|

Glossary Of Stock Market Terms

Following is a glossary of stock market terms. * All or none or AON: in investment banking or securities transactions, "an order to buy or sell a stock that must be executed in its entirely, or not executed at all". *Ask price or Ask: the lowest price a seller of a stock is willing to accept for a share of that given stock. *Bear market: a general decline in the stock market over a period of time. See Market trend. * Bookrunner: in investment banking, usually the main underwriter or lead-manager/arranger/coordinator in equity, debt, or hybrid securities issuances. *Bull market: a period of generally rising prices. See Market trend. *Closing print: a report of the final prices for the day on a stock exchange. *Fill or kill or FOK: "an order to buy or sell a stock that must be executed immediately"—a few seconds, customarily—in its entirety; otherwise, the entire order is cancelled; no partial fulfillments are allowed. * Green sheet: a document that accompanies a prospec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

All Or None

All or none (AON) is a finance term used in investment banking or securities transactions that refers to "an order to buy or sell a stock that must be executed in its entirety, or not executed at all". Partial execution is not acceptable; the order will execute "only if there are enough shares available in a single transaction to cover it". An all-or-none clause in an underwriting contract or investment prospectus gives a securities issuer the right to cancel an issue in its entirety if the underwriting is not fully subscribed. AON orders are similar to fill or kill (FOK) orders, but the former focuses on "complete vs. partial fulfillment", whereas the latter hinges on the immediacy of the transaction. Example If you place an AON order requesting 100 shares of JKL Co. at $2, your stockbroker will not fill that order unless they can obtain the entire 100 shares at $2; if JKL Co. shares are in such high demand that there are only 50 shares available for purchase, then y ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prospectus (finance)

{{unreferenced, date=October 2015 A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or brokerages to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries. United States In a securities offering in the United States, a prospectus is required to be filed with the Securities and Exchange Commission (SEC) as part of a registration statement. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Float

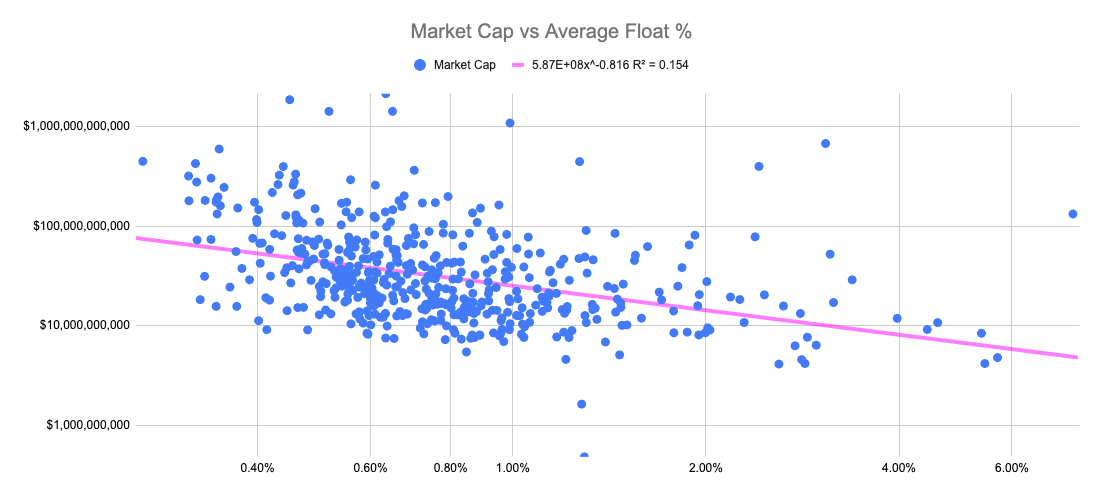

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Property

In English common law, real property, real estate, immovable property or, solely in the US and Canada, realty, is land which is the property of some person and all structures (also called improvements or fixtures) integrated with or affixed to the land, including crops, buildings, machinery, wells, dams, ponds, mines, canals, and roads, among other things. The term is historic, arising from the now-discontinued form of action, which distinguished between real property disputes and personal property disputes. Personal property, or personalty, was, and continues to be, all property that is not real property. In countries with personal ownership of real property, civil law protects the status of real property in real-estate markets, where estate agents work in the market of buying and selling real estate. Scottish civil law calls real property "heritable property", and in French-based law, it is called ''immobilier'' ("immovable property"). Historical background The word " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment managemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Offering

A public offering is the offering of securities of a company or a similar corporation to the public. Generally, the securities are to be listed on a stock exchange. In most jurisdictions, a public offering requires the issuing company to publish a prospectus detailing the terms and rights attached to the offered security, as well as information on the company itself and its finances. Many other regulatory requirements surround any public offering and they vary according to jurisdiction. The services of an underwriter are often used to conduct a public offering. Stock offering Initial public offering (IPO) is one type of public offering. Not all public offerings are IPOs. An IPO occurs only when a company offers its shares (not other securities) for the first time for public ownership and trading, an act making it a public company. However, public offerings are also made by already-listed companies. The company issues additional securities to the public, adding to those curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Immediate Or Cancel

An immediate or cancel (IOC) Order (exchange), order, also known as an "accept order", is a finance term used in investment banking or Security (finance), securities transactions that refers "an Order (exchange), order to buy or sell a stock that must be executed immediately". In case the entire order is not available at that moment for purchase a partial fulfillment is possible, but any portion of an IOC order that cannot be filled immediately is cancelled, eliminating the need for manual cancellation. This "partial fulfillment" aspect is what differentiates IOC orders from all or none (AON) and fill or kill (FOK) orders, but the terms might be used interchangeably in some markets. Benefits It is considered a "clean, quick, and easy way to acquire securities or goods [that] can save time and money" and the "chances of receiving at least a portion of the order within the time frame required is very good". IOC orders are generally employed when ordering "large quantities of stock". T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prospectus (finance)

{{unreferenced, date=October 2015 A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or brokerages to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries. United States In a securities offering in the United States, a prospectus is required to be filed with the Securities and Exchange Commission (SEC) as part of a registration statement. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Provision (accounting)

In financial accounting under International Financial Reporting Standards (IFRS), a provision is an account that records a present liability of an entity. The recording of the liability in the entity's balance sheet is matched to an appropriate expense account on the entity's income statement. In U.S. Generally Accepted Accounting Principles (U.S. GAAP), a provision is an expense. Thus, "Provision for Income Taxes" is an expense in U.S. GAAP but a liability in IFRS. Under International Financial Reporting Standards In the International Financial Reporting Standards (IFRS), the treatment of provisions (as well as contingent assets and liabilities) is found in IAS 37. Definition A provision can be a liability of uncertain timing or amount. A liability, in turn, is a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. Though it is often thought ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Greenshoe

Greenshoe, or over-allotment clause, is the term commonly used to describe a special arrangement in a U.S. registered share offering, for example an initial public offering (IPO), which enables the investment bank representing the underwriters to support the share price after the offering without putting their own capital at risk. This clause is codified as a provision in the underwriting agreement between the leading underwriter, the lead manager, and the issuer (in the case of primary shares) or vendor ( secondary shares). The provision allows the underwriter to purchase up to 15% in additional company shares at the offering share price. The term is derived from the name of the first company, Green Shoe Manufacturing (now called Stride Rite), to permit underwriters to use this practice in an IPO. The use of the greenshoe (also known as "the shoe") in share offerings is widespread for two reasons. First, it is a legal mechanism for an underwriter to stabilize the price of new ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |