|

Fictitious Capital

Fictitious capital (German: ''fiktives Kapital'') is a concept used by Karl Marx in his critique of political economy. It is introduced in chapter 25 of the third volume of Capital. Fictitious capital contrasts with what Marx calls "real capital", which is capital actually invested in physical means of production and workers, and "money capital", which is actual funds being held. The market value of fictitious capital assets (such as stocks and securities) varies according to the expected return or yield of those assets in the future, which Marx felt was only indirectly related to the growth of real production. Effectively, fictitious capital represents "accumulated claims, legal titles, to future production" and more specifically claims to the income generated by that production. *Fictitious capital could be defined as a ''capitalisation on property ownership''. Such ownership is real and legally enforced, as are the profits made from it, but the capital involved is fictitious; ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 pamphlet ''The Communist Manifesto'' and the four-volume (1867–1883). Marx's political and philosophical thought had enormous influence on subsequent intellectual, economic, and political history. His name has been used as an adjective, a noun, and a school of social theory. Born in Trier, Germany, Marx studied law and philosophy at the universities of Bonn and Berlin. He married German theatre critic and political activist Jenny von Westphalen in 1843. Due to his political publications, Marx became stateless and lived in exile with his wife and children in London for decades, where he continued to develop his thought in collaboration with German philosopher Friedrich Engels and publish his writings, researching in the British Mus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Fetishism

In Marxist philosophy, the term commodity fetishism describes the economic relationships of production and exchange as being social relationships that exist among things (money and merchandise) and not as relationships that exist among people. As a form of reification, commodity fetishism presents economic value as inherent to the commodities, and not as arising from the workforce, from the human relations that produced the commodity, the goods and the services. In the first chapter of '' Capital: Critique of Political Economy'' (1867) commodity fetishism explicates that the social organization of labour occurs through the buying and selling of commodities (goods and services); therefore, in the marketplace, capitalist social relations among people—who makes what, who works for whom, the production-time for a commodity, etc.—are social relations among ''objects'', not among individual persons. At market, the commodities appear in a depersonalized form, as material goods ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

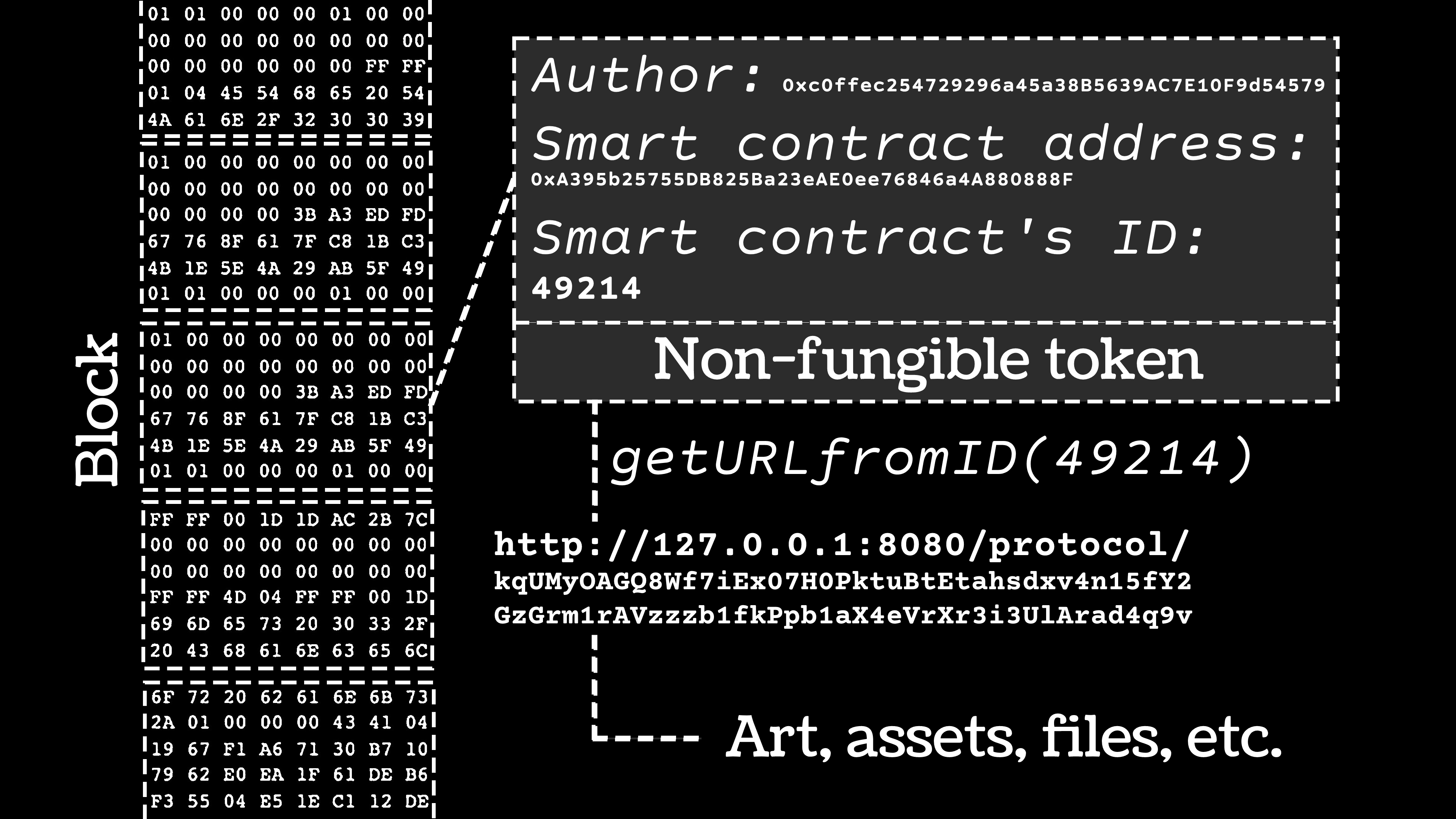

Non-fungible Token

A non-fungible token (NFT) is a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity and ownership. The ownership of an NFT is recorded in the blockchain and can be transferred by the owner, allowing NFTs to be sold and traded. NFTs can be created by anybody, and require few or no coding skills to create. NFTs typically contain references to digital files such as photos, videos, and audio. Because NFTs are uniquely identifiable assets, they differ from cryptocurrencies, which are Fungibility, fungible. Proponents of NFTs claim that NFTs provide a public certificate of authenticity or Title (property), proof of ownership, but the legal rights conveyed by an NFT can be uncertain. The ownership of an NFT as defined by the blockchain has no inherent legal meaning and does not necessarily grant copyright, intellectual property rights, or other legal rights over its associated digital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Bubble

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. Bubbles occur not only in real-world markets, with their inherent uncertainty and noise, but also in highly predictable experimental markets. In the laboratory, uncertainty is eliminated and calculating the expected returns should be a simple mathematical exercise, because participants are endowed with assets that are defined to have a finite lifespan and a known probability distribution of dividends . Other theoretical explanations of stock market bubbles have suggested that they are rational, intrinsic, and contagious. History Historically, early stock market bubbles and crashes have their roots in financial activities of the 17th-century Dutch Republic, the birth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Speculation

In finance, speculation is the purchase of an asset (a commodity, good (economics), goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline in value.) Many speculators pay little attention to the fundamental value of a security and instead focus purely on price movements. In principle, speculation can involve any tradable good or financial instrument. Speculators are particularly common in the markets for stocks, bond (finance), bonds, commodity futures, currency, currencies, fine art, collectibles, real estate, and derivative (finance), derivatives. Speculators play one of four primary roles in financial markets, along with hedge (finance), hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageus who seek to profit from situations where Fungibility, fungible instruments trade at different prices in different market segments, and investors who s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Creation

Money creation, or money issuance, is the process by which the money supply of a country, or of an economic or monetary region,Such as the Eurozone or ECCAS is increased. In most modern economies, money creation is controlled by the central banks. Money issued by central banks is termed base money. Central banks can increase the quantity of base money directly, by engaging in open market operations. However, the majority of the money supply is created by the commercial banking system in the form of bank deposits. Bank loans issued by commercial banks that practice fractional reserve banking expands the quantity of broad money to more than the original amount of base money issued by the central bank. Central banks monitor the amount of money in the economy by measuring monetary aggregates (termed broad money), consisting of cash and bank deposits. Money creation occurs when the quantity of monetary aggregates increase.For example, in the United States, money supply measured as M2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Accumulation

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form of profit, rent, interest, royalties or capital gains. The aim of capital accumulation is to create new fixed and working capitals, broaden and modernize the existing ones, grow the material basis of social-cultural activities, as well as constituting the necessary resource for reserve and insurance. The process of capital accumulation forms the basis of capitalism, and is one of the defining characteristics of a capitalist economic system.''Capital'', Encyclopedia on Marxists.org: http://marxists.org/glossary/terms/c/a.htm#capital Definition The definition of capital accumulation is subject to controversy and ambiguities, because it could refer to: *a ''net addition'' to existing wealth *a ''redistribution'' of wealth. Most often, capi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital (economics)

In economics, capital goods or capital are "those durable produced goods that are in turn used as productive inputs for further production" of goods and services. At the macroeconomic level, "the nation's capital stock includes buildings, equipment, software, and inventories during a given year." A typical example is the machinery used in factories. Capital can be increased by the use of the factors of production, which however excludes certain durable goods like homes and personal automobiles that are not used in the production of saleable goods and services. Adam Smith defined capital as "that part of man's stock which he expects to afford him revenue". In economic models, capital is an input in the production function. The total physical capital at any given moment in time is referred to as the capital stock (not to be confused with the capital stock of a business entity). Capital goods, real capital, or capital assets are already-produced, durable goods or any non-fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consol (bond)

Consols (originally short for consolidated annuities, but subsequently taken to mean consolidated stock) were government debt issues in the form of perpetual bonds, redeemable at the option of the government. They were issued by the Bank of England and the U.S. Government. The first British consols were issued in 1751. They have now been fully redeemed. The United States government issued consols from 1877 to 1930, which have likewise been redeemed. History In 1752 the Chancellor of the Exchequer and Prime Minister Sir Henry Pelham converted all outstanding issues of redeemable government stock into one bond, Consolidated 3.5% Annuities, in order to reduce the coupon (interest rate) paid on the government debt. In 1757, the annual interest rate on the stock was reduced to 3%, leaving the stock as consolidated 3% annuities. The coupon rate remained at 3% until 1888. In 1888, the Chancellor of the Exchequer, George Joachim Goschen, converted the consolidated 3% annuities, along wit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Hudson (economist)

Michael Hudson (born March 14, 1939) is an American economist, Professor of Economics at the University of Missouri–Kansas City and a researcher at the Levy Economics Institute at Bard College, former Wall Street analyst, political consultant, commentator and journalist. He is a contributor to ''The Hudson Report'', a weekly economic and financial news podcast produced by Left Out. Hudson graduated from the University of Chicago (BA, 1959) and New York University (MA, 1965, PhD, 1968) and worked as a balance of payments economist in Chase Manhattan Bank (1964–1968). He was assistant professor of economics at the New School for Social Research (1969–1972) and worked for various governmental and non-governmental organizations as an economic consultant (1980s–1990s). Hudson has devoted his career to the study of debt, both domestic debt (loans, mortgages, interest payments), and external debt. In his works, he consistently advocates the idea that loans and exponentially gr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Surplus-value

In Marxian economics, surplus value is the difference between the amount raised through a sale of a product and the amount it cost to the owner of that product to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and labour power. The concept originated in Ricardian socialism, with the term "surplus value" itself being coined by William Thompson (philosopher), William Thompson in 1824; however, it was not consistently distinguished from the related concepts of surplus labor and surplus product. The concept was subsequently developed and popularized by Karl Marx. Marx's formulation is the standard sense and the primary basis for further developments, though how much of Marx's concept is original and distinct from the Ricardian concept is disputed (see ). Marx's term is the German word "''Mehrwert''", which simply means value added (sales revenue minus the cost of materials used up), and is cognate to English "more worth". It ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)