|

Federal Savings And Loan Insurance Corporation

The Federal Savings and Loan Insurance Corporation (FSLIC) was an institution that administered deposit insurance for savings and loan institutions in the United States. History Establishment The FSLIC was established by the National Housing Act of 1934, which was signed into law by President Franklin D. Roosevelt on June 27, 1934. Upon the creation of the FSLIC, it was assigned a capital stock of $100,000,000. All federal savings and loan associations were required to apply for insurance through the FSLIC; other building and loan associations whose capital was not impaired were also allowed to apply. The FSLIC was given certain regulatory powers over insured institutions, requiring each institution to accumulate reserves over several years. FSLIC assessed an annual insurance premium, which was calculated as 0.25% of the total amount of all accounts of insured shareholders or members, plus any creditor obligations. The FSLIC would suspend insurance premiums whenever the FSLIC's r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government-owned Companies Of The United States

State ownership, also called government ownership and public ownership, is the ownership of an industry, asset, or enterprise by the state or a public body representing a community, as opposed to an individual or private party. Public ownership specifically refers to industries selling goods and services to consumers and differs from public goods and government services financed out of a government's general budget. Public ownership can take place at the national, regional, local, or municipal levels of government; or can refer to non-governmental public ownership vested in autonomous public enterprises. Public ownership is one of the three major forms of property ownership, differentiated from private, collective/cooperative, and common ownership. In market-based economies, state-owned assets are often managed and operated as joint-stock corporations with a government owning all or a controlling stake of the company's shares. This form is often referred to as a stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation In The United States

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom (where regulatory authority over the banking, securities and insurance industries is combined into one single financial-service agency). Bank examiners are generally employed to supervise banks and to ensure compliance with regulations. U.S. banking regulation addresses privacy, disclosure, fraud prevention, anti-money laundering, anti-terrorism, anti-usury lending, and the promotion of lending to lower-income po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Library Of Economics And Liberty

Liberty Fund, Inc. is an American private educational foundation headquartered in Carmel, founded by Pierre F. Goodrich. Through publishing, conferences, and educational resources, the operating mandate of the Liberty Fund was set forth in an unpublished memo written by Goodrich "to encourage the study of the ideal of a society of free and responsible individuals".Morgan N. KnullGoodrich, Pierre, '' First Principles'', 09/23/11Robert T. Grimm (ed.), ''Notable American Philanthropists: Biographies of Giving and Volunteering'', Greenwood Publishing Group, 2002, pp. 125–128 History Liberty Fund was founded by Pierre F. Goodrich in 1960. In 1997 it received an $80 million donation from Goodrich's wife, Enid, increasing its assets to over $300 million. In November 2015, it was announced that the Liberty Fund was building a $22 million headquarters in Carmel, Indiana. Liberty Fund has been cited by historian Donald T. Critchlow as one of the endowed conservative foundations whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concise Encyclopedia Of Economics

Liberty Fund, Inc. is an American private educational foundation headquartered in Carmel, founded by Pierre F. Goodrich. Through publishing, conferences, and educational resources, the operating mandate of the Liberty Fund was set forth in an unpublished memo written by Goodrich "to encourage the study of the ideal of a society of free and responsible individuals".Morgan N. KnullGoodrich, Pierre, '' First Principles'', 09/23/11Robert T. Grimm (ed.), ''Notable American Philanthropists: Biographies of Giving and Volunteering'', Greenwood Publishing Group, 2002, pp. 125–128 History Liberty Fund was founded by Pierre F. Goodrich in 1960. In 1997 it received an $80 million donation from Goodrich's wife, Enid, increasing its assets to over $300 million. In November 2015, it was announced that the Liberty Fund was building a $22 million headquarters in Carmel, Indiana. Liberty Fund has been cited by historian Donald T. Critchlow as one of the endowed conservative foundations wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financing Corporation

The Financing Corporation (FICO) was a federally established mixed-ownership corporation that assumed all the assets and liabilities of the insolvent Federal Savings and Loan Insurance Corporation (FSLIC) and operated as a financing vehicle for the FSLIC Resolution Fund after the former was abolished by the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA). History FICO was chartered by the Federal Home Loan Bank Board pursuant to the FSLIC Recapitalization Act of 1987. FICO's sole purpose was for issuing bonds to finance a rebuilding of the Federal Savings and Loan Insurance Corporation (FSLIC), and after FIRREA to function as a financing vehicle for the FSLIC Resolution Fund that succeeded the FSLIC. Pursuant to the Recapitalization Act, FICO was authorized to issue debentures, bonds, and other obligations subject to limitations, the net proceeds of which were to be used solely to purchase capital certificates issued by the FSLIC Resolution Fund, or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Institutions Reform, Recovery, And Enforcement Act Of 1989

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s. It established the Resolution Trust Corporation to close hundreds of insolvent thrifts and provided funds to pay out insurance to their depositors. It transferred thrift regulatory authority from the Federal Home Loan Bank Board to the Office of Thrift Supervision. It dramatically changed the savings and loan industry and its federal regulation, encouraging loan origination. Overview FIRREA dramatically changed the savings and loan industry and its federal regulation, including deposit insurance. The "Paulson Blueprint" summarized it in the following: # The Federal Home Loan Bank Board (FHLBB) was abolished. # The Federal Savings and Loan Insurance Corporation (FSLIC) was abolished, and all assets and liabilities were assumed by the FSLIC Resolution Fund administered by the FDIC and funded by the Fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Stock

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. "Share capital" may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). Commonly, the share capital is the total of the nominal share capital and the premium share capital. Most jurisdictions do not allow a company to issue shares below par value, but if permitted they are said to be issued at a discount or p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Home Loan Bank Board

The Federal Home Loan Bank Board (FHLBB) was a board created in 1932 that governed the Federal Home Loan Banks (FHLB or FHLBanks) also created by the act, the Federal Savings and Loan Insurance Corporation (FSLIC) and nationally-chartered thrifts. It was abolished and superseded by the Federal Housing Finance Board and the Office of Thrift Supervision in 1989 due to the savings and loan crisis of the 1980s, as Federal Home Loan Banks gave favorable lending to the thrifts it regulated leading to regulatory capture. Activities Looking to create a secondary mortgage market dedicated to buying loans from their constituent thrifts, the FHLBanks and board successfully lobbied for the creation of Freddie Mac, instead of an expanded Fannie Mae (which was limited to FHA insured loans), to be owned and controlled by the FHLBanks and the Federal Home Loan Bank Board and which would buy and sell loans from thrifts only. Organizational history The FHLBB was established as an independent agen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin D

Franklin may refer to: People * Franklin (given name) * Franklin (surname) * Franklin (class), a member of a historical English social class Places Australia * Franklin, Tasmania, a township * Division of Franklin, federal electoral division in Tasmania * Division of Franklin (state), state electoral division in Tasmania * Franklin, Australian Capital Territory, a suburb in the Canberra district of Gungahlin * Franklin River, river of Tasmania * Franklin Sound, waterway of Tasmania Canada * District of Franklin, a former district of the Northwest Territories * Franklin, Quebec, a municipality in the Montérégie region * Rural Municipality of Franklin, Manitoba * Franklin, Manitoba, an unincorporated community in the Rural Municipality of Rosedale, Manitoba * Franklin Glacier Complex, a volcano in southwestern British Columbia * Franklin Range, a mountain range on Vancouver Island, British Columbia * Franklin River (Vancouver Island), British Columbia * Fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

President Of The United States

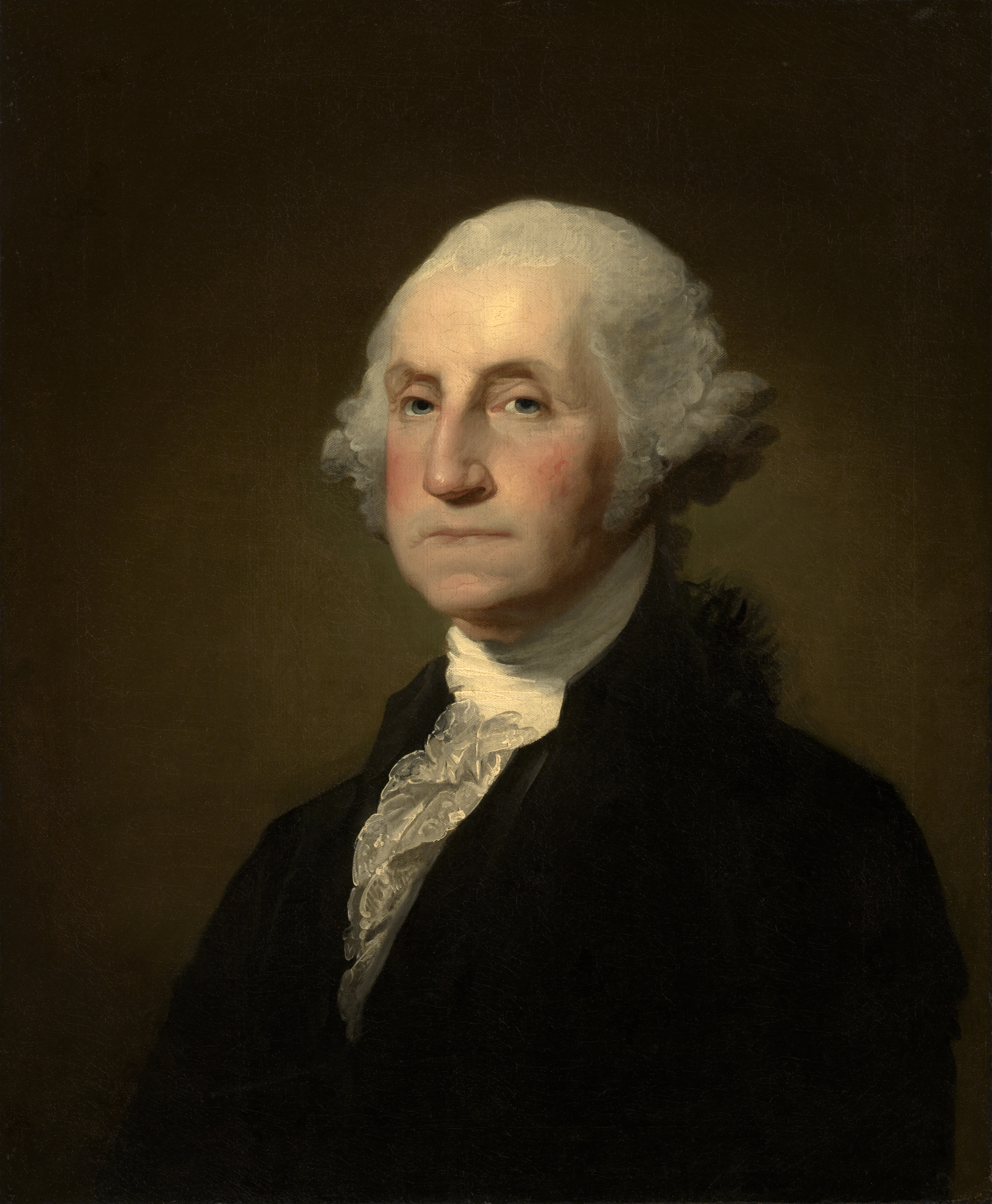

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the Federal government of the United States#Executive branch, executive branch of the Federal government of the United States, federal government and is the Powers of the president of the United States#Commander-in-chief, commander-in-chief of the United States Armed Forces. The power of the presidency has grown substantially since the first president, George Washington, took office in 1789. While presidential power has ebbed and flowed over time, the presidency has played an increasingly strong role in American political life since the beginning of the 20th century, with a notable expansion during the presidency of Franklin D. Roosevelt. In contemporary times, the president is also looked upon as one of the world's most powerful political figures as the leader of the only remaining global superpower. As the leader of the nation with t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |