|

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Applied Mathematics

Applied mathematics is the application of mathematical methods by different fields such as physics, engineering, medicine, biology, finance, business, computer science, and industry. Thus, applied mathematics is a combination of mathematical science and specialized knowledge. The term "applied mathematics" also describes the professional specialty in which mathematicians work on practical problems by formulating and studying mathematical models. In the past, practical applications have motivated the development of mathematical theories, which then became the subject of study in pure mathematics where abstract concepts are studied for their own sake. The activity of applied mathematics is thus intimately connected with research in pure mathematics. History Historically, applied mathematics consisted principally of applied analysis, most notably differential equations; approximation theory (broadly construed, to include representations, asymptotic methods, variational ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Card Counting

Card counting is a blackjack strategy used to determine whether the player or the dealer has an advantage on the next hand. Card counters are advantage players who try to overcome the casino house edge by keeping a running count of high and low valued cards dealt. They generally bet more when they have an advantage and less when the dealer has an advantage. They also change playing decisions based on the composition of the deck. Basics Card counting is based on statistical evidence that high cards (aces, 10s, and 9s) benefit the player, while low cards, (2s, 3s, 4s, 5s, 6s, and 7s) benefit the dealer. High cards benefit the player in the following ways: # They increase the player's probability of hitting a natural, which often pays out at 3 to 2 odds. # Doubling down increases expected value. The elevated ratio of tens and aces improves the probability that doubling down will succeed.Thorp (1966), pp. 24–27, pp. 41–47, pp. 98–99, pp. 102–103, p. 110, p. 115. # They pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply And Demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a particular Good (economics), good, or other traded item such as Labour supply, labor or Market liquidity, liquid financial assets, will vary until it settles at a point where the quantity demanded (at the current price) will equal the quantity supplied (at the current price), resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics. In macroeconomics, as well, the AD–AS model, aggregate demand-aggregate supply model has been used to depict how the quantity of real GDP, total output and the aggregate price level may be determined in equilibrium. Graphical representations Supply schedule A supply schedule, depicted graphically as a supply cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Liquidity

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. Money, or cash, is the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: It can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and willing buyers and sellers. It is similar to, but distinct from, market depth, which relates to the trade-off between quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Theorem Of Arbitrage-free Pricing

The fundamental theorems of asset pricing (also: of arbitrage, of finance), in both financial economics and mathematical finance, provide necessary and sufficient conditions for a market to be arbitrage-free, and for a market to be complete. An arbitrage opportunity is a way of making money with no initial investment without any possibility of loss. Though arbitrage opportunities do exist briefly in real life, it has been said that any sensible market model must avoid this type of profit.Pascucci, Andrea (2011) ''PDE and Martingale Methods in Option Pricing''. Berlin: Springer-Verlag The first theorem is important in that it ensures a fundamental property of market models. Completeness is a common property of market models (for instance the Black–Scholes model). A complete market is one in which every contingent claim can be replicated. Though this property is common in models, it is not always considered desirable or realistic. Discrete markets In a discrete (i.e. finite state) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Pricing

In financial economics, asset pricing refers to a formal treatment and development of two main Price, pricing principles, outlined below, together with the resultant models. There have been many models developed for different situations, but correspondingly, these stem from either General equilibrium theory, general equilibrium asset pricing or Rational pricing, rational asset pricing, the latter corresponding to risk neutral pricing. Investment theory, which is near synonymous, encompasses the body of knowledge used to support the decision-making process of choosing investments, and the asset pricing models are then applied in determining the Required rate of return, asset-specific required rate of return on the investment in question, or in pricing derivatives on these, for trading or hedge (finance), hedging. (See also .) General Equilibrium Asset Pricing Under General equilibrium theory prices are determined through Market price, market pricing by supply and demand. He ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Modeling

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment. Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance applications or to quantitative finance applications. While there has been some debate in the industry as to the nature of financial modeling—whether it is a tradecraft, such as welding, or a science—the task of financial modeling has been gaining acceptance and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation Of Options

In finance, a price (premium) is paid or received for purchasing or selling options. This article discusses the calculation of this premium in general. For further detail, see: for discussion of the mathematics; Financial engineering for the implementation; as well as generally. Premium components This price can be split into two components: intrinsic value, and time value. Intrinsic value The ''intrinsic value'' is the difference between the underlying spot price and the strike price, to the extent that this is in favor of the option holder. For a call option, the option is in-the-money if the underlying spot price is higher than the strike price; then the intrinsic value is the underlying price minus the strike price. For a put option, the option is in-the-money if the ''strike'' price is higher than the underlying spot price; then the intrinsic value is the strike price minus the underlying spot price. Otherwise the intrinsic value is zero. For example, when a DJI call (bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Numerical Analysis

Numerical analysis is the study of algorithms that use numerical approximation (as opposed to symbolic computation, symbolic manipulations) for the problems of mathematical analysis (as distinguished from discrete mathematics). It is the study of numerical methods that attempt at finding approximate solutions of problems rather than the exact ones. Numerical analysis finds application in all fields of engineering and the physical sciences, and in the 21st century also the life and social sciences, medicine, business and even the arts. Current growth in computing power has enabled the use of more complex numerical analysis, providing detailed and realistic mathematical models in science and engineering. Examples of numerical analysis include: ordinary differential equations as found in celestial mechanics (predicting the motions of planets, stars and galaxies), numerical linear algebra in data analysis, and stochastic differential equations and Markov chains for simulating living ce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Model

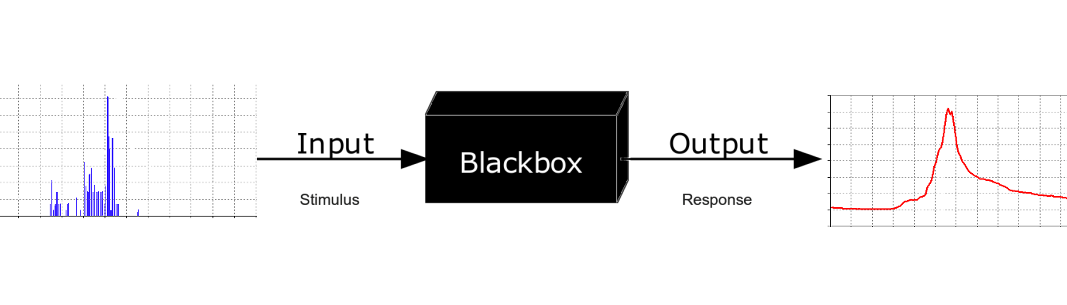

A mathematical model is a description of a system using mathematical concepts and language. The process of developing a mathematical model is termed mathematical modeling. Mathematical models are used in the natural sciences (such as physics, biology, earth science, chemistry) and engineering disciplines (such as computer science, electrical engineering), as well as in non-physical systems such as the social sciences (such as economics, psychology, sociology, political science). The use of mathematical models to solve problems in business or military operations is a large part of the field of operations research. Mathematical models are also used in music, linguistics, and philosophy (for example, intensively in analytic philosophy). A model may help to explain a system and to study the effects of different components, and to make predictions about behavior. Elements of a mathematical model Mathematical models can take many forms, including dynamical systems, statisti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |