|

Frank J. Fabozzi

Frank J. Fabozzi is an American economist, educator, writer, and investor, currently Professor of Practice at The Johns Hopkins University Carey Business School and a Member of Edhec Risk Institute. He was previously a Professor of Finance at EDHEC Business School, Professor in the Practice of Finance and Becton Fellow in the Yale School of Management, and a Visiting Professor of Finance at the Sloan School of Management at the Massachusetts Institute of Technology. He has authored and edited many books, three of which were coauthored with Nobel laureates, Franco Modigliani and Harry Markowitz. He has been the editor of the '' Journal of Portfolio Management'' since 1986 and is on the board of directors of the BlackRock complex of closed-end funds. Early life and education He earned a BA (magna cum laude) and an MA in economics from the City College of New York, both in 1970. He also earned a doctorate in economics from the City University of New York in 1972 . He is a Certified ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Brackets

A bracket is either of two tall fore- or back-facing punctuation marks commonly used to isolate a segment of text or data from its surroundings. Typically deployed in symmetric pairs, an individual bracket may be identified as a 'left' or 'right' bracket or, alternatively, an "opening bracket" or "closing bracket", respectively, depending on the directionality of the context. Specific forms of the mark include parentheses (also called "rounded brackets"), square brackets, curly brackets (also called 'braces'), and angle brackets (also called 'chevrons'), as well as various less common pairs of symbols. As well as signifying the overall class of punctuation, the word "bracket" is commonly used to refer to a specific form of bracket, which varies from region to region. In most English-speaking countries, an unqualified word "bracket" refers to the parenthesis (round bracket); in the United States, the square bracket. Various forms of brackets are used in mathematics, with s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latin Honors

Latin honors are a system of Latin phrases used in some colleges and universities to indicate the level of distinction with which an academic degree has been earned. The system is primarily used in the United States. It is also used in some Southeastern Asian countries with European colonial history, such as Indonesia and the Philippines, although sometimes translations of these phrases are used instead of the Latin originals. The honors distinction should not be confused with the honors degrees offered in some countries, or with honorary degrees. The system usually has three levels of honor: ''cum laude'', ''magna cum laude'', and ''summa cum laude''. Generally, a college or university's regulations set out definite criteria a student must meet to obtain a given honor. For example, the student might be required to achieve a specific grade point average, submit an honors thesis for evaluation, be part of an honors program, or graduate early. Each school sets its own standards ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Derivative

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition. IRDs are popular with all financial market participants given the need for almost any area of finance to either hedge or speculate on the movement of interest rates. Modeling of interest rate derivatives is usually done on a time-dependent multi-dimensional Lattice ("tree") or using specialized simulation models. Both are calibrated to the underlying risk drivers, usually domestic or foreign short rates and foreign exchange market rates, and incorporate delivery- and day count conventions. The Heath–Jarrow–Morton framework is often used instead of short rates. Types The most basic subclassification of interest rate derivatives (IRDs) is to define linear and no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short-rate Model

A short-rate model, in the context of interest rate derivatives, is a mathematical model that describes the future evolution of interest rates by describing the future evolution of the short rate, usually written r_t \,. The short rate Under a short rate model, the stochastic state variable is taken to be the instantaneous spot rate. The short rate, r_t \,, then, is the ( continuously compounded, annualized) interest rate at which an entity can borrow money for an infinitesimally short period of time from time t. Specifying the current short rate does not specify the entire yield curve. However, no-arbitrage arguments show that, under some fairly relaxed technical conditions, if we model the evolution of r_t \, as a stochastic process under a risk-neutral measure Q, then the price at time t of a zero-coupon bond maturing at time T with a payoff of 1 is given by : P(t,T) = \operatorname^Q\left \mathcal_t \right where \mathcal is the natural filtration for the process. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CFA Institute

The CFA Institute is a global, not-for-profit professional organization that provides investment professionals with finance education. The institute aims to promote standards in ethics, education, and professional excellence in the global investment services industry. Since 1945, the institute has published the peer-reviewed, quarterly journal, the '' Financial Analysts Journal''. It also publishes the ''CFA Digest'' and the ''CFA Magazine''. Structure The organization offers the Chartered Financial Analyst (CFA) designation, the Certificate in Investment Performance Measurement (CIPM), the Certificate in ESG Investing, and until December 2021, the Investment Foundations Certificate. It provides continuing education conferences, seminars, webcasts, and publications to allow members and other participants to stay current on developments in the investment industry. CFA Institute also oversees the CFA Institute Research Challenge for university students and the Research Foundation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Product

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized " structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor's investment return and the issuer's payment obligations are contingent on, or highly sensitive to, changes in the value of underly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset-backed Security

An asset-backed security (ABS) is a security whose income payments, and hence value, are derived from and collateralized (or "backed") by a specified pool of underlying assets. The pool of assets is typically a group of small and illiquid assets which are unable to be sold individually. Pooling the assets into financial instruments allows them to be sold to general investors, a process called securitization, and allows the risk of investing in the underlying assets to be diversified because each security will represent a fraction of the total value of the diverse pool of underlying assets. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans, to esoteric cash flows from aircraft leases, royalty payments, or movie revenues. Often a separate institution, called a special purpose vehicle, is created to handle the securitization of asset backed securities. The special purpose vehicle, which creates and sells the securities, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage-backed Security

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. The structure of the MBS may be known as "pass-through", where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing. For a company to grow its business, it often must raise money – for example, to finance an acquisition; buy equipment or land, or invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

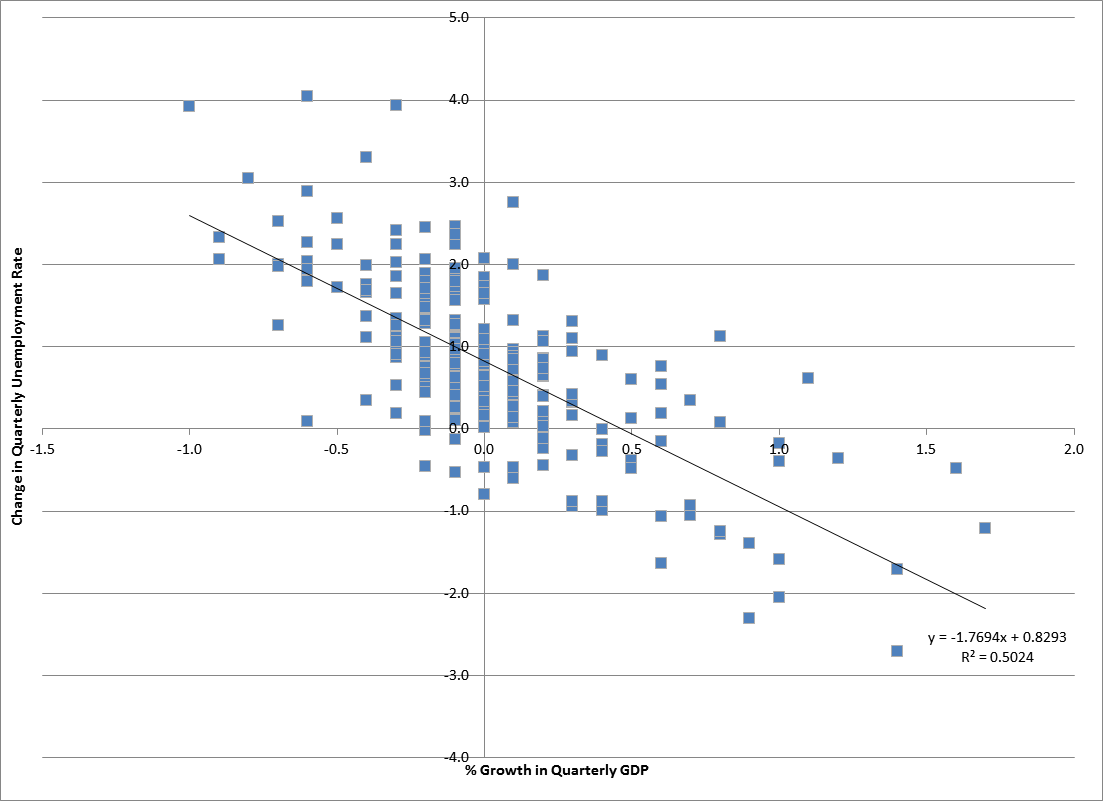

Econometrics

Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics," '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8–22 Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1 p. 1–34Abstract (2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today. A basic tool for econometrics is the multiple linear regression model. ''Economet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)