|

Finance Act 1998

The Finance Act 1998 is an Act of the United Kingdom Parliament prescribing changes to Excise Duties; Value Added Tax; Income Tax; Corporation Tax; and Capital Gains Tax. It enacts the 1998 Budget speech made by Chancellor of the Exchequer Gordon Brown to the Parliament of the United Kingdom. In the UK, the ''Chancellor'' delivers an annual Budget speech outlining changes in spending, tax and duty. The respective year's Finance Act is the mechanism to enact the changes. The rules governing the various taxation methods are contained within the various taxation acts. (For instance Capital Gains Tax Legislation is contained within Taxation of Chargeable Gains Act 1992). The Finance Act details amendments to be made to each one of these Acts. Taper Relief Notable changes in the 1998 Act included calculation changes to the taxable proportion of a capital gain by the replacement of ''indexation allowance'' with ''taper relief''. TESSAs The Act announced the phasing out of Tax-Exempt Sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Acts Of Parliament Of The United Kingdom Parliament, 1980-1999

{{British legislation lists This is an ''incomplete'' list of Acts of the Parliament of the United Kingdom from its establishment in 1801 up until the present. Lists of Acts by Year * List of Acts of the Parliament of the United Kingdom, 1801–1819 * List of Acts of the Parliament of the United Kingdom, 1820–1839 * List of Acts of the Parliament of the United Kingdom, 1840–1859 * List of Acts of the Parliament of the United Kingdom, 1860–1879 * List of Acts of the Parliament of the United Kingdom, 1880–1899 * List of Acts of the Parliament of the United Kingdom, 1900–1919 * List of Acts of the Parliament of the United Kingdom, 1920–1939 * List of Acts of the Parliament of the United Kingdom, 1940–1959 * List of Acts of the Parliament of the United Kingdom from 1960 * List of Acts of the Parliament of the United Kingdom from 1961 * List of Acts of the Parliament of the United Kingdom from 1962 * List of Acts of the Parliament of the United Kingdom from 1963 * Li ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Duties

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

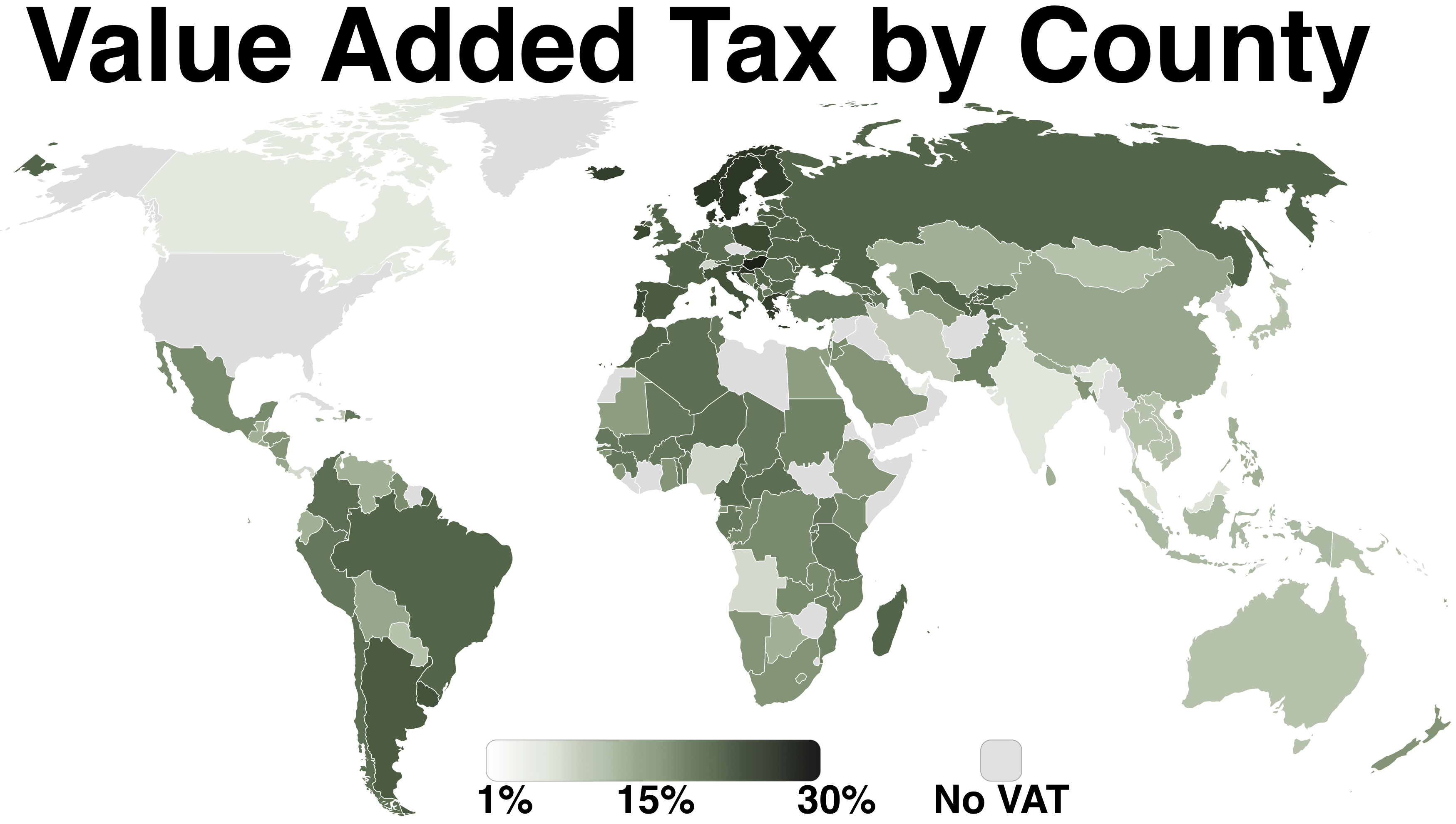

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |