|

Forex

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works thro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interbank Foreign Exchange Market

The interbank market is the top-level foreign exchange market where banks exchange different currencies. The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Broking Services (EBS) and Thomson Reuters Dealing are the two competitors in the electronic brokering platform business and together connect over 1000 banks. The currencies of most developed countries have floating exchange rates. These currencies do not have fixed values but, rather, values that fluctuate relative to other currencies. The interbank market is an important segment of the foreign exchange market. It is a wholesale market through which most currency transactions are channeled. It is mainly used for trading among bankers. The three main constituents of the interbank market are: * the spot market * the forward market * SWIFT (Society for World-Wide Interbank Financial Telecommunications) The interbank market is unregulated and decentralized. There is no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry Trade

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money ''only if nothing changes'' against the carry's favor. Interest rates carry trade / Maturity transformation For instance, the traditional revenue str ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volume (finance)

In capital markets, volume, or trading volume, is the amount (total number) of a security (or a given set of securities, or an entire market) that was traded during a given period of time. In the context of a single stock trading on a stock exchange, the volume is commonly reported as the number of shares that changed hands during a given day. The transactions are measured on stocks, bonds, options contracts, futures contracts and commodities. The average volume of a security over a longer period of time is the total amount traded in that period, divided by the length of the period. Therefore, the unit of measurement for average volume is shares per unit of time, typically per trading day. Significance Trading volume is usually higher when the price of a security is changing. News about a company's financial status, products, or plans, whether positive or negative, will usually result in a temporary increase in the trade volume of its stock. Shifts in trade volume can make obse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for or that will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can also have a strong or weak currency. There is no agreement in the econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for or that will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can also have a strong or weak currency. There is no agreement in the econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

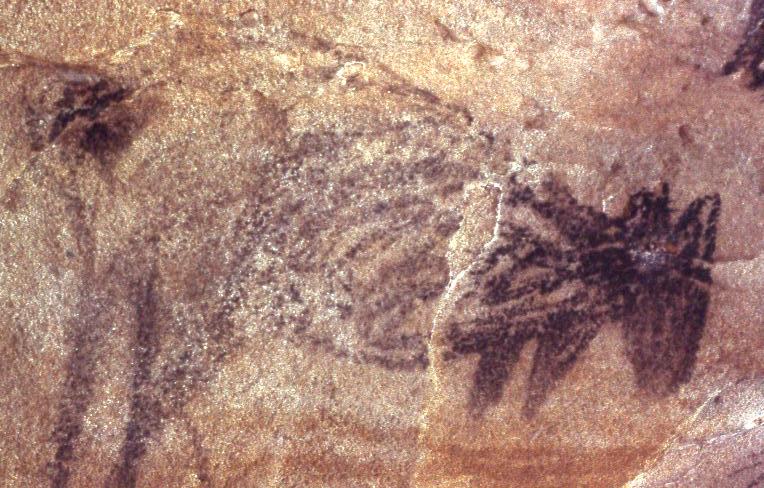

Sydney

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity

{{SIA ...

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity, the ease with which an asset can be sold * Accounting liquidity, the ability to meet cash obligations when due * Liquid capital, the amount of money that a firm holds * Liquidity risk, the risk that an asset will have impaired market liquidity See also *Liquid (other) *Liquidation (other) Liquidation is the conversion of a business's assets to money in order to pay off debt. Liquidation may also refer to: * Murder * Fragmentation (music), a compositional technique * ''Liquidation'' (miniseries), a Russian television series See a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate Regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, the elasticity of the labor market, financial market development, capital mobility ,etc. There are two major regime types: * ''Floating (or flexible) exchange rate'' regime exist where exchange rates are determined solely by market forces and often manipulated by open-market operations. Countries do have the ability to influence their floating currency from activities such as buying/selling currency reserves, changing interest rates, and through foreign trade agreements. * ''Fixed (or pegged) exchange rate'' regimes, exist when a country sets the value of its home currency directly proportional to the value of another currency or commodity. For years many curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floating Exchange Rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a ''floating currency'', in contrast to a ''fixed currency'', the value of which is instead specified in terms of material goods, another currency, or a set of currencies (the idea of the last being to reduce currency fluctuations). In the modern world, most of the world's currencies are floating, and include the most widely traded currencies: the United States dollar, the euro, the Swiss franc, the Indian rupee, the pound sterling, the Japanese yen, and the Australian dollar. However, even with floating currencies, central banks often participate in markets to attempt to influence the value of floating exchange rates. The Canadian dollar most closely resembles a pure f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)