, and physiology or medicine. They were established by the 1895 will of Alfred Nobel, which dictates that the awards should be administered by the Nobel Foundation. The Nobel Memorial Prize in Economic Sciences was established in 1968 by the Sveriges Riksbank, the central bank of Sweden, for contributions to the field of economics. Each recipient, a Nobelist or ''laureate'', receives a gold medal, a diploma, and a sum of money which is decided annually by the Nobel Foundation. Prize Each prize is awarded by a separate committee; the Royal Swedish Academy of Sciences awards the Prizes in Physics, Chemistry, and Economics; the Karolinska Institute awards the Priz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cryptocurrencies

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because ..., to uphold or maintain it. It is a decentralized system for verifying that the parties to a transaction have the money they claim to have, eliminating the need for traditional intermediaries, such as banks, when funds are being transferred between two entities. Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure E-commerce, transaction records, control the creation of additional coins, and verify the transfer of coin ownership. Despite the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)

.jpg)