|

Fairfax Financial Holdings Ltd.

Fairfax Financial Holdings Limited is a Canadian financial holding company based in Toronto, Ontario, which is engaged in property, casualty, insurance and reinsurance, investment management, and insurance claims management. The company operates primarily through several subsidiaries, including Allied World, Odyssey Re, Northbridge Financial, Crum & Forster, Verassure Insurance, Onlia Agency Inc., and Zenith Insurance Company. The company was also the largest shareholder of Torstar with 40% of the Class B shares, as of May 2020. Fairfax is led by chairman and CEO Prem Watsa, who controls nearly half of the firm. History Market Fairfax was incorporated as Markel Service of Canada on March 13, 1951, and continued under the Canada Business Corporations Act in 1976. The name was subsequently changed to Markel Financial Holdings Ltd. In 1984, Prem Watsa left GW Asset Management to found his own asset management firm, Hamblin Watsa Investment Counsel Ltd. together with his for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states, and therefore have associations and formal designations which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation (though a corporation need not be a public company), in the United Kingdom it is usually a public limited company (plc), i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Torstar

Torstar Corporation is a Canadian mass media company which primarily publishes daily and community newspapers. In addition to the ''Toronto Star'', its flagship and namesake, Torstar also publishes daily newspapers in Hamilton, Peterborough, Niagara Region, and Waterloo Region. The corporation was initially established in 1958 to take over operations of the ''Star'' from the Atkinson Foundation after a provincial law banned charitable organizations from owning for-profit entities. From 1958 to 2020, the class A shares of Torstar were held by the families of the original Atkinson Foundation trustees. The private investment firm NordStar Capital LP, owned by Jordan Bitove and Paul Rivett, officially acquired Torstar on August 5, 2020. History Torstar was founded after the Ontario government passed a law barring the provisions of late-''Toronto Star'' owner Joseph Atkinson's will from being enacted. Atkinson had bequeathed the newspaper to a charitable organization he had fou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Bubble

A housing bubble (or a housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. First there is a period where house prices increase dramatically, driven more and more by speculation. In the second phase, house prices fall dramatically. Housing bubbles tend to be among the asset bubbles with the largest effect on the real economy, because they are credit-fueled, because a large number of households participate and not just investors, and because the wealth effect from housing tends to be larger than for other types of financial assets. Housing bubble definition Most research papers on housing bubbles uses standard asset price definitions. There are many definitions of bubbles. Most of them are normative definitions, like that of Stiglitz (1990),Stiglitz, J.E. (1990). “Symposium on bubbles”. In: Journal of Economic P ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Burry

Michael James Burry (; born June 19, 1971) is an American investor, hedge fund manager, and physician. He founded the hedge fund Scion Capital, which he ran from 2000 until 2008 before closing it to focus on his personal investments. He is best known for being amongst the first investors to predict and profit from the subprime mortgage crisis that occurred between 2007 and 2010. Early life and education Burry was born and grew up in San Jose, California. He has Rusyn ancestry. At the age of two he lost his left eye to retinoblastoma and has had a prosthetic eye ever since. As a teenager, he attended Santa Teresa High School. He studied economics and pre-med at the University of California, Los Angeles, earned an MD degree from the Vanderbilt University School of Medicine, and started but did not finish his residency in pathology at Stanford University Medical Center. While off duty at night, he worked on his hobby: financial investing. Despite not practicing, Burry has kept ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tiger Management Corp

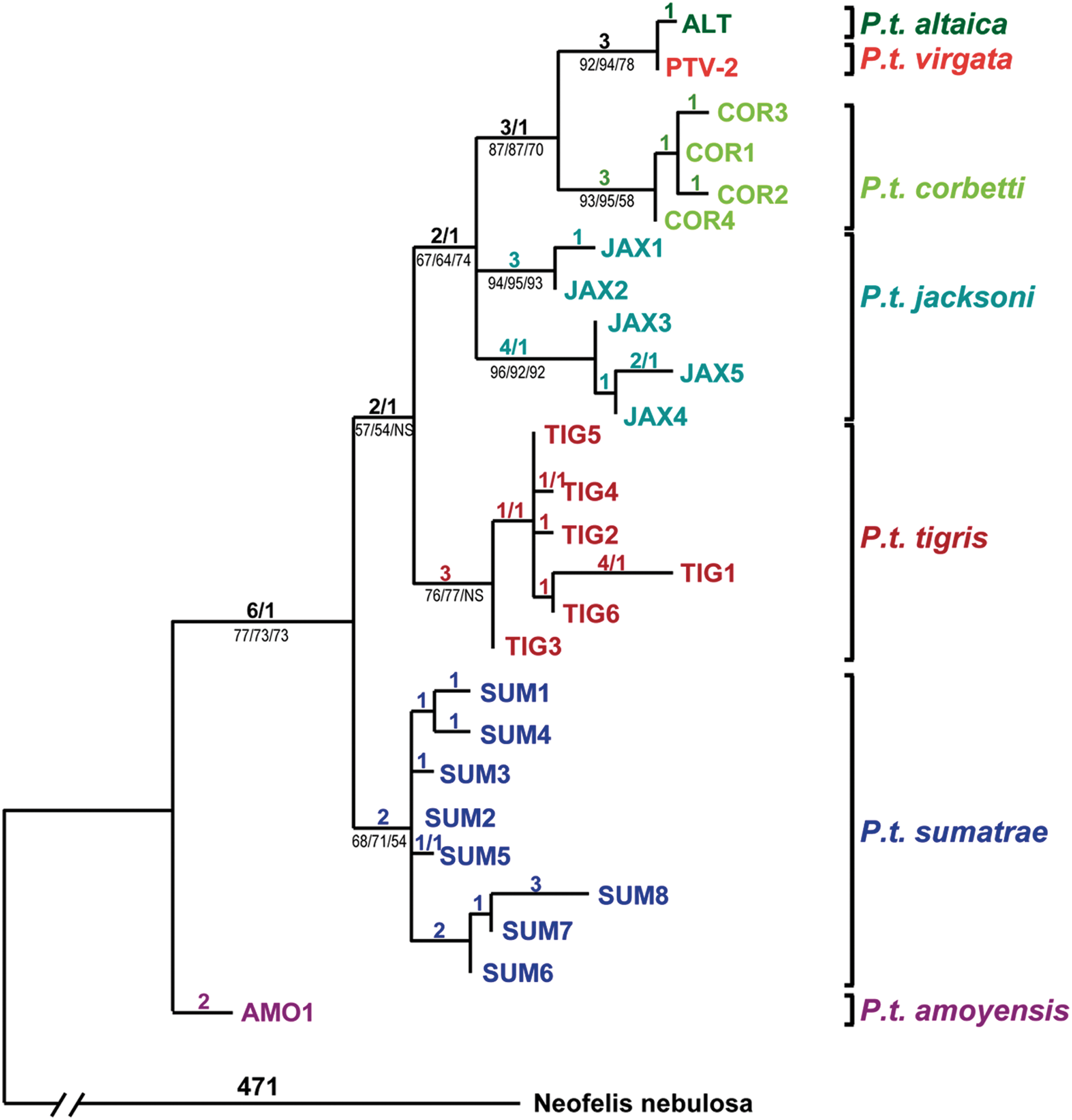

The tiger (''Panthera tigris'') is the largest living cat species and a member of the genus ''Panthera''. It is most recognisable for its dark vertical stripes on orange fur with a white underside. An apex predator, it primarily preys on ungulates, such as deer and wild boar. It is territorial and generally a solitary but social predator, requiring large contiguous areas of habitat to support its requirements for prey and rearing of its offspring. Tiger cubs stay with their mother for about two years and then become independent, leaving their mother's home range to establish their own. The tiger was first scientifically described in 1758. It once ranged widely from the Eastern Anatolia Region in the west to the Amur River basin in the east, and in the south from the foothills of the Himalayas to Bali in the Sunda Islands. Since the early 20th century, tiger populations have lost at least 93% of their historic range and have been extirpated from Western and Central Asia, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Julian Robertson

Julian Hart Robertson Jr. (June 25, 1932 – August 23, 2022) was an American billionaire hedge fund manager, and philanthropist. Robertson founded Tiger Management, one of the first hedge funds, in 1980. From its inception in 1980 to its 1998 asset peak, his fund returned 31.7% per year after fees, compared to a 12.7% annual return from the S&P 500 over the same period. However, a sharp decline thereafter led to the fund closing in March 2000. Tiger showed losses in only four of its 21 years. Robertson later mentored and provided seed funding to many notable hedge fund managers, known as the ''Tiger cubs'', including Ole Andreas Halvorsen, Stephen Mandel of Lone Pine Capital, Lee Ainslie of Maverick Capital, Bill Hwang, and Chase Coleman III. During his lifetime, Robertson contributed more than US$2 billion to charity. He was also a signatory to The Giving Pledge. At the time of his death, his net worth was estimated at $4.8 billion. Early life and education R ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andrew Lahde

Andrew Lahde is a retired hedge fund manager, who founded Lahde Capital in Santa Monica, California. Lahde received fame for his return rates in 2007. He also gained attention for the nature of his retirement, which he announced through a letter that skewered the business culture in America. Education Lahde earned a bachelor's degree in finance from Michigan State University and an MBA from the Anderson School of Business at the University of California Los Angeles. Career Lahde founded his own hedge fund, Lahde Capital, which was based out of Santa Monica. The fund speculated on increases of U.S. subprime mortgage defaults. Lahde's hedge fund strategy was based on his knowledge of real estate, real estate finance, the complex world of securitized real estate finance, and various financial vehicles associated with the transactions. What differentiated Lahde from many other hedge fund operations was an understanding of the underlying asset, residential real estate. In September ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kyle Bass

J. Kyle Bass is an American investor and founder of Conservation Equity Management, a Texas-based private equity firm focused on environmental sustainability. He is also the founder and principal of Hayman Capital Management, L.P., a Dallas-based hedge fund on global events. In 2008, Bass successfully predicted and effectively bet against the U.S. subprime mortgage crisis by purchasing credit default swaps on subprime securities which, in turn, increased in value when the real estate bubble burst. As a manager of the Coalition for Affordable Drugs (CFAD), Bass challenged the validity of 28 pharmaceutical corporations' patents via inter partes review, claiming that he wanted to invalidate weak patents imposing costs on consumers, thus making drugs covered by those patents more affordable. The drug companies targeted by Bass allege that the sole purpose of the validity challenges was to allow Bass to short the market and thus profit from the change in companies' stock prices. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paulson & Co

People with the name Paulson or its variant spellings include: * Albert Paulsen (1925–2004), Ecuadorian-American actor * Allen E. Paulson (1922–2000), American businessman * Andrew Paulson (1958–2017), American businessman * Barbara Paulson (born 1928), American human computer * Bjørn Paulson (1923–2008), Norwegian athlete * David Paulson (born 1989), American football player * David E. Paulson (1931–2015), American farmer and politician * Dennis Paulson (born 1962), American professional golfer * Erik Paulson (born 1966), American mixed martial artist * Harvey N. Paulson (1903-1993), American farmer and politician * Henry "Hank" Paulson (born 1946), American banker and former U.S. Treasury Secretary * Jacob Paulson (born 1998), Australian rapper, singer, and songwriter, known professionally as JK-47 * Jay Paulson, also known as Jay, (born 1978), American actor * John Paulson (born 1955), American hedge fund manager * Jeanne Paulson (b.?), American actress * Lawrence ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Paulson

John Alfred Paulson (born December 14, 1955) is an American billionaire hedge fund manager. He leads Paulson & Co., a New York-based investment management firm he founded in 1994. He has been called "one of the most prominent names in high finance", "a man who made one of the biggest fortunes in Wall Street history," and a "hedge fund swindler". His prominence and fortune were made in 2007 when he earned almost $4 billion and was transformed "from an obscure money manager into a financial legend" by using credit default swaps to effectively bet against the U.S. subprime mortgage lending market. In 2010, Paulson earned $4.9 billion. The ''Forbes'' real-time tracker estimated his net worth at $4.2 billion as of May 2020. Early life and education Paulson was born on December 14, 1955, in Queens, New York, the third of four children of Alfred G. Paulson (1924–2002) and Jacqueline (née Boklan, 1926–2018). [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Asset Price Bubble

The was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion.Kunio Okina, Masaaki Shirakawa, and Shigenori Shiratsuka (February 2001):The Asset Price Bubble and Monetary Policy: Japan's Experience in the Late 1980s and the Lessons More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time.Edgardo Demaestri, Pietro Masci (2003): Financial Crises in Japan and Latin America, Inter-American Development Bank Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolonged an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Globe And Mail

''The Globe and Mail'' is a Canadian newspaper printed in five cities in western and central Canada. With a weekly readership of approximately 2 million in 2015, it is Canada's most widely read newspaper on weekdays and Saturdays, although it falls slightly behind the ''Toronto Star'' in overall weekly circulation because the ''Star'' publishes a Sunday edition, whereas the ''Globe'' does not. ''The Globe and Mail'' is regarded by some as Canada's " newspaper of record". ''The Globe and Mail''s predecessors, '' The Globe'' and ''The Mail and Empire'' were both established in the 19th century. The former was established in 1844, while the latter was established in 1895 through a merger of ''The Toronto Mail'' and the ''Toronto Empire''. In 1936, ''The Globe'' and ''The Mail and Empire'' merged to form ''The Globe and Mail''. The newspaper was acquired by FP Publications in 1965, who later sold the paper to the Thomson Corporation in 1980. In 2001, the paper merged with broadcast ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)