|

Faster Payment System

Faster Payment System (FPS; , more commonly known as 轉數快) is a real-time gross settlement payment system in Hong Kong that connects traditional banks and electronic payment and digital wallet operators. Users are able to perform instant money transfer or make payment to merchants by using the recipient's phone number, e-mail or QR code that contains the user's numeric identifier. Using the "traditional way" of full name and account number to make interbank transfer is also allowed. The system was implemented by the Hong Kong Monetary Authority and operated by Hong Kong Interbank Clearing Limited (HKICL). It was launched for pre-registration on 17 September 2018. Transfers and payments is available since 30 September 2018. Features Cheap transfers Traditional interbank transfers required payment of fees between 50 HKD and 200 HKD, or a waiting time of up to two days before the payment clears. FPS provides an instant, round-the-clock and cheap way of transferring fund ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Faster Payments Service

The Faster Payments Service (FPS) is a United Kingdom banking initiative to reduce payment times between different banks' customer accounts to typically a few seconds, from the three working days that transfers usually take using the long-established BACS system. CHAPS, which was introduced in 1984, provides a limited faster-than-BACS service (by close of business that day) for "high value" transactions, while FPS is focused on the much larger number of smaller payments, subject to limits set by the individual banks, with some allowing Faster Payments of up to £1million. Transfer time, while expected to be short, is not guaranteed, nor is it guaranteed that the receiving institution will immediately credit the payee's account. Nine banks and one building society, accounting for about 95% of payments traffic, initially committed to use the service; there were 21 direct participants. For smaller organisations such as building societies and savings institutions, the service is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chiyu Banking Corporation

Chiyu Banking Corporation Limited also known as Chiyu Bank is a bank incorporated in Hong Kong. History It was founded by Tan Kah Kee on 15 July 1947, and it has 23 branches in Hong Kong and focuses on serving the community of Fujianese people in Hong Kong. Chiyu was explicitly created by Chen to create a sustainable business with profits to be devoted to education in Xiamen and the rest of Fujian province in China. Since its founding, it has spent more than HK$1 billion in education in the province, primarily through funding Jimei University and its related schools. Ownership Bank of China (Hong Kong) gradually accumulated a 70% stake in Chiyu in the 1970s; the rest of the bank is held by the Jimei University foundation, the government of Xiamen Xiamen ( , ; ), also known as Amoy (, from Hokkien pronunciation ), is a sub-provincial city in southeastern Fujian, People's Republic of China, beside the Taiwan Strait. It is divided into six districts: Huli, Siming, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Chartered Hong Kong

Standard Chartered Hong Kong (officially Standard Chartered Bank (Hong Kong) Limited, ) is a licensed bank incorporated in Hong Kong and a subsidiary of Standard Chartered. It is also one of the three commercial banks licensed by the Hong Kong Monetary Authority to issue banknotes for the Hong Kong dollar. History The history of Standard Chartered in Hong Kong dates back to 1859, when The Chartered Bank of India, Australia and China opened a branch in Hong Kong. The Bank started issuing banknotes of the Hong Kong dollar in 1862, and still does so today. In 2000, Standard Chartered acquired Hong Kong-based retail banking business of the Chase Manhattan Bank, including Chase Manhattan Card Company Limited. In 2010, Standard Chartered acquired the Hong Kong consumer operations of GE Capital. An office tower, the Standard Chartered Bank Building, in Des Voeux Road, Central, Hong Kong is named after the bank. The building is now owned by Hang Lung Group. The Chairperson of the Bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shanghai Commercial Bank

The Shanghai Commercial Bank (SCB; Chinese: 上海商業銀行) is an international bank based in Hong Kong. Its subsidiary companies offer banking and financial services across the world, but mainly in China, the United Kingdom, and the United States. The bank was founded by Chen Guangfu (K. P. Chen) in 1915. As a group, it employs over 1,790 people. The bank is a financial institution incorporated in Hong Kong. The address of its registered headquarters is 12 Queen's Road Central, Central, Hong Kong. History Historically, the Shanghai Commercial Bank was founded in Shanghai in 1915 under the leadership of K.P. Chen (1881–1976), a graduate of the University of Pennsylvania's Wharton School of Finance. In 1927, the Shanghai Commercial Bank established a travel service division, which later became the independent China Travel Service. The bank expanded in the late 1920s and early 1930s, endured the period of Japanese aggression, but suffered significant set-backs during the C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

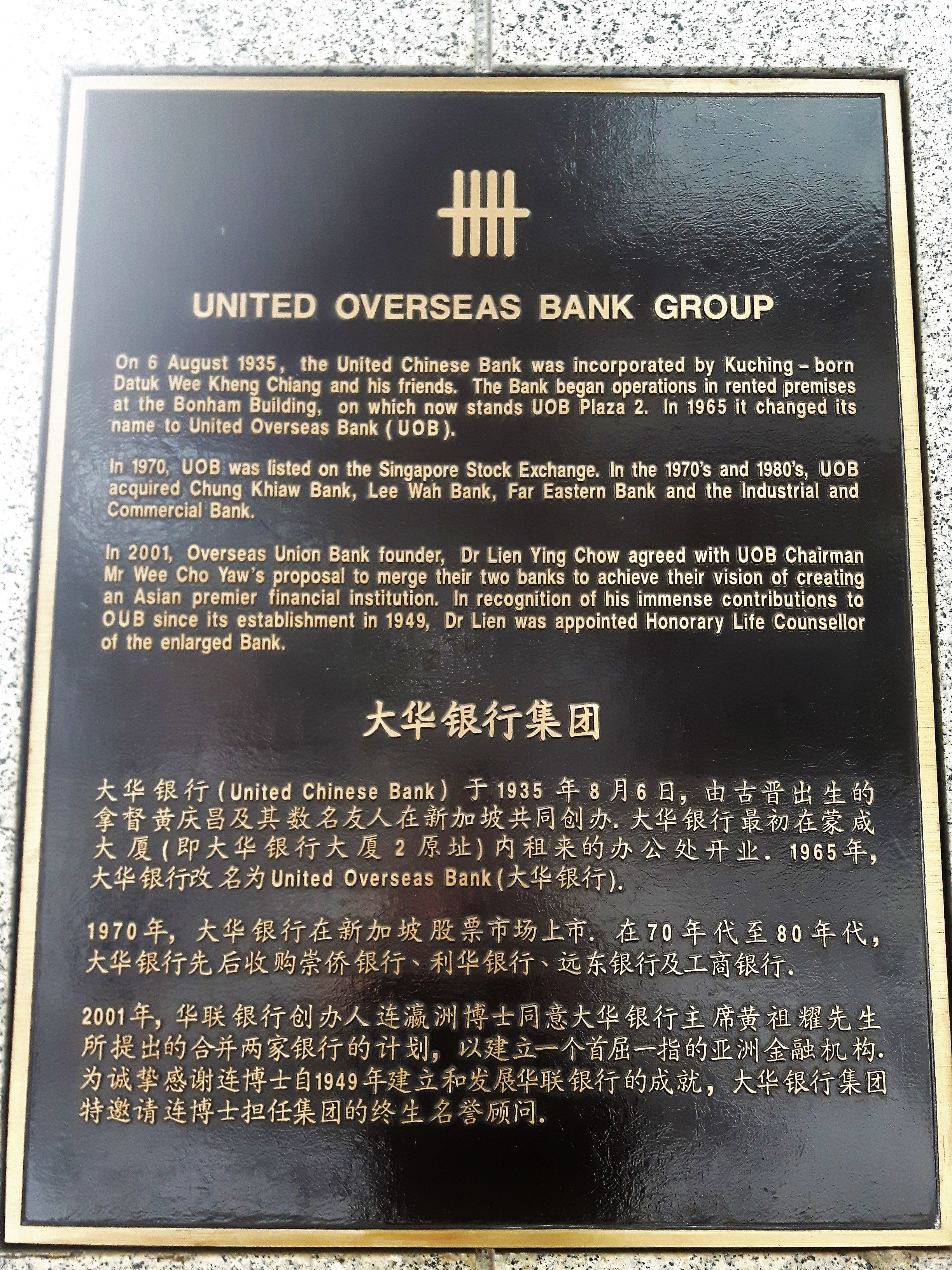

United Overseas Bank

United Overseas Bank Limited (), often known as UOB, is a Singaporean multinational banking corporation headquartered in Singapore, with branches mostly found in most Southeast Asian countries. Founded in 1935 as United Chinese Bank (UCB) by Sarawak businessman Chew Teck Weng, the bank was set up together with a group of Chinese-born businessmen. The bank is the third largest bank in Southeast Asia by total assets. UOB provides commercial and corporate banking services, personal financial services, private banking and asset management services, as well as corporate finance, venture capital, investment, and Insurance services. It has 68 branches in Singapore and a network of more than 500 offices in 19 countries and territories in Asia Pacific, Western Europe and North America. History On 6 August 1935, businessman Wee Kheng Chiang, together with six other friends, established the bank after raising S$1 million. The bank was named ''United Chinese Bank (UCB)'' to emphasi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OCBC Wing Hang Bank

OCBC Wing Hang Bank Limited (), formerly Wing Hang Bank Limited is a licensed bank with its head office in Hong Kong, where it is the eighth biggest bank by total assets. Since end of July 2014 Wing Hang Bank has been a subsidiary of Oversea-Chinese Banking Corporation (OCBC) of Singapore. The acquisition of Wing Hang has given OCBC a network of about 70 branches spanning Hong Kong, Macau and mainland China to add to OCBC's existing operations in Hong Kong and China. History Mr Y K Fung established Wing Hang Ngan Ho in 1937 in Canton to engage in money changing. Its early years were difficult due to the turbulent political and economic conditions in China. In 1941, the firm established a subsidiary, Banco Weng Hang, in Macau. In 1945 Wing Hang Ngan Ho re-established itself in Hong Kong with a capital of HK$300,000 and a staff of 19. The firm prospered during the post-war boom and in 1960 incorporated as Wing Hang Bank. In 1973 the Irving Trust Company of New York acquire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nanyang Commercial Bank

Nanyang Commercial Bank (NCB, Chinese: 南洋商業銀行) is a bank based in Hong Kong and a wholly owned subsidiary of China Cinda Asset Management China Cinda Asset Management Co., Ltd. known as China Cinda or just Cinda is a Chinese merchant bank and asset management company. The corporation was founded as a state-owned enterprise and a bad bank for China Construction Bank in 1999. The ban ... (Cinda), with 42 branches. It was established in Hong Kong on 14 December 1949. NCB primarily focuses on corporate customers, in particular trading companies. In 2015 Cinda acquired Nanyang Commercial Bank from Bank of China (Hong Kong) for HK$68 billion. Cinda had purchased NCB to diversify its business in areas of cross-border finance. Strategic Development It was reported in December 2018 that Nanyang Commercial Bank was one of the shareholders of a new fintech firm Nova Credit, which had entered bid to a new Know Your Client utility platform to be implemented for banks in Hon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industrial And Commercial Bank Of China (Asia)

The Industrial and Commercial Bank of China (Asia), or more commonly known as ICBC (Asia) (Traditional Chinese: 中國工商銀行(亞洲), 工銀亞洲) is a licensed bank incorporated in Hong Kong. It is a subsidiary of the Industrial and Commercial Bank of China. History ICBC acquired Union Bank of Hong Kong (友聯銀行), founded in Hong Kong in 1964, and traded on the Hong Kong Stock Exchange since 1973, on August 21, 2000; ICBC then renamed its acquisition ICBC (Asia) in July 2001. On April 30, 2004, ICBC (Asia) acquired the retail banking business (but not the wholesale banking business) of Fortis Bank Asia HK from Fortis. Fortis Bank Asia became a wholly owned subsidiary of ICBC (Asia) and reverted to its earlier name, Belgian Bank. On October 10, 2005, all Belgian Bank's branches were rebranded as ICBC (Asia). This merger has resulted in ICBC (Asia) rising to the position of being the sixth largest bank on the Hong Kong Stock Exchange, from its former position of tenth. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Hongkong And Shanghai Banking Corporation

The Hongkong and Shanghai Banking Corporation Limited (), commonly known as HSBC (), was the parent entity of the multinational HSBC banking group until 1991, and is now its Hong Kong-based Asia-Pacific subsidiary. The largest bank in Hong Kong, HSBC operates branches and offices throughout the Indo-Pacific region and in other countries around the world. It is also one of the three commercial banks licensed by the Hong Kong Monetary Authority to issue banknotes for the Hong Kong dollar. The Hongkong and Shanghai Bank was established in British Hong Kong in 1865 and was incorporated as The Hongkong and Shanghai Banking Corporation in 1866, and has been based in Hong Kong (although now as a subsidiary) ever since. It was "The Hongkong and Shanghai Banking Corporation Limited" in 1989. It is the founding member of the HSBC group of banks and companies, and, since 1990, is the namesake and one of the leading subsidiaries of the London-based HSBC Holdings PLC. The company's busi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hang Seng Bank

Hang Seng Bank Limited () is a Hong Kong-based banking and financial services company with headquarters in Central, Hong Kong. It is one of Hong Kong's leading public companies in terms of market capitalisation and is part of the HSBC Group, which holds a majority equity interest in the bank. Hang Seng Bank is a commercial bank whose major business activities include retail banking, wealth management, commercial banking, treasury services, and private banking. Hang Seng Bank operates a network of around 260 service outlets in Hong Kong. It also has a wholly owned subsidiary in mainland China, Hang Seng Bank (China) Limited which has a network of 46 branches and sub branches. It established the Hang Seng Index as a public service in 1969 and this stock market index is now generally known as the primary indicator of the Hong Kong stock market. History In 1933, business partners Lam Bing Yim ( 林炳炎), Ho Sin Hang ( 何善衡), Sheng Tsun Lin ( 盛春霖), and Leung Chi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

DBS Bank (Hong Kong)

DBS Bank (Hong Kong) Limited () is a licensed bank incorporated in Hong Kong. It is a subsidiary of DBS Bank headquartered in Singapore and it is also the seventh-largest bank in Hong Kong by total assets. History In 1999, DBS Bank acquired Kwong On Bank and formed the DBS Kwong On Bank Limited. In 2001, DBS Bank acquired Dao Heng Bank, including its subsidiary, Overseas Trust Bank, from Guoco Group. In 2003, DBS Bank merged the three banks, DBS Kwong On Bank Limited, Dao Heng Bank and Overseas Trust Bank, to form DBS Bank (Hong Kong). Mei Foo Branch Incident On October 5, 2004, DBS Bank (Hong Kong) Limited announced that, during the renovation of its branch in Mei Foo Sun Chuen, in Kowloon, when the bank attempted to remove more than 900 empty safety boxes from the branch, 83 safety boxes rented by customers and containing valuables were accidentally removed. The 83 boxes were subsequently sent to a scrapyard and crushed. The bank reported that 36 boxes were recovered, although ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dah Sing Bank

Dah Sing Banking Group Limited (DSBG) is a Hong Kong-based banking and financial company, headquartered in Wan Chai. It has been listed on the Hong Kong Stock Exchange since 2004. It has three main banking subsidiaries (Dah Sing Bank, Banco Comercial de Macau and Dah Sing Bank (China) Limited) providing relevant services through a branch network of around 70 branches over Hong Kong, Macau and Mainland China, and a securities trading company. The group was established on 1 May 1947. Mr. David Shou-Yeh Wong was appointed as the chairman whilst Mr. Harold Tsu-Hing Wong (王祖興), the son of Mr. David Wong, joined as the group managing director and chief executive of DSBG. History 1947: Establishment of Dah Sing Bank, Limited (DSB). 1987: DSB acquired Hong Kong Industrial and Commercial Bank Limited; Public listing of Dah Sing Financial Holdings Limited(DSFH) 1990: Establishment of Dah Sing Life Assurance Co. Limited. 1993: DSFH acquired Wing On Bank Limited. 1994: Dah ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |